The Ultimate Guide to Buying a House with Cash

Buying a house with cash is an appealing option for many, offering peace of mind and simplicity that comes with owning property outright. Although it’s not feasible for everyone, those who can afford it often find it an enticing alternative to traditional mortgage financing. This comprehensive guide will explore the benefits, potential drawbacks, and essential steps involved in buying a house with cash.

Understanding the Possibility of Buying a House with Cash

Absolutely! Buying a house with cash is entirely possible and legal. When people refer to a "cash purchase," they generally mean a transaction without financing from a lender. Instead of taking out a mortgage, the buyer pays the total amount upfront. While it might sound like you’re showing up with a suitcase full of money, in reality, it means transferring the funds electronically or writing a check for the full purchase price.

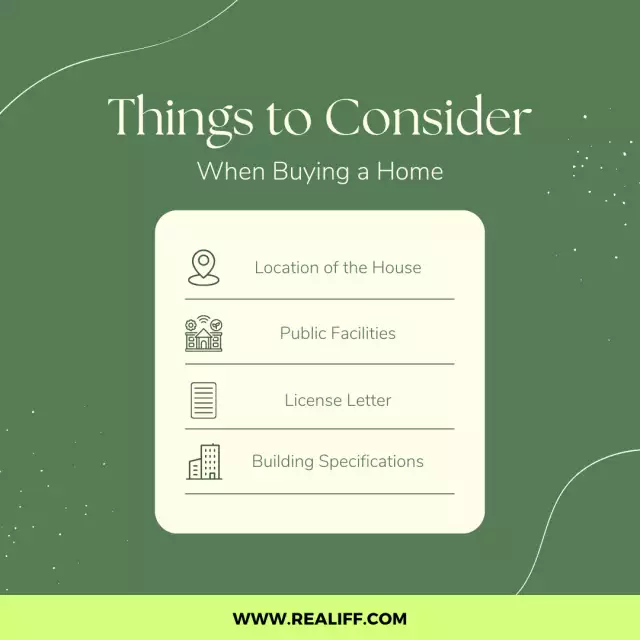

Reasons to Consider Buying a House with Cash

Deciding whether to buy a house with cash depends on several factors, including your financial situation, market conditions, and personal preferences. Here are some compelling reasons to consider it:

Peace of Mind

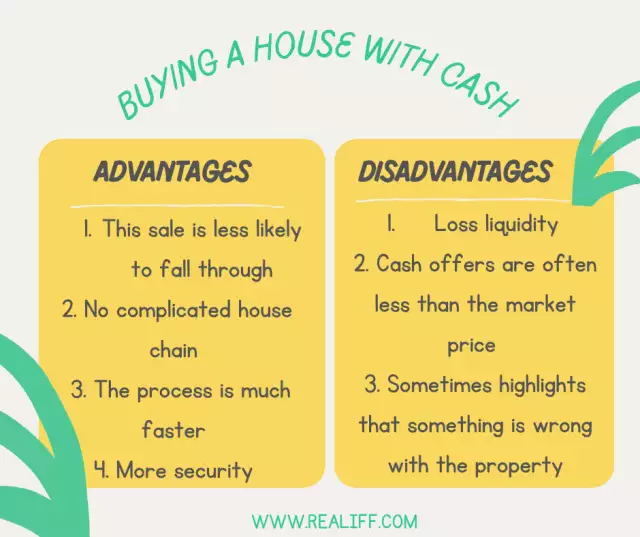

Owning a home outright means no monthly mortgage payments and no worries about interest rate fluctuations. You eliminate the risk of foreclosure and always have a place to live.

Appealing to Sellers

Cash offers are attractive to sellers because they guarantee quicker and more certain closings. There’s no risk of the deal falling through due to financing issues, making cash buyers more competitive, especially in a hot market.

Faster Closing

Without the need for mortgage approval, the closing process is much faster. You can move from an accepted offer to closing in just a few days or weeks, rather than the 30-45 days typical of financed transactions.

Benefits of Buying a House with Cash

No Monthly Payments

- Paying in full means you won’t have to worry about making monthly mortgage payments, freeing up your income for other expenses or investments.

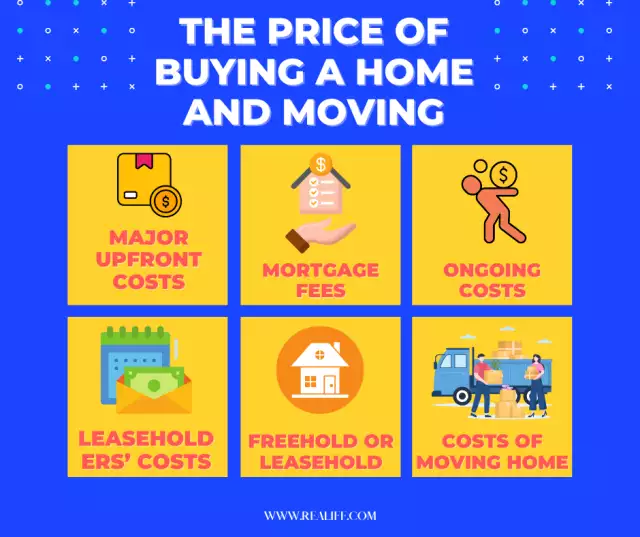

Reduced Closing Costs

- Many costs associated with securing a mortgage, such as loan origination fees and appraisal fees, are avoided when you pay cash. This can save you a significant amount at closing.

Stronger Negotiating Position

- Sellers often favor cash offers over those contingent on financing. This could allow you to negotiate a lower purchase price or win a bidding war against buyers with traditional financing.

No Underwriting Hassles

- Cash buyers avoid the often stressful and invasive process of

mortgage underwriting, which scrutinizes your finances and credit

history.

Drawbacks of Buying a House with Cash

Illiquid Asset: Investing a large sum of money into a home makes those funds non-liquid. Unlike cash in a bank account, you can’t quickly access this money if you need it for other purposes.

Opportunity Cost:By tying up a significant amount of capital in real estate, you might miss out on other investment opportunities that could offer higher returns, such as the stock market.

No Mortgage Interest Deduction:Homeowners with mortgages can often deduct interest payments on their tax returns, potentially saving a substantial amount. Paying cash means you miss out on these deductions.

The Cash Home Buying Process

Determine Your Budget:Assess your finances to decide how much you can comfortably afford to spend on a house without depleting your reserves.

Work with a Real Estate Agent:Hire a real estate agent who understands the local market. They can help you find properties that fit your criteria and budget.

Make an Offer:When you find a home you like, make an offer. Emphasize the benefits of your cash offer, such as a quicker closing and no financing contingencies.

Conduct Due Diligence:Even if you’re paying cash, it’s crucial to conduct thorough due diligence. This includes getting a home inspection to uncover any potential issues and ensuring the property is worth the asking price.

Proceed to Closing:Once your offer is accepted and due diligence is complete, proceed to closing. Since there’s no mortgage involved, this process is usually quicker and involves fewer fees.

Should You Still Get a Home Inspection?

Yes, absolutely! Even if you’re buying a house with cash, a home inspection is crucial. It helps identify any potential problems that could affect the property’s value or require expensive repairs. Skipping the inspection could lead to costly surprises down the road.

What is Delayed Financing?

Delayed financing is an option that allows you to buy a house with cash and then take out a mortgage shortly after the purchase. This way, you can enjoy the benefits of making a cash offer but still leverage financing to keep your funds more liquid.

Frequently Asked Questions About Buying a House with Cash

Q. Why buy a house with cash?

A.Cash purchases offer peace of mind, no monthly payments, and can make your offer more appealing to sellers.Q. When is it advantageous to buy a house with cash?

A.Buying with cash is beneficial in competitive markets or when you want to avoid the complexities of mortgage financing.Q. Where can I find cash-only listings?

A.Look for cash-only listings on real estate websites or ask your agent to help identify properties that might be receptive to cash offers.Q. What are the risks of buying a house with cash?

A.Risks include tying up a large amount of capital in a non-liquid asset and missing out on potential higher returns from other investments.Q. Who should consider buying a house with cash?

A.Those with sufficient funds, looking for a straightforward purchase process, or seeking to avoid monthly mortgage payments should consider it.Q. How do I proceed with buying a house with cash?

A.Determine your budget, find a suitable property, make a compelling cash offer, conduct due diligence, and close the deal.The Most Comprehensive Tips for All Aspects of Buying a House with Cash

- Evaluate Your Financial Situation:Ensure you have enough funds to buy the house and maintain an emergency reserve.

- Understand Market Conditions:Know whether the market is favoring buyers or sellers to make informed decisions.

- Hire a Real Estate Agent:Even without financing, an experienced agent can provide valuable insights and assistance.

- Get a Home Inspection:Always inspect the property to avoid unexpected repairs and ensure you’re making a sound investment.

- Consider Future Flexibility:Think about your long-term plans and whether having so much capital tied up in a home aligns with them.

- Use Professional Services:Hire professionals for legal advice, appraisals, and other services to protect your investment.

Buying a house with cash can be a straightforward and beneficial process if approached correctly. By understanding the benefits and potential drawbacks, and following a structured approach, you can make a wise and informed decision.