Wolf Street

The Most Splendid Housing Bubbles in America, December Update: Now Dallas, Las Vegas, Phoenix Plunge Fastest. San Francisco, Seattle, San Diego Down Most from Peak

No dear, this is not seasonal.

By Wolf Richter for WOLF STREET.

Declines in house prices have turned into a relentless drumbeat. Today, the S&P CoreLogic Case-Shiller Home Price Index for “October” was released. Time frame: A three-month moving average of closed home sales that were entered into public records in August, September, and October; these are deals that were largely made in July through September.

Since then, home prices have dropped

... moreNo dear, this is not seasonal.

By Wolf Richter for WOLF STREET.

Declines in house prices have turned into a relentless drumbeat. Today, the S&P CoreLogic Case-Shiller Home Price Index for “October” was released. Time frame: A three-month moving average of closed home sales that were entered into public records in August, September, and October; these are deals that were largely made in July through September.

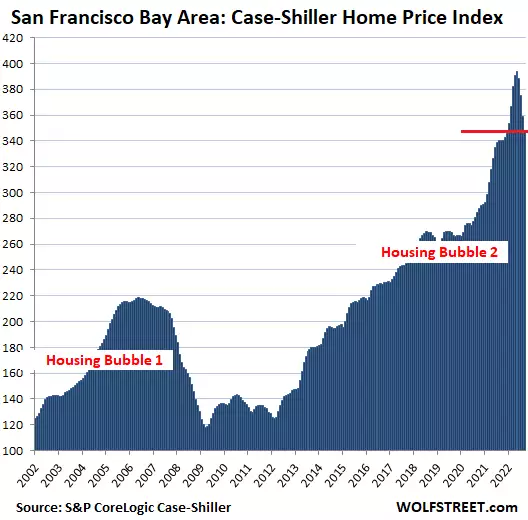

Since then, home prices have dropped further nationwide, as we know from different median-price indices; for example, in the city of San Francisco, the median house price has now plunged by 27% from the peak in April.

The Case-Shiller Index here – it covers 20 metropolitan areas – is a more reliable indicator than the sometimes-crazy median-price indices that can be heavily skewed by a change in the mix of homes that are sold. But the Case-Shiller index lags months behind.

On a month-to-month basis, house prices dropped again in all 20 metros that are in the Case-Shiller Index. On a year-over-year basis, the price gains were further slashed, with the condo index for San Francisco now negative; and the house price index just about flat.

The biggest month-to-month drops in today’s “October” index occurred in:

From their various peaks, which range from May to July, house prices dropped the most in:

In the San Francisco Bay Area, house prices dropped by 1.7% in “October” (three month moving average of sales that were entered into public records in August, September, and October), and are now down by 13.0% from the peak in May.

Plunging faster than it had spiked: Over those five months since the peak, the index plunged by 51.4 points. Over the five months to the peak, it had spiked by 48.6 points.

The five monthly drops from the peak have nearly wiped out the year-over-year gain (+0.6%). The Case-Shiller Index for San Francisco Bay Area condos is already down by 1.3% year-over-year.

The index for “San Francisco” covers five counties of the nine-county San Francisco Bay Area: San Francisco, part of Silicon Valley, part of the East Bay, and part of the North Bay.

In the Seattle metro, house prices dropped 1.0% in October from September, and are now down 12.2% from the peak in May.

Over those five months since the peak, the index plunged by 50.4 points. Over the five months to the peak, it had spiked by 55.9 points.

These five months of price drops slashed the year-over-year gain to 4.5%.

San Diego metro:

Denver metro:

Los Angeles metro:

Changing leadership among the most splendid housing bubbles. For Los Angeles, the current index value of 395 means that home prices ballooned by 295% since January 2000, when the index was set at 100. Based on the increase since 2000, Los Angeles was the #1 Most Splendid Housing Bubble in America until February 2022, when it was bypassed by San Diego.

But both were bypassed by Miami in August 2022, as prices in Los Angeles and San Diego were plunging, while prices in Miami had just started to drop. So Miami has become the #1 Most Splendid Housing Bubble in America, with prices still up by 301% from January 2000. Now they’re all chasing each other down.

Methodology of the Case-Shiller Index: The index uses the “sales pairs” method, comparing sales in the current month to when the same houses sold previously. The price changes within each sales pair are integrated into the index for the metro, are weighted based on how long ago the prior sale occurred, and adjustments are made for home improvements and other factors (methodology).

Phoenix metro:

Dallas metro:

Las Vegas metro:

Portland metro:

Boston metro:

Washington D.C. metro:

Tampa metro:

Miami metro:

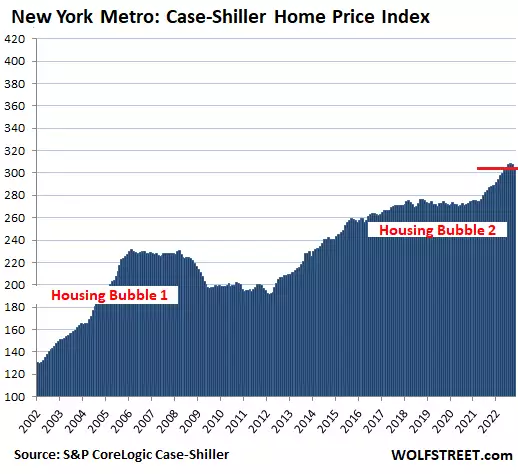

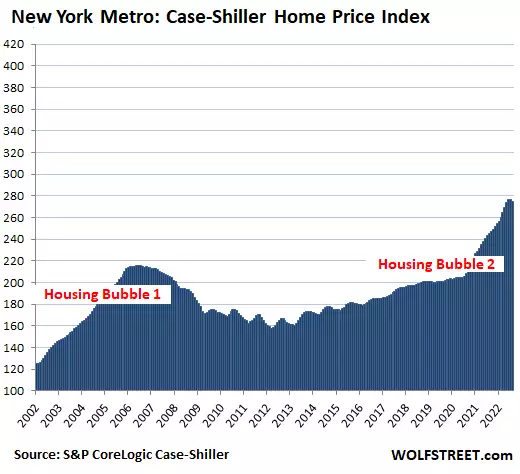

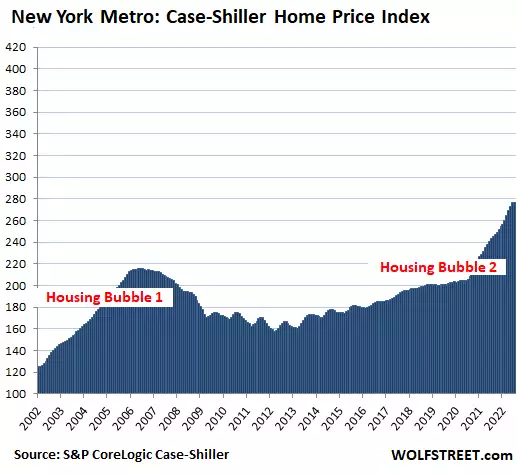

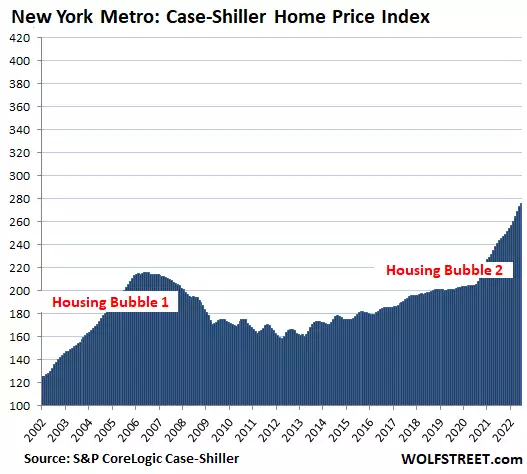

In the New York metro:

In the New York metro, house price inflation since 2000 amounted to 172%, based on the Case-Shiller Index value of 273 today. This makes it the taillight of the Most Splendid Housing Bubbles.

In the remaining six cities in the 20-City Case-Shiller Index, house price inflation has been less, and they don’t qualify for this roster. But they also experienced month-to-month declines in the “October” index, following the declines September: Chicago (-0.5%), Charlotte (-0.9%), Minneapolis (-0.7%), Atlanta (-0.8), Detroit (-0.9%), and Cleveland (-1.0%).

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

(adsbygoogle = window.adsbygoogle || []).push({});

less

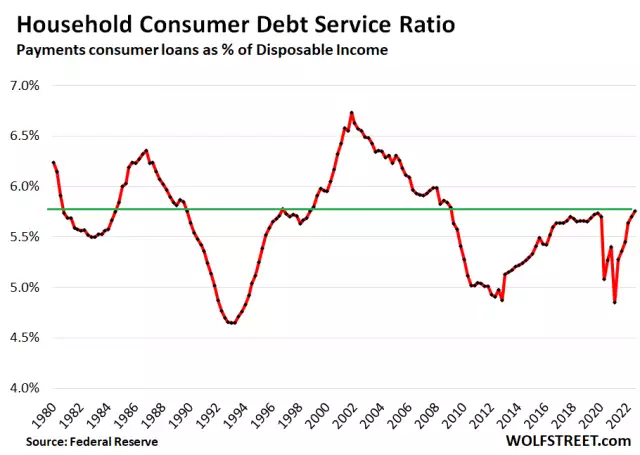

The Price of Easy Money Now Coming Due

How Strung-Out Are Households with their Debt Service & Financial Obligations as the Miracle of Free-Money Fades?

Home Sales Melt Down Nationally to Depths of Housing Bust 1. Prices -10% in 5 Months. Cash Buyers, Investors Massively Pull Back

San Francisco & Silicon Valley Housing Markets Puke Huge Price Drops, as Startups, Crypto, Tech, Social Media Make Total Mess

THE WOLF STREET REPORT: The Price of Easy Money Now Coming Due

The Crazy Stuff & Asset Prices that arose during Easy Money are coming unglued as Easy Money ended.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email

... moreThe Crazy Stuff & Asset Prices that arose during Easy Money are coming unglued as Easy Money ended.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

(adsbygoogle = window.adsbygoogle || []).push({});

less

Starting to Be Housing Bust 2 for Homebuilders & New Single-Family Houses

Drop in 10-Year Treasury Yield & Mortgage Rates Is Just Another Bear-Market Rally. Longer Uptrend in Yields Is Intact, with Higher Highs and Higher Lows

The Most Splendid Housing Bubbles in America, November Update: Deflating Everywhere, Fastest in San Francisco & Seattle. Phoenix & Dallas Roll Over Too

Massive Cancellations Make Mess of Already Low New-House Sales. Inventory Glut at Deep Housing Bust 1 Level. Buyer Traffic Plunges

The Most Splendid Housing Bubbles in America: Biggest Price Drops since Housing Bust 1. Record Plunge in Seattle (-3.9%), Near-Record in San Francisco (-4.3%) & Denver. Drops Spread Across the US

Mortgage Bankers Predict Mortgage Rates to Drop to 5.4% by End of 2023. A Year Ago, They Forecast 4% by Now, but Now We’re at 7%. Wishful Thinking by Crushed Mortgage Lenders?

Housing Bubble Woes: Home Sales Plunge, Prices Drop 7% in 3 Months, Price Reductions Surge. Mortgage Rates Spike

Investors are also pulling back.

By Wolf Richter for WOLF STREET.

Sales of all types of previously owned homes – houses, condos, and co-ops – fell for the eighth month in a row, by 1.5% in September from August, to a seasonally adjusted annual rate of sales of 4.71 million homes, according to the National Association of Realtors in its report. Compared to the peak in October 2020, sales were down 30%.

Beyond the two lockdown months of April and May 2020,

... moreInvestors are also pulling back.

By Wolf Richter for WOLF STREET.

Sales of all types of previously owned homes – houses, condos, and co-ops – fell for the eighth month in a row, by 1.5% in September from August, to a seasonally adjusted annual rate of sales of 4.71 million homes, according to the National Association of Realtors in its report. Compared to the peak in October 2020, sales were down 30%.

Beyond the two lockdown months of April and May 2020, this was the lowest rate of sales since March 2014, and since the summer of 2012, indicating to what extent the housing market is frozen. Potential buyers refused to even look at prices that sellers want. Sellers refused to cut their aspirational prices to where the buyers might be – though there is a lot more price cutting going now than a year ago. And other potential sellers waited for a Fed pivot that would lead to lower mortgage rates and higher prices before they put their homes on the market – though the opposite is now happening (historic data via YCharts):

These are sales across the US that closed in September, based on deals that were made earlier. So they just about entirely predated Hurricane Ian which made landfall in Florida on September 28.

Compared to a year ago, the seasonally adjusted annual rate of sales was down 23.8%, the fourteenth month in a row of year-over-year declines (historic data via YCharts):

Sales of single-family houses dropped by 0.9% in September from August, and by 23% year-over-year, to a seasonally adjusted annual rate of 4.22 million houses.

Sales of condos and co-ops fell 5.8% in September from August, to 490,000 seasonally adjusted annual rate, down 30% year-over-year.

Sales by region: On a year-over-year basis (yoy), sales plunged in all regions. On a month-over-month (mom) basis, only the West showed no declines in sales from the desperately low levels in August:

The median price of all types of homes whose sales closed in September dropped for the third month in a row, and is now down 7% from the peak in June.

In terms of seasonality, the 7% decline was the largest for this period since the end of Housing Bust 1, and more than double the 3.2% decline during this period in 2021. The average decline during this period over the prior 10 years was 4.2%. In 2020, prices jumped during this period. In 2019, prices fell 4.9% during that period. And in 2018, prices fell 6.2% during this period, but the housing market was weakening as mortgage rates were heading to 5% amid QT, rate hikes, and swooning stocks.

This monthly decline in prices whittled down the year-over-year price increase to 8.4%, down from the 20% to 25% increases at peak frenzy last year (historic data via YCharts):

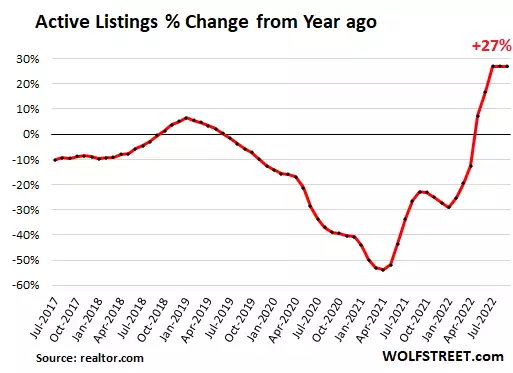

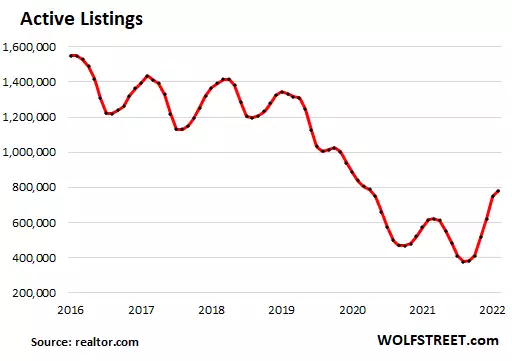

Active listings – meaning, total inventory for sale minus the properties with pending sales – rose to 732,000 homes in September, the highest since October 2020, up by 27% year-over-year for the third month in a row, according to data from realtor.com.

Compared to pre-pandemic years, active listings remain low, in a sign that the housing market is sort of frozen, with sellers not interested in selling at prices where the buyers might be; and buyers not interested in buying at prices where the sellers are, and so there is this standoff that shows up in the plunge in sales.

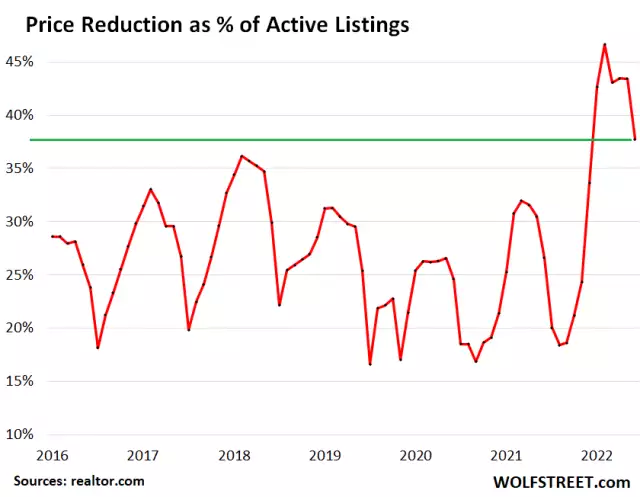

Price reductions have jumped from historic lows, a sign that some sellers are backing off from their aspirational prices and are cutting prices to where the buyers might be.

The number of price reductions jumped by 75% year-over-year from the mania-lows of the pandemic and is back in the range where it was before the pandemic:

Investors or second home buyers purchased 15% of the homes in September, down from a share of 16% in August, and down from the 17%-22% range in the spring and winter, according to NAR data.

“All-cash” buyers, which include many investors and second home buyers, declined to a share of 22% of total sales, down from a share of 24% in August, and down from a share of 25% to 26% earlier this year.

This declining share of sales to investors, amid plunging overall sales, shows that investors are losing interest in this market at these prices.

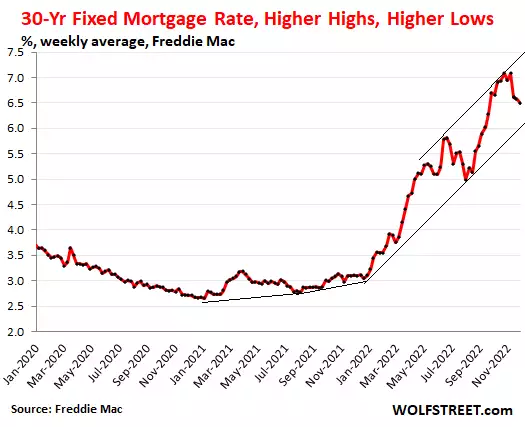

Holy-moly mortgage rates. After the fantasy-Fed-pivot-drop from 6% in mid-June to 5% by mid-August, mortgage rates are now at around 7%.

The daily measure of the average 30-year-fixed mortgage rate jumped to 7.37% today, according to Mortgage News Daily.

Freddie Mac’s weekly measure of the average 30-year fixed mortgage rate, released today, based on mortgage rates early this week, rose to 6.94%, over twice the rate a year ago.

But a 7% mortgage rate, as huge as it may be when applied to today’s crazy home prices, is still low, given that CPI inflation is over 8%. But it’s catching up:

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

(adsbygoogle = window.adsbygoogle || []).push({});

less

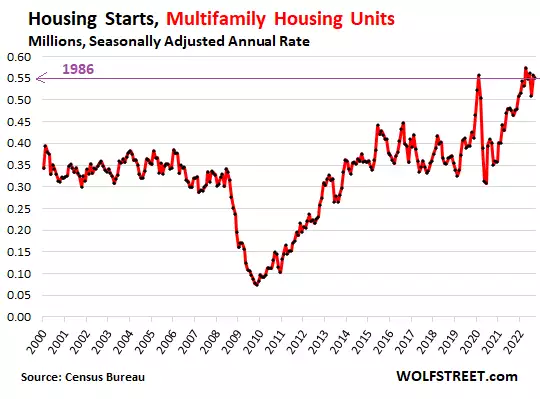

Boom v. Bust: Construction Starts of Multifamily Buildings v. Single-Family Houses

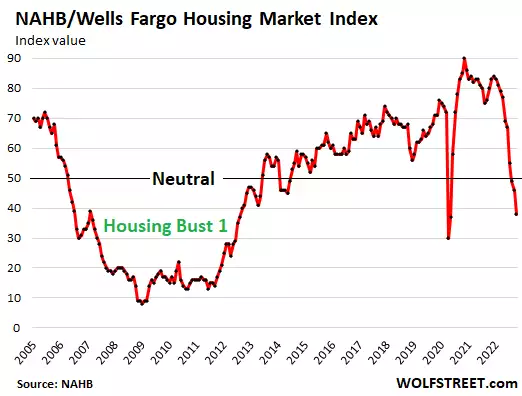

Housing Bubble Woes: Plunge in Buyer Traffic & Homebuilder Confidence a Lot Faster than During Housing Bust 1

Holy-moly mortgage rates of 7% slash demand for new houses due to super-inflated prices, but prices are now coming down.

By Wolf Richter for WOLF STREET.

Traffic of prospective buyers of new single-family houses plunged to the lowest since 2012, excluding the two lockdown months April and May, and is now approaching even the levels of those two lockdown months, according to data today from the National Association of Home Builders.

The NAHB index for traffic of

... moreHoly-moly mortgage rates of 7% slash demand for new houses due to super-inflated prices, but prices are now coming down.

By Wolf Richter for WOLF STREET.

Traffic of prospective buyers of new single-family houses plunged to the lowest since 2012, excluding the two lockdown months April and May, and is now approaching even the levels of those two lockdown months, according to data today from the National Association of Home Builders.

The NAHB index for traffic of prospective buyers dropped to 25, about where it was in mid-2007, well on the way down into Housing Bust 1. From 2008 through 2011, the index hovered around 10. Only this time, the descent is happening a lot faster than in 2005-2007:

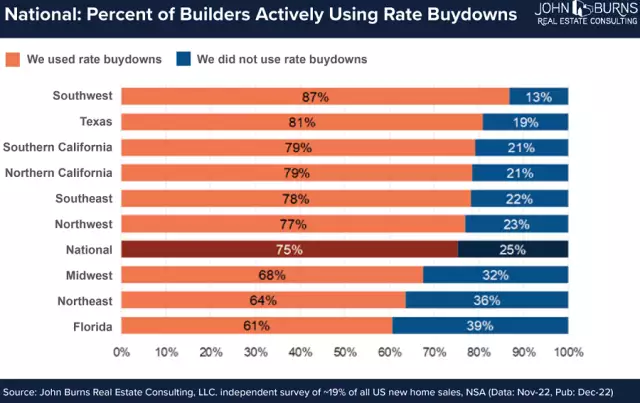

Traffic is a sign of interest among potential homebuyers, but many of them lost interest amid still sky-high prices and holy-moly mortgage rates of around 7%. The response from homebuilders is to reduces prices and offer incentives (including mortgage-rate buydowns, anything to avoid the stigma of a price reduction).

The overall confidence of builders of single-family houses fell for the 10th month in a row in October, as “rising interest rates, building material bottlenecks, and elevated home prices continue to weaken the housing market,” the NAHB report said.

With today’s index value of 38, the NAHB/Wells Fargo Housing Market Index is now nearly where it had been in May 2020 during the lockdown, and below where it had been in February 2007, on the way down into Housing Bust 1.

Current descent much faster than during Housing Bust 1.

From April this year, when mortgage rates began to bite, until October, the index dropped by 39 points in six months (from 77 in April to 38 in October).

When Housing Bust 1 took off for homebuilders in October 2006 (index at 68), the index dropped in six months by 17 points. There was never any 6-month period during Housing Bust 1 when the index dropped anywhere near 39 points. The fastest drop was 24 points in the 6-month period that ended in September 2009.

The current 6-month drop now nearly matches the 6-month plunge through lockdown April 2020:

Home builder confidence by region:

The NAHB’s regional Housing Market Index plunged the most and the fastest in the West (red line in the chart below). From its high this year in March (91), it plunged by 66 points in seven months.

The speed of the descent: Since December:

The NAHB index for current sales dropped by 9 points to an index level of 45, the eighth month in a row of declines. This means that more builders rated current sales as “poor” rather than “good” (50 is even).

The NAHB index for future sales dropped 11 points, to an index level of 35, the lowest since June 2012, coming out of Housing Bust 1. And on the way down into Housing Bust 1, the descent reached that level in July 2007.

Price declines.

Homebuilders can improve sales by cutting prices and by using various incentives and mortgage rate buydowns (when the builder subsidizes the mortgage). Homebuilders cannot just sit on the homes they’ve started building or have already completed. They must sell them one way or the other.

According to the Burns Home Builder Survey for September, by John Burns Real Estate Consulting, prices net of incentives had started to decline from month to month in late spring, with year-over-year price increases falling from the 20%-range in May, to 11% in September.

“Very likely this chart [of year-over-year price changes net of incentives] ends the year flat to slightly down given market momentum we’re picking up on the ground, tweeted Rick Palacios Jr., Director of Research at John Burns (click on chart to enlarge):

Holy-moly mortgage rates.

The average 30-year fixed mortgage rate rose to 6.92% last week, the highest since February 2002, according to the weekly measure by Freddie Mac, which was released last Thursday, reflecting mortgage rates earlier last week. The daily measure by Mortgage News Daily has been just above 7% for days.

“Holy-moly mortgage rate” is my technical term based on the utterances potential homebuyers make when they see the mortgage payment of the house they’re trying to buy at these still sky-high prices.

Sure, rates were a lot higher back in the day, say in the 1970s and 1980s, but home prices were a whole lot lower compared to income levels. So I can’t say that 7% mortgage rates are no big deal because my first mortgage was 8% in the late 1980s, and it was just fine. And others who’d bought their home years before with a 15% mortgage, and came out of it OK, can’t say that 7% today is no big deal.

High prices and high mortgage rates don’t go together – and prices have been inflated to ridiculous levels amid years of the Fed’s QE and interest rate repression, which are now unwinding.

At today’s sky-high prices, the 7% 30-year fixed-rate mortgage does a job on home sales and on prices, as we’re already seeing.

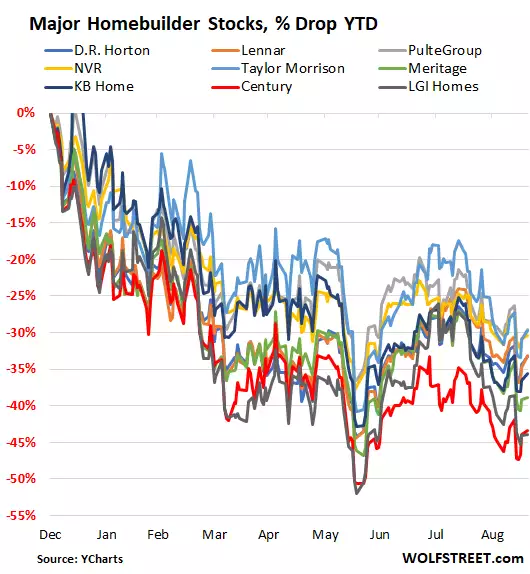

Homebuilder stocks are down between 27% and 46% so far this year (data via YCharts):

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

(adsbygoogle = window.adsbygoogle || []).push({});

less

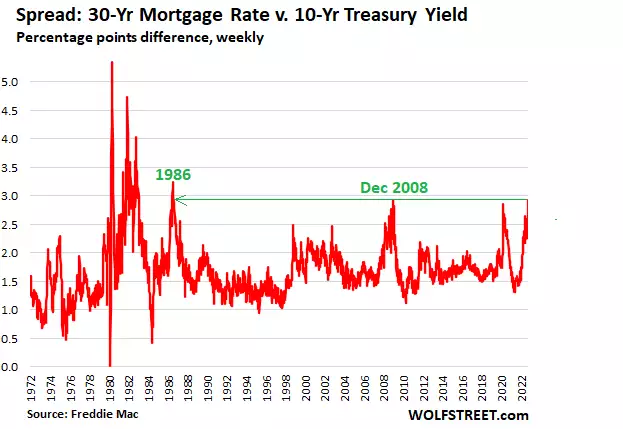

Housing Bubble Woes: Mortgage Demand Plunges, Rates Near 7%, Spread Between Mortgage Rate & 10-Year Treasury Yield Blows Out Most since Dec. 2008 and 1986

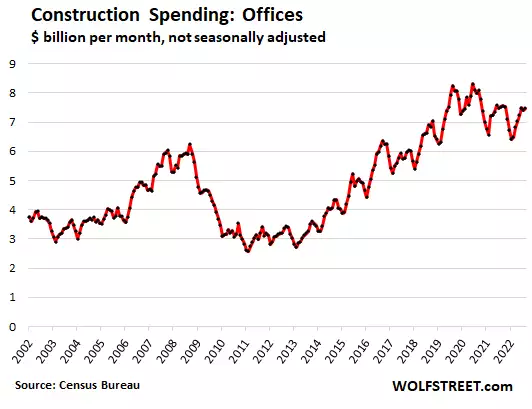

Construction Spending Ticks up, Non-Residential Hits Record, Residential Stalls after Blistering Boom

The Most Splendid Housing Bubbles in America: Price Drops Spread across US. Steepest Monthly Plunges since Housing Bust 1 in San Francisco -3.5%, Seattle -3.1%, San Diego -2.5%

Housing Bubble Woes: Home Prices Drop 3.5%, Steepest Monthly Drop since Jan. 2016. Sales, already at Lockdown Levels, Drop Further. Active Listings Rise Further

But these sales happened during the “Fed pivot” fantasy that pushed mortgage rates down to 5%. Now mortgage rates are near 6.5%.

By Wolf Richter for WOLF STREET.

In July and through mid-August, mortgage rates fell sharply from the 6%-range in mid-June, on the widely propagated fantasy of a Fed “pivot” on rate hikes. By mid-August, the average 30-year fixed mortgage rate was down to 5%. Yesterday, they were at 6.47%. But the brief interlude of dropping mortgage

... moreBut these sales happened during the “Fed pivot” fantasy that pushed mortgage rates down to 5%. Now mortgage rates are near 6.5%.

By Wolf Richter for WOLF STREET.

In July and through mid-August, mortgage rates fell sharply from the 6%-range in mid-June, on the widely propagated fantasy of a Fed “pivot” on rate hikes. By mid-August, the average 30-year fixed mortgage rate was down to 5%. Yesterday, they were at 6.47%. But the brief interlude of dropping mortgage rates slowed down the decline in home sales – sales declined again in August from July but at a slower rate – with Realtors in mid-August talking about the market waking back up.

But prices backed off for the second month in a row, and in a big way, amid widespread price reductions, and that also helped getting some deals done.

The median price of existing single-family houses, condos, and co-ops whose sales closed in August dropped a hefty 3.5% in August from July, the largest month-to-month percentage drop since January 2016, after the 2.4% drop in the prior month, to $389,500, according to the National Association of Realtors. While there is some seasonality involved, the percentage drop was much bigger than normal in August, whittling down the year-over-year price increase to 7.7%, down from the 25% year-over-year increases last summer (data via YCharts):

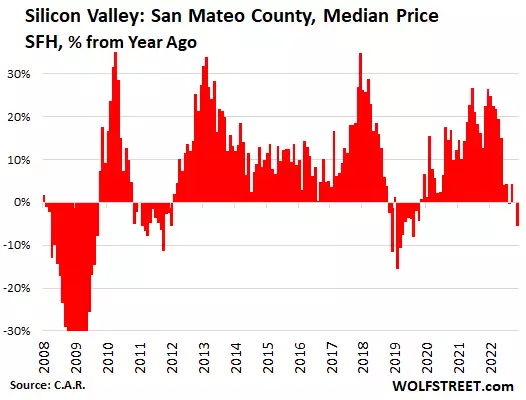

In the West, price drops are further advanced, amid dismal sales. For example, in San Francisco and in Silicon Valley, median prices have plunged in recent months – now down on a year-over-year basis in San Francisco and Santa Clara County (San Jose) and up just a hair in San Mateo County, according to data from the California Association of Realtors.

Sales of existing houses, condos, and co-ops across the US dipped a smidgen from July, after the 5.9% plunge in the prior month, to a seasonally adjusted annual rate of sales of 4.80 million homes, roughly level with lockdown-June 2020, according to the National Association of Realtors in its report. This was the seventh month in a row of month-to-month declines.

Beyond the lockdown months, it was the lowest sales rate since 2014, and down by 29% from October 2020 (historic data via YCharts):

Sales of single-family houses dropped by 0.9% in August from July, and by 19% year-over-year, to a seasonally adjusted annual rate of 4.28 million houses.

Sales of condos and co-ops rose 4% from July, to 520,000 seasonally adjusted annual rate, down 25% year-over-year.

Compared to August last year, sales fell by 20%, the 13th month in a row of year-over-year declines, based on the seasonally adjusted annual rate of sales (historic data via YCharts):

Sales by region: On a year-over-year basis, sales dropped sharply in all regions. On a month-over-month (mom) basis, you can see a little uptick in two of the four regions:

Sales dropped in all price ranges but dropped the most at the low end.

Sales volume has been low because potential sellers are clinging to their aspirational prices of yesteryear, when mortgage rates were 3%, and many would rather keep the home off the market or pull it off the market than sell for less, for as long as they can. But price reductions have now taken off by sellers who want to sell.

Price reductions started spiking in May from record low levels last winter and spring as sales stalled, and as mortgage rates surged. In July, they reached the highest level since 2019, according to data from realtor.com. In August, price reductions dipped just a little as sellers might have felt that price reductions were less needed, amid the declining-mortgage-rate-Fed-pivot fantasy in July and August:

Active listings – total inventory for sale minus the properties with pending sales – rose to 779,400 homes in August, the highest since October 2020, up by 27% from a year ago, according to data from realtor.com:

The National Association of Realtors is clamoring for more single-family houses to be built. But homebuilders, they are having trouble selling the houses that they have already built or are building, sales have plunged, inventories have spiked to the highest since 2008, and homebuilders have started cutting prices, buying down mortgage rates, and piling on other incentives to get their inventory moving.

Investors or second home buyers purchased 16% of the homes in August, up from 14% in July, but down from the 17%-22% range in the spring and winter, according to NAR data.

“All-cash” buyers, which include many investors and second home buyers, remained at 24% of total sales, down from a share of 25% to 26% April through June.

Going forward: holy-moly mortgage rates. After the fantasy-drop from 6% in mid-June to 5% by mid-August, mortgage rates are now solidly over 6%.

The daily measure of the average 30-year-fixed mortgage rate is at 6.47%, according to Mortgage News Daily.

According to Freddie Mac’s weekly measure, released last week, based on mortgage rates early last week, rose to 6.02%, more than double a year ago. These 6%-plus mortgage rates are still very low, considering that CPI inflation is over 8%. But they’re catching up.

And potential sellers that hung on to their homes in July and August because they didn’t want to meet the price where the buyers were – hoping the “pivot” fantasy would push down mortgage rates further – now face the effects of these 6%-plus mortgage rates:

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

(adsbygoogle = window.adsbygoogle || []).push({});

less

Housing Bubble Woes: Home Builders Cut Prices, Pile on Incentives, amid Plunging Traffic of Buyers, Spiking Cancellations, Holy-Moly Mortgage Rates

To prop up sales, 24% of home builders cut prices, others tried mortgage-rate buydowns or other incentives.

By Wolf Richter for WOLF STREET.

“Buyer traffic is weak in many markets as more consumers remain on the sidelines due to high mortgage rates and home prices that are putting a new home purchase out of financial reach for many households,” according to the National Association of Home Builders this morning regarding its survey of home builders.

Incentives:

... moreTo prop up sales, 24% of home builders cut prices, others tried mortgage-rate buydowns or other incentives.

By Wolf Richter for WOLF STREET.

“Buyer traffic is weak in many markets as more consumers remain on the sidelines due to high mortgage rates and home prices that are putting a new home purchase out of financial reach for many households,” according to the National Association of Home Builders this morning regarding its survey of home builders.

Incentives: “In another indicator of a weakening market,” and a “soft market,” over 50% of the builders reported using incentives to prop up sales or reduce cancellations – more on those cancellations in a moment. Those incentives, the NAHB said, include “mortgage rate buydowns, free amenities, and price reductions.”

Price reductions: The percentage of home builders who reported cutting prices jumped to 24% in the September survey, up from 19% in August, and up from 13% in July.

Cutting prices and using mortgage rate buydowns (when the builder subsidizes the mortgage) counteract some of the effects of soaring mortgage rates – now over 6%. When the market begins to freeze over, price cuts is what needs to happen, because home builders cannot just sit on the houses they have started on or have completed. They must sell them one way or the other.

The confidence of builders of single-family houses fell again in September, the ninth month in a row of declines, “as the combination of elevated interest rates, persistent building material supply chain disruptions, and high home prices continue to take a toll on affordability,” the NAHB report said.

With today’s index value of 46, the NAHB/Wells Fargo Housing Market Index is now below where it had been in May 2006, on the way down into the Housing Bust.

Home builder confidence by region:

The NAHB’s regional Housing Market Index plunged the most in the West (red line in the chart below), after still rising during the first three months of 2022. This is a stunning plunge from March (91), when home builders still expressed enormous confidence, and six months later, now at 34, the lowest since June 2012, as the West was coming out of the Housing Bust.

The index dropped the least in the South (green line), which is the only region with a reading still above 50, which marks the neutral line in the index. But even in the South, sentiment has been falling sharply. The chart shows from December through September:

Traffic of prospective buyers deteriorated further.

The index for traffic of prospective buyers dropped to 31. Buyer traffic is a sign of interest among potential homebuyers. And many of them lost interest at these prices. Hence the price reductions and other incentives to get them to look and nibble:

The NAHB index for current sales has dropped for the seventh month in a row, to 54. This means that slightly more builders rated current sales as “good” rather than “poor” (50 is even).

The NAHB index for future sales dropped to 46, the lowest since 2012. This means that slightly more builders rated future sales as “poor” rather than “good.”

But then, what do these “sales” even mean, when 20% or 30% of those sales suddenly get cancelled?

Cancellations jumped.

In the Southwest, home builder cancellation rates in August spiked to 36%, up from 9% are year ago. In Texas, the cancellation rate spiked to 31%; in Northern California, it spiked to 29%, based on the home builder survey by John Burns Real Estate Consulting. These are huge cancellation rates.

Across the US, the cancellation rate among home builders in August jumped to 19%, the highest in years, up from 17.6% in July, and up from 16.5% during the worst lockdown month, and up from 7% in August 2021 (chart via Rick Palacios Jr., Director of Research at John Burns):

I previously reported on The Boots-on-the-Ground Observations by 21 Home Builders about the Housing Market They’re Facing, also based on John Burns’ home builder survey. For example, a builder in Phoenix said: “Incentives continue to grow, with some communities pushing 20% in total discount packages. The positive is there’s light at the end of the tunnel for improving build cycle times. The negative is there won’t be customers on the other side of said tunnel.”

Holy-moly mortgage rates.

The average 30-year fixed mortgage rate rose to 6.42% today, according to Mortgage News Daily’s measure, which tracks mortgage rates on a daily basis.

The weekly measure by Freddie Mac, released last Thursday and reflecting mortgage rates earlier in the week, hit 6.02%, the highest since November 2008. It has now more than unwound the “Fed pivot” mirage over the summer, when it had briefly dipped to 4.99%.

“Holy-moly mortgage rate” is becoming a technical term based on what potential homebuyers say when they see the mortgage payment of the house they’re trying to buy at these prices and rates.

Homebuilder stocks, after the summer rally that ended in mid-August, are down between 30% and 44% so far this year (data via YCharts):

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

(adsbygoogle = window.adsbygoogle || []).push({});

less

California Housing Market: Dismal Sales, Prices Sag in San Francisco (-20% fr. peak), Silicon Valley, San Diego, Orange County…

And this was during the summer rally as mortgage rates dropped to 5%, stocks bounced, the Fed “pivoted,” and the Good Times started all over again.

By Wolf Richter for WOLF STREET.

Home sales that closed in August were made somewhere from a few days to a couple of months before they closed – so roughly around and before the peak of the summer bear-market rally in mortgage rates and stocks that started in mid-June and ended in mid-August.

By mid-June, the

... moreAnd this was during the summer rally as mortgage rates dropped to 5%, stocks bounced, the Fed “pivoted,” and the Good Times started all over again.

By Wolf Richter for WOLF STREET.

Home sales that closed in August were made somewhere from a few days to a couple of months before they closed – so roughly around and before the peak of the summer bear-market rally in mortgage rates and stocks that started in mid-June and ended in mid-August.

By mid-June, the average 30-year fixed rate mortgage was at or above 6%, having doubled in less than a year. And stocks had sunk. But then the tightening-deniers fanned out and trolled the media with nonsense about the Fed being “dovish,” that it would “pivot” in September or whatever, and they declared that inflation was “over,” etc. etc., and stocks bounced off their mid-June lows and mortgage rates fell from 6% to 5%, and for a moment just below 5%. And Realtors were already talking about how the housing market was picking up again.

Now we know that all this was a hoax. Mortgage rates are now solidly over 6%. Fed chair Powell finally got through to everyone with his Jackson Hole speech that the Fed will tighten further. Inflation got worse and has shifted to services, from where it’s difficult to dislodge. And the stock market, now finally seeing inflation and higher rates, has given up most of the bear-market rally gains.

But back then, it seemed real enough to lots of people. In the San Francisco Bay Area and in Southern California – whose housing markets are heavily dependent on the stock market – there were hopes of an uptick amid re-surging stock prices, plunging mortgage rates, and gorgeously imagined Fed pivots. Those were the Good Times. So here is what we got instead from the California Association of Realtors for August:

Prices sank further. In four of the five big Bay Area counties, prices were down year-over-year. Sales volume was dismal, though slightly less dismal than the collapse in July. Time on the market about doubled year-over-year. And supply surged year-over-year.

San Francisco County leads:

Sales volume, single-family houses (SFH): -24% year-over-year, slightly less dismal than -26% in July.

Median time on the market: 20 days, up from 15 days in July, and up from 11 days a year ago.

Supply of unsold inventory: 2.2 months, same as in July, compared to 1.7 months a year ago.

Median Price, single-family houses: $1.635 million, lowest price for any August since 2019 ($1.60 million): -3.8% from July, fifth month in a row of declines, -20.6% from peak in March, -11.6% year-over-year.

In San Francisco, prices usually hit their seasonal lows in January or February; so this will be interesting. The green line connects the Augusts:

These are massive price declines in San Francisco. Yes, median prices are volatile, and we look at them with a good dose of circumspection, and trends need to be confirmed over time. But this trend here is being confirmed nicely so far.

One glance at the chart tells us that the median price will eventually bounce again, to zigzag lower rather than to go to heck in a straight line.

Santa Clara County, southern Silicon Valley.

Sales volume, single-family houses: -28% year-over-year, less dismal than -46% in July.

Median time on the market: 16 days, up from 14 days in July, and up from 8 days a year ago.

Supply of unsold inventory: 2.0 months, compared to 2.6 months in July, and 1.4 months a year ago.

Median Price, single-family houses, $1.65 million: -5.2% from July, fourth month in a row of declines, -15.4% from peak in April, -0.3% year-over-year:

San Mateo County, northern Silicon Valley.

Sales volume, single-family houses: -30% year-over-year, slightly less dismal than -35% in July.

Median time on the market: 14 days, up from 12 days in July, and up from 9 days a year ago.

Supply of unsold inventory: 2.3 months, compared to 2.2 months in July, and 1.5 months a year ago.

Median Price, single-family houses, $1.95 million: -0.8% from July, fourth month in a row of declines, -14.5% from peak in April, +1.3% year-over-year:

Alameda County, East Bay.

Sales volume, single-family houses: -30% year-over-year, less dismal than -35% in July.

Median time on the market: 16 days, up from 13 days in July, and up from 9 days a year ago.

Supply of unsold inventory: 2.1 months, compared to 2.4 months in July, and 1.3 months a year ago.

Median Price, single-family houses, $1.23 million: -8.2% from July, third month in a row of declines, -14% from peak in May, -5.4% year-over-year:

Contra Costa County, East Bay.

Sales volume, single-family houses: -27% year-over-year, less dismal than -36% in July.

Median time on the market: 18 days, up from 13 days in July, and more than double the 9 days a year ago.

Supply of unsold inventory: 2.3 months, compared to 2.5 months in July, and 1.4 months a year ago.

Median Price, single-family houses, $870,000: -3.6% from July, fourth month in a row of declines, -10% from peak in April, -2.2% year-over-year:

Southern California trying to catch up.

In Southern California overall, house prices fell for the third month in a row, -5.9% from the peak, which whittled the year-over-year gain down to 4.6%. So here are the three biggest counties. In San Diego, the median price dropped nearly 5% from July. In Orange, it dropped 2.5%, but it ticked up in Los Angeles. So here we go, starting with the most splendid housing bubble, San Diego.

San Diego County.

Sales volume of single-family houses: -28% year-over-year, less dismal than -41% in July.

Median time on the market: 15 days, up from 10 days in July, and nearly double the 8 days a year ago.

Supply of unsold inventory: 2.5 months, compared to 3.1 months in July, and 1.7 months a year ago.

Median Price, single-family houses, $885,000: -4.8% from July, fourth month in a row of declines, -9% from peak in April, which cut the year-over-year gain to +6.0%:

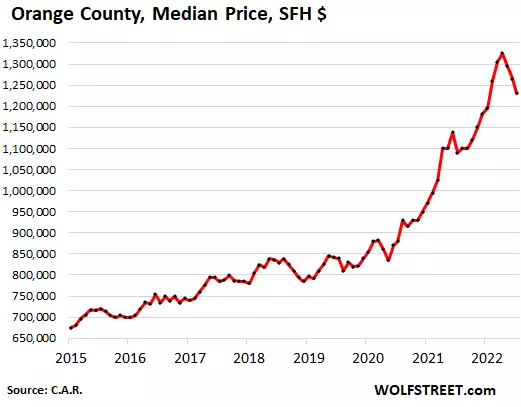

Orange County.

Sales volume of single-family houses: -30% year-over-year, less dismal than -39% in July.

Median time on the market: 17.5 days, up from 13 days in July, more than double the 8 days a year ago.

Supply of unsold inventory: 2.5 months, compared to 3.0 months in July, and 1.6 months a year ago.

Median Price, single-family houses, $1.2 million: -2.5% from July, fourth month in a row of declines, -9% from peak in April, which cut the year-over-year gain to +9.1%:

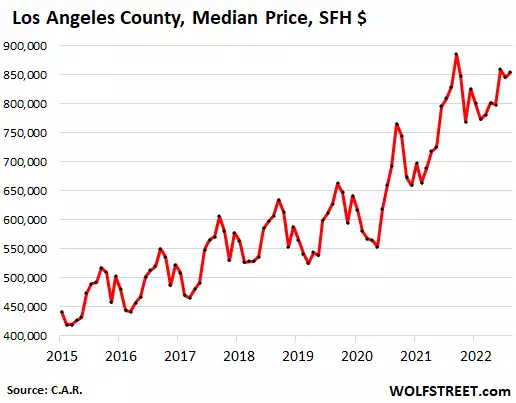

In Los Angeles County.

Sales volume of single-family houses: -29% year-over-year, slightly less dismal than -32% in July.

Median time on the market: 16 days, up from 13 days in July, nearly double the 9 days a year ago.

Supply of unsold inventory: 3.1 months, compared to 3.3 months in July, and 2.0 months a year ago.

Median Price, single-family houses, $855,000: +1.0% from July, -3.5% from peak last September, +3.0% year-over-year:

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

(adsbygoogle = window.adsbygoogle || []).push({});

less

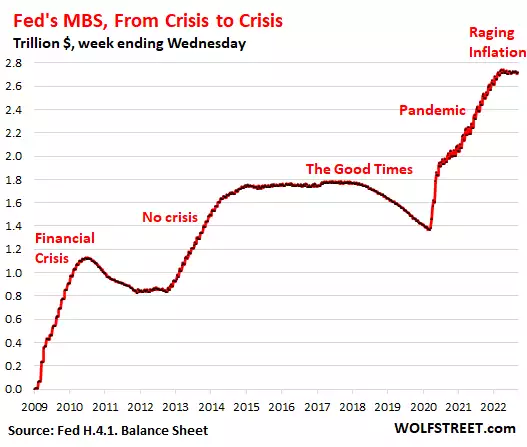

The Fed Stopped Buying MBS Today.

The purpose of MBS purchases was to repress mortgage rates and inflate home prices. That process has already started to reverse.

By Wolf Richter for WOLF STREET.

A date for history: Today, September 15, the Fed stopped buying mortgage-backed securities altogether. It had been tapering its purchases since late last year. Since June, when the phase-in of QT started, it still purchased MBS to replace some of the pass-through principal payments from mortgage payoffs and mortgage

... moreThe purpose of MBS purchases was to repress mortgage rates and inflate home prices. That process has already started to reverse.

By Wolf Richter for WOLF STREET.

A date for history: Today, September 15, the Fed stopped buying mortgage-backed securities altogether. It had been tapering its purchases since late last year. Since June, when the phase-in of QT started, it still purchased MBS to replace some of the pass-through principal payments from mortgage payoffs and mortgage payments that reduced the balance of its MBS faster than the cap of $17.5 billion. The idea was to keep the run-off of MBS within the cap of $17.5 billion in June, July, and August. But this circus is finally over.

On today’s release of scheduled purchases by the New York Fed, there were zero MBS purchases scheduled:

The Fed’s final trade in MBS.

Yesterday, September 14, the Fed conducted its final purchase of MBS. The Fed bought $387 million in MBS in the To Be Announced (TBA) market, which is a minuscule amount by the Fed’s standards. It went out with a whimper, so to speak.

This is a screenshot of the trade that the New York Fed posted on its website. I underlined the operation date (Sep 14) and the settlement date (Oct 20):

Trades in the TBA market settle after one to three months. As you can see in the image of the trade info above, this particular trade will settle on October 20.

The Fed books these trades when they settle. So, it will book this trade on October 20, which is a Thursday. Its weekly balance sheets are always as of Wednesday evening, and are published on Thursday. This trade will show up on the next balance sheet after October 20, which is the balance sheet to be released on October 27.

So halleluiah, the balance sheet on October 27 will show the final purchases of MBS. And then it’s over.

A trickle of trades haven’t settled yet.

The MBS that were purchased over the past two months will still trickle into the weekly balance sheet until October 27.

This includes a batch of MBS trades that the Fed conducted on July 25 and that settled on September 14, and that showed up on today’s balance sheet. Here is one of the trades that settled yesterday and was included today:

In total, $9.2 billion in MBS trades showed up on the balance sheet today. It is these trades, when they settle, that cause the balance of MBS to rise in the jagged manner.

MBS come off the balance sheet mostly through pass-through principal payments. When the underlying mortgages are paid off because a home is sold or a mortgage is refinanced, or when regular mortgage payments are made, the principal portion is forwarded by the mortgage servicer (such as your bank) to the entity that securitized the mortgage (such as Fannie Mae), which then forwards those principal payments to the holders of the MBS (such as the Fed).

The book value of the MBS shrinks with each pass-through principal payment. This reduces the amount of MBS on the Fed’s balance sheet.

These pass-through principal payments are uneven and unpredictable, and do not match the purchases in the TBA market. So the MBS balances form this jagged line of increases when TBA purchases settle, and the decreases when the pass-through-principal payments come off.

The upticks are the purchases from one to three months ago, when the Fed was still phasing in QT and was still purchasing MBS to replace pass-through principal payments. The downticks are the pass-through principal payments. Sometimes both coincide, and the net moves are smaller:

The last time the Fed did QT Nov 2017 – Feb 2020.

During the last episode of QT, the Fed shed MBS from November 2017 through February 2020. The chart below shows this phase of the MBS reduction. During the phase-in, it took about three months before the first declines became recognizable. QT back then was much slower, and the phase in was much longer, than in the current era of QT.

Note how the upticks essentially vanished as the Fed bought fewer or no MBS to maintain the cap of the runoff, and the line smoothened out on the way down:

Going to zero?

Going forward, after October 27, 2022, after the last MBS purchases have shown up, the upticks will disappear, and the line will smoothen as it heads down. But this time, the decline will be steeper and faster.

The Fed has said many times over the years that it wants to get rid of its MBS entirely, and that it wants only Treasury securities as assets. So if everything goes according to plan, the MBS balances will go to zero. And this might require that the Fed starts selling MBS outright later in the process to supplement the pass-through principal payments. The Fed has already put this option on the table.

The entire episode of MBS on the Fed’s balance sheet started in late 2008, when the Fed for the first time started buying MBS as part of QE-1. By the peak in April, 2022, the Fed had $2.74 trillion in MBS on its balance sheet.

The purpose of MBS purchases was to repress mortgage rates and inflate home prices. That process has already started to reverse.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

(adsbygoogle = window.adsbygoogle || []).push({});

less

Boots-on-the-Ground Observations by 21 Home Builders about the Housing Market They’re Facing

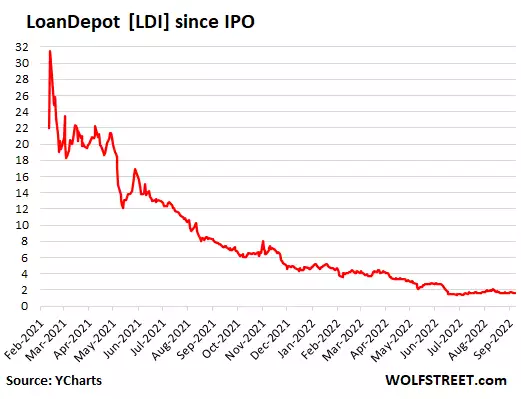

Mortgage Lender Woes

It’s not that mortgages are bad, it’s that mortgage volume collapsed. And the stocks of the biggest mortgage lenders collapsed after IPO or SPAC merger.

By Wolf Richter for WOLF STREET.

The latest entry in the long litany of mortgage-lender layoffs is Citibank, which let go some people in its mortgage unit. Well Fargo, JPMorgan Chase, and numerous other banks, along with the non-bank mortgage lenders, have laid off staff starting late last year.

The biggest

... moreIt’s not that mortgages are bad, it’s that mortgage volume collapsed. And the stocks of the biggest mortgage lenders collapsed after IPO or SPAC merger.

By Wolf Richter for WOLF STREET.

The latest entry in the long litany of mortgage-lender layoffs is Citibank, which let go some people in its mortgage unit. Well Fargo, JPMorgan Chase, and numerous other banks, along with the non-bank mortgage lenders, have laid off staff starting late last year.

The biggest mortgage lenders aren’t banks. They’re nonbanks: Rocket Companies (owns Quicken Loans), United Wholesale Mortgage (owns United Shore Financial), and LoanDepot have cut their staff by thousands of people. LoanDepot also exited its wholesale business. AI-powered mortgage lender startup Better.com became infamous when its CEO mass-fired people via Zoom, which was followed by more layoffs. Some mortgage lenders have filed for bankruptcy. Others have shut down.

The stocks of the three biggest mortgage lenders have collapsed: Rocket Companies by 82%, United Wholesale Mortgage by 75%, and LoanDepot by 95%. All three went public either via IPO or via merger with a SPAC during the housing mania over the past two years amid immense hype and hoopla. All three have been inducted into my Imploded Stocks.

But mortgage lenders are not getting in trouble because homeowners are suddenly defaulting on their mortgages or whatever.

They’re getting in trouble because their revenues have collapsed because mortgage origination has collapsed, particularly refinance mortgages, where origination has collapsed to 22-year lows because few homeowners are going to refinance an old 3% mortgage with a new 6% mortgage, unless they have to in order to draw cash out, and that can be done more cheaply with a HELOC.

Applications for mortgages to refinance an existing mortgage fell by 1% in the latest week, having collapsed by 83% from a year ago, to the lowest level in 22 years, according to the Mortgage Bankers Association’s weekly Refinance Mortgage Applications Index, released today:

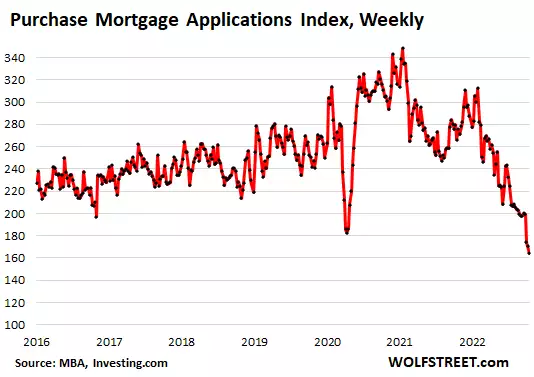

Applications for mortgages to purchase a home dropped by 3% in the latest week, as the newly returned 6% mortgage rates put a further damper on home purchasing activity. The MBA’s Mortgage Purchase Index has now plunged by 23% from a year ago and is approaching the lows during the April 2020 lockdowns:

The plunge in applications for purchase mortgages has for months shown up in home sales: Sales of new houses plunged by 30% year-over-year in July; and sales of existing homes plunged by 20%.

But it’s not mortgages that are going bad…

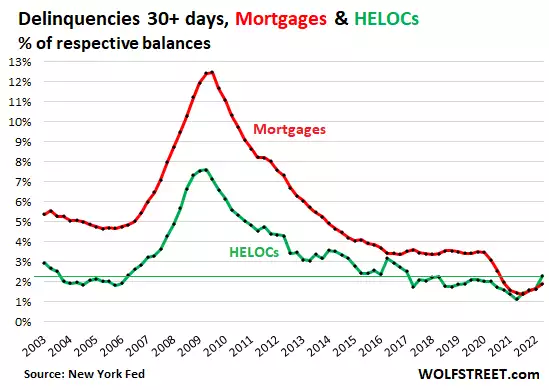

The mortgages that are outstanding have been holding up well. Delinquencies and foreclosures have started to tick up, but from the super record lows during the era of forbearance, when delinquent mortgages were moved into forbearance programs where homeowners didn’t have to make payments, and their mortgage was no longer considered delinquent.

The spike in home prices since spring 2020 allowed homeowners to exit forbearance in various ways, including by selling the home, paying off the mortgage, and walking away with extra cash. But the forbearance programs are being phased out.

So mortgage delinquencies have started their trip back to normal: Mortgage balances that were 30 days or more delinquent ticked up to 1.9% of total mortgage balances in Q2 but remain well below the lows of the Good Times (red line).

Foreclosures have also started to tick up but are still far below any of the prior lows before the pandemic:

For mortgage lenders: A collapse in revenues from mortgage origination.

The three largest mortgage lenders are nonbanks; they hold the mortgages they originate for only short periods of time, until they have enough mortgages together to sell them to Fannie Mae, Freddy Mac, the VA, Ginnie Mae, etc., which then securitize the mortgages and sell them to investors as MBS. These mortgage lenders, by not keeping mortgages on their balance sheet for long, slough off the credit risk to the buyers of their mortgages (and ultimately to taxpayers that guarantee many of these mortgages).

But during the period that mortgage lenders hold the mortgages, they’re exposed to the risk that mortgage rates spike, causing the value of the mortgage that has a lower interest rate to decline. This isn’t normally a big issue, but it was a big issue this spring when mortgage rates spiked by historic amounts in weeks, causing some losses among mortgage lenders.

These losses came just as revenues collapsed. Nonbank mortgage lenders get their revenues from net interest income (small portion of total revenues), gains on origination and sales of mortgages, origination income, servicing fees, etc.

At Rocket Companies, which surpassed Wells Fargo years ago as the largest mortgage lender – revenues collapsed by 48% in Q2, to $1.39 billion.

The company went public via IPO during the housing mania in August 2020 at $18 a share. Its shares [RKT] have collapsed by 82% from their high in March 2021, and by 59% from their IPO price, to $7.54 (data via YCharts):

United Wholesale Mortgage underwrites and provides closing documentation for mortgages originated by brokers, small banks, and credit unions. Its loan origination volume plunged by 51% in Q2 compared to a year ago.

It went public via merger with a SPAC. The merger closed in January 2021. The SPAC’s shares peaked after the announcement but before the merger closed, with an intraday high on December 28, 2020, of $14.38. From that high in December 2020, shares have collapsed by 75%. The chart only goes back to the date of the completion of the merger, to the first day the shares traded under their new ticker [UWMC]. From the closing high on that day, shares have plunged by 68%, to $3.61 (data via YCharts):

At LoanDepot, revenues in Q2 collapsed by 60% from a year ago, to $308 million, generating an astounding net loss of $223 million, compared to a net profit of $26 million in Q2 2021.

The company went public via IPO in February 2021 at $14 a share. During the first two days, shares performed a spectacular hype-and-hoopla “pop” intraday to $39.85, and then collapsed by 95% from that high, and by 88% from the IPO price, to $1.66 (data via YCharts):

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

(adsbygoogle = window.adsbygoogle || []).push({});

less

The Most Splendid Housing Bubbles in America, August Update: First Price Drops Appear, All in the West

Sales of New Houses Collapse (in the West by 50%!) Inventories & Supply Spike to High Heaven, Worst since Peak of Housing Bust 1

Forget “housing shortage.” It’s about crazy prices: For sales to revive at these mortgage rates, prices have got to come down a lot — and they’re starting to.

By Wolf Richter for WOLF STREET.

The plunge in home sales is just stunning. Sales of new single-family houses collapsed by 12.6% in July from the already beaten-down levels in June, and by nearly 30% from July last year, to a seasonally adjusted annual rate of 511,000 houses, the lowest since January 2016,

... moreForget “housing shortage.” It’s about crazy prices: For sales to revive at these mortgage rates, prices have got to come down a lot — and they’re starting to.

By Wolf Richter for WOLF STREET.

The plunge in home sales is just stunning. Sales of new single-family houses collapsed by 12.6% in July from the already beaten-down levels in June, and by nearly 30% from July last year, to a seasonally adjusted annual rate of 511,000 houses, the lowest since January 2016, and well below the lockdown lows, according to data from the Census Bureau today.

New house sales plunged in every region compared to July last year. Note the West, oh dear:

A similar plunge, but now quite as bad, occurred in sales of previously owned homes, which plunged by 20% across the US in July compared to a year ago. In California, sales of existing homes collapsed by 31% year-over-year; and in the previously hottest market, San Diego, by 41%!

Sales obviously would be a lot higher if prices were a lot lower, and more people could actually buy at these mortgage rates – today, the average 30-year fixed rate is at 5.7% again, according to Mortgage News Daily – but it takes a sustained plunge in volume to hammer the message into increasingly motivated sellers what they need to do if they want to sell: They have to go where the buyers are, and the buyers are a lot lower.

Homebuilders know this because they have been lamenting for months the plunge in traffic of prospective buyers, according to the survey of homebuilders, conducted by the National Association of Home Builders:

Suddenly no “housing shortage”: Inventories and supply spike to high heaven.

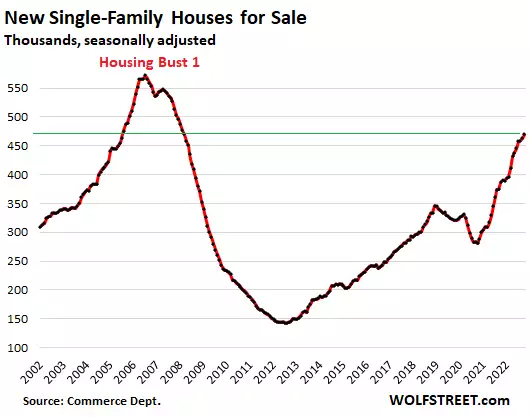

Inventory for sale in all stages of construction jumped to 464,000 houses, up by 28%, from July last year, and the highest since March 2008:

Supply of unsold new houses spiked to nearly 11 months of sales, on this surge in inventory and the collapse in sales. This was the highest since the worst months of Housing Bust 1 in late 2008 and early 2009:

By region, unsold inventory jumped in three of the four regions, in terms of the percent increase year-over-year:

Prices must come down at these mortgage rates, and they’re starting to.

The median price of new single-family houses that were sold in July rose to $439,000, not quite undoing the plunge in June. This was down by $20,000 from the peak in April, whittling down the year-over-year gain to 8.2%, the smallest gain since November 2020. In a moment, we’ll look at the three-month moving average, which gives a clearer picture:

The three-month moving average, which irons out some of the month-to-month ups-and-downs of the median price, fell for the second month in a row, the first such declines since the lockdown months.

Note the crazy price distortions since then. And now with much higher mortgage rates, at those crazy prices, sales volume has collapsed, cancellations have spiked, traffic of prospective buyers has plunged. If builders want to bring in buyers and sell houses, they’ve got to cut prices – and by a lot:

Worst construction-cost inflation ever is rising less crazy-fast as demand plunges.

Over the past two years, spiking demand for new houses triggered astounding spikes in prices and shortages of materials and supplies, combined with a labor shortage that have delayed projects and inflated costs for homebuilders, and they passed those surging costs on to their over-eager customers, no problem, until suddenly customers balk, which is now.

Demand by homebuyers has collapsed by 30% year-over-year to multi-year lows. And homebuilders are throttling back their demand for materials and supplies, and suddenly the crazy price spikes abate.

Construction costs of single-family houses – excluding the cost of land and other non-construction costs – ticked up only 0.4% in July from June, according to separate data the Census Bureau released today. Although that’s still big increase (around 5% annualized), it was by far the slowest increase since November 2020. The month-to-month increases had peaked at over 2% late last year, and in May and June were still at around 1.5%.

This whittled down the year-over-year spike in costs to 16.8%. Beyond the spikes this year, it was still the highest in the data going back to the 1960s. The previous high was in mid-1979 at 14%.

This chart shows the actual construction cost index and the cumulative nature of those price spikes. Note that during Housing Bust 1, construction costs actually fell – and this might be happening again as homebuilders cut back and demand sags.

Note that none of this goes into CPI inflation. The housing costs that enter into CPI are based on rents.

Homebuilder stocks: -25% to -40% year-to-date.

The stocks of homebuilders are down between 25% and 40% year-to-date, despite a powerful summer rally, and have by far out-dropped the S&P 500 Index (-13% year-to-date):

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

(adsbygoogle = window.adsbygoogle || []).push({});

lessCalifornia Housing Market Pukes: As Sales Collapse (San Diego County -41%), Prices Begin to Swoon

San Francisco & Silicon Valley lead. Southern California is catching up. In Los Angeles County, prices fell in July from June for the first since Adam and Eve.

By Wolf Richter for WOLF STREET.

It’s peak home-buying season in California, but sky-high home prices, holy-moly mortgage rates, the collapse of cryptos, the vanishing DeFi, and the implosion of tech startups, SPACs, and IPOs, all of which are crucial to the wealth, or perceived wealth, of many Californians,

... moreSan Francisco & Silicon Valley lead. Southern California is catching up. In Los Angeles County, prices fell in July from June for the first since Adam and Eve.

By Wolf Richter for WOLF STREET.

It’s peak home-buying season in California, but sky-high home prices, holy-moly mortgage rates, the collapse of cryptos, the vanishing DeFi, and the implosion of tech startups, SPACs, and IPOs, all of which are crucial to the wealth, or perceived wealth, of many Californians, pulled the rug out from under California’s splendid housing markets.

Sales volume of single-family houses (SFH) in California plunged by 14% in July from June, seasonally adjusted, and by 31% from a year ago, the 13th month in a row of year-over-year declines, according to the California Association of Realtors.

Sales volume of condos plunged by 18% in July from June, and by 36% from a year ago.

Prices eventually follow volume: The median price of single-family houses dropped 3.5% in July from June, down for the second month in a row, slashing the year-over-year gain to just 2.8%. The median price of condos dropped 2.3%, down for the third month in a row, whittling down the year-over-year gain to 7.5%.

San Francisco and Silicon Valley lead with the declines.

Sales volume of houses and condos in the entire San Francisco Bay Area has collapsed by 37% from a year ago.

Price has started to follow volume. Year-over-year, the median price of houses across the Bay Area was down for the first time since lockdown May 2020.

Year-over-year, it was down in three of the five big counties that cover San Francisco, Silicon Valley, and part of the East Bay, led by San Francisco, where the median price was down 8.2% year-over-year. We’ll get to the charts in a moment.

Southern California is behind but catching up.

Sales volume of houses plunged by 20% from June, and by 37% from a year ago. In San Diego, sales volume collapsed by 21% in July from June and by 41% year-over-year. In Orange County, sales volume collapsed by 39% year-over-year, in Los Angeles County by 32%.

Price eventually follows volume, even in Southern California. In the counties of San Diego and Orange, the median price dropped for the third month in a row.

In Los Angeles County, the median price had peaked in September 2021 and has been on a wild ride since, up and down. But in July it fell, which was a bummer because it always rises from June to July; it even rose in 2009 from June to July, when all heck had broken loose, which puts this drop in a special light.

Supply and median time on the market jump.

In all of California, supply of houses and condos for sale rose to 3.2 months, up from 1.9 months a year ago, and the highest level since May 2020.

The median time on the market jumped to 14 days in July, up from 11 days in June, and up from 8 days a year ago.

In the Bay Area, supply jumped to 2.5 months in July, up from 2.0 months in June, and up from 1.5 months in July last year.

The median time on the market jumped to 15 days in July, up from 12 days in June, and up from 10 days a year ago.

In Southern California, supply jumped to 3.3 months, up from 2.5 months in June, and up from 1.9 months in July last year.

The median time on the market jumped to 13 days in July, up from 10 days in June, and up from 8 days a year ago.

Median Prices of SFH the Biggest Counties.

Median prices are very volatile, and we need to look at them with a good dose of circumspection, and trends need to be confirmed over time. But when the median price is down so far that the huge year-over-year gains in prior periods get whittled down to just small gains or even year-over-year declines, then the data points are starting to acquire heft as trends. And that’s what we’re now starting to see.

The Bay Area leads in price declines.

In the overall San Francisco Bay Area, the median price of single-family houses dropped for the third month in a row in July, is down 15.5% from the peak, and down 0.1% from a year ago, down year-over-year for the first time since lockdown May:

In San Francisco, house prices fell for the third month in a row, are down 17% from the peak and are down 8% year-over-year. These are very large and sudden declines, especially in June and July, and it rolled the median price back to where it first was in February 2018:

In San Mateo County, the northern part of Silicon Valley, the median price also fell for the third month in a row, -18% from the peak and -7% year-over-year. These are large and sudden drops that took the median price back to where it had first been in March 2021:

In Santa Clara County, which includes the southern part of Silicon Valley, the median price also fell for the third month in a row, -12% from the peak, but still +4% year-over-year, compared to the 20% gains last year:

In Alameda County, in the East Bay, house prices fell for the second month in a row, -13% from the peak, but still +3% year-over-year:

In Contra Costa County, in the East Bay, house prices fell for the third month in a row, -14% from the peak, -4% year-over-year:

Southern California trying to catch up with the Bay Area.

In Southern California overall, house prices fell for the second month in a row, -4% from the peak, but still +6% year-over-year.

In San Diego County, the median house price fell for the third month in a row, -5% from the peak, which whittled the year-over-year gain from the 30%-range last year to +8% in July:

In Los Angeles County, the median house price has gone wild since the peak in September last year, -4.5% from that peak. Year-over-year, +4.5%.

But wait… special nugget: Seasonally, in LA County, the median price always rises from June to July, and this year’s drop in July from June was the first drop in many, many years. During the Housing Bust in 2008, the median price was essentially flat. And even in July 2009, as all heck had broken loose, the median price rose from June, which puts this year’s 1.6% drop in July from June into a very special light.

In Orange County, the median house price fell for the third month in a row, -7% from the peak, which whittled the year-over-year gain from the 27%-range early this year to 13% in July:

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

(adsbygoogle = window.adsbygoogle || []).push({});

less

Housing Bubble Getting Ready to Pop: The Big Boys Leave, Waiting for Reset

THE WOLF STREET REPORT: Housing Bubble Getting Ready to Pop – The Big Boys Leave, Waiting for Reset

Biggest investors in single-family houses: “We need to be patient and allow the market to reset” (you can also download the WOLF STREET REPORT wherever you get your podcasts).

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Biggest investors in single-family houses: “We need to be patient and allow the market to reset” (you can also download the WOLF STREET REPORT wherever you get your podcasts).

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

(adsbygoogle = window.adsbygoogle || []).push({});

less

Trip Back to Reality Starts: Mortgages, HELOCs, Delinquencies, and Foreclosures in Q2