Loan Application Process

When it comes to getting a loan, the loan application process can often seem overwhelming and confusing. However, understanding the process and what is required from borrowers can make the process smoother and increase the chances of approval. In this article, we will explore the loan application process, including the information and documentation required from borrowers, the types of loans available, loan approval and disbursement, loan repayment, and tips for a successful loan application.

Overview of Loan Application Process

The loan application process begins with the borrower submitting an application to a lender. This application typically includes personal and financial information, such as income, employment history, and credit score. Lenders use this information to assess the borrower's creditworthiness and ability to repay the loan.

Once the application is submitted, the lender will review the borrower's credit history and other factors to determine whether to approve the loan. If approved, the lender will provide a loan offer, including the loan amount, interest rate, and repayment terms. If the borrower accepts the offer, they will sign a loan agreement, and the funds will be disbursed to the borrower's account.

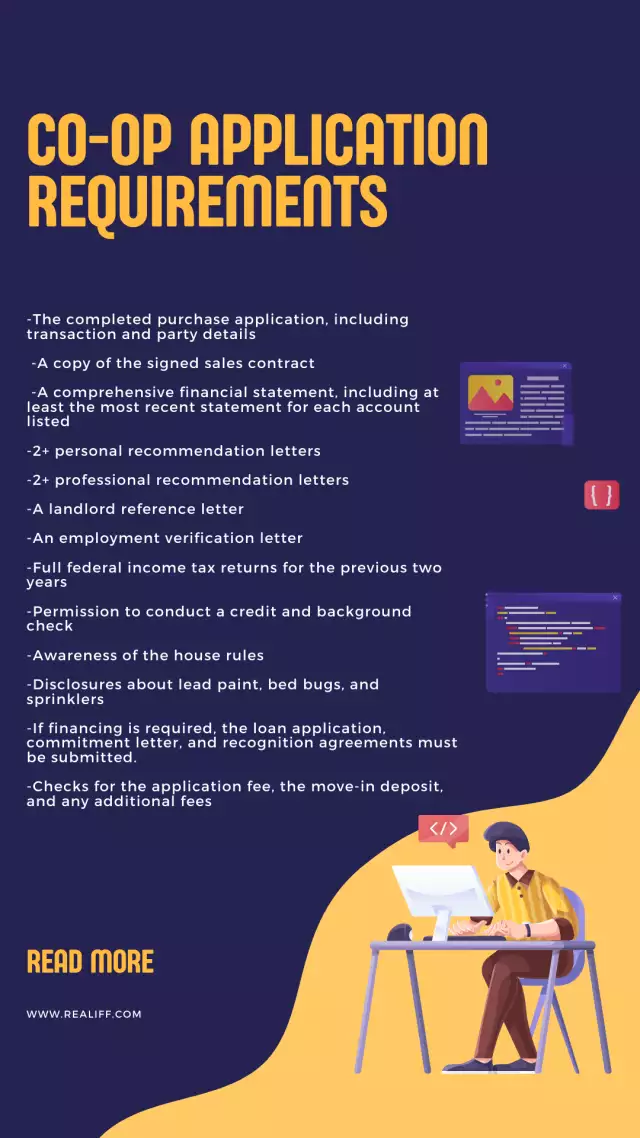

Required Information and Documentation

To apply for a loan, borrowers typically need to provide the following information:

- Personal information, such as name, address, and Social Security number

- Employment information, such as job title, employer name, and length of employment

- Financial information, such as income and expenses

- Credit history, including credit score and any outstanding debts

Borrowers may also need to provide documentation to support the information provided in the application. This documentation may include:

- Pay stubs or tax returns to verify income

- Bank statements to verify assets and expenses

- Proof of identity, such as a driver's license or passport

- Proof of residence, such as a utility bill

It is important to provide accurate and complete information and documentation to increase the chances of loan approval.

Types of Loans

There are many types of loans available to borrowers, each with its own requirements and benefits. Some common types of loans include:

- Personal loans: Unsecured loans that can be used for any purpose, such as debt consolidation or home improvements.

- Auto loans: Secured loans used to purchase a vehicle, with the vehicle serving as collateral.

- Home loans: Secured loans used to purchase a home, with the home serving as collateral.

- Student loans: Loans are used to pay for education expenses, with the loan amount based on the cost of attendance.

- Business loans: Loans used to start or grow a business, with the loan amount and terms based on the business's financials.

Loan Approval and Disbursement

Loan approvalis based on several factors, including credit history, income, and debt-to-income ratio. Lenders may also consider the purpose of the loan and the collateral available. If approved, the lender will provide a loan offer, including the loan amount, interest rate, and repayment terms.

Once the borrower accepts the loan offer and signs the loan agreement, the lender will disburse the funds to the borrower's account. The timeline for disbursement varies depending on the lender and the type of loan, but it typically takes a few days to a week for the funds to become available.

Loan Repayment

Loan repayment typically begins soon after the loan is disbursed. The repayment schedule and options vary depending on the type of loan but may include monthly payments over a set period of time or flexible repayment options based on income.

It is important to make loan payments on time to avoid late fees and negative impact on credit scores. If a borrower is unable to make payments, they should contact the lender to discuss repayment options, such as deferment or forbearance.

Tips for Successful Loan Application

To increase the chances of loan approval, there are several tips that borrowers can follow:

- Check credit score and report: Before applying for a loan, borrowers should check their credit score and report to ensure accuracy and identify any areas for improvement.

- Compare loan options: It is important to compare loan options from multiple lenders to find the best rates and terms for the borrower's financial situation.

- Prepare documentation in advance: Gathering required documentation in advance can streamline the loan application process and increase the chances of approval.

- Improve credit score: Improving credit score through on-time payments and paying down debts can increase the chances of loan approval and improve the loan terms.

- Avoid new credit applications: Applying for new credit shortly before or during the loan application process can negatively impact your credit score and decrease the chances of loan approval.

In conclusion, the loan application process can be complex, but understanding the process and what is required can increase the chances of approval and help borrowers find the best loan options for their financial needs. By providing accurate information and documentation, choosing the right loan option, and making timely payments, borrowers can successfully navigate the loan application process and achieve their financial goals.