Navigating the Mortgage Market: A Breakdown of the Different Loans Available to Homebuyers

Navigating the Mortgage Market: A Breakdown of the Different Loans Available to Homebuyers

When it comes to buying a home, one of the most important decisions you will make is how to finance it. There are many different types of loans available to homebuyers, each with their own set of pros and cons. Navigating the mortgage market can be overwhelming, but understanding the different loan options available can help you make an informed decision.

One of the most popular loan options for homebuyers is the conventional loan. Conventional loans are not guaranteed or insured by the government and are offered by private lenders. These loans typically require a down payment of at least 3% and have stricter credit and income requirements than government-backed loans. They also require private mortgage insurance (PMI) if the down payment is less than 20%.

Another popular loan option is the Federal Housing Administration (FHA) loan. FHA loans are government-backed loans that are designed to make it easier for first-time homebuyers to purchase a home. These loans have more lenient credit and income requirements than conventional loans and require a down payment of only 3.5%. However, they also require mortgage insurance premium (MIP) for the life of the loan.

VA loans are a great option for veterans and active duty service members. These loans are guaranteed by the U.S. Department of Veterans Affairs (VA) and do not require a down payment. VA loans also do not require private mortgage insurance (PMI) and offer competitive interest rates. However, these loans have specific eligibility requirements and limits on the amount that can be borrowed.

Another option is the USDA loan, which is backed by the United States Department of Agriculture (USDA) and is designed to help low- and moderate-income families in rural areas buy a home. These loans have no down payment requirement and offer competitive interest rates, however, these loans are only available for properties located in rural areas.

Lastly, a common alternative is to use a portfolio loan. These loans are not backed by the government and are offered by community banks or credit unions. They are typically used for borrowers who do not qualify for traditional loans and have unique or specific financing needs. They can have flexible underwriting guidelines and are often tailored to meet the needs of the borrower.

It's important to note that each loan option has its own set of pros and cons, and it's essential to evaluate your options and compare the pros and cons of each loan type to determine which one is best for your specific needs and circumstances. You should also consider your credit score, income, and the amount of money you have available for a down payment.

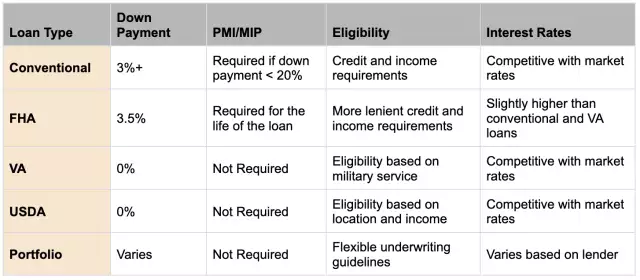

Comparing different home loans

In summary, conventional loans have lower down payment requirements but require PMI if down payment is less than 20%, FHA loans have a lower down payment requirement but require MIP for the life of the loan, VA loans do not require down payment or PMI, USDA loans are only available for properties located in rural areas, and portfolio loans have flexible underwriting guidelines but interest rates and down payment requirements vary by lender.

Questions and Answers on Different Home Loan Types

Q: What is a conventional loan? A: A conventional loan is a type of mortgage that is not guaranteed or insured by the government and is offered by private lenders. These loans typically require a down payment of at least 3% and have stricter credit and income requirements than government-backed loans. They also require private mortgage insurance (PMI) if the down payment is less than 20%.

Q: What is an FHA loan? A: An FHA loan is a government-backed loan that is designed to make it easier for first-time homebuyers to purchase a home. These loans have more lenient credit and income requirements than conventional loans and require a down payment of only 3.5%. However, they also require mortgage insurance premium (MIP) for the life of the loan.

Q: What is a VA loan? A: A VA loan is a type of loan guaranteed by the U.S. Department of Veterans Affairs (VA). These loans are available to veterans, active duty service members, and certain members of the National Guard and Reserves. They do not require a down payment or private mortgage insurance (PMI) and offer competitive interest rates. However, these loans have specific eligibility requirements and limits on the amount that can be borrowed.

Q: What is a USDA loan? A: A USDA loan is a type of loan backed by the United States Department of Agriculture (USDA) and is designed to help low- and moderate-income families in rural areas buy a home. These loans have no down payment requirement and offer competitive interest rates. However, these loans are only available for properties located in rural areas.

Q: What is a portfolio loan? A: A portfolio loan is a type of loan that is not backed by the government and is offered by community banks or credit unions. They are typically used for borrowers who do not qualify for traditional loans and have unique or specific financing needs. They can have flexible underwriting guidelines and are often tailored to meet the needs of the borrower.

How should you decide which one is the best option for you?

Deciding which loan type is the best option for you depends on your individual circumstances, including your credit score, income, the amount of money you have available for a down payment, and the type of property you want to purchase. Here are some tips to help you decide which loan type is the best option for you:

Assess your credit score and income: Different loan types have different credit and income requirements, so it's important to understand how your credit score and income will impact your eligibility.

Consider the amount of money you have for a down payment: Some loan types, such as VA and USDA loans, do not require a down payment, while others, such as conventional loans, require a higher down payment.

Evaluate your long-term financial goals: Consider whether you plan to stay in the home for a long time and if you can afford the monthly payments for the life of the loan.

Research the different loan types and compare the pros and cons of each: Make sure you understand the terms and conditions of each loan type, including interest rates, fees, and any additional costs such as mortgage insurance.

Get pre-approved and work with a trusted lender: Once you have a good understanding of the different loan types and have an idea of which one is best for you, it's time to get pre-approved and work with a trusted lender to help you through the process.

It's important to note that while the above tips may help you to decide which loan type is the best option for you, the best way to make a final decision is to consult with a mortgage lender or loan officer who can provide you with personalized advice and guide you through the process. They can help you understand the terms and conditions of each loan type and how they will impact your overall financial situation. Additionally, they can help you compare different loan options and find the one that best fits your needs and goals.

It's also important to keep in mind that the best loan type for you may not be the same as the best loan type for someone else, as everyone's financial situation is unique. By working with a lender and considering your individual circumstances, you can make an informed decision and choose the loan type that is best for you.

In conclusion, navigating the mortgage market can be overwhelming, but understanding the different loan options available can help you make an informed decision. Whether you choose a conventional loan, FHA loan, VA loan, USDA loan or a portfolio loan, it's essential to do your research and work with a trusted lender to find the best loan for you.