Total Mortgage

How to Refinance an Inherited House - Total Mortgage

How to Use Gift Money for a Down Payment - Total Mortgage

Credit Score & Home Buying: What Credit Score Is Needed to Buy a House? - Total Mortgage

When it comes time to purchase a house, a potential buyer’s credit score plays a critical role in the lender’s decision. If you are asking yourself, ‘what is the perfect credit score?’ the answer is that it depends.

Various factors are at play to determine the credit score needed to buy a house, and different mortgage products have their own unique credit score minimums attached.

In addition, each of the three credit bureaus — Experian, TransUnion, and Equifax — maintain their

... moreWhen it comes time to purchase a house, a potential buyer’s credit score plays a critical role in the lender’s decision. If you are asking yourself, ‘what is the perfect credit score?’ the answer is that it depends.

Various factors are at play to determine the credit score needed to buy a house, and different mortgage products have their own unique credit score minimums attached.

In addition, each of the three credit bureaus — Experian, TransUnion, and Equifax — maintain their consumer credit scores, culminating in multiple FICO scores, and lenders are likely to want to see all of them before making a credit decision. Prospective homebuyers could qualify to buy a home with a 640 credit score or even lower in some cases.

What Is the Lowest Credit Score Needed to Buy a House?

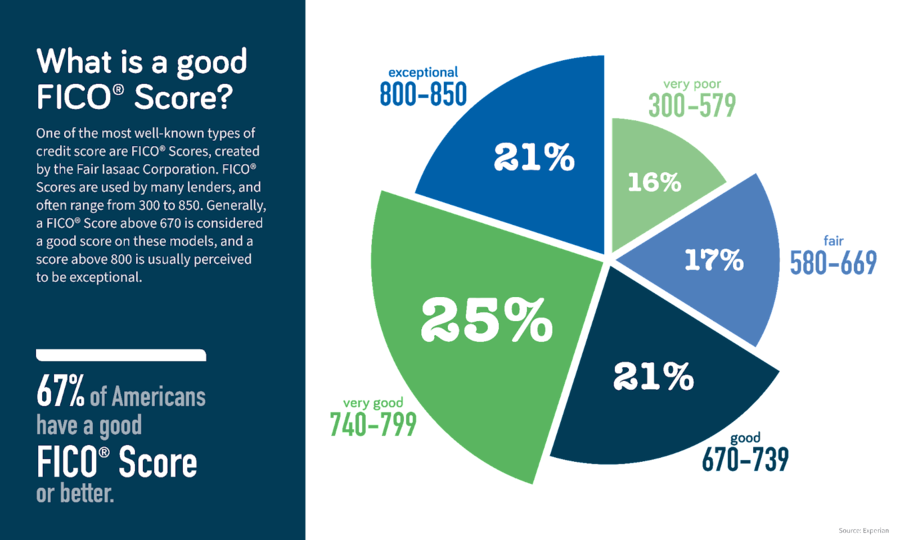

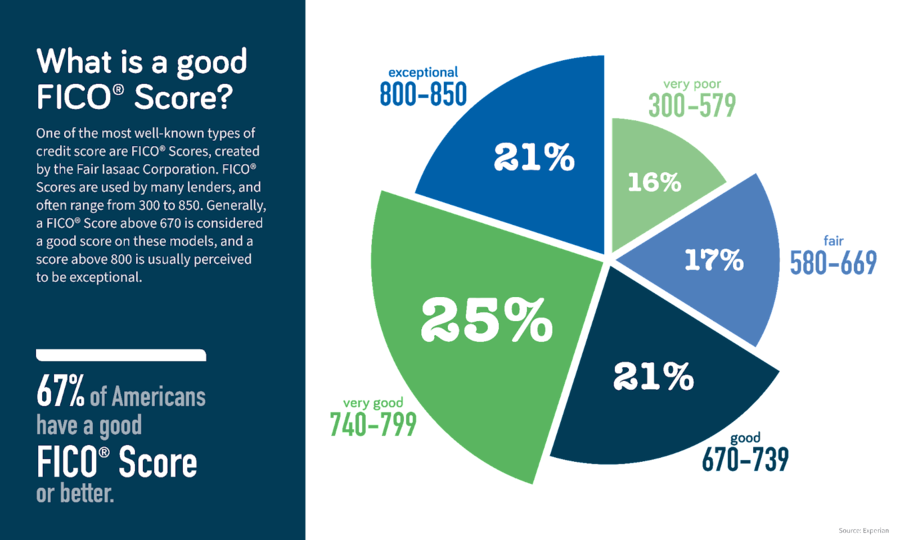

Credit scores range from 300 to 850, as do FICO scores. Lenders are generally interested in all three of a prospective home buyer’s credit scores plus their FICO score attached to each report.

Generally speaking, a 640 credit score or better should be high enough to qualify for one of the major mortgage options. However, for some mortgage products, a lower credit score will suffice. Keep in mind that the higher your credit score, the more attractive the interest rate attached to your mortgage is going to be.

For potential homebuyers who want to have a low down payment advantage of 3.5% on a Federal Housing Administration (FHA) loan, the rock-bottom FICO needed to buy a house is approximately 580.

However, the FHA doesn’t necessarily preclude consumers whose credit score is below that level from qualifying for a mortgage. Prospective homebuyers with a FICO score of less than 580 would need to make a 10% down payment to meet the agency’s loan standards.

Types of Loans and Credit Scores Needed to Buy a House

Beyond the FHA, other loan products have their own criteria for the lowest credit score needed to buy a house.

VA and USDA Loans

Veterans could use a U.S. Department of Veterans Affairs (VA) backed loan to purchase a new home or refinance an existing mortgage. However, the VA has not established a credit score threshold to qualify for a VA loan, as this is set on a lender by lender basis.

Veterans could use the minimum credit score that most lenders adhere to, which is 620, as a gauge. The VA relies on its own “residual income guidelines” relative to a borrower’s debts and expenses to ensure veterans don’t take out a loan they can’t afford.

The United States Department of Agriculture (USDA) has a host of criteria to qualify for a loan. However, similar to the VA, the USDA steers clear of a specific credit score requirement.

Experian states that most lenders facilitating USDA-backed loans look for a credit score of at least 640. According to the Mortgage Research Center’s USDALoans.com, borrowers with a credit score of 640 or better could qualify for the USDA’s automated underwriting system.

Potential borrowers with a credit score below that level might be able to qualify for the USDA’s manual underwriting standards.

Conventional Loan

Conventional loans could either be conforming or non-conforming. Whether conforming or non-conforming determines whether it meets the Federal Housing Finance Agency’s (FHFA’s) criteria around income and debt, covering loan size.

The loan size limit as of 2022 is $647,200 but could be as high as $970,800 in pricier neighborhoods.

To qualify for a conventional loan, you must have a minimum credit score of 620, whether purchasing a new home or refinancing a mortgage. Conventional loans are neither backed nor secured by the government.

Jumbo Loan

Jumbo loans have more stringent standards considering that lenders inherit greater risk given the size of the loans. As the name suggests, jumbo loans are larger compared to other mortgages, meant for homes whose prices are on the higher side of the spectrum.

Whether you are shopping in a pricey neighborhood, or a bidding war has driven up the price of a property, a jumbo loan could be the best product.

Given the size of the loan, the credit standards are higher. We have good news if you are wondering, ‘Is 700 a good credit score?’

FHA Loan

An FHA loan is one backed by the Federal Housing Administration. As alluded to above, there are credit tiers for this type of loan product based on the buyer’s amount toward the down payment.

An FHA loan also has other requirements, including a debt-to-income ratio of less than 43%. The buyer is expected to purchase mortgage insurance, live in the home as their primary residence, and show proof of regular income and a job.

Total Mortgage works with borrowers like you across the United States. Let Total Mortgage match you with one of our mortgage experts today.

Understanding How Your Credit Score Is Determined

Credit scores let lenders assess the lending risk associated with a prospective borrower. A FICO score further analyzes that data to determine the likelihood that a consumer will be able to repay their debts on time or late.

The credit score reflects the information in each of the three credit reports, while a FICO score, in particular, is split into five separate groups with the following impacts:

What Is the Perfect Credit Score?

Many potential homebuyers want to know whether or not 680 is a good credit score or if 700 is a good credit score.

And while it is probably high enough to qualify for a mortgage, there is still room for improvement. According to Experian, the top FICO score falls between 800 and 850, a range it deems “exceptional.”

What Is a Fair Credit Score?

For potential homebuyers managing a 640 credit score, you should know that this FICO score falls into a range that is deemed fair, between 580 and 669.

What Is a Low Credit Score?

A low FICO score falls below the 670 level, according to Experian. Let’s further drill down these scores into various categories according to the following table:

Ways to Increase Your Credit Score

Prospective homebuyers whose credit score needs improvement or who are just looking to lock in the best possible interest rate on a mortgage could take specific steps to improve their credit score.

Find the Type of Loan That’s Best for You

Total Mortgage is ready to help you with your mortgage needs. Whether you are buying a home, refinancing, or seeking a home equity loan, Total Mortgage can get you a free rate quote today.

lessFHA vs. Conventional Loans: What’s Better For You? - Total Mortgage

How to Convince Your Landlord to Let You Renovate - Total Mortgage

USDA Home Loans: Everything You Need to Know - Total Mortgage

House vs Condo: What’s Better for a Second Home? - Total Mortgage

Understanding As-Is Sales: Risks and Benefits for Home Buyers - Total Mortgage

Can You Use Your 401k to Buy a House? Pros and Cons Explained - Total Mortgage

Getting a Home Loan Approval: How Long Does It Take? - Total Mortgage

As you’re starting the process of buying a home, you may be wondering how long everything takes. Specifically, you may be curious about how long the home loan approval process takes. Don’t worry, we’ve got you covered.

In this article, we’re going to highlight how long it takes to get approved for a home loan, as well as what you’ll need before starting the process.

The Home Loan Approval Process

The average time it takes to close on a home in the US is 51

... moreAs you’re starting the process of buying a home, you may be wondering how long everything takes. Specifically, you may be curious about how long the home loan approval process takes. Don’t worry, we’ve got you covered.

In this article, we’re going to highlight how long it takes to get approved for a home loan, as well as what you’ll need before starting the process.

The Home Loan Approval Process

The average time it takes to close on a home in the US is 51 days. However, that time doesn’t reflect how long it takes to get approved for a home loan.

The time it takes to get approved for a home loan is going to depend on a few different factors. With that in mind, the time it takes to close on a home is much longer than 51 days, in most cases.

Consider these activities that have to be completed before you can even start applying for mortgages.

Finding the Right Lender

The first step in the home loan approval process is finding the right lender. When you’re looking to purchase a home, you have to be sure that you’re choosing a lender that’s going to fit your needs. This means that their rates should fall within your ideal area and that they’re going to offer you the money you need to purchase your dream home.

Getting Pre-approved

Before you get approved for an actual mortgage, most lenders are going to require you to go through a pre-approval process. This process involves taking a closer look at your current financial circumstances and ensures that you fit the lender’s qualifications.

For the most part, the pre-approval process shouldn’t take long. Some lenders only take a few seconds to do a quick credit check before a pre-approval is granted. Others take a few days at the most.

Getting Approved for a Home Loan

A pre-approval is going to last anywhere between 30 to 90 days and depends on the lender you’re working with. Getting pre-approved is essentially a green light to move forward with your home search. Then, when you’ve found the perfect home, the real approval process begins.

Home loan approval is a bit different from pre-approval. Approval takes into account your financial details, as well as the characteristics of the home you’re looking to purchase.

When going through the approval process, the lender is going to require specific information about the home, like the title, an inspection, as well as a home appraisal. Most of these are going to be out of your hands.

Approval normally takes a few weeks to process, while closing takes an additional few weeks. This is what makes the process last for 51 days.

Calculate your monthly mortgage payments with Total Mortgage’s Purchase Calculator and get a feel for what you can afford.

How to Speed Up the Home Loan Approval Process

You can speed the home loan approval process up by having all the necessary information ready for the lender. We’re going to cover the 5 things you need to have on hand before you even consider starting the pre-approval process.

1. Proof of Income

Your income is a deciding factor in the approval process. Lenders want to make sure that you’ve got a history of income that will cover the cost of your monthly mortgage payments.

As you begin the pre-approval process, make sure that you have your W-2 statements from the last few years handy. Most lenders want at least two years of coverage, but some may require even more. Include any additional income, too, like alimony, bonuses, or rental income.

2. Proof of Assets

Similar to your proof of income, a lender wants to see that you’ve got the funds to cover your down payment and your closing costs. Most often, the lender wants at least 20% of the home’s value as the down payment, as well as the approximate cost of closing costs.

Make sure to prove the lender with your bank statements and investment account statements.

3. Credit Information

This isn’t necessarily something you provide. Rather, you can speed the approval process up by making sure that your credit is in top shape. Take care of any outstanding collections accounts, as well as any debts that may prevent you from taking out a mortgage.

4. Employment Verification

Lenders want assurances that they’re giving loans to suitable buyers, which means buyers who are employed. Pay stubs are a good way to prove that you’re employed, but some lenders may contact your employer to verify your claims.

Self-employed buyers will usually have to provide more detailed documentation. This includes lengthier employment and income history to make sure that income isn’t volatile.

5. Additional Documentation

You may be required to provide additional documentation. At the very least, a form of identification (driver’s license, state ID) and a social security card will be needed. All of this goes into the necessary credit reports and background checks.

Learn More About the Home Loan Approval Process

If you have additional questions about the home loan approval process, our loan officers can help guide you in the right direction. Total Mortgage has branches throughout the country and we offer a personalized mortgage experience for each borrower.

Explore Total Mortgage’s list of branches in the US to find the one that’s nearest to you. You can also apply online to get a free quote.

lessWhat Is Debt-to-Income Ratio and How Is It Calculated? - Total Mortgage

Your debt-to-income ratio, or DTI, signals your ability to repay a loan to your lender. A higher DTI means you carry too much debt compared to your monthly income, which could pose a greater risk to your lender.

By calculating your debt-to-income ratio, you can take the necessary steps to lower your DTI and get a better interest rate.

Here’s what you need to know about debt-to-income ratios, how to calculate DTI, and how it can impact your ability to qualify for a loan.

What

... moreYour debt-to-income ratio, or DTI, signals your ability to repay a loan to your lender. A higher DTI means you carry too much debt compared to your monthly income, which could pose a greater risk to your lender.

By calculating your debt-to-income ratio, you can take the necessary steps to lower your DTI and get a better interest rate.

Here’s what you need to know about debt-to-income ratios, how to calculate DTI, and how it can impact your ability to qualify for a loan.

What Is Debt-to-Income Ratio?

Your debt-to-income (DTI) ratio is the percentage of your gross monthly income that goes toward your total monthly debt. DTI is an indicator of your financial health and lenders use it to measure your ability to manage monthly payments and pay back your loan.

Lenders look for a low debt-to-income ratio because it shows that you’re more likely to make monthly payments, and are therefore less of a risk. The lower your DTI, the better your chances of getting a loan or line of credit are.

On the other hand, a high DTI can indicate that you have too much debt when compared with your income. This tells lenders that you may be overextending yourself and that taking on additional debt poses a greater risk.

There are also two types of debt-to-income ratios that a lender may evaluate: front-end DTI and back-end DTI.

Front-End

Front-end DTI is the percentage of your monthly gross income that goes toward housing expenses. For example, mortgage payments, homeowners insurance, property taxes, and homeowners association fees.

To calculate your front-end DTI, add up all of your monthly household costs and divide it by your gross monthly income. Multiply the result by 100 for your front-end DTI as a percentage.

Back-End

Back-end DTI is the amount of your monthly income that goes toward minimum monthly debt payments. This includes housing expenses, lines of credit, student loans, car loans, and more.

To calculate your back-end DTI, add up your minimum monthly debt payments and housing expenses and divide it by your gross monthly income. Multiply the result by 100 and then you’ll have your back-end DTI as a percentage.

What Affects Debt-to-Income Ratio?

Several monthly payments are factored into your debt-to-income ratio. This includes:

Lenders may also consider the following sources of income:

Here are payments that are not included when calculating your debt-to-income ratio:

Interested in learning if you qualify for a home loan? Find a Total Mortgage branch near you and speak to a mortgage advisor to discuss your loan options.

How Is Debt-to-Income Ratio Calculated?

Lenders calculate your debt-to-income ratio by comparing how much you owe each month to what you earn (before taxes). Here’s how your DTI is calculated:

Let’s say your monthly gross income is $5,500 and you have the following monthly expenses:

Add these payments for a total of $1,875. Divide that number by your gross monthly income of $5,500 and then multiply by 100. Your DTI would be 32 percent.

What Is a Good DTI?

“What is a good DTI?” is a commonly asked question, but it depends on the type of loan and the lender.

In general, most lenders like to see a debt-to-income ratio below 43 percent to qualify for most conventional mortgage loans – but some lenders may accept higher.

However, the lender will still look at other factors to determine whether you’re able to repay the loan.

How To Get a Loan With High Debt-to-Income Ratio?

You may still be able to qualify for a loan with a high debt-to-income ratio, but it might be more difficult to qualify.

Some government-backed home loans, like USDA, FHA, and VA loans, may accept higher DTIs (even up to 50 percent), but you should expect greater financial scrutiny.

Fannie Mae also accepts a maximum DTI of 50 percent, but only under certain circumstances and you must meet credit score and reserve requirements.

How To Lower Your Debt-to-Income Ratio?

If your debt-to-income ratio is too high, there are steps that you can take to lower it. Here are some strategies to help:

Rate Shopping? Total Mortgage Is Changing Lending for the Better

Your debt-to-income ratio tells lenders how much of your monthly income goes toward paying off debt. If your DTI is high, it could affect your chances of qualifying for a loan or you may be asked to pay a higher interest rate.

A low DTI means a potentially lower interest rate and better loan terms. A better rate lowers the amount of interest your pay over the life of the loan and could reduce your monthly mortgage payments. Before applying for a loan, make sure to assess your financial situation and take steps to lower your debt-to-income ratio to score the best rate possible.

If you’re mortgage shopping, check out Total Mortgage’s loan program options when you’re ready to purchase or refinance. If you have any questions, schedule a meeting with one of our mortgage experts.

Apply online today and get a free rate quote.

less

Why Home Inspections Are Good For Buyers And Sellers - Total Mortgage

How to Refinance an Inherited Property to Buy Out Heirs [2023 Guide] - Total Mortgage

What is an Inspection Contingency Clause? - Total Mortgage

With today’s competitive market moving faster than ever, it can be easy to fall in love with a home too fast or cut corners in favor of a better offer. Our advice? Don’t. Before you close the deal, make sure everything is in check – and especially be aware of your home inspection contingency clause.

There are many variables and clauses included with your purchase agreement, but one of the most critical is the home inspection contingency clause. In this article, we’ll cover what inspection contingency

... moreWith today’s competitive market moving faster than ever, it can be easy to fall in love with a home too fast or cut corners in favor of a better offer. Our advice? Don’t. Before you close the deal, make sure everything is in check – and especially be aware of your home inspection contingency clause.

There are many variables and clauses included with your purchase agreement, but one of the most critical is the home inspection contingency clause. In this article, we’ll cover what inspection contingency is, the risks involved with not having it, how to properly schedule a home inspection and more.

What is a Home Inspection Contingency Clause?

An inspection contingency clause is a common provision in real estate contracts that allows the buyer to have a property inspected by a licensed professional. If the inspection reveals any issues with the property, the buyer can then negotiate with the seller to have those issues addressed before the sale is finalized. This clause is essential for buyers because if utilized properly, it ensures they are getting a house in good condition and free from significant problems.

In most cases, the inspection contingency clause will set a due date for a home inspection to be performed; after the contingency window, however, the buyer will be on the hook for any repairs or consequences associated with backing out of the deal.

During the contingency window, the buyer can more easily back out of the contract if the inspection reveals any major or unacceptable issues. This is why even in the most competitive markets, getting a home inspection within the clause timeframe is always the right choice.

Inspection Contingency Clause Benefits

• Allows buyers to have the property inspected by a professional inspector

• Gives buyers the opportunity to identify and address any issues with the property before the sale is finalized

• Allows buyers to back out of the contract if the inspection reveals any major issues with the property that the buyer is unwilling to accept

• Provides buyers with the peace of mind that they are getting a property that is in good condition

• Helps protect buyers from any potential financial losses due to unforeseen issues with the property

Risks of Not Having an Inspection Contingency Clause

Not having an inspection contingency clause in a real estate contract can be a risky move. Without this clause, buyers are essentially agreeing to purchase a property without knowing its full condition. This could lead to costly repairs or renovations that the buyer was not expecting and may not have the money to afford. Additionally, the buyer may not be able to back out of the purchase if they find out that the property is in worse condition than they thought. This could leave them stuck in a contract for a property that they are not happy with.

For these reasons, it is important for buyers to ensure that an inspection contingency clause is included in their real estate purchase contract. It will help protect them from any potential financial losses due to unforeseen issues with the property and provide them with peace of mind that they are getting a property that is in good condition.

Work with one of Total Mortgage’s loan experts today to ensure an inspection is included in your home search.

How long does an inspection contingency clause typically last?

An inspection contingency clause typically lasts for a period of 10 to 14 days. This clause allows the buyer to inspect the property and decide if they want to proceed with the purchase. During this time, the buyer can request repairs or renegotiate the purchase price. If the buyer is not satisfied with the inspection, they can back out of the deal without any penalty.

How to Schedule a Home Inspection

With an inspection contingency clause in place, it’s important to better understand the home inspection process itself. Scheduling an inspection is a critical step in the home-buying process and should be done with a qualified and experienced inspector. Here are some tips for scheduling a home inspection:

By following these steps, you can ensure that you are getting an accurate home inspection and take your results to the negotiations. This will help you make an informed decision about the property and protect you from any potential financial losses due to unforeseen issues.

Other Types of Real Estate Contingencies

Getting Started With Total Mortgage

Working with Total Mortgage is a great way to make sure you get the best possible deal when buying a home. With competitive rates, flexible repayment plans, and experienced loan officers, we are happy to help anyone looking to secure a mortgage. Plus, we can ensure that a proper home inspection is performed – an essential if your contract includes an inspection contingency clause.

For more information, apply online for free or find a loan expert near you.

lessGuide To Land Loans: What Are They & Types of Land Loans | Total Mortgage

How to Get a Mortgage When Relocating - Total Mortgage

How FHA 203K Loans Work and How to Qualify - Total Mortgage

For buyers working with a budget or current owners looking to upgrade their home, an FHA 203k loan comes with many benefits. Not only do FHA 203k loans wrap your renovation costs and mortgage into one payment, but it typically has easier income and credit requirements as well as a low down payment option.

Here’s what you need to know about FHA 203k loans and how to use this type of financing on your home improvement projects.

How Does an FHA 203K Loan Work?

An FHA 203k loan is a mortgage

... moreFor buyers working with a budget or current owners looking to upgrade their home, an FHA 203k loan comes with many benefits. Not only do FHA 203k loans wrap your renovation costs and mortgage into one payment, but it typically has easier income and credit requirements as well as a low down payment option.

Here’s what you need to know about FHA 203k loans and how to use this type of financing on your home improvement projects.

How Does an FHA 203K Loan Work?

An FHA 203k loan is a mortgage backed by the Federal Housing Administration (FHA) that allows borrowers to finance a home purchase or refinance as well as the cost of home renovation. FHA 203k loans take the form of single long-term, fixed, or adjustable-rate loans.

The cost to rehabilitate or repair the property is wrapped into the mortgage. Essentially, renovation costs are added to the purchase or refinance loan.

There are also two types of FHA 203k loans with different sets of rules:

What Are the Requirements for an FHA 203K Loan?

FHA 203k loans are meant to encourage homeownership for low to moderate-income families, enabling them to improve older properties in need of repair. Because these loans are backed by the government, FHA 203k loans may have more lenient qualification requirements than a conventional mortgage and are subject to FHA loan limitations.

You’ll also need to find an FHA-approved lender. Not all lenders offer FHA loans. Repairs must be completed by a licensed contractor, not the borrower.

Here’s how to qualify for an FHA 203k loan, although requirements may vary depending on the lender:

Interested in applying for an FHA loan? Find a Total Mortgage branch near you and discuss your options in person with one of our loan experts.

What’s the Minimum Down Payment for an FHA 203K Loan?

The minimum down payment for FHA 203k loans depends on your credit score.

Can You Get Down Payment Assistance With an FHA 203K Loan?

You can receive 100% of your down payment as gift money from family or an approved organization. Some non-profit state and local government agencies may provide down payment money in the form of a grant for FHA 203k loans.

The seller or other interested parties are not allowed to provide down payment assistance with FHA 203k loans.

Can You Use an FHA 203K Loan for an Investment Property?

The FHA 203k loan is limited to primary residences, which means you must live in the home. However, there is a way around this.

The only way to use an FHA 203k loan for an investment property is to purchase a multifamily property with two to four units. You’ll also need to occupy one of these units for at least one year but you are free to rent out the others.

Should You Get an FHA 203K Loan?

Whether or not you should get an FHA 203k loan depends on your unique situation. If you’re hoping to use the loan on investment property, then the property must be two to four units and you must live on the property for at least one year.

There are also restrictions on the kinds of renovations and repairs that can be made, depending on the type of FHA 203k mortgage.

Most non-structural and non-luxury renovations include:

This list does not include all projects that can be done with an FHA 203k loan.

Explore FHA 203K Loan Options from Total Mortgage

If you’re making renovations or repairs to your current or future home, then an FHA 203k loan could be the right fit. However, you must meet your lender’s requirements to qualify and there are restrictions on the kinds of projects you can complete.

There are also two different types of FHA 203k loans. The one you choose depends on what you plan to have done to your property.

Total Mortgage has been helping homeowners and buyers get the financing they need for over 20 years. Find an expert near you or apply for a loan online!

lessHome Loan Offset Account: What Is It and How Does It Work? - Total Mortgage

Boston Real Estate & Housing Market Prices | Total Mortgage

Boston is one of the hottest real estate and housing markets in the United States. However, even Boston experienced a slowdown in 2022 after the housing market faced several headwinds, making it more challenging for potential homebuyers to afford an increased down payment and mortgage.

As a result, price growth has been weak while homebuyers and sellers alike have often remained sidelined. According to CoreLogic’s deputy chief economist, Selma Hepp, home value growth rates in Boston declined to

... moreBoston is one of the hottest real estate and housing markets in the United States. However, even Boston experienced a slowdown in 2022 after the housing market faced several headwinds, making it more challenging for potential homebuyers to afford an increased down payment and mortgage.

As a result, price growth has been weak while homebuyers and sellers alike have often remained sidelined. According to CoreLogic’s deputy chief economist, Selma Hepp, home value growth rates in Boston declined to 10% annually compared to 13-14% with expectations for a steeper drop by year-end.

Rising interest rates, high inflation, and a looming economic recession heavily affected Boston’s housing market in 2022, and many want to believe that the worst is over. The outlook for the Boston real estate market in 2023 is looking up, with a potential recovery in sight, though it isn’t expected to unfold overnight.

The Current State of Boston’s Housing Market

Even Boston’s white-hot housing market has cooled down, along with most of the U.S. real estate market.

In the state of Massachusetts, just over 3,800 single-family homes were sold in November, down nearly 30% compared to last year’s levels, a report by The Warren Group reveals. Condo sales fell slightly more than 20% compared to last year’s 1,663 units per month. In the face of these market dynamics, prices still managed to increase.

We see

It was a similar scenario in the greater Boston area. The Greater Boston Association of Realtors reveals that Eastern Massachusetts has followed a similar trend as the state, suffering a decline in home sales. GBAR President Melvin A. Vieira Jr. blames soaring inflation and rising interest rates, both of which have weakened consumers’ buying power and resulted in weakened demand.

In November 2022, Eastern Massachusetts experienced a 30% decline in sales across single-family homes and condominium units, while multi-family homes suffered a steeper 33% sales decline vs. year-ago levels.

For the most part, Boston’s average home price is trending lower, too. Values in the following neighborhoods have fallen accordingly:

However, there are some towns bucking the downward trend. Prices in the following Boston neighborhoods have risen accordingly:

Why Is Boston’s Real Estate Market One of the Hottest in the Country?

The Northeastern United States in general is a white-hot real estate market. The Boston real estate market, in particular, is one of the hottest around. For one, it is the capital of Massachusetts, making it home to many universities, government buildings, and thriving businesses.

The city is an extremely popular destination for both homebuyers and renters, resulting in some of the highest-priced properties in the industry. Boston attracts professionals and high-net-worth individuals looking to make the northeast home.

Let’s explore why Boston is one of the hottest housing markets in the country in more detail!

Average Salaries

The average salary in the city of Boston is $84,000 annually. In addition, the cost of living is over 50% higher than average in the United States. Therefore the city attracts professionals who can afford to live in this high-priced city, such as software engineers, data analysts, and more.

Professionals Moving to Boston Suburbs

However, there is also a trend of professionals flocking to the suburbs, which has benefited homebuyers in the city of Boston. This trend has resulted in higher housing inventory levels, more stable prices, and fewer irrational bidding wars for homes.

Millennials Flocking to Boston

Millennials are also making their way to Boston, representing the largest cohort of homebuyers in the city. Younger home buyers prefer the action that the city has to offer compared to the suburbs and therefore are increasingly choosing to make Boston their home.

Forecast for Boston’s Real Estate Market: What to Expect

If 2023 is anything like 2022, the Boston real estate market should follow in the direction of the broader Massachusetts and U.S. housing markets. If there is a recovery ahead for the economy in 2023, that bodes well for Boston’s real estate market.

Let’s explore some of the Boston housing market predictions to get an idea of what to expect in the new year.

Home Sales

According to Realtor.com, Boston home sales are expected to decline in 2023, but only slightly. The company expects that sales will fall fractionally, not even by half a percent, in the new year. So home sales should remain relatively stable.

Housing prices

Home prices are a different story. House prices for Boston are expected to rebound and rise by 9.5% in 2023 vs. 2022 levels, also according to Realtor.com.

Price Negotiations

According to real estate agent Livia Monteforte with Compass Real Estate, price negotiations are returning to Boston’s real estate market, which bodes well for buyers in 2023. By the same token, Monteforte says that “irrational” bargaining tactics in the local market are fading.

Should You Invest Now?

Based on the latest Boston real estate forecasts, home prices are likely to increase in the new year while sales should stay almost flat. As a result, you might want to jump in now while housing prices are generally lower.

Once the economy begins to show signs of recovery, and the Fed has taken its foot off the interest rate gas pedal, demand is likely to return, which would probably send home prices in one direction — higher. If the Fed decides to remain on its interest rate increase trajectory, then you might want to lock in your rate sooner than later in case they go higher.

While there are Boston housing market predictions available, there is no telling with 100% certainty the condition of the market one year from now.

Total Mortgage is Ready to Help

If you are in the market for a new house in the Boston area, Total Mortgage has offices and loan experts available to help you navigate the unique Boston housing market.

Our mortgage bankers can help find the loan that is best suited to your needs. Find a mortgage expert in your neck of the woods today and move closer to your goal of home ownership in the Boston housing market.

lessHow to Remove FHA Mortgage Insurance - Total Mortgage

How Are Interest Rates Determined and How Do They Work? - Total Mortgage

Interest rates are a critical factor in determining the cost of a mortgage and play a significant role in the housing market. They are determined by various factors, including monetary policy set by the Federal Reserve, demand for mortgage-backed securities on the bond market, and the creditworthiness of the borrower.

The Federal Reserve, through its monetary policy, sets the discount rate, which is the short-term interest rate at which banks can borrow money from the Federal Reserve. When the Fed raises

... moreInterest rates are a critical factor in determining the cost of a mortgage and play a significant role in the housing market. They are determined by various factors, including monetary policy set by the Federal Reserve, demand for mortgage-backed securities on the bond market, and the creditworthiness of the borrower.

The Federal Reserve, through its monetary policy, sets the discount rate, which is the short-term interest rate at which banks can borrow money from the Federal Reserve. When the Fed raises rates, the cost of borrowing money increases, and this can affect mortgage interest rates. For example, the Federal Reserve adjusted its monetary policy and set interest rates near 0% in response to the pandemic in March 2020. These were the rates at which banks could borrow money to lend to consumers. Mortgage rates are not directly tied to the Fed's rates, but the prime rate for mortgages will typically follow the Fed's actions.

The bond market also plays a role in determining mortgage interest rates. Mortgage-backed securities, also known as mortgage bonds, are sold on the bond market, and the demand for these securities can affect mortgage rates. When bond rates rise, mortgage rates tend to fall, and vice versa. The bond market affects mortgage rates because they attract the same type of investors—those looking for a fixed and stable return with less risk. Mortgage rates are usually lower than certain types of revolving credit but are higher than the prime rate.

Lenders also evaluate the creditworthiness of borrowers when determining interest rates. Factors such as credit score, loan-to-value ratio, loan term, interest rate type, and loan type can all affect the interest rate offered to a borrower. Borrowers with lower credit scores and higher loan-to-value ratios, for example, may be considered a higher risk and may be offered a higher interest rate.

Finally, broader economic factors such as inflation and the overall state of the economy can also affect interest rates. During periods of economic growth, high inflation, and low unemployment, interest rates tend to rise, while during an economic slowdown, lower inflation, and higher unemployment rates, rates tend to decline.

It's also worth mentioning that interest rates can be affected by the lender's policies and practices.

Here are a few examples of how interest rates can be affected by various factors:

A borrower with a credit score of 700 may be offered a lower interest rate than a borrower with a credit score of 600. This is because lenders consider borrowers with higher credit scores to be less risky and more likely to make on-time payments.

A borrower looking to purchase a home with a loan-to-value ratio of 80% may be offered a lower interest rate than a borrower with a loan-to-value ratio of 90%. This is because borrowers with a lower loan-to-value ratio are considered to be less risky, as they have more equity in the home.

A borrower choosing a 15-year fixed-rate mortgage may be offered a lower interest rate than a borrower choosing a 30-year fixed-rate mortgage. This is because shorter-term loans generally have lower interest rates and lower overall costs.

A borrower applying for a conventional loan may be offered a different interest rate than a borrower applying for a government-backed loan such as an FHA loan or a VA loan. This is because rates can vary significantly by the type of loan product and have distinct eligibility requirements.

During a period of high inflation and economic growth, interest rates may be higher compared to a period of low inflation and economic downturn.

Also, some lenders may offer lower interest rates than others, depending on their policies and practices. It's recommended to shop around and compare rates from different lenders to find the best option.

Here are a few recommendations for consumers looking to get the best mortgage interest rate:

- Improve your credit score: A higher credit score can help you qualify for a lower interest rate. Take steps to improve your credit score by paying off outstanding debts, disputing any errors on your credit report, and avoiding applying for new credit in the months leading up to your mortgage application.

- Make a larger down payment: A larger down payment can lower your loan-to-value ratio and make you a more attractive borrower to lenders, which can result in a lower interest rate.

- Consider a shorter loan term: Shorter-term loans, such as a 15-year fixed-rate mortgage, generally have lower interest rates than longer-term loans like a 30-year fixed-rate mortgage.

- Compare rates from multiple lenders: Interest rates can vary significantly from lender to lender, so it's important to shop around and compare rates from multiple lenders to find the best option.

- Choose a fixed-rate mortgage: Fixed-rate mortgages generally have lower interest rates than adjustable-rate mortgages, which can be subject to rate increases.

- Understand the different types of loans: Rates can vary significantly by the type of loan product you choose. Conventional loans, non-conforming loans, and government-backed loans are all different and have distinct eligibility requirements. It’s important to understand the pros and cons of each loan type and compare them before making a decision.

- Be mindful of the overall economic situation: Interest rates are affected by the overall economic situation and the Federal Reserve monetary policy. It's advisable to follow the interest rate trends and the economic news.

Keep in mind that these recommendations are general and may not apply to every individual. It's important to consult with a financial advisor or a mortgage professional to understand the specific requirements and options available for you.

lessHELOC on Rental Property: Home Equity Line of Credit Explained - Total Mortgage

If you are fortunate enough to own an investment property, you probably know something about generating additional income streams. You’ve heard about getting a home equity line of credit on your primary residence – but what about a rental?

If you are looking for more ways to access capital, you may be wondering if you can get a home equity line of credit, or HELOC, on a rental property. The answer is yes, though there may be some hoops you’ll need to jump through. If you’ve got adequate equity

... moreIf you are fortunate enough to own an investment property, you probably know something about generating additional income streams. You’ve heard about getting a home equity line of credit on your primary residence – but what about a rental?

If you are looking for more ways to access capital, you may be wondering if you can get a home equity line of credit, or HELOC, on a rental property. The answer is yes, though there may be some hoops you’ll need to jump through. If you’ve got adequate equity in your investment property that you’re looking to capitalize on, keep reading to learn more about how to get a HELOC on a rental property.

What is a HELOC?

A HELOC, or home equity line of credit, is a loan that uses the equity you’ve built up in your home as collateral. According to BankRate, you can expect to borrow as much as 85 percent of the value of your home after deducting any remaining mortgage balance.

You draw on the capital as you need it up to a certain amount, similar to a credit card, and therefore only use what you need. There is a draw period during which the borrower can access capital and repay it to the lender, plus interest, allowing the credit line to be replenished.

Interest rates on HELOC loans can be variable in nature. Therefore, monthly payments will fluctuate based on the economy’s prime rate and the size of the home equity line of credit. However, some lenders may offer fixed-rate options on a HELOC.

One such feature is to convert a portion of the credit line into a home equity loan, allowing the borrower to repay the funds over the original HELOC term. Locking in the rate is advised, when possible, in a rising rate environment.

HELOC products are applicable for both primary residences and investment properties, though they are more common for the main home. However, that doesn’t mean you can’t get a HELOC on a rental property. The property serves as collateral on a HELOC, and if payments are missed, the borrower is at risk of defaulting on the loan and losing their home.

Can You Take Out a HELOC on a Rental Property?

The short answer is yes – you can take out a HELOC on a rental property. However, you must have enough equity built up in the home to do so. Use the funds to make upgrades or repairs on the property to continue optimizing your rental income.

Like any loan, you’ll need to qualify for a HELOC on a rental property. You may find that the lending standards for a HELOC on a rental property are higher than those associated with the primary residence. More factors come into play, such as the payment history of the renter on the investment property. HELOCs for rentals are also not as popular as their counterparts, and lenders can be harder to come by.

If you are in a position where you could benefit from a HELOC on a rental property, let us know. Total Mortgage has loan experts standing by at locations across the country to get started on your application today and bring you one step closer to your goal.

How to Get a HELOC on Rental Properties

Before you pursue a HELOC on a rental property, you should take some steps of preparation that will save you time in the long run. These include:

Total Mortgage’s loan experts can advise you on the specific criteria you will need to increase your chances of approval for a rental property HELOC.

Pros and Cons of taking a HELOC on rental property

There are multiple advantages tied to taking out a HELOC on a rental property, including:

Taking out a HELOC on a rental property also has a few disadvantages you might want to be aware of, including:

Explore Loan Options from Total Mortgage

Having a HELOC on a rental property gives the homeowner options to invest in the investment home that might not otherwise be available, thanks to the sum of cash at their disposal. Don’t wait too long until you know you can get a HELOC on a rental property.

When it comes to real estate, there is no time like the present, and Total Mortgage has offices located across the US to ensure you won’t miss a beat. Reach out to one of our loan experts today so you can move forward with a HELOC on a rental property.

lessHome Inspection vs. Appraisal: The Big Differences to Know - Total Mortgage

The Complete Guide to Selling a House to a Family Member | Total Mortgage

They say not to mix family and money.

Sometimes, though, the stars line up perfectly and selling your house to a family member just makes the right kind of sense. Maybe it’s an old home that has sentimental value, or maybe you just want to give a leg up to a younger relative.

Regardless, having a buyer for your house already lined up keeps your home off Zillow and puts you in a great position.

1. Agree on a price, but stay flexible

In a standard real estate transaction, the

... moreThey say not to mix family and money.

Sometimes, though, the stars line up perfectly and selling your house to a family member just makes the right kind of sense. Maybe it’s an old home that has sentimental value, or maybe you just want to give a leg up to a younger relative.

Regardless, having a buyer for your house already lined up keeps your home off Zillow and puts you in a great position.

1. Agree on a price, but stay flexible

In a standard real estate transaction, the buyer and seller are on opposing teams. They both want to come out on top—or at least with most of their demands met. When your buyer is a friend or family member, though, you don’t have the luxury of thinking like that.

If both parties value the relationship, it’s a smart idea to get everything in writing and have both an inspection and an appraisal done fairly early into the process, preferably as soon as the buyer gets pre-approved by their lender and knows their spending limit.

An inspection protects the buyer from ending up with a lemon. It’s generally one of several contingencies put in place with the initial sale contract, but when the seller and buyer are friendly, it’s an easy thing to skip, potentially at the cost of hurt feelings.

An appraisal, meanwhile, will be required by the buyer’s lender to make sure the home is worth more than the loan amount. Sometimes, the numbers come in higher or lower than expected, especially if a realtor with knowledge of the market wasn’t involved in the pricing, as is common with sales to relatives.

Though the result doesn’t always have an impact on the sale, it would be wise for both parties to be flexible once the results come in. Otherwise, things may get tense.

2. Selling your home to family below market value can get tricky

In some situations, the seller might want this transaction to look less like a sale and more like a gift. This can be more complicated than it seems, though.

Sell the home more than 25% below market value, and it’s likely the buyer will get hit with a gift tax courtesy of Uncle Sam. There are a few alternative options, though:

3. Stay on the IRS’ good side

The IRS likes to keep a close eye on transactions that take place between relatives, and for good reason. When the buyer and the seller are on the same side, it’s a lot more likely for funny business to go down. That funny business often takes the shape of fake tax deductible losses or fake short sales.

As far as the IRS is concerned, you can sell your property at a loss to a family member all you want, but you can’t take a deduction on the loss, and you can’t sell the property for less than you owe to the bank.

For some helpful examples, this is a good resource.

4. Swap your realtor for a lawyer

While you can probably skip the realtor, a qualified real estate attorney is going to be your best friend if you’re planning on selling a house to a family member. A lawyer will be able to fill in the gaps in the process that a realtor would generally have helped fill for you, like getting the right paperwork and lining up the title search and transfer.

They’ll also have a much clearer idea of your options and be able to make recommendations with your goals in mind.

lessCan You Get A Mortgage Without A Job? 6 Tips To Get Approved | Total Mortgage

There’s no arguing that having a job means you’re more likely to get approved for a mortgage. However, getting a mortgage without a job isn’t impossible, so if you’re gainfully unemployed and on the hunt for a house, check out these tips below.

1. Check the requirements

Every lender is different, so make sure you reach out and see what your lender’s specific requirements are.

Remember that lenders might have different requirements, but they all share one thing

... moreThere’s no arguing that having a job means you’re more likely to get approved for a mortgage. However, getting a mortgage without a job isn’t impossible, so if you’re gainfully unemployed and on the hunt for a house, check out these tips below.

1. Check the requirements

Every lender is different, so make sure you reach out and see what your lender’s specific requirements are.

Remember that lenders might have different requirements, but they all share one thing in common—you have to have a reliable source of income. So if you’ve been making any sort of money from side projects, now would be a good time to share that fact.

2. Reserve funds

If you have fat stacks of cash lying around, snap a few selfies and send it over to the lenders to prove you can pay your mortgage in the time remaining until you find a job. You can also use non-photo documentation (e.g. bank statements) to prove your worth.

3. Non-revocable employment contract

If you have a job lined up, you can ask your employer for a non-revocable employment contract, which guarantees employment for a specified amount of time. But be warned, these contracts rarely apply to those who aren’t pilots, doctors, or teachers.

4. Relocating

If you have to make a big move for your next job, it’s possible your lender will understand the situation and approve your loan. In other words, start looking for a job far, far away.

5. Ask for help

While the other options are doable by yourself, this strategy requires another person. It’s fairly simple: if you can’t pay now, have someone you know help you out. They can either co-sign the mortgage, or they could just lend you some cash. Just be careful who you ask, because they might show up at your doorstep ten years later like you owe them something.

Other Resources

Does Mortgage Pre-Approval Affect Credit Score? Here’s What You Need to Know - Total Mortgage

When you’re searching for your new home, a mortgage pre-approval will not only tell you what you can afford but can also help you stand out as a serious buyer. However, you’ll want to protect your credit score while you’re shopping for the best rate.

So, does a mortgage pre-approval affect credit score? Here’s how getting pre-approved impacts your credit score and how to shop for a mortgage without damaging your credit.

What Does It Mean to Get Pre-Approved for a Mortgage?

A

... moreWhen you’re searching for your new home, a mortgage pre-approval will not only tell you what you can afford but can also help you stand out as a serious buyer. However, you’ll want to protect your credit score while you’re shopping for the best rate.

So, does a mortgage pre-approval affect credit score? Here’s how getting pre-approved impacts your credit score and how to shop for a mortgage without damaging your credit.

What Does It Mean to Get Pre-Approved for a Mortgage?

A mortgage pre-approval is a letter from the lender saying that you are generally qualified for a mortgage loan. The lender will evaluate your income, debt, assets, and credit history and determine what interest rate you qualify for and how much money you can borrow based on the loan program you’re applying for.

Although a mortgage pre-approval doesn’t guarantee a loan offer, including a pre-approval letter with your offer does make your bid stronger. It shows the seller that you are a serious buyer and that you have good enough credit to qualify for a home loan.

How Does a Mortgage Pre-Approval Affect Credit Score?

By getting pre-approved for a mortgage, you’re authorizing the lender to pull your credit report from the three main credit bureaus — Experian, TransUnion, and Equifax. When a lender requests to review your credit report, it’s recorded as a hard inquiry.

Hard inquiries will temporarily affect your credit score and will stay on your credit report for about two years. Inquiries tell lenders how frequently you apply for credit.

Credit inquiries have a small impact on your credit score. While the impact will vary from person to person based on credit history, one inquiry will lower your score by up to five points, according to FICO. Inquiries play a minor role in assessing risk and only account for 10% of your FICO credit score.

Mortgage shopping is generally seen as a positive financial move by credit scoring models, and multiple credit checks from mortgage lenders within a 14 to 45-day window will only be recorded as a single inquiry. This allows buyers to shop around and get mortgage pre-approval from several lenders without their credit score taking a significant hit.

There are also soft inquiries, but these generally occur when a lender provides a rate quote or when you view your own credit report. Soft inquiries don’t impact your credit score.

Find out if you qualify for a mortgage with Total Mortgage. We have branches across the US where you can talk to our mortgage advisors. Find a Total Mortgage branch near you.

Does Getting Prequalified Hurt Your Credit?

A mortgage prequalification is an estimate of what you may be able to borrow on a mortgage using basic financial information. Prequalifications are considered to be less reliable than a mortgage pre-approval because the information is typically not verified.

Prequalifications usually rely on self-reported information or the lender may do a soft pull on your credit report. If there’s no hard inquiry, then getting prequalified won’t hurt your credit.

Does Applying for a Mortgage Hurt Your Credit Score?

Similar to a mortgage pre-approval, applying for a mortgage involves a hard inquiry on your credit report, which could lower your credit score by a few points. If you fill out multiple mortgage applications within the 14 to 45-day shopping window, then it will only count as a single inquiry.

The mortgage shopping window only applies to credit checks from mortgage lenders or brokers’ credit cards, according to the Consumer Financial Protection Bureau, and other inquiries will show separately on your credit report.

After you close on a new mortgage, your credit score may go down again temporarily. Because of this, it may be difficult to get other loans or with the terms you prefer. You may have to wait several months before applying for a larger loan.

On the other hand, a mortgage can also help build your credit over the long run if you make timely payments.

How to Shop for a Mortgage Without Hurting Your Credit?

You can still shop around for the best rate without hurting your credit if you use the right strategy. Here are some times on how to shop for a mortgage without hurting your credit.

Apply for a Mortgage Today with Total Mortgage

Does mortgage pre-approval affect credit score? Yes, but not by much and only for a short period of time. Plus, if you apply for a mortgage within the mortgage shopping window, it will only count as a single inquiry on your credit report.

If you’re looking to buy a home, you can get a free rate quote and apply online with Total Mortgage. Schedule a meeting with one of our mortgage experts to learn more about your options.

less