Surprising Ways Refinancing Your Mortgage Can Save You Money

Surprising Ways Refinancing Your Mortgage Can Save You Money

Refinancing your mortgagecan be a great way to save money on interest, lower your monthly payments, or even shorten the term of your loan. However, it's important to ask the right questions to make sure you're getting the best deal for your unique financial situation. Here are some important questions to ask when refinancing:

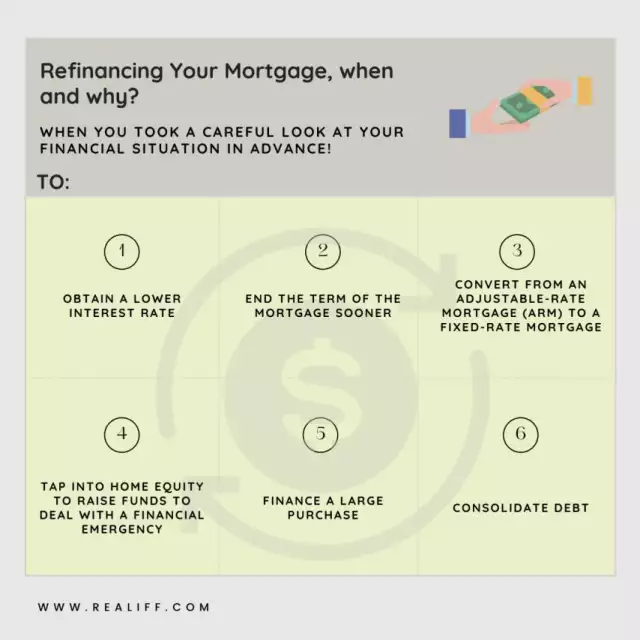

Why am I refinancing?

It's important to understand why you're considering refinancing. Are you looking to lower your monthly payments, reduce the total interest you'll pay over the life of your loan, or access cash for other expenses? Once you understand your goals, you can determine which refinancing option is best for you. For example, if you're looking to lower your monthly payments, you may want to consider a longer loan term, which will result in a lower monthly payment but may result in paying more interest over the life of the loan. If you're looking to reduce the total interest you'll pay, you may want to consider a shorter loan term, which will result in a higher monthly payment but will allow you to pay off your mortgage faster.

What are the costs associated with refinancing?

Refinancing typically involves closing costs, which can include application fees, origination fees, appraisal fees, and more. It's important to understand these costs upfront and factor them into your decision-making process. Some lenders may offer "no-closing-cost" refinancing options, but these may come with a higher interest rateor other fees. Be sure to ask about all the costs associated with refinancing so you can make an informed decision.

How long will it take to recoup my refinancing costs?

Because there are costs associated with refinancing, it's important to determine how long it will take you to break even on these costs. This can help you determine whether refinancing is the right choice for you. You can calculate your break-even point by dividing your total closing costs by your monthly savings. For example, if your closing costs are $3,000 and you'll save $100 per month on your mortgage payment, it will take you 30 months (or 2.5 years) to break even on your refinancing costs.

What is my new interest rate?

One of the biggest advantages of refinancing is the ability to secure a lower interest rate. Make sure you understand what your new interest rate will be and how it compares to your current rate. Even a small reduction in your interest rate can save you thousandsof dollars over the life of your loan. For example, if you have a $200,000 mortgage with a 4% interest rate and you refinance to a 3.5% interest rate, you could save over $18,000 in interest over the life of your loan.

What will my new monthly payment be?

Your new interest rate and loanterms will affect your monthly mortgage payment. Make sure you understand what your new payment will be and whether it's affordable for your budget. Keep in mind that your monthly payment will also be affected by factors such as property taxes and homeowners insurance. Make sure you factor these costs into your budget as well.

What are the terms of my new loan?

Make sure you understand the terms of your new loan, including the length of the loan, the type of interest rate (fixed or adjustable), and any prepayment penalties. For example, if you're currently 10 years into a 30-year fixed-rate mortgage and you refinance to a new 30-year fixed-rate mortgage, you may end up paying more in interest over the life of the loan even if your new interest rate is lower. Make sure you understand how the length of your loan will affect your total interest payments.

Are there any other benefits or drawbacks to refinancing?

Refinancing can have other benefits beyond just lowering your interest rate and monthly payments. For example, refinancing to a shorter term can help you pay off your mortgage faster and save money on interest in the long run. However, there may also be drawbacks to consider, such as extending your loan term or resetting the clock on your mortgage payments. Additionally, there may be other benefits or drawbacks to refinancing depending on your personal financial situation. For example, if you have a high credit score, you may be able to qualify for a lower interest rate or better loan terms than someone with a lower credit score. It's important to consider all of these factors and weigh the pros and cons of refinancing before making a decision.

How do I apply for refinancing?

Once you've decided to refinance, you'll need to apply for a new mortgage. Make sure you understand the application process and what documentation you'll need to provide, such as income verification and credit reports. You'll also need to choose a lender to work with. Shop around and compare offers from different lenders to find the best deal for your needs.

What happens after I apply for refinancing?

After you apply for refinancing, the lender will review your application and documentation. They may order an appraisal of your home to determine its current value. Once the lender has all the necessary information, they'll provide you with a loan estimate that outlines the terms of your new mortgage, including the interest rate, monthly payment, and closing costs. If you decide to move forward with the refinance, you'll need to sign the loan documents and close the loan. This typically involves paying the closing costs and signing the mortgage paperwork.

What happens to my old mortgage after refinancing?

When you refinance, your new mortgage pays off your old mortgage in full. Your old mortgage will be closed, and you'll make payments on your new mortgage going forward. It's important to make sure your old mortgage is paid off in full and that there are no outstanding balances or fees. Your new lender should handle the process of paying off your old mortgage, but it's always a good idea to double-check to make sure everything has been taken care of.

In conclusion, refinancing can be a great way to save money on your mortgage, but it's important to ask the right questions and understand all of the costs and benefits before making a decision. By taking the time to research your options and ask questions, you can make an informed decision and feel confident in your refinancing choice.