Types of loans: An overview of the different types of loans available in real estate

Types of loans: An overview of the different types of loans available in real estate

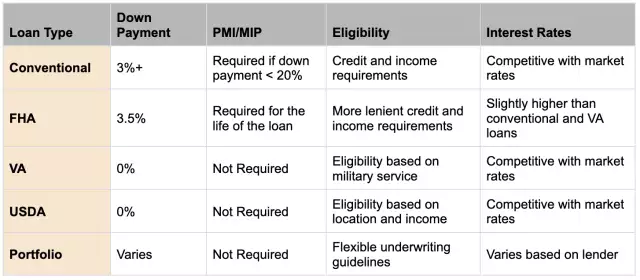

Loans are an essential aspect of the real estate industry. Whether you are a first-time homebuyer, a seasoned investor, or a real estate agent, understanding the various types of loans available in the market is crucial. In this article, we will discuss the different types of loans available in real estate, their features, and their pros and cons.

Fixed-rate loans

Fixed-rate loans havea set interest rate that stays the same throughout the life of the loan, typically 15 or 30 years. This means that your monthly mortgage payment will remain constant over time, which can make budgeting and financial planning easier. Fixed-rate loans are a popular choice for buyers who plan to stay in their home for a long time and want the predictability of a consistent mortgage payment.

Pros:

Stable payments:Because the interest rate on a fixed-rate loan remains the same throughout the loan term, your monthly mortgage payments will also remain the same, making it easier to budget and plan your finances.

Predictable interest rate:With a fixed-rate loan, you know exactly what your interest rate will be, which can provide peace of mind and help you plan for the future.

Protection against interest rate hikes:If interest rates rise, your mortgage payment will remain the same, providing protection against rising housing costs.

Cons:

Higher interest rates:Fixed-rate loans typically have higher interest rates than adjustable-rate loans, which can make them more expensive over the life of the loan.

Limited flexibility:Because the interest rate is fixed, you cannot take advantage of lower interest rates if they become available in the future.

Higher monthly payments:Because fixed-rate loans have higher interest rates, your monthly mortgage payment may be higher than it would be with an adjustable-rate loan.

Adjustable-rate loans

Adjustable-rate loans, also known as ARMs, have an interest rate that can fluctuate over time based on market conditions. The initial interest rate on an ARM is typically lower than a fixed-rate loan, which can make it an attractive option for buyers who plan to sell or refinance their home within a few years. However, the interest rate can increase over time, which can make it difficult to budget and plan for future payments.

Pros:

Lower interest rates:Adjustable-rate loans typically have lower interest rates than fixed-rate loans, which can save you money over the life of the loan.

Initial lower monthly payments:Since the interest rate on an adjustable-rate loan is typically lower at the beginning of the loan term, your monthly mortgage payment may also be lower initially.

Flexibility:If interest rates decrease in the future, your mortgage payment may also decrease, providing more flexibility.

Cons:

Unpredictable payments:Because the interest rate on an adjustable-rate loan can change over time, your monthly mortgage payment may also change, making it harder to budget and plan your finances.

Risk of higher payments:If interest rates rise, your monthly mortgage payment could increase significantly, which can make it difficult to afford your home.

Higher risk:Adjustable-rate loans are generally riskier than fixed-rate loans because of the unpredictability of interest rate changes.

FHA loans

FHA loans areinsured by the Federal Housing Administration and are designed to help first-time homebuyers and buyers with low credit scores or limited down payment funds. FHA loans have more lenient credit score requirements than conventional loans and allow for down payments as low as 3.5%. However, they also require mortgage insurance premiums, which can add to the cost of the loan.

Pros:

Low down payment:FHA loans require a down payment of only 3.5%, which can make it easier to qualify for a mortgage and purchase a home.

More relaxed credit score requirements:FHA loans have more flexible credit score requirements than conventional loans, making it easier for borrowers with lower credit scores to qualify.

Mortgage insurance:FHA loans require mortgage insurance, which protects the lender in case the borrower defaults on the loan. However, FHA loans offer lower mortgage insurance premiums than conventional loans.

Cons:

Upfront and ongoing mortgage insurance premiums:FHA loans require both an upfront mortgage insurance premium and an ongoing monthly mortgage insurance premium, which can add to the cost of the loan.

Property requirements:FHA loans require the property to meet certain standards, such as being move-in ready and free from any health or safety hazards.

Loan limits:FHA loans have loan limits that vary by location and can be lower than conventional loan limits, which can limit your borrowing power.

VA loans

VA loans areguaranteed by the Department of Veterans Affairs and are available to eligible veterans, active-duty service members, and their spouses. VA loans offer 100% financing, meaning that buyers can purchase a home without putting any money down. They also have more flexible credit score requirements and do not require mortgage insurance. However, VA loans have a funding fee that must be paid at closing, and they have property and location requirements that can limit eligibility.

Pros:

No down payment: VA loans offer 100% financing, meaning that you can purchase a property without putting any money down.

No mortgage insurance:Unlike FHA and conventional loans, VA loans do not require mortgage insurance, which can save you thousands of dollars over the life of the loan.

Flexible credit score requirements:VA loans have more flexible credit score requirements than conventional loans, making it easier for borrowers with lower credit scores to qualify.

Cons:

Funding fee:VA loans require a funding fee, which can be added to the loan amount or paid upfront. The amount of the funding fee varies depending on your military status, loan amount, and down payment.

Limited eligibility:VA loans are only available to certain eligible veterans, active-duty service members, and their spouses, which can limit who can qualify for this type of loan.

Property requirements:Like FHA loans, VA loans also have property requirements, including a minimum property condition standard that must be met.

Loan limits: VA loans also have loan limits that vary by location and can be lower than conventional loan limits, which can limit your borrowing power.

USDA loans

USDA loans areguaranteed by the U.S. Department of Agriculture and are designed to help buyers in rural areas. USDA loans offer 100% financing and have more flexible credit score requirements than conventional loans. However, they also require mortgage insurance and have location and income requirements that can limit eligibility.

It's important to research and speaks with a mortgage professional to determine which loan is right for your unique situation. The right loan can make a significant impact on your financial future, so take the time to make an informed decision.

Pros:

No down payment:USDA loans offer 100% financing, meaning that you can purchase a property without putting any money down.

Low-interest rates:USDA loans offer low-interest rates, which can save you money over the life of the loan.

Flexible credit score requirements:USDA loans have more flexible credit score requirements than conventional loans, making it easier for borrowers with lower credit scores to qualify.

Cons:

Limited eligibility:USDA loans are only available to borrowers who meet certain income and location requirements. Specifically, the property must be located in a qualified rural area, and the borrower's income must be below a certain threshold.

Mortgage insurance:USDA loans require mortgage insurance, which can add to the cost of the loan.

Property requirements:Like FHA and VA loans, USDA loans also have property requirements, including a minimum property condition standard that must be met.

Frequently Asked Questions (FAQs)

Q: What is the difference between a fixed-rate loan and an adjustable-rate loan?

A: A fixed-rate loan has a fixed interest rate that remains the same throughout the loan term, while an adjustable-rate loan has a variable interest rate that can change over time.

Q: What is mortgage insurance?

A: Mortgage insurance is an insurance policy that protects the lender in case the borrower defaults on the loan. Mortgage insurance is typically required for loans with a down payment of less than 20%.

Q: Can I get a loan if I have bad credit?

A: It depends on the type of loan and the lender's requirements. FHA loans and VA loans have more relaxed credit score requirements than conventional loans, making it easier for borrowers with lower credit scores to qualify.

Q: How much down payment do I need for a loan?

A: It depends on the type of loan and the lender's requirements. FHA and VA loans offer 100% financing, meaning you can purchase a property without putting any money down. Conventional loans usually require a down payment of at least 3%, while USDA loans require no down payment.

In conclusion, understanding the different types of loans available in the real estate market can help you make an informed decision when purchasing a property. Fixed-rate loans and adjustable-rate loans offer different advantages and disadvantages, while FHA loans, VA loans, and USDA loans offer unique benefits.