Understanding the Relationship between Credit Scores and Debt-to-Income Ratio for Loan Approval

Understanding the Relationship between Credit Scores and Debt-to-Income Ratio for Loan Approval

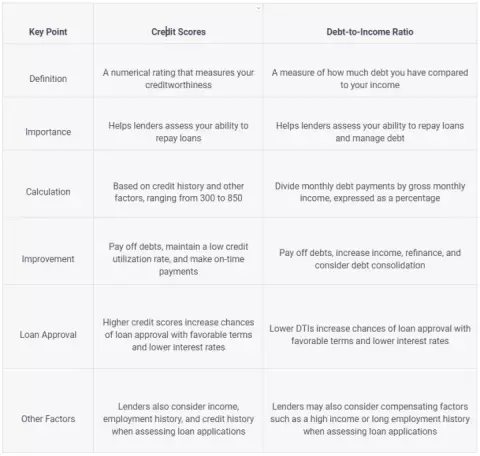

When you apply for a loan, such as a mortgage, personal loan, or auto loan, the lender will assess your creditworthiness to determine whether you're a good candidate for the loan. The two most important factors that lenders consider are your credit score and your debt-to-income ratio (DTI). In this blog post, we'll provide an overview of credit scores and DTI, explain how they are calculated, and why they are important factors in loan approval.

Credit Scores

Your credit scoreis a numerical representation of your creditworthiness. It is based on your credit history, which includes information about your past credit accounts and how you've managed them. This information is reported to the three major credit bureaus in the US (Equifax, Experian, and TransUnion), who use it to calculate your credit score.

There are several credit scoring models, but the most widely used is the FICO score. This score ranges from 300 to 850, with higher scores indicating better creditworthiness. The FICO score is calculated based on five main factors:

- Payment history - whether you've paid your bills on time

- Credit utilization - how much of your available credit you're using

- Length of credit history - how long you've had credit accounts

- Types of credit - the different types of credit accounts you have (e.g. credit cards, loans, mortgages)

- New credit - how many new credit accounts you've opened recently

Each of these factors has a different weight in the calculation of your credit score. Payment history and credit utilization are the most important, accounting for 35% and 30% of your FICO score, respectively.

Why Credit Scores Matter

Credit scores are important because they provide lenders with an objective measure of your creditworthiness. When you apply for a loan or credit card, the lender will check your credit score to determine whether to approve your application and what interest rate to offer you.

If you have a high credit score (generally considered to be above 700), you're more likely to be approved for loans and credit cards with favorable terms and lower interest rates. On the other hand, if you have a low credit score (below 600), you may have trouble getting approved for credit or may have to pay higher interest rates and fees.

Improving Your Credit Score

If you have a low credit score, there are several things you can do to improve it:

- Pay your bills on time - Late payments can have a significant negative impact on your credit score, so make sure to pay your bills on time.

- Reduce your credit utilization - Try to use at most 30% of your available credit. If you have high balances on your credit cards, pay them down as quickly as possible.

- Keep old credit accounts open - The length of your credit history is an important factor in your credit score, so it's generally a good idea to keep old credit accounts open even if you're not using them.

- Limit new credit applications - Applying for too much new credit in a short time can negatively impact your credit score.

Debt-to-Income Ratio (DTI)

Your debt-to-income ratio is a measure of your monthly debt payments relative to your income. It's calculated by adding up all of your monthly debt payments (including rent/mortgage, car payments, credit card payments, student loan payments, and any other debts) and dividing that number by your gross monthly income.

For example, if you have a monthly mortgage payment of $1,500, a car payment of $300, a credit card payment of $100, and a gross monthly income of $5,000, your DTI would be 38% ($1,900 divided by $5,000).

Why DTI Matters

DTI is an important factor in loan approval because it helps lenders assess your ability to repay the loan. A high DTI indicates that you're spending a large percentage of your income on debt payments, which could make it difficult for you to make additional loan payments. Generally, lenders prefer borrowers with lower DTIs, as they're considered to be less risky.

Different types of loans have different DTI requirements. For example, when applying for a mortgage, lenders typically look for a DTI of 43% or lower. However, some lenders may be willing to lend to borrowers with higher DTIs if they have strong credit scores or other compensating factors.

How to Calculate Your DTI

To calculate your DTI, you'll need to add up all of your monthly debt payments and divide that number by your gross monthly income. For example, if you have a monthly mortgage payment of $1,500, a car payment of $300, a credit card payment of $100, and a gross monthly income of $5,000, your DTI would be 38% ($1,900 divided by $5,000).

If your DTI is high, there are several things you can do to improve it:

- Pay off debt - The most effective way to lower your DTI is to pay off debt. Focus on paying off high-interest debts first, such as credit cards.

- Increase your income - Consider taking on a side job or asking for a raise at work to increase your income.

- Refinance - If you have high-interest debt, you may be able to lower your monthly payments by refinancing to a lower-interest rate.

- Consider debt consolidation - If you have multiple debts with high-interest rates, consolidating them into a single loan with a lower interest rate may help lower your DTI.

Loan Approval

When you apply for a loan, lenders will consider various factors, including your credit score, DTI, income, employment history, and credit history. These factors help lenders assess your ability to repay the loan and determine whether to approve your application. If you have a high credit score and low DTI, you're more likely to be approved for a loan with favorable terms and lower interest rates. However, even if you have a lower credit score or higher DTI, you may still be able to get approved for a loan if you have other compensating factors, such as a high income or a long employment history. When applying for a loan, it's important to shop around and compare offers from different lenders. This can help you find the best loan for your needs and budget. Be sure to read the terms and conditions carefully and understand all fees and charges associated with the loan.

Conclusion

Credit scores and DTIs are two important factors in loan approval.Your credit score provides lenders with an objective measure of your creditworthiness, while your DTI helps them assess your ability to repay the loan. By understanding these factors and taking steps to improve them, you can increase your chances of getting approved for loans with favorable terms and lower interest rates. Remember to shop around and compare offers from different lenders to find the best loan for your needs and budget.