The process of refinancing a mortgage, including when it makes sense to refinance and how to go about it

The process of refinancing a mortgage, including when it makes sense to refinance and how to go about it

Refinancing a mortgage isthe process of taking out a new loan to replace an existing mortgage. This is done to achieve lower monthly payments, lower interest rates, or shorten the loan term. Refinancing a mortgage can be a great way to save money on monthly payments or to free up cash for other expenses. In this post, we will take a detailed look at the process of refinancing a mortgage, including when it makes sense to refinance and how to go about it.

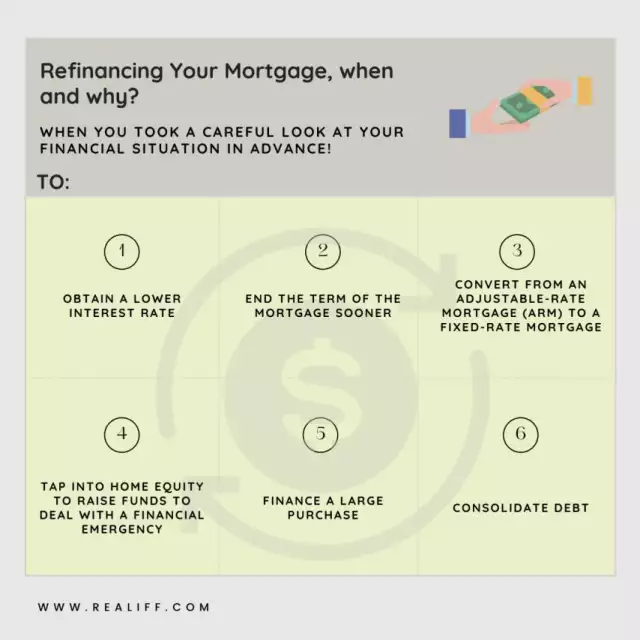

When Does it Make Sense to Refinance a Mortgage?

Refinancing a mortgage can be a great financial move, but it is important to consider the costs involved and whether it makes sense for your particular situation. Here are some common reasons why people consider refinancing their mortgage:

Lowering Interest Rates:One of the most common reasons people refinance their mortgage is to lower their interest rate. If interest rates have decreased since you took out your mortgage, refinancing can lower your monthly payment and save you thousands of dollars over the life of your loan.

Shortening the Loan Term:Another reason to refinance a mortgage is to shorten the loan term. By refinancing to a shorter loan term, you can pay off your mortgage faster and save money on interest payments.

Switching from an Adjustable Rate Mortgage (ARM) to a Fixed Rate Mortgage: Adjustable rate mortgageshave interest rates that can fluctuate over time, which can make budgeting for monthly payments difficult. Refinancing from an ARM to a fixed-rate mortgage can provide stability and consistency in monthly payments.

Cash-Out Refinancing:A cash-out refinance allows you to take out a new mortgage for more than your current mortgage balance and receive the difference in cash. This can be a good option if you need to pay for home improvements or other expenses.

How to Refinance a Mortgage

If you've decided that refinancing your mortgage makes sense, the next step is to start the process. Here are the steps to follow when refinancing a mortgage:

Evaluate Your Current Mortgage:Before you start the refinancing process, evaluate your current mortgage to determine whether it's worth refinancing. Consider factors such as your interest rate, loan term, and monthly payments. Also, check your credit score to make sure it's in good standing.

Shop Around for Lenders: When considering refinancing, it's important to shop around for lenders to find the best terms and interest rates available. Start by doing research online to compare rates and fees from different lenders. Then, reach out to lenders directly to ask for personalized quotes based on your specific financial situation. Don't be afraid to negotiate for better rates and terms, and be sure to carefully read and understand all the terms and conditions before signing any loan agreement. By taking the time to shop around for lenders, you can potentially save thousands of dollars over the life of your loan.

Apply for the Refinance Loan: Once you've researched and compared lenders and found the best option for your refinancing needs, it's time to apply for the refinance loan. The application process is similar to applying for a new mortgage and will involve providing personal and financial information, such as your income, credit score, and employment history. The lender will also likely require an appraisal of your home to determine its current market value. It's important to be upfront and honest about your financial situation, as any discrepancies or omissions could potentially jeopardize the loan approval process. After submitting your application, the lender will review your information and make a decision on whether to approve or deny the loan. If approved, you will need to review and sign the loan documents before the refinance can be completed. Keep in mind that the process can take several weeks or even months, so be prepared to be patient and responsive to any requests for additional information from the lender.

Lock in Your Interest Rate: One important step in the refinancing process is locking in the interest rate on your new mortgage. Interest rates can fluctuate based on market conditions, and locking in a rate ensures that you will receive the same rate regardless of any future changes. Typically, lenders will offer a rate lock for a specific period of time, such as 30, 45, or 60 days. During this time, you have the security of knowing your interest rate won't change, but you will also be expected to close on the loan within that time frame. Keep in mind that some lenders may charge a fee for locking in a rate, so be sure to factor that into your overall cost analysis. It's also important to understand that if interest rates drop significantly during the rate lock period, you won't be able to take advantage of the lower rate without renegotiating the terms of your loan. Overall, locking in the interest rate is an important step in refinancing your mortgage and can help provide peace of mind during the loan process.

Close the Loan:After you've locked in your interest rate, you'll need to close the loan. This involves signing a variety of documents, including the loan agreement, disclosure documents, and other paperwork. You'll also need to pay any fees associated with the refinancing process, such as appraisal fees and closing costs.

Start Making Payments:Once the loan is closed, you'll start making payments on the new mortgage. Be sure to keep track of your payments and check your mortgage statement regularly to ensure that everything is correct.

It's important to work with a reputable lender and carefully evaluate the costs and benefits of refinancing before proceeding with the process. Refinancing can be a great way to save money on monthly payments or free up cash for other expenses, but it's important to weigh the costs and benefits carefully to ensure that it makes financial sense for you.

Costs Associated with Refinancing a Mortgage

When considering refinancing a mortgage, it is important to be aware of the costs associated with the process. Refinancing a mortgage can involve a variety of fees and expenses, including:

Application Fees: When refinancing a mortgage, it's important to be aware of any applicable fees that may be associated with the process. Application fees are charges levied by the lender to cover the cost of processing and evaluating your loan application. These fees can vary depending on the lender and the type of loan, but they can typically range from a few hundred to a few thousand dollars. It's important to carefully review the terms and conditions of your loan agreement to understand what application fees you may be required to pay. Some lenders may also offer to waive or reduce application fees in exchange for other terms, such as a higher interest rate. When comparing lenders and loan offers, be sure to factor in the cost of application fees as part of your overall cost analysis to ensure you're getting the best deal possible.

Appraisal Fees: In addition to application fees, another cost to consider when refinancing your mortgage is the appraisal fee. An appraisal is a professional assessment of your home's value, and lenders typically require one before approving a refinance loan. The cost of an appraisal can vary depending on the location, size, and complexity of your home, but it generally ranges from several hundred to several thousand dollars. It's important to note that the appraisal fee is typically paid by the borrower, regardless of whether the loan is approved or not. Some lenders may offer to waive the appraisal fee as part of a promotion or as part of the loan agreement, so be sure to ask about any potential cost savings. While an appraisal fee may seem like an additional expense, it can ultimately help you secure a better loan with lower interest rates and more favorable terms by providing a clear picture of your home's value.

Title Search and Insurance:To ensure that you have clear ownership of the property, you may be required to pay for a title search. This fee can range from a few hundred to several thousand dollars. In addition, you may need to purchase title insurance to protect against any legal claims or disputes over the property. The cost of title insurance can vary based on the value of the property and other factors.

Origination Fees: Another cost to consider when refinancing a mortgage is the origination fee. This fee is charged by the lender for processing and underwriting the loan, and it typically ranges from 0.5% to 1% of the loan amount. Origination fees are used to cover the cost of evaluating your creditworthiness, preparing the loan documents, and processing the loan application. Some lenders may offer to waive the origination fee as part of a promotion or as part of the loan agreement, so be sure to ask about any potential cost savings. It's important to factor in the cost of the origination fee when comparing different loan offers, as a lower interest rate on one loan may be offset by a higher origination fee. Overall, the origination fee is a common cost associated with refinancing a mortgage, and it's important to understand the terms and conditions of your loan agreement to ensure you're getting the best deal possible.

Closing Costs:Closing costs are fees associated with the transfer of ownership of the property and may include fees for attorneys, recording fees, and other costs. Closing costs can vary, but they typically range from 2% to 5% of the loan amount.

Prepayment Penalties:Some mortgages may include prepayment penalties, which are fees charged if you pay off the mortgage early. If your mortgage includes a prepayment penalty, you will need to factor this cost into your decision to refinance.

When considering refinancing a mortgage, it is important to weigh the costs of refinancing against the potential savings. If the costs of refinancing are too high, it may not make financial sense to proceed with the process. However, in some cases, the savings from refinancing can outweigh the costs and make it a worthwhile financial move. It is important to carefully consider your options and work with a reputable lender to ensure that you are making an informed decision.

Conclusion

Refinancing a mortgage can be a great way to save money on monthly payments or to free up cash for other expenses. However, it is important to carefully consider the costs and benefits of refinancing before proceeding with the process. If you are considering refinancing, evaluate your current mortgage, check your credit score, shop around for lenders, and carefully consider the costs associated with the process. With careful planning and research, refinancing a mortgage can be a great financial move that saves you money and helps you achieve your financial goals.