Sales leader to top 100 Mobile Home Park Investor with Jefferson Lilly

Sales leader to top 100 Mobile Home Park Investor with Jefferson Lilly

In this episode we interview Jefferson Lilly from Park Street Partners. Jefferson and his team have purchased 19 mobile home parks with values over $30 million in the past 10 years. He's found his niche and he's sticking to it!

In the episode you will discover:

-MHP's for retirement income -Cash Flow -MHP cap rates -MHP management -Financing strategies -Due diligence -Jefferson's mastermind -MHP expenses -Deal flow -And much much more!

You can contact us to get more choices

0

You can contact us to get more choices

Related posts

In this episode we interview Jefferson Lilly from Park Street Partners. Jefferson and his team have purchased 19 mobile home parks with values over $30 million in the past 10 years. He's found his niche and he's sticking to it! In the episode you will discover: -MHP's for retirement income -Cash Flow -MHP cap rates -MHP management -Financing strategies -Due diligence -Jefferson's mastermind -MHP expenses -Deal flow -And much much more! Park Street Partners | Team

In this episode we interview Jefferson Lilly from Park Street Partners. Jefferson and his team have purchased 19 mobile home parks with values over $30 million in the past 10 years. He's found his niche and he's sticking to it! In the episode you will discover: -MHP's for retirement income -Cash Flow -MHP cap rates -MHP management -Financing strategies -Due diligence -Jefferson's mastermind -MHP expenses -Deal flow -And much much more! Park Street Partners | Team

This Sunday, Matt interviews Andrew Keel, a CEO of Keel Team, a company that currently manages 16 manufactured housing communities across seven states. Tune in and find out what are the things you have to watch out when moving into mobile home parks, what skills are required for this kind of business, what Andrew thinks about 2020 recession, and many more!

Learn more about your ad choices. Visit megaphone.fm/adchoices

This Sunday, Matt interviews Andrew Keel, a CEO of Keel Team, a company that currently manages 16 manufactured housing communities across seven states. Tune in and find out what are the things you have to watch out when moving into mobile home parks, what skills are required for this kind of business, what Andrew thinks about 2020 recession, and many more!

Learn more about your ad choices. Visit megaphone.fm/adchoices

Meet Kevin Bupp, a real estate expert, and a CEO of Sunrise Capital Investors. He is here to tell you more about a slightly different business, mobile home park investment! Learn what to look for when acquiring home parks, how the process of negotiating the purchase differs from buying a single-family house, and the 3 guiding principles for Kevin’s success.

Learn more about your ad choices. Visit megaphone.fm/adchoices

Meet Kevin Bupp, a real estate expert, and a CEO of Sunrise Capital Investors. He is here to tell you more about a slightly different business, mobile home park investment! Learn what to look for when acquiring home parks, how the process of negotiating the purchase differs from buying a single-family house, and the 3 guiding principles for Kevin’s success.

Learn more about your ad choices. Visit megaphone.fm/adchoices

The Pelican Palms Village has a new owner.

The Pelican Palms Village has a new owner.

Eager to make it as an investor, Hunter Thompson was up for any vehicle that has risk-adjusted returns with predictable income and results. After the European Debt Crisis, which caused great volatility in the US stock market, it became apparent to him that real estate is the key. Hence, he became a full-time real estate investor. Hunter started by pooling funds from family and friends and to date, he has raised $20 million in private capital. He is the host of the Cash Flow Connections Podca...

Eager to make it as an investor, Hunter Thompson was up for any vehicle that has risk-adjusted returns with predictable income and results. After the European Debt Crisis, which caused great volatility in the US stock market, it became apparent to him that real estate is the key. Hence, he became a full-time real estate investor. Hunter started by pooling funds from family and friends and to date, he has raised $20 million in private capital. He is the host of the Cash Flow Connections Podca...

Former owner of AMF Bowling sells 23-acre site to Utah investors who specialize in mobile home communities.

Former owner of AMF Bowling sells 23-acre site to Utah investors who specialize in mobile home communities.

Will Coleman and Mike Taravella interview Ekatarina Stepanova of M2K Partners. Key Information: Mobile home parks are divided into lots which have homes owned by either the park or the tenants. Mobile homes are considered personal property and not real estate. When underwriting mobile home parks, only underwrite the lots and do not include the homes. Banks typically do not lend on homes in parks because of their rapid depreciation. Look to optimize the infrastructure in the park: septic ta...

Will Coleman and Mike Taravella interview Ekatarina Stepanova of M2K Partners. Key Information: Mobile home parks are divided into lots which have homes owned by either the park or the tenants. Mobile homes are considered personal property and not real estate. When underwriting mobile home parks, only underwrite the lots and do not include the homes. Banks typically do not lend on homes in parks because of their rapid depreciation. Look to optimize the infrastructure in the park: septic ta...

Kasia is so excited about getting to 100 podcast episodes and thankful to all her listeners. She shares the top 10 podcast episodes y'all have listened to over the past few years.

And if you are getting ready to sell your house soon, get my free ebook "10 Things Every Homeowner Should Do Before Selling Their Home" so you can get a jump on the spring real estate market at https://bit.ly/3pqjlKA

Kasia is so excited about getting to 100 podcast episodes and thankful to all her listeners. She shares the top 10 podcast episodes y'all have listened to over the past few years.

And if you are getting ready to sell your house soon, get my free ebook "10 Things Every Homeowner Should Do Before Selling Their Home" so you can get a jump on the spring real estate market at https://bit.ly/3pqjlKA

July 14, 2022

Tom Ichniowski

KEYWORDS airport infrastructure / Federal Aviation Administration / Phillip Washington

Order Reprints

No Comments

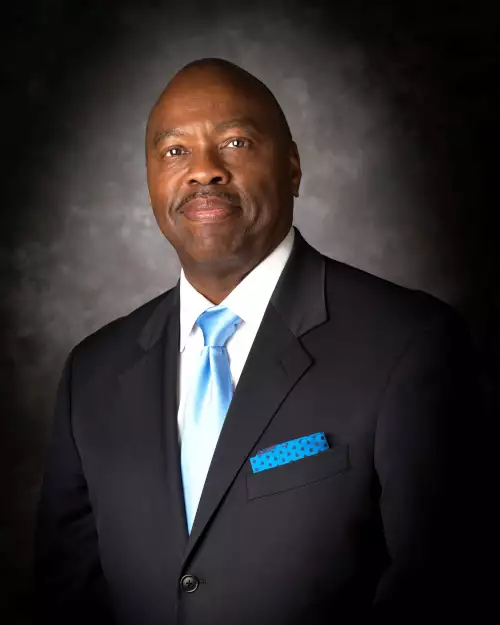

President Joe Biden has nominated Phillip A. Washington, director of Denver’s airport for the past year and a long-time leader in the transit industry and advocate for transportation equity, to h...

July 14, 2022

Tom Ichniowski

KEYWORDS airport infrastructure / Federal Aviation Administration / Phillip Washington

Order Reprints

No Comments

President Joe Biden has nominated Phillip A. Washington, director of Denver’s airport for the past year and a long-time leader in the transit industry and advocate for transportation equity, to h...

Check out the most expensive recent home sales in Nashville in this weekly feature.

Check out the most expensive recent home sales in Nashville in this weekly feature.