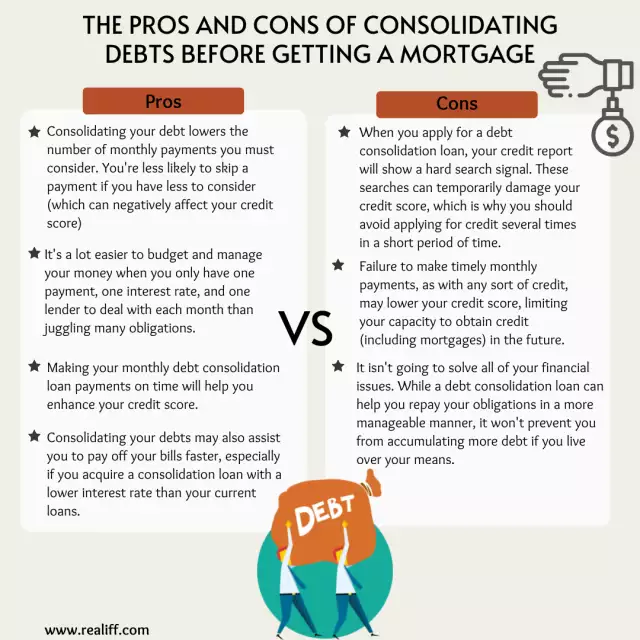

Is consolidating your debts suitable for you?

Is consolidating your debts suitable for you?

It's impossible to say without knowing more about your specific position and the debts you want to consolidate. If you're having trouble repaying your numerous bills, a debt consolidation mortgagecould be the answer, and there are two methods to go about it.

1. Changing lenders and remortgaging your entire debt

This method allows you to obtain a new mortgage for the amount of your previous mortgage, plus any outstanding debt. For example, if you have a £200,000 mortgage and £20,000 in debt, you will take out a £220,000 mortgage with a new lender.

2. Keeping your mortgage and getting a new one (secured against your home)

This essentially implies you'll have two mortgages on your home. You might, for example, keep your £200,000 mortgage and obtain a new secured loan for the amount owed (£20,000).

Every situation is unique, so to better understand the approach that’s best for you, we recommend researching more about it. read more in

https://realiff.com/post/bzYx1QfZJ0xj/your-complete-debt-consolidation-process

https://realiff.com/post/eOXw9ETshhhE/debt-consolidation-lowers-costs-as-credit-card-rates-climb

- mortgage |

- debt |

- buying a house |

- lender |

- loan |

- house loan