Mastering Personal Finances with Debt Consolidation Loans Before Buying a Home

Mastering Personal Finances with Debt Consolidation Loans Before Buying a Home

Buying a home is a landmark achievement in one’s life, signifying not only a substantial financial commitment but also a pivotal personal milestone. The journey towards homeownership, however, can be fraught with challenges, particularly in today's economic landscape where property prices are continually rising, and the financial market is becoming increasingly complex. One powerful strategy that prospective homeowners can leverage to navigate these challenges effectively is the use of debt consolidation loans. This approach can streamline your debt management, potentially lower your interest rates, and improve your eligibility for a mortgage, making the home buying process less daunting and more attainable.

What is a Debt Consolidation Loan?

A debt consolidation loan is a financial tool designed to simplify your debt obligations. It involves combining multiple debts, such as those from credit cards, personal loans, or other financial liabilities, into a single loan. This loan often comes with a lower interest rate and a unified payment process, making it easier to manage your finances.

The primary allure of debt consolidation lies in its ability to streamline financial management and reduce the total amount of interest you pay over time. By consolidating your debts into one manageable payment, you can save money and reduce the stress associated with juggling multiple payment deadlines.

Moreover, this financial strategy can help you create a more structured repayment plan, enabling you to take control of your financial future. For many, this simplification of their financial obligations can be the key to maintaining a steady path toward homeownership.

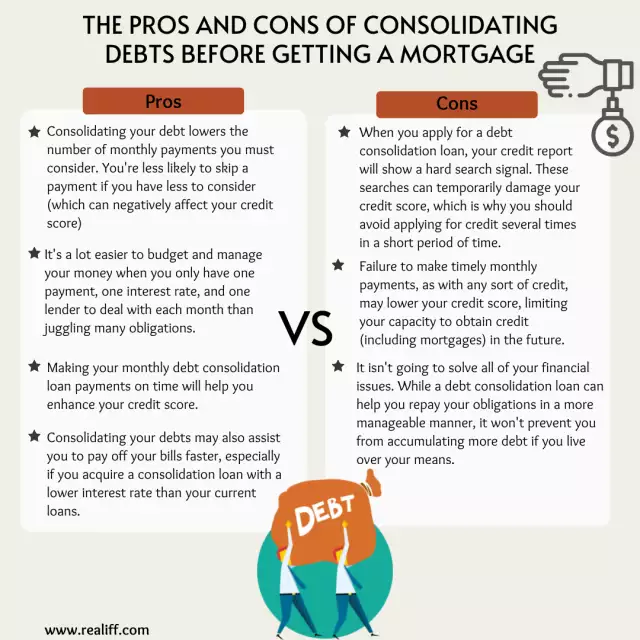

Advantages of Using a Debt Consolidation Loan Before Buying a Home

Improved Financial Management

One of the significant benefits of a debt consolidation loan is the simplification of your financial management. Juggling multiple debt accounts with different due dates can be overwhelming and increase the risk of missing payments. Consolidating these debts into a single loan means you only have one account to manage and one payment deadline to meet each month.

This simplification can greatly ease your monthly budgeting process, allowing you to allocate funds more efficiently and avoid the pitfalls of missed payments or late fees. With fewer accounts to monitor, you can focus more on saving for your future home rather than worrying about your current debt obligations.

Enhanced Mortgage Eligibility

Mortgage lenders closely scrutinize your debt-to-income ratio (DTI) when assessing your eligibility for a home loan. This ratio compares your total monthly debt payments to your gross monthly income and is a crucial indicator of your financial health. A lower DTI suggests that you have more disposable income available to manage a mortgage, making you a more attractive candidate to lenders.

By consolidating your debts into one loan, you can potentially reduce your monthly payments, thus improving your DTI. This improvement can significantly enhance your mortgage eligibility, making it easier to secure a loan with favorable terms. For prospective homeowners, this could be the difference between approval and denial when applying for a mortgage.

Lower Interest Rates

Many high-interest debts, particularly credit card balances, can quickly accumulate substantial interest charges, increasing your overall debt burden. Debt consolidation loans often offer lower interest rates compared to these high-interest debts, which can lead to significant savings over time.

Reducing your interest rates not only lowers your monthly payments but also helps you pay off your debt faster. This can free up more of your income for saving towards a home or managing other financial goals. The financial relief provided by lower interest rates can be a game-changer in your journey toward homeownership.

Potential Disadvantages of Debt Consolidation

Impact on Credit Score

Applying for a debt consolidation loan typically involves a hard inquiry into your credit report. While this may temporarily lower your credit score, the long-term benefits of managing your debt more effectively can outweigh this initial dip.

Consistent, on-time payments on your consolidation loan can help improve your credit score over time, demonstrating your ability to manage debt responsibly. However, it’s essential to be aware of the potential short-term impact and plan accordingly if you’re close to applying for a mortgage.

Extended Payment Terms

While consolidating your debts can lower your monthly payments, it often involves extending the overall term of your debt. This means you could end up paying more in total interest over the life of the loan unless you manage it carefully.

It’s crucial to evaluate the terms of the consolidation loan and consider the long-term financial implications. Balancing lower monthly payments with the potential for increased total interest requires careful financial planning to ensure that you’re making a decision that benefits your overall financial health.

Risks to Collateral

If you opt for a secured debt consolidation loan, which is backed by assets such as your home or car, you must be diligent about making payments. Failure to meet your payment obligations can put these assets at risk, leading to serious financial consequences such as foreclosure or repossession.

Secured loans often offer lower interest rates because they pose less risk to lenders. However, the trade-off is the potential risk to your assets. It’s essential to weigh these risks carefully and consider whether a secured or unsecured loan is the better option for your financial situation.

How a Debt Consolidation Loan Affects the Home Buying Process

A well-managed debt consolidation loan can positively impact your credit profile, showcasing your ability to handle debt responsibly. This can be particularly beneficial when you apply for a mortgage, as lenders will see that you’ve taken steps to manage your financial obligations effectively.

However, if you struggle to adhere to the new payment terms or fail to manage the consolidated loan properly, it could negatively affect your credit score and hinder your ability to secure a mortgage. It’s vital to approach debt consolidation with a clear plan and a commitment to maintaining disciplined financial habits.

The goal of using a debt consolidation loan is to create a more manageable and structured financial environment, paving the way for successful homeownership. By improving your credit profile and demonstrating financial responsibility, you can enhance your chances of securing a favorable mortgage.

Considerations Before Using Your Mortgage for Debt Consolidation

Using your mortgage to consolidate debt can be tempting due to the typically lower interest rates. However, this strategy comes with significant risks and long-term implications that need careful consideration.

Secured vs. Unsecured Debt

Transferring unsecured debt, such as credit card balances, into a secured debt tied to your mortgage increases your risk. If you fail to make payments, you could face foreclosure, putting your home at risk.

While the lower interest rates of a mortgage may be appealing, it’s essential to understand the implications of converting unsecured debt into secured debt. This move ties your debt to a critical asset, and any payment issues could jeopardize your home.

Comparing Costs vs. Rates

Lower interest rates can be attractive, but it’s important to consider the total cost over the life of the loan. Mortgages typically have long repayment terms, which means you could end up paying more in total interest even with a lower rate.

Carefully calculate the total cost of consolidating your debt into your mortgage, including the extended repayment period. Compare this with other consolidation options to determine the most cost-effective strategy for your situation.

Repayment Flexibility

Mortgages generally come with longer repayment terms, which can lower your monthly payments but increase the total interest paid over time. While this may make payments more manageable, it’s essential to weigh this against the overall financial impact.

Evaluate whether the extended repayment period aligns with your financial goals and consider whether you prefer the flexibility of shorter-term loans that can be paid off more quickly.

Viable Alternatives to Mortgage-Based Debt Consolidation

Balance Transfer Credit Cards

For those with good credit, balance transfer credit cards can be an effective way to consolidate debt. These cards often come with low or zero percent introductory rates, significantly reducing interest costs if the balance is paid off before the introductory period ends.

However, it’s crucial to have a repayment plan in place to avoid high-interest rates once the introductory period expires. This option can provide temporary relief and cost savings if managed carefully.

Unsecured Personal Loans

Unsecured personal loans offer another viable alternative for debt consolidation. These loans can come with competitive rates without requiring collateral, which means you’re not putting your home or other assets at risk.

Personal loans provide a structured repayment plan and can simplify your debt management without the risks associated with secured loans. They can be a flexible and safer option for consolidating debt.

Real Estate News: Current Trends and Insights

The real estate market is constantly evolving, and understanding the current trends can help you make informed decisions as you navigate the home buying process. Here are some insights into the latest developments:

Rising Interest Rates

Interest rates have been fluctuating recently, impacting both borrowing costs and the overall affordability of home loans. Keeping an eye on interest rate trends can help you time your mortgage application to secure the best possible rates.

Shift Toward Suburban Living

The COVID-19 pandemic has accelerated a shift toward suburban living, with many buyers seeking more space and remote work opportunities. This trend has led to increased demand for suburban homes, driving up prices and competition in these areas.

Increasing Demand for Eco-Friendly Homes

Sustainability is becoming a key factor in real estate, with a growing demand for energy-efficient and environmentally friendly homes. Buyers are looking for properties with green features, such as solar panels and efficient heating and cooling systems, which can reduce utility costs and have a positive impact on the environment.

Expert Insight

As Barbara Corcoran, a renowned real estate investor and businesswoman, once said, "The best investment on Earth is earth." Her words emphasize the enduring value of real estate and the importance of making informed, strategic decisions in the market. By understanding your financial options and leveraging tools like debt consolidation, you can position yourself to make the most of your real estate investments.

The Most Comprehensive Tips for Managing a Debt Consolidation Loan

To effectively manage a debt consolidation loan and make it work for you, consider the following tips:

Assess the Total Cost:Evaluate the total cost of the consolidation loan compared to your current debt obligations. Consider the interest rates, repayment terms, and any associated fees to ensure you’re makinga financially sound decision. Understanding the complete financial picture will help you avoid any surprises and ensure that the loan offers genuine benefits over your current situation.

Check for Hidden Fees:Carefully review the terms of the debt consolidation loan for any hidden fees or penalties, particularly those for early repayment. These charges can add up and impact the overall cost-effectiveness of the loan. Transparency is key, so ensure you fully understand all terms and conditions before committing.

Ensure Manageable Monthly Payments:Make sure the monthly payments of the consolidation loan are manageable within your budget. The primary goal of debt consolidation is to make your debt easier to manage, so it’s crucial that the new payment plan fits comfortably into your financial plan. Struggling to make payments can negate the benefits of consolidation.

Consider the Impact on Your Credit Score:Understand how the consolidation loan will affect your credit score in the short term and the long term. While there might be an initial dip due to the hard inquiry, consistent and timely payments can help improve your credit score over time. Keep an eye on your credit report to monitor the effects.

Consult with Financial Experts:Before finalizing your decision, seek advice from financial experts who can help tailor a plan to fit your specific financial situation. Professionals can provide insights and strategies that you might not have considered, ensuring you choose the best path for your needs.

Essential Questions About Debt Consolidation Loans

Q: Why Choose a Debt Consolidation Loan?

A debt consolidation loan simplifies your debt management by combining multiple debts into a single, more manageable payment. It can improve your financial health by potentially lowering your interest rates and reducing the total amount of interest paid over time. This can also enhance your eligibility for a mortgage by improving your debt-to-income ratio and demonstrating responsible debt management to lenders.

Q: When is the Best Time to Apply for a Debt Consolidation Loan?

The optimal time to apply for a debt consolidation loan is before you apply for a mortgage. This timing allows you to consolidate and manage your debts effectively, improving your credit profile and making you a more attractive borrower to mortgage lenders. Ensure you can manage the single monthly payment effectively to maximize the benefits.

Q: Where Should You Apply for a Debt Consolidation Loan?

Consider applying for a debt consolidation loan from reputable lenders who offer competitive rates and transparent terms. Online platforms like Realiff.com can help you compare different loan options and choose the best one for your needs. Look for lenders with positive reviews and a track record of customer satisfaction.

Q: What are the Risks of a Debt Consolidation Loan?

The potential risks of a debt consolidation loan include temporary impacts on your credit score due to a hard inquiry, the possibility of higher total interest costs if the repayment term is extended, and the risk to collateral if the loan is secured. It’s essential to weigh these risks against the benefits and ensure you have a solid repayment plan.

Q: Who Can Benefit from a Debt Consolidation Loan?

Individuals with multiple high-interest debts who are looking to simplify their payments and reduce interest rates can benefit from a debt consolidation loan. It’s particularly beneficial for those seeking to improve their financial management and enhance their mortgage eligibility by consolidating their debts into one lower monthly payment.

Q: How Does a Debt Consolidation Loan Affect Mortgage Applications?

A well-managed debt consolidation loan can positively affect your mortgage application by improving your debt-to-income ratio and demonstrating responsible debt management. However, if not managed properly, it can negatively impact your credit score and hinder your ability to secure a mortgage. Careful planning and disciplined repayment are key to leveraging debt consolidation for mortgage success.

Conclusion

Navigating the complexities of buying a home and managing personal finances can be challenging, but strategies like debt consolidation loans can provide significant relief and advantages. By consolidating your debts into a single, manageable payment, you can simplify your financial obligations, lower your interest rates, and improve your mortgage eligibility.

Realiff.com, with its AI-driven technology and extensive real estate listings, stands out as a premier resource for both buyers and sellers. Whether you are looking to capitalize on buyer's markets or find quality homes at competitive prices, Realiff.com provides the tools and insights you need to navigate the real estate landscape with confidence.

Barbara Corcoran’s insight, "The best investment on Earth is earth," underscores the enduring value of real estate. By making informed, strategic decisions and leveraging financial tools like debt consolidation, you can achieve your homeownership dreams and secure a solid foundation for your financial future.

Ultimately, the key to success in real estate and personal finance lies in thorough research, careful planning, and disciplined management. Whether you are consolidating debt or exploring the housing market, the right strategies and resources can empower you to make decisions that align with your goals and aspirations.

Embark on your journey to homeownership with clarity and confidence, armed with the knowledge and tools to manage your finances effectively and secure the perfect home for your future.