Ultimate Guide to Understanding Mortgages and the Different Types Available

Ultimate Guide to Understanding Mortgages and the Different Types Available

Purchasing a homeis one of the most significant investments most people will make in their lifetime, and for many, this requires obtaining a mortgage. A mortgage is a type of loan used to purchase a property or refinance an existing property. Understanding how mortgages work and the different types available can help you make an informed decision when choosing a mortgage that is right for you. It can also help you avoid costly mistakes that can impact your finances and your ability to achieve your long-term financial goals.

The role of the lender

The lender in a mortgage agreement has several responsibilities. First, the lender will assess the creditworthiness of the borrower to determine if they are a good risk for the loan. This involves reviewing the borrower's credit score, income, and other financial information to determine their ability to repay the loan.

Once the lender has determined that the borrower is a good risk, they will set the terms and conditions of the loan. This may include factors such as the interest rate, length of the loan, and the size of the down payment. The lender will also be responsible for managing the payments on the loan and ensuring that the borrower is making timely payments.

In addition, the lender may require the borrower to purchase certain types of insurance, such as homeowners insurance, to protect the property and the lender's investment in the event of damage or loss. The lender may also require regular inspections of the property to ensure that it is being maintained properly.

The role of the borrower

The borrower in a mortgage agreement also has several responsibilities. First and foremost, the borrower is responsible for making timely payments on the loan. This includes both the principal amount borrowed as well as the interest on the loan.

In addition to making payments, the borrower is also responsible for maintaining the property. This includes keeping the property in good condition and making any necessary repairs. Failure to maintain the property may result in a violation of the mortgage agreement and could lead to a default on the loan.

The borrower may also be required to purchase certain types of insurance, such as homeowners insurance, to protect the property and the lender's investment. It is important for the borrower to understand the terms of the mortgage agreement and to meet all of their responsibilities to avoid default on the loan.

Overall, both the lender and the borrower have important roles to play in a mortgage agreement. By understanding these roles and responsibilities, borrowers can make informed decisions about the best mortgage for their needs and lenders can manage their risk and ensure timely repayment of the loan.

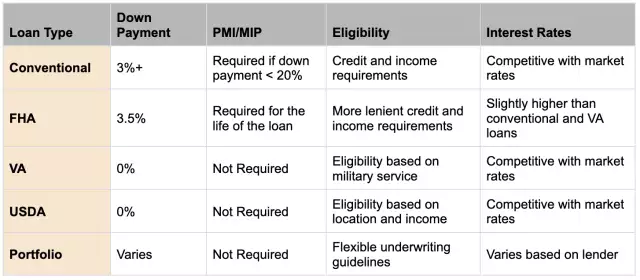

Types of Mortgages

Fixed-Rate Mortgages

A fixed-rate mortgageis a type of mortgage in which the interest rate remains the same throughout the loan's term. This means that your monthly payments will remain the same, making it easier to budget and plan for your mortgage payments. Fixed-rate mortgages are popular among borrowers who prefer predictable monthly payments and want to avoid the uncertainty of fluctuating interest rates.

Adjustable-Rate Mortgages

An adjustable-rate mortgageis a type of mortgage in which the interest rate can change periodically. This means that your monthly payments may increase or decrease over time, depending on the current interest rates. Adjustable-rate mortgages typically have lower initial interest rates than fixed-rate mortgages, which can make them attractive to borrowers who want to save money on their monthly payments. However, the uncertainty of changing interest rates can make budgeting and planning more difficult.

FHA Loans

An FHA loanis a type of mortgage insured by the Federal Housing Administration. This type of loan is popular among first-time homebuyers, as it requires a lower down payment and has less stringent credit requirements. FHA loans also have more flexible income

Collateral

One important aspect of mortgages is the use of collateral. In a mortgage agreement, the property being purchased serves as collateral for the loan. This means that if the borrower is unable to make payments on the loan, the lender can take possession of the property and sell it to recover their losses. Because the property is used as collateral, it is important to carefully consider the financial responsibility of taking on a mortgage.

How mortgages work

The mortgage process can seem complex, but understanding the basics can make it easier to navigate. To obtain a mortgage, a borrower typically applies for a loan from a lender, who will assess their creditworthiness and determine the terms and conditions of the loan. This may include factors such as the interest rate, length of the loan, and the size of the down payment.

Once the loan is approved, the borrower will make payments on the loan over the course of the loan term. The amount of the payment will typically include both the principal amount borrowed as well as interest, which is the cost of borrowing money. Depending on the terms of the mortgage, the payment may also include additional costs such as property taxes and homeowners insurance.

Choosing the right mortgage

With so many types of mortgages available, it is important to carefully consider your options before choosing the right one for your needs. Factors such as your credit score, down payment, and interest rates can all play a role in determining which type of mortgage is right for you.

For example, if you have a low credit score, an FHA loan may be a good option, as they are designed to help borrowers with less-than-perfect credit. Alternatively, if you are a veteran, a VA loan may offer attractive terms and conditions. Fixed-rate mortgages can provide stability and predictability in your monthly payments, while adjustable-rate mortgages may offer lower initial payments but carry the risk of increased payments over time.

Conclusion

Understanding mortgages and the different types available can be a valuable tool for anyone looking to purchase a home or refinance an existing mortgage. By understanding the role of the lender, borrower, and collateral, as well as the different types of mortgages available, borrowers can make informed decisions about the best mortgage for their needs. Remember to carefully consider your options and consult with a trusted professional before making a decision.