Seiz Refinancing Opportunities and Save Thousands By Realiff

Seiz Refinancing Opportunities and Save Thousands By Realiff

In the dynamic world of mortgage rates , timing plays a crucial role in helping homeowners secure low-interest rates and save money through refinancing. Surprisingly, a staggering 75% of Americans miss out on the chance to refinance their homes when rates are at their lowest. However, with Realiff, homeowners can ensure they never miss such opportunities again. Realiff's program serves as a reliable reminder, helping homeowners stay informed about the best times to refinance and enabling them to save thousands of dollars when the next favorable opportunity arises. Refinancing a mortgage can be a complex process, and the intricacies of the housing market make it challenging for homeowners to accurately predict when the rates will be at their lowest. As a result, many homeowners end up missing out on substantial savings that could have been achieved through refinancing. Realiff addresses this issue by providing homeowners with timely and relevant information. Using a combination of historical data, market trends , and sophisticated algorithms, Realiff continuously monitors the mortgage market. It analyzes various factors that influence interest rates, such as economic indicators, inflation, and monetary policy. By crunching these numbers and comparing them against personalized homeowner profiles, Realiff identifies optimal refinancing opportunities unique to each user. Realiff's user-friendly interface allows homeowners to input their mortgage details and preferences, creating a personalized profile. Once the profile is set up, Realiff keeps a watchful eye on the market and sends timely notifications to homeowners when rates are expected to be favorable for refinancing. These notifications include detailed information about the potential savings and benefits associated with refinancing at that particular time. The Realiff program goes beyond simple reminders. It provides homeowners with valuable insights and guidance throughout the refinancing process. Realiff's team of mortgage experts is readily available to answer questions, offer advice, and assist homeowners in making informed decisions. They provide detailed analysis, explain the impact of market changes, and help homeowners navigate the intricacies of refinancing. By partnering with Realiff, homeowners gain a competitive edge in the mortgage market. They can confidently make decisions based on accurate information and seize the right opportunities when they arise. Realiff empowers homeowners to take control of their finances, maximize their savings, and achieve their long-term financial goals.

Understanding the Importance of Refinancing

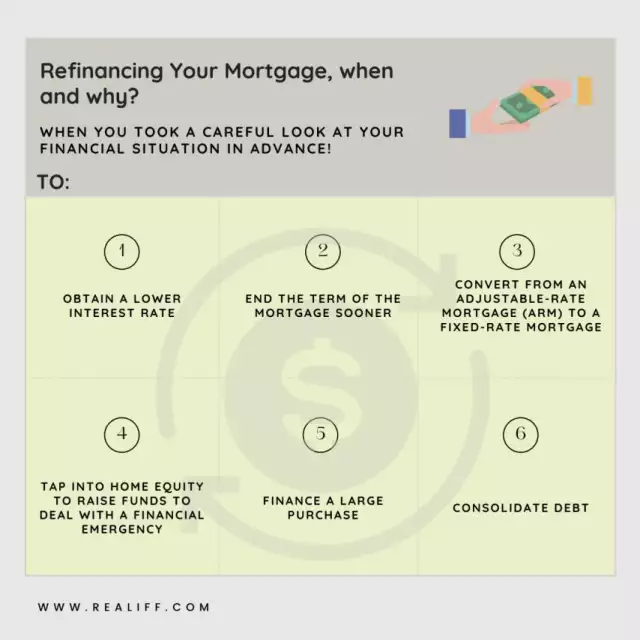

Refinancing a mortgage is a financial strategy that entails the substitution of an existing loan with a new one, offering improved terms and conditions that can ultimately benefit homeowners in various ways. One of the primary advantages of refinancing is the opportunity to secure a lower interest rate on the new loan. This can lead to substantial long-term savings, as even a slight reduction in the interest rate can result in significant decreases in monthly mortgage payments . By taking advantage of periods when interest rates are low, homeowners can capitalize on this opportunity to potentially reduce their overall mortgage costs and increase their disposable income. Additionally, refinancing allows borrowers to modify the duration of their loan. For instance, switching from a 30-year mortgage to a 15-year mortgage can result in higher monthly payments, but it can also help homeowners pay off their mortgage faster and save on interest payments over the life of the loan. Conversely, extending the loan duration may lead to lower monthly payments, providing more financial flexibility in the short term. Another advantage of refinancing is the potential to consolidate debt. Homeowners who have accumulated high-interest debts, such as credit card balances or personal loans, can use the equity in their homes to pay off these debts by refinancing. This approach not only simplifies monthly payments but also often results in lower interest rates compared to other forms of debt. Moreover, refinancing can enable homeowners to access their home equity for important expenses, such as home renovations or education costs. By refinancing, individuals can tap into the equity they have built up over time and convert it into cash to fund these endeavors. In summary, refinancing a mortgage presents homeowners with a range of potential benefits, including lower interest rates, reduced monthly payments, shorter loan durations, debt consolidation, and access to home equity. However, it's important to carefully consider the costs and fees associated with refinancing to ensure that the long-term financial gains outweigh the short-term expenses.

a) Lower Interest Rates:When mortgage interest rates decrease, homeowners who refinance can secure new loans at a lower rate. This reduction can lead to substantial savings over the life of the loan, as even a small percentage decrease can translate into thousands of dollars saved.

b) Monthly Payment Reduction:Refinancing can help homeowners lower their monthly mortgage payments. By extending the loan term or securing a lower interest rate, homeowners can achieve more manageable payments, freeing up funds for other essential expenses or financial goals.

c) Shorter Loan Duration:Refinancing also allows homeowners to shorten the loan term. By opting for a shorter repayment period, borrowers can pay off their mortgages faster and save on overall interest payments, potentially becoming debt-free sooner.

d) Cash-Out Refinance:In addition to securing better terms, homeowners can use refinancing as an opportunity to access their home's equity. Through a cash-out refinance, borrowers can tap into their home's value and receive a lump sum of cash, which can be used for home improvements, debt consolidation, or other financial needs.

Current Statistics on Homeowners Refinancing

To comprehend the scale of missed refinancing opportunities, let's consider recent statistics on the percentage of homeowners who refinance during low-rate periods:

- According to industry data, only 25% of American homeowners take advantage of favorable refinance opportunities. This means that a significant majority fail to capitalize on potentially significant savings.

- Research indicates that during historically low-rate periods, the number of homeowners refinancing remains far below the potential for savings. This disparity highlights the missed opportunities that homeowners should actively seek to avoid.

How do you find a real estate agent that offers rebates

Why are More Homeowners Not Refinancing?

Several factors contribute to the low percentage of homeowners who seize refinancing opportunities:

a) Lack of Awareness:Many homeowners are not aware of the potential savings that can be achieved through refinancing or fail to monitor market trends closely. They may not realize that even a slight decrease in interest rates can make a significant impact on their long-term financial well-being.

b) Complexity and Time:The refinancing process can seem daunting and time-consuming, leading homeowners to postpone or neglect exploring this option. Paperwork, gathering financial documents, and navigating the loan application process can be overwhelming, causing homeowners to shy away from refinancing.

c) Perception of Savings Insignificance:Some homeowners underestimate the cumulative impact of small interest rate differences over the long term, assuming the savings won't be significant enough to justify the effort. However, even a 0.25% reduction in interest rates can potentially save thousands of dollars over the life of a mortgage.

d) Financial Constraints:Homeowners may face financial constraints or have unfavorable credit conditions that prevent them from qualifying for better refinancing terms. Concerns about credit scores , income stability, or loan-to-value ratios can discourage homeowners from pursuing refinancing, even when rates are favorable.

Realiff's Program for Seizing Refinancing Opportunities

Realiff is a pioneering company that empowers homeowners to seize the opportunities presented by refinancing. Recognizing the challenges and complexities involved in the refinancing process, Realiff has developed a comprehensive program tailored to address these issues and ensure that homeowners never miss out on potential savings. With their expertise and advanced technology , Realiff simplifies the refinancing journey, making it accessible and convenient for homeowners of all backgrounds. By partnering with Realiff, homeowners gain access to a wealth of resources and guidance to navigate the intricacies of refinancing with confidence. Realiff's program starts by analyzing each homeowner's unique financial situation and goals. Through a thorough assessment of factors like current interest rates, loan terms , and market conditions, Realiff identifies opportunities for savings and presents personalized refinancing options. They go the extra mile to negotiate with lenders on behalf of homeowners, striving to secure the most favorable terms and conditions possible. Realiff understands that refinancing can be a time-consuming process, which is why they leverage their cutting-edge technology to streamline the entire experience. Their user-friendly online platform allows homeowners to submit required documents, track progress, and communicate with their dedicated team seamlessly. The program also includes educational resources, empowering homeowners with knowledge and insights about refinancing. Realiff's team of experts is readily available to answer questions, address concerns, and provide guidance throughout the process. Their commitment to transparency ensures that homeowners have a clear understanding of the costs, fees, and potential savings associated with refinancing. By partnering with Realiff, homeowners can confidently navigate the refinancing landscape and unlock the full benefits that refinancing offers. Whether it's securing a lower interest rate, reducing monthly payments, shortening the loan duration, or consolidating debt, Realiff is dedicated to helping homeowners achieve their financial goals. With their comprehensive program and unwavering support, Realiff empowers homeowners to make informed decisions and take control of their mortgage, ultimately leading to greater financial freedom and stability.

a) Intelligent Notifications: Realiff's program constantly monitors market trends and notifies homeowners when favorable refinancing opportunities arise. By leveraging advanced algorithms and historical data analysis, Realiff can identify optimal times for refinancing and send personalized notifications to homeowners, keeping them informed about potential savings.

b) Educational Resources:Realiff provides homeowners with educational materials and resources to help them understand the benefits of refinancing, the process involved, and how to evaluate whether refinancing is right for them. This includes articles, guides, and interactive tools that simplify complex concepts and empower homeowners to make informed decisions.

c) Personalized Assistance:Realiff understands that every homeowner's situation is unique. To cater to individual needs, Realiff offers personalized assistance through mortgage experts who can guide homeowners through the refinancing process, answer questions, and provide professional advice. These experts have in-depth knowledge of the industry and can offer tailored recommendations based on homeowners' financial goals.

d) Streamlined Refinancing Process:Realiff streamlines the refinancing process, leveraging technology to simplify paperwork, accelerate approvals, and reduce the overall time and effort required. By automating certain tasks and integrating with trusted lending partners, Realiff eliminates unnecessary complexities, making refinancing more accessible and efficient.

Importance of Interviewing Multiple Real Estate Agents

Conclusion

Refinancing presents homeowners with substantial opportunities to save money on their mortgages, yet a significant percentage of Americans miss out on these chances due to various factors. Realiff's program aims to bridge this gap by empowering homeowners with timely notifications, educational resources, personalized assistance, and a streamlined refinancing process. Through Realiff, homeowners can seize the best refinancing opportunities, potentially saving thousands of dollars and achieving greater financial stability. By providing proactive notifications, Realiff ensures that homeowners stay informed about favorable refinancing opportunities, eliminating the issue of unawareness. In addition, educational resources offered by Realiff equip homeowners with knowledge about the benefits of refinancing, the intricacies of the process, and how to assess its alignment with their financial goals. Personalized assistance from mortgage experts provides guidance and tailored recommendations, addressing concerns and navigating complexities. Realiff's streamlined refinancing process simplifies the paperwork, accelerates approvals, and minimizes effort, making it more accessible for homeowners. By embracing Realiff, homeowners gain the ability to make informed decisions, optimize mortgage terms, and unlock significant long-term savings. With Realiff's support, homeowners can confidently navigate the refinancing landscape, secure their financial future, and avoid missing out on valuable opportunities to save thousands of dollars.

The Evolution of Real Estate: From Ancient Times to the Present Day