Deciphering Mortgage Interest Rates: Key Factors That Determine Your Rate

Deciphering Mortgage Interest Rates: Key Factors That Determine Your Rate

Securing a mortgage is a significant milestone in many people's lives, one that can be both exhilarating and daunting. Among the myriad considerations applicants face, the interest rate on a mortgage loan stands out for its profound impact on the long-term cost of the home. Understanding what factors influence these rates can empower borrowers to secure more favorable terms, potentially saving thousands over the life of their loan. As an expert in the field, I'm here to demystify these factors and guide you through the intricacies of mortgage interest rates.

1. Credit Score: The Borrower's Financial Report Card

Your credit score is arguably the most critical factor determining your mortgage interest rate. Think of it as a summary of your financial reliability. Higher scores indicate to lenders that you're a low-risk borrower, which can result in lower interest rates. Conversely, lower scores may lead to higher rates as lenders compensate for the increased risk. Regularly checking your credit report and improving your credit score before applying can significantly influence the rates you're offered.

2. Down Payment: More Upfront, Less Overtime

The size of your down payment can also affect your mortgage rate. Generally, a larger down payment signals financial stability and reduces the lender's risk, which can lead to more favorable interest rates. Additionally, borrowers who can put down 20% or more typically avoid the added cost of private mortgage insurance (PMI), further reducing monthly expenses.

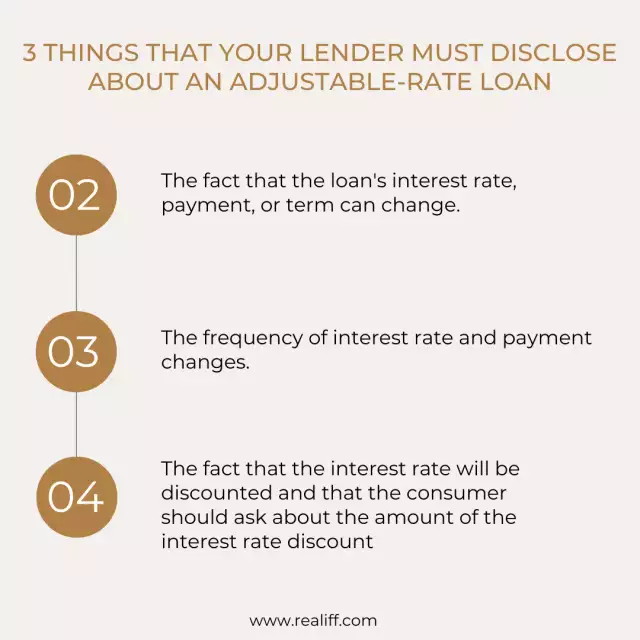

3. Loan Type: Choose Your Path Wisely

The type of mortgage loan you choose influences your interest rate. Fixed-rate mortgages provide a stable interest rate and predictable monthly payments for the life of the loan, often at a slightly higher initial rate. Adjustable-rate mortgages (ARMs), on the other hand, offer a lower initial rate that adjusts over time based on market conditions. Government-backed loans, such as FHA, VA, and USDA loans, can offer different rates and terms as well, often designed to assist specific groups of borrowers.

4. Loan Term: Duration's Dual-Edged Sword

The term of your loan, or how long you have to repay it, plays a significant role. Shorter-term loans, like 15-year mortgages, typically have lower interest rates than 30-year loans but come with higher monthly payments. Choosing the right term involves balancing your monthly budget constraints with your long-term financial goals.

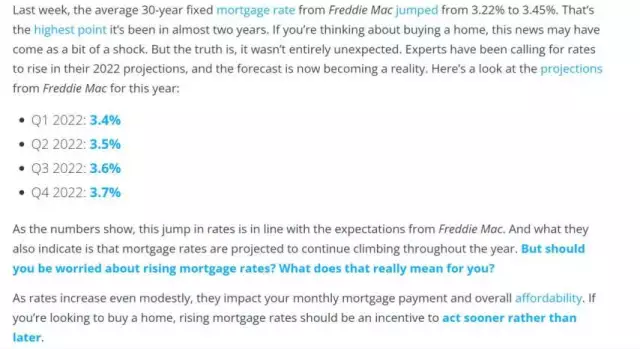

5. Economic Factors: The Big Picture

Broad economic indicators such as inflation, the Federal Reserve's monetary policy, and the state of the housing market can influence mortgage rates. For example, when inflation is high, lenders typically raise interest rates to maintain their profit margins. Conversely, in times of economic downturn, rates may fall to stimulate borrowing.

6. The Lender: Shopping Around Pays Off

Finally, the lender you choose can impact your mortgage rate. Interest rates can vary significantly from one lender to another, even for borrowers with similar financial profiles. Therefore, it's essential to shop around, compare rates from multiple lenders, and negotiate the best possible terms.

Conclusion: Empowerment Through Knowledge

Understanding the factors that affect mortgage interest rates puts you in a stronger position to negotiate better terms and make informed decisions that align with your financial goals. Remember, the mortgage process is not just about finding a loan; it's about finding the right loan for you. By focusing on the aspects you can control and staying informed about the economic landscape, you can navigate the complexities of mortgage interest rates with confidence.