Mortgage market trends: An overview of current trends in the mortgage market, including interest rates, lending standards, and t

Mortgage market trends: An overview of current trends in the mortgage market, including interest rates, lending standards, and t

The mortgage market is a dynamic industry that is constantly changing and evolving. As such, keeping up with the latest trends in the mortgage market is critical for anyone who is interested in buying a home or refinancing an existing mortgage. In this comprehensive blog post, we will provide an overview of current trends in the mortgage market, including interest rates, lending standards, and the availability of different types of loans.

| Mortgage Market Trends | Overview |

| Interest Rates | Interest rates are currently low, but they are slowly rising. As of February 2023, the average interest rate for a 30-year fixed-rate mortgage is 3.81%. However, experts predict that interest rates will continue to rise over the next few years. |

| Lending Standards | Lending standards have tightened in recent years, but they are beginning to loosen. Many lenders are now offering loans with lower credit score requirements and smaller down payments. However, lenders are still cautious about lending to borrowers with a high debt-to-income ratio. |

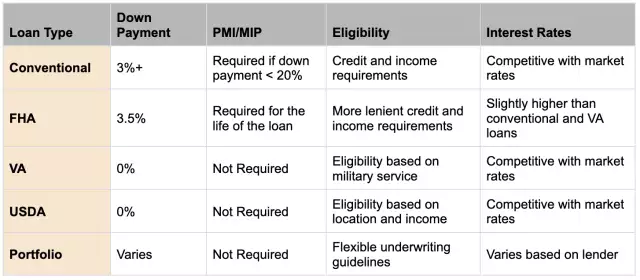

| Types of Loans | There are several types of loans available to homebuyers, including conventional loans, FHA loans, VA loans, and USDA loans. Conventional loans are the most common type of mortgage, but FHA loans are popular among first-time homebuyers because they require a lower down payment. VA loans are available to veterans and active-duty military personnel, and USDA loans are available to homebuyers in rural areas. Many lenders also offer adjustable-rate mortgages (ARMs), which have a lower initial interest rate but can fluctuate over time. |

Interest Rates

The low-interest rate environment has had significant implications for the mortgage market, affecting both homebuyers and lenders. For homebuyers, low-interest rates have made it easier to obtain affordable financing, resulting in increased demand for housing. This has led to a surge in home prices in many markets, making it more difficult for some buyers to afford homes.

On the other hand, low-interest rates have been a boon for lenders, who have experienced increased demand for mortgages and refinancing. Lenders have been able to generate higher profits as a result of the increased volume of loans, and they have been able to pass some of the savings from lower interest rates onto borrowers in the form of lower fees and closing costs.

The record-low interest rates in 2020 also created an opportunity for homeowners to refinance their existing mortgages and take advantage of the lower rates. Many homeowners were able to lower their monthly payments and save money over the life of their loans.

However, rising interest rates in 2021 have tempered some of the market's enthusiasm. As interest rates increase, homebuyers may find it more challenging to afford homes, especially if they are already stretching their budgets to buy in a hot market. Higher interest rates can also make refinancing less attractive, as the savings may not be significant enough to justify the cost of refinancing.

Despite these challenges, interest rates are still relatively low by historical standards. Homebuyers who are prepared to navigate the market's ups and downs can still find affordable financing options. Moreover, the housing market is complex, and factors such as local supply and demand, employment trends, and economic conditions can also affect affordability.

Lending Standards

Lending standards have also changed in recent years. In the aftermath of the 2008 financial crisis, lending standards tightened considerably. Banks and other lenders became much more cautious about who they lent money to and required higher credit scores and down payments. As a result, many people were unable to qualify for a mortgage. In recent years, lending standards have loosened somewhat. Lenders are now more willing to work with borrowers who have lower credit scores and less money for a down payment. For example, in 2020, the Federal Housing Administration (FHA) lowered its minimum credit score requirement for FHA loans from 580 to 500. However, borrowers with lower credit scores may still face higher interest rates and more stringent loan requirements.

Availability of Different Types of Loans

Another trend in the mortgage market is the availability of different types of loans. In addition to traditional fixed-rate mortgages, there are now several other types of loans available to borrowers, including adjustable-rate mortgages (ARMs), interest-only mortgages, and balloon mortgages. Adjustable-rate mortgages (ARMs) have a lower initial interest rate than fixed-rate mortgages, but the rate can fluctuate over time. Interest-only mortgages allow borrowers to pay only the interest on the loan for a set period, after which the principal must be repaid. Balloon mortgages have a relatively low monthly payment for a set period, after which the borrower must pay the remaining balance in full. These alternative types of loans can be useful for borrowers who have specific needs or financial situations. For example, an ARM might be a good option for someone who plans to move in a few years and doesn't want to pay a higher interest rate for a fixed-rate mortgage. However, it is essential to carefully consider the risks and benefits of these types of loans before choosing one.

Refinancing

Refinancing has been a significant trend in the mortgage market in recent years, with many homeowners taking advantage of lower interest rates to reduce their monthly payments and save money over the life of their loans. Refinancing can be an excellent option for homeowners who have built up equity in their homes or who want to take advantage of lower interest rates.

In 2020, refinancing activity increased significantly as interest rates hit historic lows. According to the Mortgage Bankers Association, refinance applications increased by 104% in 2020 compared to the previous year. Low-interest rates created an opportunity for homeowners to refinance their existing mortgages and save money.

Refinancing can provide several benefits, including reducing monthly payments, shortening the term of the loan, and accessing home equity. Lower monthly payments can free up cash flow for homeowners, allowing them to save more or pay down other debt. Shortening the term of the loan can help homeowners pay off their mortgages sooner while accessing home equity can provide cash for home improvements, education expenses, or other needs.

However, refinancing may not be the right choice for everyone. Homeowners must weigh the costs of refinancing, such as closing costs and fees, against the potential savings. If a homeowner plans to sell their home in the near future, refinancing may not be worthwhile, as the savings may not outweigh the costs.

In 2021, refinancing activity has slowed somewhat as interest rates have risen. Higher interest rates can make refinancing less attractive, as the savings may not be significant enough to justify the cost of refinancing. However, refinancing can still be an option for homeowners who have built up equity in their homes or who want to take advantage of lower interest rates.

Government Programs

Finally, there are several government programs available to help homebuyers and homeowners. The Federal Housing Administration (FHA) provides loans with lower down payment requirements and more flexible credit requirements. The Veterans Administration (VA) provides loans to military veterans with no down payment and competitive interest rates. The Department of Agriculture (USDA) provides loans to low-income borrowers in rural areas.

In addition to these traditional programs, the government has also launched several programs in response to the COVID-19 pandemic. The CARES Act, passed in March 2020, provided mortgage relief for homeowners affected by the pandemic. The relief included a foreclosure moratorium, the option to forbear mortgage payments for up to a year, and the suspension of negative credit reporting for those who participate. The Federal Housing Finance Agency (FHFA) also implemented a moratorium on foreclosures and evictions for single-family mortgages owned by Fannie Mae or Freddie Mac. This moratorium has been extended several times and is currently set to expire on June 30, 2021.

Conclusion

The mortgage market is a complex industry that is influenced by a wide range of factors, including interest rates, lending standards, and government programs. In recent years, interest rates have been at historic lows, but they are starting to rise. Lending standards have also loosened somewhat, making it easier for some borrowers to qualify for a mortgage. Different types of loans are available to borrowers, and refinancing activity has increased dramatically in recent years. The government provides several programs to help homebuyers and homeowners, including traditional programs such as FHA, VA, and USDA loans, as well as COVID-19 pandemic relief measures. If you are considering buying a home or refinancing your mortgage, it is essential to stay up-to-date on current trends in the mortgage market and to work with a reputable lender who can help you navigate the process. By doing so, you can ensure that you get the best possible mortgage for your needs and financial situation.