Better

15 Safety Measures to Protect Your Home | Better Mortgage

Your home is likely one of the most significant investments you’ll ever make. But beyond that, it also holds everything you hold near and dear to your heart — your family, pets, heirlooms, and all other valued possessions.

So, it’s worthwhile to do everything you can to safeguard your home from serious hazards, such as fire, carbon monoxide, flooding, and security risks. Here’s a list of safety measures you can take to protect your home and everyone in it.

Fire Safety

A tiny spark can turn into a roaring blaze in minutes, threatening your family’s safety and the structural integrity of your home. Fortunately, there are ways you can prevent fires or handle the situation safely should one occur. Here are several fire safety tips to implement today:

Does everyone in your house know what to do if a fire breaks out? If not, consider creating a fire escape plan that spells out critical details, such as how each person should exit the property and where the family should meet outside.

If you have children in your home, consider reviewing your fire escape plan at least once per year. You can even conduct an annual family fire drill to test everyone’s knowledge of the plan.

Smoke alarms can alert you if there’s a fire before the situation gets out of control. Therefore, each level of your home should have at least one smoke alarm located in prime locations, such as the kitchen and bedrooms.

Because smoke alarms can only do their job when they’re in working order, set a calendar reminder to change the batteries at least every year and replace the units every 10 years. It’s also recommended to test the alarms periodically to ensure they still work.

Quick thinking and action could save the day if a fire breaks out. In addition to knowing where the fire extinguisher is located in your home, everyone should be familiar with how to use it safely.

Depending on the size of your residence, it might make sense to have multiple units to cover the garage, kitchen, or other areas.

More than half of deaths from residential house fires occur between 11 p.m. and 7 a.m. — when most people are tucked away in bed. This means you’ll want to take precautions to ensure your main living areas and bedrooms are as safe as possible.

Here are several ways to protect yourself and loved ones from fire hazards:• Close your bedroom doors at night (this can slow down how quickly a blaze spreads).• Use flame-retardant mattress covers.• Ensure all candles, cigarettes, and incense burners are fully extinguished before going to sleep.• Properly extinguish a fire and any ashes in a wood-burning fireplace; live ashes can take up to 24 hours to cool down• Extinguish a grease fire quickly by covering it and depriving it of oxygen or use a nearby fire extinguisher

Carbon monoxide safety

Carbon monoxide is a colorless, odorless, and tasteless gas. As a result, victims of carbon monoxide poisoning are often unaware there’s an issue. The good news is you can protect yourself and your family by taking a few critical steps:

Early detection is key to avoiding carbon monoxide poisoning. Having a detector on every level of your home can ensure you're notified if this gas is present. Be sure to replace the batteries every six months and install new units every five to seven years. You may also want to test each detector periodically to ensure they still work.

Knowing the symptoms of carbon monoxide poisoning can help you escape a dangerous situation before it’s too late. Some common signs include headache, nausea, vomiting, fatigue, lack of coordination, shortness of breath, dizziness, or mental confusion. If you or loved ones begin to feel these signs without other explanation, then get outside quickly and contact emergency medical services.

Charcoal, oil, and gasoline-burning equipment, such as generators, charcoal grills, camp stoves, or similar items,emit carbon monoxide. When using these devices, it’s critical to have proper ventilation and never use them inside your home (including your basement or garage) or near a window. Also, avoid running your car inside your attached garage even if the garage door is open.

Broken or improperly maintained gas, oil, or coal-burning appliances and heating systems can also leak carbon monoxide into your home. Fortunately, you can significantly reduce that risk by having those units serviced annually by qualified technicians.

Improper use of your fireplace can result in carbon monoxide exposure. To use it safely, open the fireplace damper before lighting your fire and keep it open until the ashes are cool.

Flood safety

A severe weather event or faulty plumbing could put some or all of your home underwater. Here are several ways you can protect your residence from flooding.

Before practicing flood safety, you should know your flood zone and understand your risk. If your home is in an area that regularly floods, it’s crucial to obtain flood insurance. Typically, basic homeowner's insurance doesn’t cover flood damage, so you’ll need this specific policy for protection. Your mortgage holder may even require you to obtain flood insurance if your home is located in a flood zone.

While hurricanes and other natural disasters are often the culprits behind flooding, plumbing leaks can also cause significant damage to your home. Fortunately, you can catch potential problems by regularly inspecting your water heater, toilets, sinks, and outdoor fixtures for leakage.

Some essential home maintenance can help ensure water doesn’t make its way into your home. For instance, sealing your foundation and basement walls with a waterproofing compound can help keep your interior dry. You can also ensure rainwater flows away from your foundation by periodically cleaning your gutters, drains, and splash pads.

You can install equipment to protect your home from water damage. Here are several you may wish to consider:Flood sensors can detect moisture and alert you if your house is wet where it shouldn’t be.An automatic shutoff valve can stop water from flowing from your water supply if it detects a leak.A sump pump moves liquid away from your property’s foundation if the level gets too high.

Security

According to recent reports, a house is burglarized every 26 seconds in the U.S. You can deter burglars and protect your property by enhancing your home’s security with these steps:

Deny intruders easy access to your residence by locking all doors and windows and securing pet doors and mail slots. Also, avoid keeping a spare key outside, even if you think it’s well-hidden. Instead, consider installing smart locks to control your house remotely.

Loud noises can convince a would-be robber to run away, so installing an alarm system can be a wise investment. Some systems can also automatically call local security dispatch and contact the police if an alarm is triggered.

Next time you decide to take a trip, don’t make it obvious. Burglars love to target empty houses because there’s less risk of confrontation. You can make it seem like you’re still home by putting your lights on an automatic timer, having someone park in your driveway, and asking your neighbor to collect your mail. In addition, avoid talking about your getaway on social media (especially on public profiles) until after you return.

Protect your home the Better way

The best way to safeguard your home and family from risk is to be proactive and implement crucial safety measures like the ones outlined above. But a comprehensive homeowner’s insurance policy can take your protection to the next level.

Some homeowner's insurance, like some provided through Better Cover, even offer discounts on your policy for installing an alarm system. And, if you use your Better Home Card to finance the installation, you’ll benefit from a competitive interest rate and will have 3-5 years to pay back the loan depending on your terms. *

With Better Cover, we help you find the right policy for you. Just answer a few short questions, and we’ll take care of the rest. You could even save up to 20% on your coverage by switching from another provider.

*Notable is a direct lender dedicated to providing a fast, transparent digital lending experience backed by superior customer support. All rights reserved. © Notable Finance, LLC | 6 Landmark Sq, Fl 4, Stamford, CT 06901 NMLS #1824748. Notable is a registered trademark with the U.S. Patent and Trademark Office. California customers: Loans made or arranged pursuant to a California Finance Lenders Law License. Not available in all states."

less

How to Get to Know Your Neighborhood | Better Mortgage

How Homeowners Can Save Money on Utility Bills | Better Mortgage

New Homeowner Checklist: 5 Essential Things to Do When Moving In

What Are Non-QM Loans or Asset-Based Loans? | Better Mortgage

Mortgage loans are the most common way to help homebuyers finance the cost of a home. But what happens if you don’t meet certain qualifying loan criteria because you’re self-employed or struggle to prove a steady income?

That doesn’t necessarily mean you’re going to be a lifelong renter. Other loan options exist to help.

Non-qualified mortgage (Non-QM) loans, also known as asset-based loans, are a less traditional way to purchase property. Unlike most other mortgages, approval for non-QM loans does not rely solely on your income or credit score.

Speak to a Better Mortgage Loan Consultant to see if a non-QM loan is right for you, by calling: (949)570-5753.

What is non-QM or asset-based lending?

Just because you may need to consider a non-qualified mortgage doesn’t necessarily mean you’re not qualified to obtain home financing. Instead, a non-qualified loan simply means the mortgage itself does not meet specific standards set by the Consumer Financial Protection Bureau (CFPB).

To be approved for a traditional, or “qualified,” home loan, a borrower usually must:

Non-QM loans are often used for borrowers who do not meet the criteria for a traditional loan but can handle monthly mortgage payments. These loans tend to have more lenient credit requirements and require less documentation. Therefore, they may be a great option for:

Different types of asset-based lending

There are various asset-based loans, all with their own benefits and general qualifying guidelines.

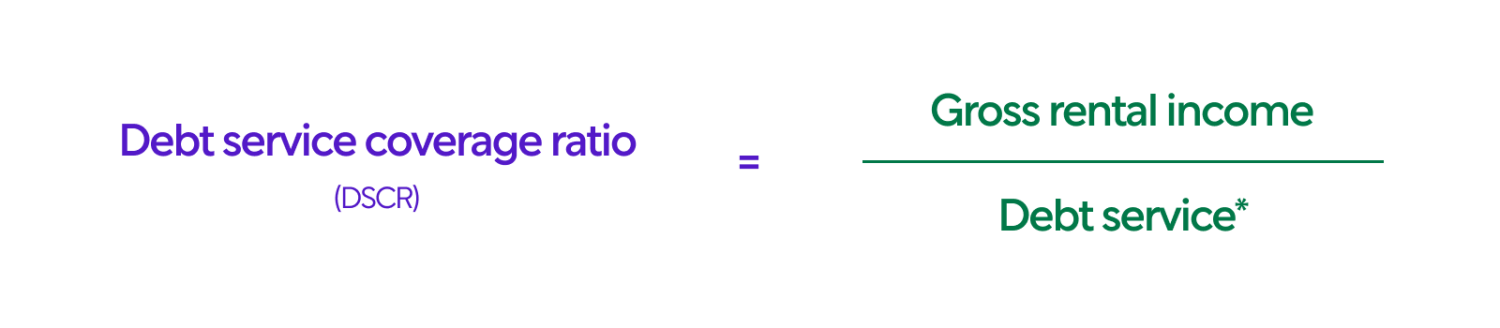

Debt service coverage ratio (DSCR) loans

A debt service coverage ratio loan is a type of non-QM loan designed with real estate investment in mind.

It’s a way to qualify for financing that focuses on individual property cash flow rather than your total income and liabilities. While these loans are typically used for commercial properties, they can also be used for residential investment property mortgages.

Approval for these non-QM loans centers around the DSCR ratio, which measures your ability to repay the loan with cash flow from real estate operations. Here’s the formula lenders typically use to determine your DSCR ratio:

*Debt service = Principal, interest, taxes, insurance, and association dues (PITIA)

The higher the DSCR ratio, the more likely a lender is to approve a financing request for a real estate purchase.

Speak to a Better Mortgage Loan Consultant to see if a non-QM loan is right for you, by calling: (949)570-5753.

Bank statement loans

Bank statement loans allow lenders to issue loan approvals based on personal information and bank statements, rather than tax returns and employer verification. This makes them potentially ideal for consultants, freelancers, small business owners, real estate investors, or anyone who doesn’t have a steady cash flow or has trouble proving their income after business write-offs or deductions.

While requirements vary by lender, common documents and criteria for a bank statement loan include:

Asset depletion loans

Employment income is a main factor when lenders consider qualifying someone for a typical mortgage. But in some cases, borrowers can afford a mortgage even if they don’t receive a regular paycheck.

In these scenarios, asset depletion loans can help because they use a formula to help borrowers get approved for a mortgage by counting their saved assets as monthly income.

For instance, let’s say you’re a new business owner, and you don’t have enough verifiable income to qualify for a traditional mortgage. However, you have large sums of money in investment accounts that can easily help you pay for a mortgage. In this case, your lender could use those assets to determine a hypothetical income stream.

To do so, lenders add the value of all your qualifying assets and divide the amount by the number of repayment months to calculate your maximum loan amount.

Keep in mind, some lenders may only use a percentage of certain asset’s values when calculating how much you can afford. For example, 100% of your savings and checking balances may typically be used, while 401k or similar investment balances could be limited to 70% to account for taxes or early withdrawal penalties.

Why do banks offer non-QM loans?

Put simply, banks make money by lending money and charging interest on the funds lended. The more low-risk loans they approve, the higher their income potential.

That may be why it's uncommon for banks to offer asset based lending. Without traditional loan criteria, most lenders view non-QM loans as high risk. But some banks and lenders, like Better Mortgage, choose to offer alternative qualification options to help customers who may not be well served by traditional loan products.

Offering non-QM loans allows banks to say “yes!” more often than they could with only traditional loan products.

With less government restrictions and requirements, lenders can provide loans to borrowers who don’t meet the strict qualification and documentation requests of a qualified mortgage but still have the means to pay for home financing.

Why are rates higher for asset-based mortgages?

Lenders tend to raise rates when they’re up against more risk. Therefore, borrowers are likely to pay higher interest rates and even upfront fees and points for non-QM loans that may not be necessary for qualified mortgages.

On average, non-QM loans have interest rates 1.25% higher than a qualified mortgage. No matter the type of loan, it’s always important to shop around for rates to ensure you’re getting the best offer possible.

Get qualified for a non-QM loan

With traditional mortgage loans, it can be difficult to find a lender who will approve you when you have a hard time proving your income. Luckily, non-QM loans can pave the road to homeownership when you don’t meet the traditional criteria but still have the financial means to pay a monthly mortgage.

Speak to a Better Mortgage Loan Consultant to see if a non-QM loan is right for you, by calling: (949)570-5753.

less

Real Estate Attorneys: What You Need to Know | Better Mortgage

Look Twice (or Thrice) Before Locking in a Mortgage Rate | Better Mortgage

If you’re in the process of searching for a new home, then news of rising interest rates might be a little unsettling.

Although rates have been creeping up, the good news is they’re still nowhere near historic highs. In fact, when looking back over the past 50 years, today’s mortgage rates are well below the average.

Still, higher rates could result in increased mortgage costs for homebuyers. Therefore, it’s more important than ever to ensure you’re shopping around for the best mortgage rate with different lenders.

Not all lenders offer the same rates and benefits, so homebuyers who skip rate shopping could end up paying (quite literally) for it in the end.

A recent survey also found that 56% of all homebuyers don’t compare mortgage lenders before locking in an interest rate — a mistake that could equate to significantly higher mortgage costs over time.

So, here’s an overview on how to shop around and ensure you’re not overpaying on your mortgage.

Why you should look before you lock

Rate shopping is the practice of checking with several lenders and comparing their offered terms.

When you contact each lender, you’ll need to submit financial information regarding your income, employment, and outstanding debts to get pre-approved. Lenders will also need to pull your credit score to confirm the mortgage rates and terms you’ll be eligible for.

(You can get pre-approved with Better Mortgage in as little as 3 minutes! And it won’t ding your credit. Many lenders use a hard credit check at this stage, which may impact your credit score)

While every new hard credit inquiry typically lowers your score by a few points, there is an exception when it comes to mortgage rate shopping. All pulls within a 30-day window count as a single inquiry—as long as they’re all for a mortgage and not other debt.

Here’s what to do when shopping for a mortgage:

Once you find a rate that fits your needs, you may want to consider “locking it in” to make it official. Locking an interest rate means you'll be guaranteed the lower rate even if rates rise due to market conditions. Rate locks typically last between 30 to 60 days, which should be enough time to make it to the closing table. (In this competitive market, Better Mortgage let’s you lock a rate for 90 days to give you extra time to find a home, so you can shop with peace of mind.)

Experts anticipate the 30-year fixed mortgage rate could be as high as 7% by the end of 2022. That’s why locking in a rate today can save you from tomorrow’s higher interest rates.

Shopping around could save you substantially

You might think that a fraction of a percent won’t make a huge difference in payments over the lifetime of a mortgage. But the truth is, even a 0.50% difference in interest rate can greatly affect your monthly payments and long-term costs.

Let’s say that Nora is buying her first home and will need a mortgage of $300,000. She’s searching for rates and has two options to choose from. The first lender offers a 30-year fixed rate of 5.50%, while the second lender quotes a 30-year fixed rate of 5.00%.

Disclaimer: Based on a $300,000 home. Image and figures displayed are for illustrative purposes only. These do not reflect current mortgage rates. Your rates, cost and loan amount will vary. Monthly mortgage payment excludes taxes and insurance. Nora is not an actual Better Mortgage customer.

By shopping around and choosing the lender with the lower rate, Nora can save almost $100 a month and more than $30,000 over the life of her mortgage.

While even comparing two lenders could mean significant savings, shopping with multiple lenders further improves your chances. A Freddie Mac survey found that you’re more likely to secure a lower interest rate when you shop with more lenders. While borrowers who got one extra rate quote still saved, those who got five quotes saved nearly three times as much.

Other benefits of shopping around

Shopping for a mortgage isn’t just about comparing monthly payments and lifetime interest (even though these savings can be impressive). Here are other ways shopping for a mortgage can save you at the closing table and beyond:

Ensure you’re comparing apples to apples

There are many different types of mortgages. Terms, fees, and rates vary for them all. It’s important to remember this when shopping for a loan rate. Comparing a 30-year mortgage rate with one lender to a 15-year mortgage rate with another won’t give you an accurate picture of where you’re saving.

A great way to compare loans is by using the Better Mortgage loan comparison calculator. By putting in the different terms of two separate mortgages, you can quickly compare monthly payments and lifetime costs to ensure you’re getting the best deal possible.

Lock a low rate with Better Mortgage

As mortgage rates rise, it’s crucial to compare lenders before locking a rate.

Are you ready to lock in a low mortgage rate and save? See your personalized rates when you get pre-approved with Better Mortgage in as little as 3 minutes.

Start the mortgage application process today.

less

Whole Life Insurance Provides Long Lasting Coverage | Better Mortgage

Buying a home is a great investment in your (and your family’s!) future. And while it isn’t the most light-hearted topic to discuss, life insurance is a good way to help protect that investment for years to come.

There are two main types of life insurance: term life insurance and whole life insurance. Explore some of the most commonly asked questions about this insurance type below.

What is whole life insurance?

While term life insurance is for a set term (typically between 10 and 30 years), whole life insurance provides coverage for the entire span of your life. As long as you have an active policy, there’s no way that you can outlive the policy itself. This helps ensure your dependents and beneficiaries receive a benefit.

Considering a whole life policy is important even if you don’t have direct dependents. For example, you can name beneficiaries as people who could use support from you in the form of financial gains. Life insurance is a way to help continue supporting those you care about after you’re gone.

Homeowners, married individuals, parents, and caregivers may find whole life insurance especially important. The benefit your beneficiaries receive will make up for the loss of your income and help them maintain not just the essentials like a mortgage payment, but also their accustomed standard of living. For any caregiving you provide to others, the insurance could make it possible for paid caregivers to deliver that support.

How does whole life insurance work?

For the most part, whole life insurance works the same as many other insurance types. You pay a premium at a set interval in exchange for coverage. In this case, the coverage is a benefit that is issued to your specified beneficiaries in the event of your death.

One of the most unique aspects of whole life insurance is that it incorporates a savings portion that is known as a cash value. That value can be borrowed against during your lifetime like a line of credit. However, any unpaid loan amounts will be deducted from the total benefit when you pass away.

You can also elect for the funds to be distributed in increments, rather than all at once in a lump sum, when the time comes. While incremental payments can accrue interest, keep in mind that the interest is taxable, while the standard benefit is not typically taxed.

What is the difference between term and whole life insurance?

Whole life insurance is distinct from term life insurance because of how long it lasts. Term insurance only provides coverage for a set period of time, typically 10, 20, or 30 years. With a term life insurance policy, you could potentially outlive the coverage, but with whole life insurance, you can’t.

Another difference between the two comes down to cost. The premiums you pay for whole life are generally higher than those with term policies, but you receive additional benefits. First, the coverage won’t end as long as you continue paying the premiums. Second, there is a cash value to the policy that can build up over time, which can increase the benefit your beneficiaries will receive. The cash value also delivers a benefit that could be used while you’re still alive. If you have a major expense, you can take out a loan against the value of the cash your policy has accumulated.

One advantage of opting for whole life insurance first, instead of choosing a term policy, is the ability to lock in potentially lower premiums when buying the insurance from a younger age. For example, if you opted for term life insurance and then wanted a whole life policy when the term ended, you would be required to purchase whole life coverage at an older age with likely higher premiums.

When you select whole life insurance at the outset, your premiums may be lower and may also contribute to the buildup in the cash value of the policy. On the other hand, with a term policy, if you’re still alive after the period ends, there is no way to recoup any of the value of the premiums you paid over the duration of the policy.

Get a whole life insurance quote

Life insurance quotes are unique to individual situations and circumstances, so the best way to estimate the cost to you is to get an exact quote from a provider. You’ll want to know what type of policy you’re interested in most as well as how much coverage you’re looking to have when preparing for a quote. Most financial advisors recommend you have about 10 times your salary in coverage, so that your family will be able to live comfortably for a long period without the income you provided.

A Better Cover agent can help you determine the coverage you need based on your current income and expenses. Once you know that amount, Better Cover can help you get a quote, within minutes, of what a whole life policy, or any other type of life insurance, might cost you.

When requesting a quote, keep in mind that some life insurance companies require a medical exam from a physician before they grant a policy. However, the process of getting coverage through Better Cover is entirely digital as long as you’re seeking less than $3 million in coverage. If you need more protection, we’ll simply ask you to complete a no-cost at-home health check.

Speak to a whole life insurance agent

Life insurance can be an essential component of financial security. But getting coverage doesn’t have to be a burdensome or time-consuming process. Better Cover makes it quick and easy. If you’re about to buy a home, Better Cover can bundle life insurance with your mortgage. Ensuring that your loved ones won’t have to worry about finances if they lose you will provide security that makes every penny you pay in premiums feel worthwhile. To get started, simply request to chat with an agent today.

Disclaimer: Insurance quotes and policies are offered through Better Cover, LLC. A Pennsylvania Resident Producer Agency. License #881593. A full listing of Better Cover, LLC's license numbers may be found here. Better Cover is Registered in the U.S. Patent and Trademark Office.

less

Cost cheat sheet for buyers, staging advice for sellers | Better Mortgage

Term life insurance is a low-cost way to protect your family | Better Mortgage

Life Insurance Basics You Should Know | Better Mortgage

Buying a new home is an exciting new chapter! It’s more than just a place to live—it’s an investment in stability, community, and generational wealth. And while any new buyer quickly learns that they’ll need homeowners’ insurance and title insurance, it’s also a great time to read up on the benefits of life insurance as well.

We get it, life insurance isn’t typically the topic of choice at the dinner table. But if anyone, such as a partner or children, depends on your income, it’s certainly an option worth considering.

The good news is that the right insurance partner can make selecting a policy and obtaining coverage less stressful. To help you get started, here’s what you should know about life insurance, the different policies available, and how to determine how much coverage you might need.

How does life insurance work?

When you purchase a life insurance policy, you’ll choose a coverage amount, which is typically based on your financial circumstances (more on this later). Then, moving forward, you’ll pay monthly or annual premiums to pay for your coverage.

An insurance company will look at several factors to determine your premium rate, including your:

If you pass away while your policy is active, the coverage amount you originally selected will be paid to your beneficiaries, who you selected to receive the funds.

In most cases, the proceeds are tax-free. So, if you had a policy for $300,000, for example, your beneficiaries would get the full amount, without the federal and state governments collecting a share.

Types of life insurance

Here are three basic categories of life insurance to help you determine which might be right for your needs:

Term life insurance

As the name implies, term life insurance lasts for a specific term, or time frame, such as 10, 15, 20, or 30 years. If you pass away at any time during the policy term, your beneficiaries will receive the amount of your coverage. You’ll make premium payments during that time, until the policy expires.

People often choose term insurance for the years they’ll need to replace the income they receive through work. However, once they reach retirement age, when their spouse or children might have access to their retirement investments, a life insurance policy may no longer be needed.

The advantage of term life insurance is that these policies are generally the least expensive type. The disadvantage is that when the term runs out, your loved ones will no longer have access to any of the money you contributed in premiums over the years.

Whole life insurance

Whole, or permanent, life insurance provides coverage that lasts for your entire life, as long as you continue to make payments.

Whole life policies have an investment component that can increase the value of the benefit your beneficiaries receive. Even while you’re alive, you may be able to borrow against the policy’s value.

The advantage of whole life insurance is that you don’t have to worry about your policy expiring after a certain timeframe. However, these policies tend to be much costlier than the premiums for term coverage.

Do I need a separate life insurance policy if I have one through work?

It’s an excellent benefit to have life insurance through your employer, but that alone might not provide the protection you need.

First, work policies are not portable. If you leave your employer, you can’t bring the life insurance with you. Second, the coverage from workplace policies is usually limited, often equaling only about one to two times your annual salary.

For the best protection, you may find you need additional coverage to meet your family’s needs.

How much life insurance do I need?

The amount of coverage you’ll require will depend on your personal financial circumstances. A common recommendation for coverage is 10 times your annual salary. However, this is just a general guideline.

Better Cover has a team of licensed agents that can help discuss your options and needs.

Can I get life insurance without a medical exam?

Some life insurance companies require a medical exam or even bloodwork before they grant a policy. This is because providers want to determine your health and potential risk factors before guaranteeing your coverage and premium amounts.

However, with Better Cover, the process of getting coverage is entirely digital. Better Cover offers life insurance up to $3M in coverage, possibly without medical exams, by just filling out a few health questions online. If eligible, you can get approved and covered in minutes. If you need protection above that amount, we’ll simply ask you to complete a quick, free, at-home health check.

Ready to get a life insurance quote? Now is the time

Better Cover makes the process of obtaining coverage quick and easy.

Disclaimer: Insurance quotes and policies are offered through Better Cover, LLC. A Pennsylvania Resident Producer Agency. License #881593. A full listing of Better Cover, LLC's license numbers may be found here. Better Cover is Registered in the U.S. Patent and Trademark Office.

less

Loan forgiveness and listing agreements | Better Mortgage

Second Home vs Investment Property: What's the difference? | Better Mortgage

A Comprehensive Guide to a Second Home Loan | Better Mortgage

Contingencies, seller strats, and renos w ROI | Better Mortgage

Housing market corrections, buyer mindsets, and summer living | Better Mortgage

Buy-curious renters, staging tips, and water safety | Better Mortgage

What a First-Time Homebuyer in Texas Should Know | Better Mortgage

Inflation-savvy budgets, spruced up sales strategies, and utility cost-cutters | Better Mortgage

What does inflation mean for your homebuying budget?

Inflation is complicated. But the impact it has on your dollar is pretty straightforward. As the price of consumer goods and services go up, consumer spending power dwindles. In simple terms, your dollar doesn’t go as far as it once did.

📈 According to the Bureau of Labor Statistics, the rate of inflation hit 8.6% in the past year. That’s the highest rate of inflation since 1981!²

If you’re just kicking off your search for a new home or you’ve been at it for a while, consider how the current condition of the market will impact your homebuying budget.

✅ Getting pre-approved is often the first step in the homebuying process, giving you a sense of your financing options without going through the entire underwriting process.

Keep in mind that it’s almost 30% more expensive to buy a home than it was just a year ago.³ Unless your income has also trended upward in that time, your homebuying budget should account for the decreased power of your dollar. Adjust for inflation to avoid overextending yourself on a long-term financial commitment.

😎 Once you have your budget set, use summer to make your move. This is a time when many buyers take their eyes off the prize in favor of vacations and travel plans.

💪 On top of distracted competition, a 29% increase in inventory boosts the odds for determined buyers even higher.⁴

👀 Keep your eyes peeled for listings that might be re-entering the market. Deals can fall through for a variety of reasons, and that home you really loved last month might be available again for less than the original asking price.

Sellers, add some elbow grease to your sales strategy

Bidding wars and above-asking-price offers are becoming less common. Buyer demand is beginning to decline in some areas, with many people rethinking their homebuying plans entirely in light of increased interest rates and other economic trends. The buyers that remain aren’t as willing to overlook cosmetic issues as they were six months ago.

Outdated fixtures, bad paint jobs, and old carpet might seem like superficial details, but buyer standards are on the rise.

If you’re selling a home, you might not be able to solely rely on the hot-hot-hotness of the market to move your listing.

Investing in aesthetic upgrades can improve the impression that buyers have of your home and generate excitement.

Making those changes sooner rather than later will give you time to take full advantage of the remaining summer market. Talk to an agent about the smartest upgrades to make to your home.

Manage rising utility costs with these tips

Utilities are a recurring expense that homeowners have to manage year-round, and summer is the season that tends to push budgets to the brink.

With inflation driving up the price of goods and services in every sector, it’s even more important to manage energy costs effectively. Here are some ways to mitigate the rising cost of utilities:

Get your custom rates in minutes with Better Mortgage. Their team is here to keep you informed and on track from pre-approval to closing.

This newsletter does not constitute an endorsement or recommendation of Better Mortgage Corporation; Better Real Estate, LLC; Better Cover, LLC; Better Settlement Services, LLC; or their services. Better Cover is solely responsible for homeowners insurance services. Better Mortgage is solely responsible for making all credit and lending decisions with respect to mortgage loans.

less

Real estate psychology + the power of equity in an uncertain economy | Better Mortgage

Check out reforms, ask before you sell, and fireproof your property | Better Mortgage

Leverage your lock, refresh outdoor spaces, and check local listing trends | Better Mortgage

Hitting homebuyer stride, going low in listing limbo & beating buyer’s remorse | Better Mortgage

Shopping strategies, panic-pricing, and backyard benjamins | Better Mortgage

Here’s a look at the latest developments in the mortgage market this week.

Shop smarter as bidding wars subside

Rising interest rates are causing some people to hit pause on their home search—and their hesitation is your opportunity. As competition cools and more listings go live, determined buyers are looking at a more level playing field for the first time in years. How should this shift in the market impact your shopping strategy?

Rising interest rates are causing some people to hit pause on their home search—and their hesitation is your opportunity. As competition cools and more listings go live, determined buyers are looking at a more level playing field for the first time in years. How should this shift in the market impact your shopping strategy?

Just a couple months ago, buyers were in a less advantageous position. The market was flooded with a surplus of highly motivated buyers and a shortage of available listings. The result? Bidding wars aplenty! Because of the cutthroat competition, many buyers were willing to waive critical contingencies in an effort to make their offer as attractive as possible.

Contingencies are conditions that need to be met before a sale is finalized—they can include things like mortgage contingencies, appraisals, home inspections, and repairs. Contingencies offer a way for buyers to mitigate risk and in general, waiving them is a no-no. As bidding wars begin to subside this summer, buyers likely won’t have to make as many major concessions to stand out to sellers.

TL;DR? Waiving a home inspection or an appraisal to win a bidding war might have made sense in some cases. But as more inventory hits the market and interest rates diminish buyer competition, you can afford to hold strong on contingencies. Really want to maximize your advantage in the coming months? Have your pre-approval in hand and be ready to make your first offer your best.

Get verified to make a stronger offer

✅ 💪 A Verified Pre-approval Letter strengthens your offer because our underwriting team will have reviewed and verified your finances. Plus, it saves you time once your offer is accepted.

Your first step is to get pre-approved in as little as 3 minutes, then ask a Home Advisor about getting verified.

Sellers, make sure the price is right

Interest rates and active listings are on the rise. As these factors begin to stem the tide of uber-eager buyers, some sellers might be wondering if they should reduce the price tag on their property to stand out. While it might be tempting, underpricing your home is a mistake that can have big consequences. Rather than panic-pricing, use these tips to make sure your listing is competitive:

Speak with multiple real estate agents.The best real estate agent isn’t necessarily the one who claims they can sell your house for the highest price. Interview multiple real estate agents and find one familiar with your neighborhood. Sometimes local expertise can mean the difference between closing fast and sitting on the market for months as interest rates continue to rise and buyers lose interest.

Get a Competitive Market Analysis.CMAs can provide a real-time snapshot of homes currently listed in your area, ones that have recently sold, and expired listings. This info will give you a realistic composite if you want to price your home slightly lower than similar homes that sold recently in your neighborhood.

Make an informed choice based on knowledge, not fear.If you’re like most sellers, you’re probably planning to buy your next home with the money you make selling your current one—so this transaction impacts your future shopping budget as well. Even though buyer demand has fallen, it remains above pre-pandemic levels. In other words? Don’t panic! And especially don’t let panic inform your pricing strategy.

Save big with Better Real Estate

A Better Real Estate Agent will list your home for free when you buy and sell with Better Real Estate, and fund with Better Mortgage—the traditional fee is 3%.

That’s $15,000 savings on a $500,000 home!

Pool your money this summer

Just because you’re not ready to sell your home right now doesn’t mean you can’t turn a profit with your property...

When temperatures start to rise, there’s nothing more refreshing than a quick dip in a pool—but not everyone has access to this coveted amenity. Sure, there are public pools but nothing quite beats a private experience. On top of that, a nationwide lifeguard shortage could prevent around a third of public pools from opening this summer, according to the National Lifeguard Association.

In other words? Having a pool at your house has never been more enviable—and with the help of an app called Swimply, it’s also never been more lucrative. Much like Airbnb makes it possible to list your home as a rental for vacationers, Swimply lets homeowners rent out their pools by the hour.

Savvy homeowners looking to make some extra cash this summer may not need to look any further than their own backyard.

Get your custom rates in minutes with Better Mortgage. Their team is here to keep you informed and on track from pre-approval to closing.

This newsletter does not constitute an endorsement or recommendation of Better Mortgage Corporation; Better Real Estate, LLC; Better Cover, LLC; Better Settlement Services, LLC; or their services. Better Cover is solely responsible for homeowners insurance services. Better Mortgage is solely responsible for making all credit and lending decisions with respect to mortgage loans.

less

Inventory waves, move-in readiness, and acing your maintenance phase | Better Mortgage

Adjustable-rate mortgages, inventory upswings, and summer listers | Better Mortgage

No Cash Out Refinance vs. Limited Cash Out Refinance: What You Need to Know Before Getting Started

Buying or selling a home? Here’s what you need to know | Better Mortgage

Pros and Cons of a Cash Out Refinance | Better Mortgage

A Guide to a Cash Out Refinance | Better Mortgage