Spark Rental

Capital Gains Tax on Real Estate – And How to Avoid It

18 Housing Alternatives & Green Housing Ideas to Save Money & Travel

You’re not alone. From the rise of tiny homes to the spiking interest in green housing ideas, people from all walks of life are rebelling against skyrocketing traditional home prices.

And it’s not just about money, either. With more Americans than ever working remotely, there’s less reason than ever to chain yourself to one location.

18 Alternative Housing Options

A decade ago, green homes were rare, as were tiny homes, accessory dwelling units, and smart home technologies

... moreYou’re not alone. From the rise of tiny homes to the spiking interest in green housing ideas, people from all walks of life are rebelling against skyrocketing traditional home prices.

And it’s not just about money, either. With more Americans than ever working remotely, there’s less reason than ever to chain yourself to one location.

18 Alternative Housing Options

A decade ago, green homes were rare, as were tiny homes, accessory dwelling units, and smart home technologies that reduced energy usage.

Today they’re everywhere.

Whether you’re looking to save money, embrace a more eco-friendly or nomadic lifestyle, or just beat your own drum a little differently, scope out these ideas to get you excited about alternative housing.

1. House Hack with an ADU

Who wouldn’t want to live for free?

The idea is simple: you buy a home and find ways to have someone else pay the mortgage. The classic model is buying a small multifamily, and renting out the neighboring unit(s). Sharing walls with other housing units is inherently more eco-friendly than detached single-family homes, both in the use of building materials and energy efficiency. Here’s a detailed house hacking case study on how a 27-year-old with no real estate experience house hacked and currently lives for free in a beautiful suburban home.

If you don’t love the idea of living in a multi-unit building, or if multifamily properties are scarce where you want to live, you can house hack with an accessory dwelling unit (ADU). That could mean a basement or garage apartment, or a standalone structure like a carriage house or tiny home on your property. You can continue living in the main house if you like, or move into the ADU and rent out the main house. Not only would you collect more rent, but it will help you live more simply, and with a smaller environmental footprint.

Alternatively, you could rent out bedrooms to housemates in a single-family home. Deni and I have both done this, and it worked out beautifully.

In fact, Deni even house hacked her suburban single-family home by bringing in a foreign exchange student, and the placement service covered half her housing costs! A little creativity can go a long way, both with alternative housing and clever ways to cover your traditional house costs.

Compare mortgage terms on Credible, and keep in mind you can use the rents from neighboring units to help you qualify for the loan.

2. Tiny House in Tow

By now, everyone’s familiar with the tiny house movement. But tiny homes are good for more than just adding an ADU to your backyard. You can also use them to travel comfortably and even live nomadically, hitching up a tiny house to the back of your car or truck.

First, you don’t need a dedicated RV — you can keep your own car or truck, assuming it has enough power to pull a hitch. Which, let’s be honest, is usually much cheaper than buying an RV for your alternative housing.

Second, you don’t necessarily need to stay at RV parks for power and water. Many tiny homes have their own solar roofs, with rainwater reclamation and filtration systems for the ultimate green housing solution.

Beyond the warm-and-fuzzies of green housing, tiny homes with solar power and rainwater reclamation systems also help you stay self-sufficient. That means you can pull up just about anywhere you like, and settle in for as long as you like. Assuming the law doesn’t come shaking its stick at you.

Who needs a mortgage, anyway? Throw down $10,000-50,000 and go forth into the world!

3. RV Living

When you think of an RV, what do you picture? If you think of those rickety beige trailer-buses from the ‘70s, think again.

Today’s RVs often share more in common with luxury homes than trailers. Many include enormous “slides” — rooms that slide out of the main section to create a multi-room home when parked. From jacuzzi tubs, queen-sized beds, fully-equipped kitchens and comfortable bathrooms to any other amenity you could ask for, RV living is whatever you want it to be.

Or you could keep it simple with a classic camper van. Your choice.

Whether you earn $1,000/month or $10,000/month, consider a fun and mobile RV lifestyle at whatever luxury level you can afford. It sure beats overpaying for a dingy apartment!

My father-in-law doesn’t live full-time in his RV, but he and his wife take off for months at a time. They stay as long as they like at a given RV park, then move on. This is alternative housing at its finest.

On the other end of the spectrum, Paul and Nina live a frugal-but-fun and rewarding full-time life in their RV on a modest budget. They prove you don’t need much money for a fun nomadic life, and can take advantage of the many cheap unconventional housing alternatives out there. Your only limits are your own creativity.

4. Stay at a Campground

Many campgrounds offer RV parking, water, sewer, and electricity. In fact, I’m told that some campgrounds fill up for the year within minutes of opening reservations.

But you don’t have to have an RV to spend a month or two (or longer!) living at a campground. When I was younger, I used to stay at Cape Henlopen State Park’s campground, nestled between Lewes and Rehoboth Beach in Delaware. They had full bathrooms with showers, and fresh water pumps. My friends and I would spend all day on the beach, then shower and go out to restaurants and bars at night.

I never stayed longer than a week, but a determined camper could push those boundaries if they had a few solar chargers. As green housing ideas go, it doesn’t get much more eco-friendly than that.

Or much more affordable, for that matter.

5. Live on a Boat

Who says you have to live on land?

My sister Lauren dated a guy who wanted to live closer to her, so he bought a used houseboat for around $40,000 and rented a slip a few blocks down the waterfront Promenade in Baltimore’s Fells Point. It had two bedrooms, full electricity, a 46-inch LED television, heat, running water, and of course a motor.

I always thought they should have toodled down the coast, parking the house boat in the Florida Keys or somewhere equally enticing. They didn’t, alas. But I love how this other couple sold their home, bought a multifamily rental to become landlords, then bought a houseboat and are currently sailing around Europe. All with far lower living expenses than back home in the US.

If you’re interested, my fellow personal finance blogger My Money Wizard breaks down all the advantages to a houseboat, from cost to mobility to an upgrade in scenery and view.

Nor is a houseboat the only boat-based alternative to buying a house. Why not sail around the world with your spouse, significant other, or just a (really) good friend? Check out Kristin Hanes’s experience at The Wayward Home to see what it’s like to live full-time on a sailboat.

And ditch your assumptions about costs. Boats can offer extremely affordable housing with low energy costs, your own built-in outdoor space, and plenty of mobility.

Who needs a mortgage, anyway? Throw down $10,000-50,000 and go forth into the world!

(article continues below)

Free Masterclass: No Repairs or Renters — Earn 15-50% on Passive Real Estate Syndications

6. Prefab Cabins

Own some land? Pick up a prefab cabin!

Even better, build your own cabin using a cabin kit. My father and uncle did this — they bought a 10-acre lot near the Madison River in Montana, bought a three-bedroom log cabin kit, and spent a few summers building it.

It’s gorgeous, boasting solar panels for electricity, a rainwater reclamation system for running water, and a propane-powered on-the-fly hot water heater.

For heat, a pellet stove or wood-burning stove works wonders, and are cheap to buy and install.

Prefab cabins offer affordable, self-sufficient green housing options with low environmental impact.

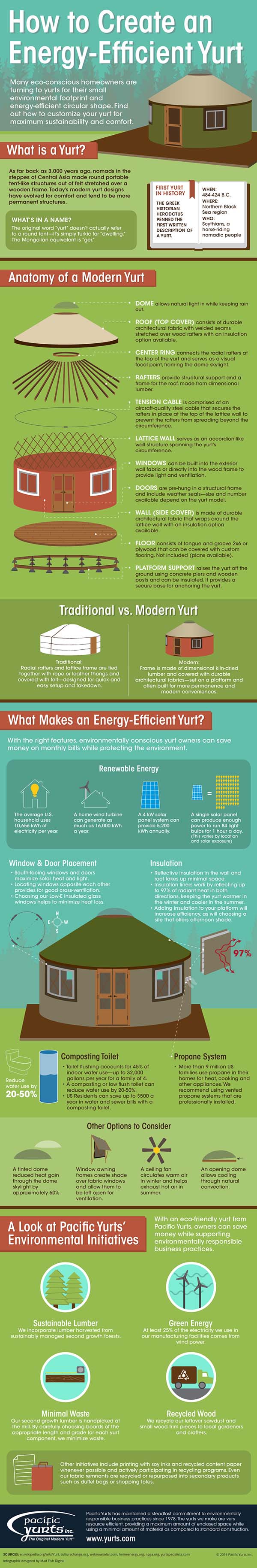

7. Yurts

Yurts originated with the nomadic tribes of Central Asia, as round, dome-like tents. Today, people often use them for “glamping,” and they run the gamut from spare and easy to move to luxurious and semi-permanent.

You can buy comfortable, high-end yurt kits online for between $5,000 – $10,000, with the glaring addendum that “some assembly is required.” Note that yurts tend not to have electrical wiring or plumbing, so people typically use composting toilets with them.

Consider erecting a yurt on your property to rent on Airbnb for vacationers looking for a unique glamping experience. You could also build a yurt on land that you own, whether to rent to campers or to use yourself.

Or, if you’re feeling adventurous, you could try moving around with a yurt that’s easy to set up and collapse.

8. Housesit

Not everyone without a permanent address is homeless. Why not go live in other people’s homes?

Want to stay for free in others’ homes? Offer to housesit! For free matchmaking services for pet owners and house sitters, check out TrustedHousesitters.com, Rover.com, or HouseSittersAmerica.com. In most cases, you do have to care for other people’s pets while they’re away. But that’s a small price to pay for free rent at upscale homes.

Additional options include Craigslist, local pet owners’ groups on Facebook, and local Realtors.

While some people use housesitting to score free accommodations while traveling, others actually live as full-time nomads housesitting for other people. Check out Brittnay and Jayden’s blog about housesitting full-time for a fun example.

9. Home Swaps

When you travel, your house sits vacant and unused.

But just as you need a place to stay when you visit another city, other vacationers need a place to stay when they visit your city. Housing swap websites offer a network of people who make their homes available while they aren’t using them, so you can stay at other people’s vacant homes and they can stay at yours.

In the classic housing swap, you and someone else literally swap homes for a week or however long you like. But that’s hard to arrange, finding someone in the exact place you want to go who also wants to visit your city — on the exact same dates.

So websites like HomeExchange.com let you accrue Guest Points as a house swap currency. When people stay at your home, they pay you in Guest Points. When you stay in other people’s homes, you pay them with Guest Points.

Think of it like Airbnb, but instead of paying with money, you barter home stays.

For nomads looking to spend much of the year traveling, you can theoretically stay for free indefinitely at unique homes around the world, for endless alternative housing options.

10. Airbnb & Geoarbitrage

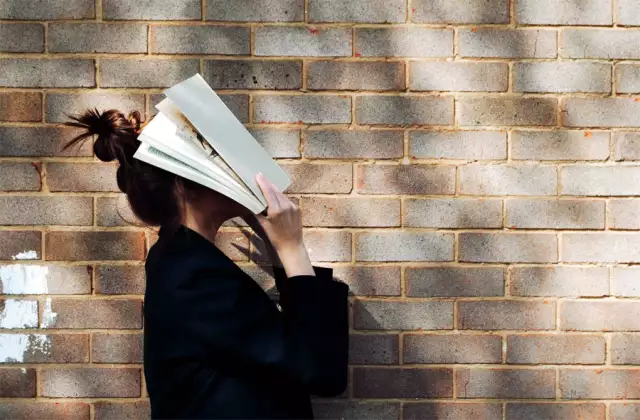

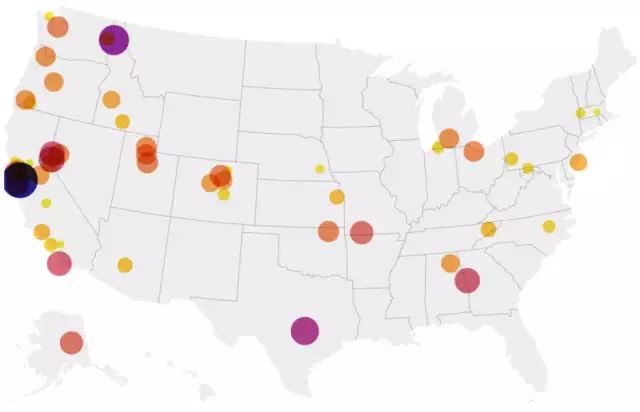

If you hadn’t noticed, the cost of real estate isn’t exactly the same everywhere.

The cost per square foot of housing space in San Francisco is around $1,100(!). In Buenos Aires, the cost per square foot is around $167.

You can live like a king on a modest income in some parts of the world, or live like a pauper on a high income in others. So stop thinking so linearly about where you live, and start exploring parts of the world you never considered before. Research places with a high quality of life at a low cost of living.

Having traveled all over this planet, a few that come to mind for me include:

Go stay for a month at an Airbnb or VRBO vacation rental. If you like it, consider moving there permanently.

11. Teach Abroad & Live for Free

My wife Katie is a school counselor, who spent the first four years of her career in Maryland. Then she took a job at an American school in Abu Dhabi, where we thought we would spend two years as a fun adventure before moving back to the US.

That was eight years ago. We still live abroad, currently in Brazil.

International educators get not just a comparable (or higher) salary than in the US, but they often get free furnished upscale housing, full comprehensive health insurance, and paid flights home to the US each year.

Couple that with the fact schools typically put you up near campus, so you may not need a car. Katie and I shared one car for the four years we lived in Abu Dhabi, and didn’t bother getting a car at all in Brazil.

That means that three of the largest expenses for most households — housing, transportation, and health insurance — are completely removed from our budget. We can save and invest all of the money we would otherwise have spent on them.

Here’s the island where we lived for free in Abu Dhabi:

12. Shipping Container Homes

Once considered a novelty, shipping container homes have come a long way.

Think of shipping containers as lego building blocks, that architects and home designers can mix and match any way they like. You can create a home that shows off its roots, or a home that you can’t tell was constructed from old shipping containers.

Not only are these homes more affordable to construct, but they’re also incredibly durable. And that says nothing of the environmental impact of recycling old shipping containers to build sturdy, beautiful homes rather than cutting down trees to do it.

(article continues below)

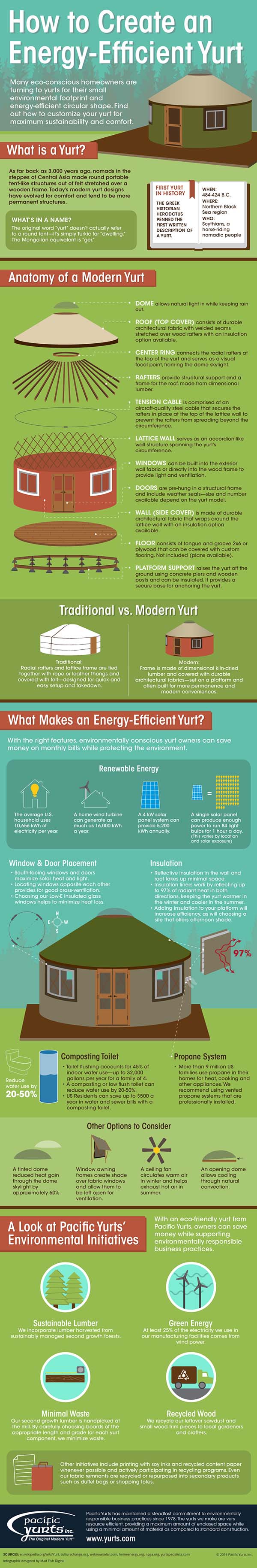

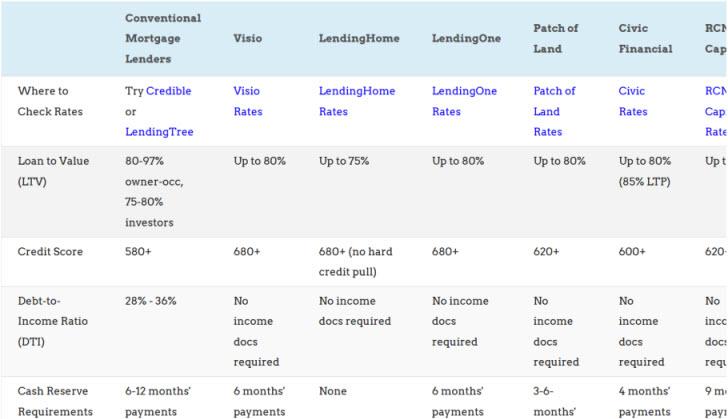

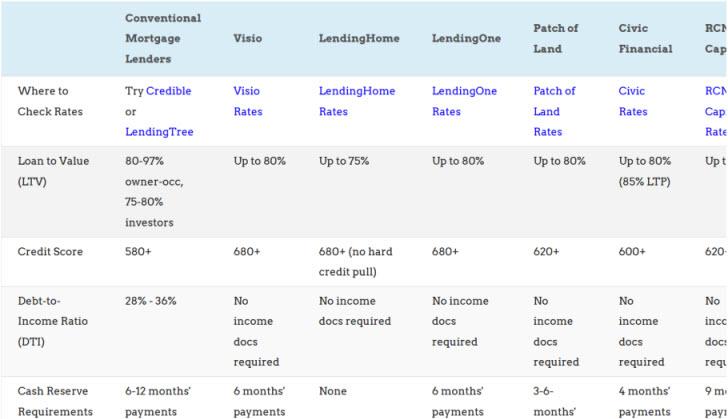

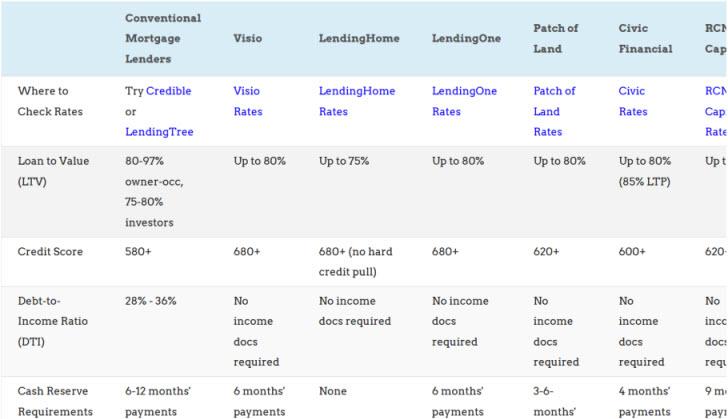

Want to compare investment property loans?

What do lenders charge for a rental property mortgage? What credit scores and down payments do they require?

What do lenders charge for a rental property mortgage? What credit scores and down payments do they require?

How about fix-and-flip loans?

We compare the best purchase-rehab lenders and long-term landlord loans on LTV, interest rates, closing costs, income requirements and more.

13. Boxcar Homes

The same principle applies with boxcar homes. But instead of using old shipping containers, builders recycle old train cars.

On the downside, boxcars don’t combine easily like shipping containers. That limits your options for building larger or complex homes.

But as a tiny house, boxcars offer plenty of character, with minimal cost to convert. And like shipping container homes, they reuse existing structures to create a new home, rather than having to use new materials.

Since they once served as a mode of transportation, many boxcar homes lend themselves to towing behind a truck as well.

Here’s an example of what they can look like as homes:

(image courtesy of Goods Home Design)

14. Pallet Homes

Many people and companies consider wooden pallets to be commercial waste. They literally just throw them away.

But it’s useful wood, already constructed into building blocks. That means you can get the framing for free, to construct a modest DIY house out of recycled materials.

Again, it offers an eco-friendly alternative source of building materials, using existing wood for framing. Just beware that these homes may not be sturdy enough to withstand extreme weather, if you live along the path of frequent hurricanes, tornadoes, or earthquakes.

(image courtesy of 99 Pallets)

15. Silo Homes

What happens to the silos when a farm closes down?

In a perfect world, they become the structure for a home.

Or part of a home, if you prefer. You can incorporate a silo as simply one architectural element in a more traditional home, to give it some unique personality and flair.

You can often pick up old silos for free, or rather for the cost of hauling them away. And once more, you get to reuse existing building materials.

If you like the idea of rustic charm for a do-it-yourself homebuilding project, look into converting a silo into a home.

(image courtesy of Decoist)

16. Earth Berms/Hobbit Holes

We all fell in love with Bilbo Baggins’ hobbit hole in The Lord of the Rings. But I didn’t realize people actually built and lived in these until I saw a Welsh guy and his father-in-law build one in the late 2000s.

They dug and built the hobbit hole house in four months with no heavy construction equipment, and created a gorgeous, infinitely livable home. And they used nothing but locally available building materials, such as stone from the dig-out, tree branches, and lime plaster. Straw bales provided breathable flooring and wall insulation, and of course all hobbit holes have a green roof.

See the details of how they built this eco-friendly hobbit hole here.

You can also buy prefabricated shells to embed in hillsides as earth shelter homes. That spares you having to frame out the walls and roof, and offers more moisture protection, but comes with higher costs. Learn more at providers like Green Magic Homes.

As green housing ideas go, hobbit holes offer built-in insulation for energy efficiency. They stay cool in the summer, and if you get chilly in the winter, a fireplace, wood-burning stove, or pellet stove can heat the entire house.

17. Cob Houses

As an alternative to modern building materials, you can go old school with cob houses.

Cob or cobb is a type of earth masonry, made with subsoil such as clay, fibrous organic material, and sometimes lime. Made properly, it’s as strong as concrete, but more attractive, temperature regulating, and environmentally friendly.

You can build charming cottages that look like they stepped out of a fairy tale with cob. Check out a few examples to see what I mean:

Image: Thannal

Image: Michael Buck

18. Treehouses

What kid doesn’t want to live in a treehouse?

If your inner child never quite let go of that dream, consider building a habitable treehouse. Treehouses come with some challenges, since you’re building the structure around a living organism that constantly grows, moves, and changes.

But you win infinite style points for a proper treehouse.

As a variation on treehouses, you can also install a free spirit sphere in a large tree. It hangs suspended — securely — from the tree.

Final Thoughts

As someone who hasn’t paid full price for housing since 2011, I’m all about alternative housing ideas.

That could mean more travel-oriented housing alternatives such as RVs, houseboats, housesitting, or housing swaps. Other people get more excited about green housing ideas such as earth berms, cob houses, silo homes, shipping container homes. And some combine travel with green housing options like tiny homes that you can take anywhere.

Many of these green housing alternatives are also self-sufficient. Eco-friendly homes often include rainwater reclamation systems for water, small Energy Star appliances, and solar panels or green roofs.

Bear in mind that many parts of the world use housing with a far lower energy consumption than the US. My apartment in Brazil uses an electric tankless water heater for the showerhead, and requires no central heating or air conditioning because the climate is mild year-round. Our home has almost no carbon footprint.

Think outside the box when you explore sustainable homes. You can find cheap alternative housing ideas in other countries that offer green home designs at a fraction of the cost of similar homes in the US.

What alternatives to buying a house have you considered (or done)? Share your experiences and thoughts on alternative housing in the comments below, we love hearing from readers, and are always looking for case studies to feature!

More Unconventional Reads:

How to Invest $1,000 in Real Estate

How to Find Good Deals on Investment Properties – Even in a Hot Market

About the Author

G. Brian Davis is a landlord, real estate investor, and co-founder of SparkRental. His mission: to help 5,000 people reach financial independence by replacing their 9-5 jobs with rental income. If you want to be one of them, join Brian, Deni, and guest Scott Hoefler for a free masterclass on how Scott ditched his day job in under five years.

I want to know more about…

Connect with us on social!

less

Ep. #113: 12 Invisible Expenses That Cost You $12K A Year

Looking for easy ways to save more money?

Start by cutting these 12 expenses that can save you more than $12,000 per year, without ruining your quality of life.

Video Broadcast Version

Audio Podcast Version

Also available on iTunes, Stitcher, and wherever else you listen 🙂

Want to compare investment property loans?

Looking for easy ways to save more money?

Start by cutting these 12 expenses that can save you more than $12,000 per year, without ruining your quality of life.

Video Broadcast Version

Audio Podcast Version

Also available on iTunes, Stitcher, and wherever else you listen 🙂

Want to compare investment property loans?

What short-term fix-and-flip loan options are available nowadays?

What short-term fix-and-flip loan options are available nowadays?

How about long-term rental property loans?

We compare several buy-and-rehab lenders and several long-term landlord loans on LTV, interest rates, closing costs, income requirements and more.

Deni: How is everybody doing? Welcome to Spark Rental podcast. Facebook Live Stream.

Brian: Youtube stream.

Deni: Right. All of the above.

Brian: Today we are talking about 12, quote, invisible costs to cut for $12,000 a year in annual savings. These are things that do not ruin your quality of life. Easy things you can cut, easy expenses to cut. If you’re looking for ways to save more money without eating ramen noodles every night for the next month.

Deni: I used to do that with my kids.

Brian: I did, too. I mean, you know, that’s called college, right? I mean, that’s just what you do. But you probably don’t want to live like you’re in college when you’re an adult. So diving right in with something that is just super simple is stop buying bottled water. Bottled water is 2000 times more expensive per ounce than tap water is. So if you don’t like the taste of the water where you live, just get a filter. You can’t get a water filter. So the the water project dot org estimates that the average American spends $100 per year per person in the household on bottled water. But it could be way higher than that for you. It could be thousands of dollars per year if you or your family members drink nothing but bottled water. So this is a really simple one. Just get a water filter in your kitchen so that you don’t have to buy bottled water in areas where you don’t like the taste of the tap water.

Deni: And what is some others?

Brian: Well, in keeping in that same theme of beverages, sweetened beverages, which include sodas, sweetened teas, coffee beverages like packaged coffee drinks.

Deni: Oh, so pre-made.

Brian: Yeah. Beverages that come in a can or in a bottle that have sugar. Like soft drinks, basically. So, first of all, this statistic is a little bit outdated. This is from a few years ago now from the USDA. So they estimated that the average non snapping food stamps program, the federal food stamp program, the average non stamp household spends $ 2,239 per year on sweetened beverages. What’s really disturbing, though, is that SNAP recipients so food stamp recipients… Sweetened beverages actually made up the second largest grocery expense total on their average grocery spending bills after meat. That’s pretty scary! So it made up almost 10% of food stamp recipients. Grocery bills, the sweetened beverages. Sodas, basically. I mean, all of the rest of us are subsidizing billions of dollars to the soft drink industry every year, which I got to tell you as a taxpayer really pisses me off. Yeah. But sweetened beverages are also terrible for you. I mean, this is like the fast lane to diabetes. So save yourself thousands of dollars a year, avoid diabetes, stop drinking sweetened beverages, make tea at home.

Deni: Oh, and it’s so much better!

Brian: Yeah. Yeah, absolutely! My wife, Katie, and I, we just we keep a pitcher of green tea and the refrigerator. We throw a little bit of stevia in it when we make it, and we make iced tea with green tea. A little stevia that’s sugar free. It’s dirt cheap. It probably costs us a few cents per glass of tea. All right, enough proselytizing!

Brian: Number three: wasted food. The USDA estimates that 31% of the food that consumers buy goes to waste. 31%. That’s almost a third of the food that the average American household buys goes to waste. So with an average annual grocery bill of around $4,500, according to the BLS, that’s close to $1,500 a year in annual food waste per household.

Deni: That’s hard to hear. It’s like my father used to say at the table, Don’t waste your food. There’s a poor, starving child somewhere. And a smart butts, we would say name, name one. But there are. There are. And it’s sad to know that we have all that waste and that could be actually feeding somebody else.

Brian: Absolutely. All right! Number four: coffee shop coffee. So people love their lattes from Starbucks, but and they spend an absurd amount of money on them. So I was just looking at this earlier today. The the the average cost of a medium latte or cappuccino at Starbucks is close to $5. Now it’s $4.55.

Deni: For one coffee?

Brian: Yeah, one coffee. So if you have one of those every workday throughout the year, that comes out to almost 1200 dollars a year, it’s $183 a year. This is another easy one to fix. Make your own coffee at home and pay pennies per cup instead of almost $5 per cup on coffee.

Deni: That’s true.

Brian: All right. Number five: Cigarettes. Average cost of a pack of Cigarettes in the US is around $8 a pack. This varies wildly by state as different states put different taxes on tobacco, but it’s around $8 a pack. Nationwide average that comes to almost $3,000 per year for a pack a day smoker, it’s 20 $920 a year. So it’s like with the sodas, like you’re paying a fortune every year to give yourself cancer. This is totally irrational. Stop doing it. And this says nothing of the health care savings either, both on the health insurance premium side and on actual health care bills. And of course, your health, which is priceless.

Deni: Right.

Brian: Number six: happy hour drinks and happy hour snacks and bites. If you go out to happy hour once per week and if you spend $25, including drinks, bar food tax tip, that comes to 1300 dollars per year in happy hour drinks and snacks.

Brian: I get it. You want to meet up with people after work, try to find ways of doing that without going to a commercial establishment. Go have drinks at the office, have drinks at someone’s house, have drinks at the local park, go to the local boardwalk or beach or whatever and have some drinks there. Find ways of not spending money at commercial establishments for this stuff.

Brian: All right. Number seven: Cable TV. Average cost of a cable subscription, $106 a month. That comes out to $1,274 per year. Just get a streaming service for ten or 15 bucks a month.

Deni: Yeah, I mean, slowly but surely that’s being phased out as we move forward anyway.

Brian: Cut the cord. Cut the cord.

Brian: All right. Number eight: similar here. Landlines. Landline, home phone service, average annual cost of a landline. $353 a year may not sound like much, but I can think of things that I would rather do with that $353 every year.

Deni: Especially since it’s probably just sitting there now.

Brian: Yeah, we all have cell phones, right?

Brian: All right, number nine: unused gym memberships. Average monthly costs $60 per year. But here’s the thing. 67% of gym members, two thirds of gym members never actually go to the gym. I go to the gym. I love going to the gym

Deni: They join them in January.

Brian: Yeah. So we call them resolutions. You know, the first three weeks of the year, the gym just floods with people. And then by the end of January, they’re all gone. Like, Yeah. Resolutions. But yeah, look, if you use your gym membership, by all means, keep it! I pay for a gym membership and I use it several times a week. But there’s no reason to spend an average of $60 a month on a gym membership if you don’t actually go, That’s 70. I’m sorry, $720 a year wasted for a service that you don’t use.

Brian: Okay. Number ten, moving right along here, checking account fees like monthly maintenance fees on your checking accounts. These come an average of around $11 a month, $10.99 a month. But they can be as high as $35 a month. So that means you’re spending between $132 a year and or as much as $420 a year on something you can get for free. Tons of banks offer free checking accounts. There’s no reason to pay a monthly maintenance fee.

Brian: All right. I’ve been talking a lot. Deni, tell us about number 11.

Deni: Credit card interest. We shouldn’t be using them anyway, you know, maybe for emergencies or whatnot. But credit card interests on average household debt is almost $9,000, and that’s 20.38% comes to about $1,822 in credit card interest a year. And I believe, more people that have more. And I think working to reduce that will help greatly and help your credit.

Brian: Yeah. Credit cards are a tool. Like any tool, they can be abused and misused. If you are not paying your credit card balance off in full every single month, you’re doing it wrong and you should not be using credit cards. So until you get to the point where you’re paying off your credit card balance every single month in full, put your credit cards aside in like a locked drawer or something, or cut them up or whatever. But think of credit cards as a privilege, not a right.

Deni: Right.

Brian: All right. The last one here. Mutual funds, transaction fees or commissions on stocks or ETFs. These transaction fees typically range from like around $5 in the low end, like 4.95, up to $20 in the high end, like 1995. You can avoid these by either using a commission free brokerage like I use Charles Schwab, or avoiding mutual funds that charge transaction fees, lowered fees. So instead just buy index fund ETFs. And if you were to buy shares in two funds every time you got paid every two weeks and you were paying an average of $10 per transaction, that would come to $520 a year and wasted money to bank fees, basically brokerage bank fees, investment bank fees. And I can tell you right now, JPMorgan does not need that money from you. This is not like a charity we’re talking about here. Like save yourself the money.

Deni: Yes. Wow. That’s that’s crazy. Do you know what else. I know we’re only supposed to do 12, but I’m going to add a 13 real quick!

Brian: Please yeah, absolutely! We got a bonus.

Deni: Subscription fees. So you don’t know how many times people don’t even realize they’re getting charged them.

Brian: Absolutely.

Deni: So I go through your credit card bills or your checking account or whatnot and look and see which ones they are and cancel them because you’re probably not using 95% of them.

Brian: And yeah, it could be like those beauty box subscriptions. It could be like an audio streaming service, could be a video streaming service, you know, Dollar Shave Club, you know, believe you me, these guys, they’re making a good profit margin on these. You are not saving money by having razors delivered to you every month, I promise.

Deni: Well, they’re premiums now.

Brian: Deni, anything else you want to add before we call this episode complete?

Deni: I don’t think so, Brian. I think that was it.

Brian: All right. Well, on that note, happy Tuesday! You guys stay in touch. Let us know what you want to hear more about in future episodes and future weeks. We are here [email protected] We read all these. Stay in touch.

Deni: See you later, bye!

Keep Learning More, Keep Earning More!

What Is Savings Rate? Retirement Numbers, Saving Rate Calculator & More

5 Fundamentals of FIRE from Real Estate

The Debt Snowball Method, FIRE, and Real Estate Investing

Ditch Your Day Job: How to Retire Early with Rental Income (Free 8-Video Course)

I want to know more about…

Connect with us on social!

less

10 Ways to Find Distressed Properties as an Investor

Ep. #112: When To Use A Co-Signor For An Investment Property Loan

When should real estate investors bring on a co-signor for an investment property mortgage?

Brian and Deni break down when it makes sense to use a co-signor for investment property loans — and when to fly solo.

Video Broadcast Version

Audio Podcast Version

Also available on iTunes, Stitcher, and wherever else you listen 🙂

Want to compare investment property loans?

When should real estate investors bring on a co-signor for an investment property mortgage?

Brian and Deni break down when it makes sense to use a co-signor for investment property loans — and when to fly solo.

Video Broadcast Version

Audio Podcast Version

Also available on iTunes, Stitcher, and wherever else you listen 🙂

Want to compare investment property loans?

What short-term fix-and-flip loan options are available nowadays?

What short-term fix-and-flip loan options are available nowadays?

How about long-term rental property loans?

We compare several buy-and-rehab lenders and several long-term landlord loans on LTV, interest rates, closing costs, income requirements and more.

Brian: Hey, guys. Happy Tuesday. So we’re glad to be with you as you guys join us. Let us know where you’re tuning in from. We love to hear that stuff. Let us know your questions. This is a dialog. It’s not. Deni and me just talking at you. So today we are going to talk all about Cosigners for investment property loans. So how to use a cosigner to help you borrow money if your credit is not up to snuff or if you have some other challenges with getting a loan to buy rental properties, investment properties, this is how to do it. So without further ado, Deni, what is a cosigner and what are their responsibilities?

Deni: Well, people confuse cosigner and co-borrower and they are different. A cosigner has no ownership in the property itself. They’re just basically backing your loan.

Brian: Your guarantor for your loan.

Deni: Right. So if you default, they’re basically responsible.

Brian: So no upside for them.

Deni: Yeah, not really. There are a few and we’ll talk about that later. And it’s usually usually, usually it’s a very close family member or friend or something like that.

Brian: Right. You’re doing your favor basically.

Deni: Right. It’s not like you’re going to go out and look for an investor cosigner. It doesn’t. Right. But it is a good way for maybe somebody who is entering with little to no credit. It’s a little harder to get cosigners When you have bad credit, it tends to be a little easier if you have a little bit of a lower income amount like than they ordinarily would use. But if you have iffy credit, they can also help. But if you’re if you have super bad, bad credit, most banks are still not going to allow you to use a cosigner. And frankly, most cosigners aren’t going to unfortunately, they’re not going to say, “sure, I’ll take the chance!”

Brian: So but even if so, if you have bad credit, would a bank and let’s say you lined up a cosigner with excellent credit, would a bank lend to you?

Deni: It depends like if we’re talking like low 500 for three, probably not. You know, but if you’re on the, you know, middle ground like between five and six, possibly, Yes.

Brian: Okay. All right. So now what’s aside from the cosigner just doing this because they love you, You know, because your parent or your spouse or something. Why would a cosigner do this for you?

Deni: Well, I mean, you don’t have any financial investment. There’s no payment. Hopefully, you don’t have to deal with the day to day management of anything. And if the payments are made on time, it actually has a positive effect on your credit.

Brian: For conventional mortgages that report on your credit, not for portfolio lenders who don’t.

Deni: No, no, no, no, no, no.

Brian: Right. Okay. Well, that all makes sense. And who is the ideal borrower to do this with? Like when did someone say, “You know what? I probably need to bring in a cosigner here to help me?”

Deni: I think if you’re close, you know, I mean, like, if you have your mortgage process or whoever says, look, you’re a little shy here on income, your credit’s a little iffy, but we might be able to push this through with a cosigner under those circumstances. It’s not a bad idea. And, you know, you could refinance later on your own. Once payments are made on time and your situation changes. So it could also be a temporary situation. I know people that have done that. But yeah, for the most part and again, it’s great for the one somebody that wants to get involved early because let’s face it, when you’re young, you have either school loans and you’re just not you know, you’re not in the position as some other people might be. So it’s a good way to still be able to invest in real estate, get a portfolio started and get, you know, get it going.

Brian: Yeah. So that’s how I’ve seen people use Cosigners in the past to get started with real estate investing. You know, typically younger borrowers, people in their twenties, maybe their thirties either don’t have much credit yet or maybe they’ve made some mistakes with their credit, but they have parents who are willing to take the risk with them and cosign the loan on their behalf. Maybe an older sibling who’s willing to do that on their behalf. It’s also great for house hacking. People who are looking to buy, say, a multifamily property, move into one unit, rent out the other units. One of the advantages to doing that is that you can use the future rents from the other units to help you qualify on income, but sometimes that still isn’t quite enough to get you over the hump on your debt to income ratio. So you can use a cosigner to. Help with that to help you qualify on income to house a multifamily property. So I’ve seen people use Cosigners successfully there as well.

Deni: And that’s probably one of the most popular scenarios for this. But obviously there are others as well, and it’s good to know that a lot of your loan processors and whatnot, they’re going to want to know the relationship. So it’s not like you’re going to just, you know, call some whatever, you know, maybe have a side deal or something with them or whatever. And and then they can cosign for a lot of banks are very tough on that. There would have to be some type of an existing relationship.

Brian: So restricted to family members. Or can friends cosign for you I mean how does that work?

Deni: I think depending again, on the lender and underwriters, processors, whatnot, it could probably be a friend, but you probably would have to maybe exhibit to them where this relationship started and and all of that.

Brian: Yeah. And sometimes mortgage lenders will require a letter of certification from people like Cosigners. If someone gives you a gift to help you with your down payment, they’ll require a letter certifying that it is a gift that doesn’t have to be repaid. It’s not a loan. So yeah, to your point, sometimes lenders do want to get a letter from people who are involved in your loan, you know, just sort of lying on paper what the relationship is with the expectations are from the cosigner and so forth.

Deni: Yeah, It’s not like you’re going to go out and buy a 30 unit multi-unit building on your first try and then try it with a cosigner. So we’re looking when you’re first getting in, not that it couldn’t happen that way, but chances are not. Yeah but it’s a great way to knock down those barriers that might ordinarily prevent you from getting getting involved.

Brian: Yeah, because, you know, it’s something that you and I talk about all the time. There are some barriers to entry with real estate investing, you know, from the down payment to credit requirements, income requirements. So, you know, like you said, using a cosigner is a great way to get over that hump and break through that barrier to entry for new investors. By the way, we did add a link in the comments to where you can compare lenders who specialize in working with real estate investors. You can compare some some terms, their loan terms. Deni, Is there anything else that people need to know about borrowing money with a cosigner to buy investment properties?

Deni: Well, just make sure that you know that if something happens and you have a close relationship with this person, it could potentially, you know, mess that up as well. So you want to make sure if.

Brian: You default on your payments, any other person gets stuck holding the bag? Pretty much.

Deni: Pretty much, Yeah. You know, that’s pretty tough. So you want to make sure that the relationship is strong and that you are committed to the process.

Brian: Absolutely. All right. That’s all for today. Quick, simple. You know, great way to get started, though, with real estate investing. So on that note, we will see you guys next week. Stay in touch. Let us know what you want to hear about support at Spark Rental dot com. Deni and I read all those emails and we will catch you on the flip side.

Deni: Absolutely. Have a great day, guys!

Keep Learning More, Keep Earning More!

What Is Savings Rate? Retirement Numbers, Saving Rate Calculator & More

5 Fundamentals of FIRE from Real Estate

The Debt Snowball Method, FIRE, and Real Estate Investing

Ditch Your Day Job: How to Retire Early with Rental Income (Free 8-Video Course)

I want to know more about…

Connect with us on social!

less

Ep. #111: What To Do If Your Tenant Goes To Jail

Rent never came. And you find out your tenant is in jail. What do you do? What steps do you take? Brian and Deni break down what landlords should do when their tenant is locked up.

Video Broadcast Version

Audio Podcast Version

Also available on iTunes, Stitcher, and wherever else you listen 🙂

Want to compare investment property loans?

Rent never came. And you find out your tenant is in jail. What do you do? What steps do you take? Brian and Deni break down what landlords should do when their tenant is locked up.

Video Broadcast Version

Audio Podcast Version

Also available on iTunes, Stitcher, and wherever else you listen 🙂

Want to compare investment property loans?

What short-term fix-and-flip loan options are available nowadays?

What short-term fix-and-flip loan options are available nowadays?

How about long-term rental property loans?

We compare several buy-and-rehab lenders and several long-term landlord loans on LTV, interest rates, closing costs, income requirements and more.

Brian: Hey, guys! Brian Davis and Deni Supplee here from Spark Rental.

Deni: Hi, everyone!

Brian: Happy Tuesday or whenever it is that you’re listening to the podcast recording. Super glad to have you with us. Last week, Deni interviewed Courtney Poulos about flipping during this environment. You know, there is a lot of uncertainty about interest rates where housing markets are headed, whether there’s a recession coming. All that good stuff. Today we’re driving a little bit more niche into a question of what happens if your tenant goes to jail, which I’ve actually experienced this before myself. Deni, have you have you had this personally happen to you?

Deni: I did.

Brian: Yeah! It’s weird. So as you guys join us, let us know where you’re tuning in from. Fire questions at us. It’s an interactive podcast, video broadcast. You guys are just as much part of the show as Deni and I are.

Deni: Absolutely.

Brian: On that note, Deni. Let’s start with the basics here. What do you do if you suspect that your tenant has been incarcerated?

Deni: Well, let me clear something up. If you are just suspecting but the rent is coming in and everything else, I don’t think I would do anything. At this point. I mean, housing, rents, right? I mean, unless there’s other things going on like you see, you know, drug deals or whatever hanging out in the front. Right. But other than that, I would just leave it. Leave it go. Because you can’t just…

Brian: What if the rent is not coming in.

Deni: Now if the rent’s not coming in or there are other issues or you just hear through the grapevine as we all do, first of all, you don’t want to call family or friends or anything and say, yo, is so-and-so in jail? You don’t want to do it. Can actually get in trouble for it. What you do want to do.

Brian: Though, it’s public information if someone gets it is.

Deni: But there is something there are legal ramifications in certain instances where a family could say different things. And then if you go ahead and try to evict, say not so much based on nonpayment, but say there is issues like damage to the unit or people hanging out or something like that, then you could get into some hot water. So it’s best not to just you know, you could call them and say, how is so-and-so? I haven’t heard from them. I’m a little concerned. But, you know, stay away from the circumstances.

Brian: You can ask if they are still residing in the property.

Deni: Yeah. Just be vague and say, oh, are you behind bars? And then Shani Dixon, this has happened to someone I know. I think that if you’ve been in this business long enough, it probably has happened. I was lucky. Ironically. The person who, you know, the situation I knew he was on work release, so he continued to pay for his rental and his family took care of it and made sure the heat was on, trash was out and all that stuff. And they came to me, so I wouldn’t have known, but so that was a little bit easier of a situation. Now when you have another situation where they’re not paying rent and whatnot, there are several ways that you should handle this. In most states, we as landlords have the obligation to secure the unit. So what this means is maybe there was a raid and windows are open and the doors left open or something like that. You do have the right to go in and secure the the place and everything else. Or what if it’s in the middle of winter and the heat’s turned off? You can do what you need to do to make sure that you’re not going to frozen pipes and all of those things. But you can.

Brian: Do this even if the tenant is paying the rent, right? Like if you think that they’ve been.

Deni: If it’s abandoned. Right. Well, if you see any signs of abandonment, you know, where you feel that your property is in danger, then you have the right to go in.

Brian: Like if the place is freezing and they don’t have the heat on or…

Deni: Right. Now say you go in and everything’s out of there. There’s nothing in the refrigerator. All the furniture is out. Maybe the family came in and took everything out. You can then go through the normal eviction procedures and. You know.

Brian: As an abandoned unit.

Deni: Right. You’re probably not going to have too much. When you start eviction procedures, make sure that you are following your state’s letter of the law, the notices and everything else you would send them to the unit unless you have another address for it. But for the most part, you would send it directly to the unit. Yeah. Really? Oh, maybe. Yes. Mail forwarded there. But anyway, so you want to do that? A lot of times you’d be surprised. You know, people have family taken care of. Even if they’re not paying the rent, they you’ll still maybe see a girlfriend, boyfriend, somebody going in and out and they might get the mail and get it to them. So you want to mail your notices as you would at any other time. Right. There is also I mean, if you wanted to I don’t suggest this, but it is an idea you could actually, you know, if they reach out to you, if he say they reach out to you, then incarcerated tenant, then you can actually say, look, I’ll come down if you want to release and relinquish the apartment and give me the permission to allow your family to come in and clean it out and all of that. I can come down there and then you can have him sign him or her sign a document and then close it out right there.

Brian: For an early lease termination, you mean?

Deni: Yes, yes…

Brian: Why don’t you recommend that?

Deni: I mean, I don’t know. I just, you know, going to the prison, getting all that done, you really should get it. Load of rice. So you got to bring somebody else or a witness. And I mean, do you really want to take your day and go to the county jail?

Brian: But it might be worth it to to close out that lease contract cleanly.

Deni: Right? Oh, right. And if it’s that easy, like if if this tenant is contacting you and then it’s not that far, you’re not driving 3 hours to do this, right? Then it probably makes sense to do it.

Brian: But you can always send like, you know, your deadbeat nephew to the prison to get this signed. Right.

Deni: And send Greedo? No.

Brian: Yeah.

Deni: Anyway. So those are the things that you want to do. You want to start eviction if you need to. If the rent is not coming in. If the rent’s coming in, I would just leave it. Just make sure it’s not abandoned. You don’t want to harass anybody. And I’ve heard stories of people doing that. And that’s going to come back to bite you in your butt. You definitely don’t want to do that. You don’t want to go into the unit for any other reason to take their stuff. Don’t do anything with any of that stuff until you have permission written and…

Brian: Until the sheriff goes with you. Right?

Deni: Yeah!

Brian: Or hand back possession to you.

Deni: Even then, you have to be careful and handle the property as per your state’s regulations. And there are some states that make you hold it for 45 days…

Brian: Yeah. And some cities there are some very tenant friendly cities with anti-landlord laws that we talk about all the time that have just crazy regulations on this side where the tenant can abandon their junk and the property and you as the landlord still have to pay to store it even after the eviction for months afterwards. And that can certainly apply here if your tenant is imprisoned.

Deni: Absolutely.

Brian: These are reasons to avoid areas with anti landlord laws. You know, it’s funny. So Shani Dixon says that for the person that it happened to, that she knows, she says I happened to see it in the online newspaper. By chance, owner had no idea that their tenant had been arrested and incarcerated. Wow.

Deni: And I mean, generally, you’re not going to know if everything is is good and if it’s the middle of the month, you’re not going to know to rent do again, unfortunately, unless you have some kind of inkling or like I had maintenance people that would tell me if an apartment was abandoned or whatnot. So, I mean, it’s kind of. Oh, my goodness. He was for murder!

Brian: Yeah. In the comments. For anyone even listening, Shani said that the tenant had been arrested for murder, unfortunately.

Deni: So chances are he’s not going to have work release.

Brian: Right. Well, I suppose that’s true, Deni.

Deni: So I guess, yeah. That’s all I have for today. Again, don’t throw away their stuff. Don’t take anything if you have to inventory it. He never came back. Shani Dixon just said. I would assume so.

Brian: Yeah. But, yeah, the bottom line here is you really have to follow your state and city eviction laws to the tee. Document everything. You know, C.Y.A. right. Because you may be challenged later either by the tenant when they get out of prison or by their family members. So you really have to Cover Your Ass here and just document everything, cross every t, dot every eye when it comes to your state’s eviction laws and city eviction laws.

Deni: And the legal ramification that I was talking about, like, if you ask a family like say, you know, this guy is is in for murder, technically until he has his court hearing, he’s not a murderer. So if you act upon something like that without, you know.

Brian: Oh, yeah, yeah, you can’t evict someone for alleged crimes that they have not been proven guilty of. Even if your lease has a clause about criminal activity in it, you really have to. You can only evict people for violations of the lease agreement.

Deni: Exactly.

Brian: All right. On that note, we will see you guys next Tuesday. Stay in touch. Let us know what you want to hear about in the coming weeks and we will catch you guys. On the flip side.

Deni: We are and I’m going to be a grandmother tomorrow. I’m very excited. Another grandmother, my 11th. Thank you. Yeah. Yeah.

Brian: Well, congratulations again, Deni, and we’ll see you guys soon!

Deni: All right. Bye.

Keep Learning More, Keep Earning More!

What Is Savings Rate? Retirement Numbers, Saving Rate Calculator & More

5 Fundamentals of FIRE from Real Estate

The Debt Snowball Method, FIRE, and Real Estate Investing

Ditch Your Day Job: How to Retire Early with Rental Income (Free 8-Video Course)

I want to know more about…

Connect with us on social!

less

Ep. #110: Flipping Homes in a Cooling Housing Market with Courtney Poulos

Deni interviews Courtney Poulos, hos of Season 2 of The American Dream TV, a former member of the Forbes Real Estate Council, and a recurring panelist at Inman Connect, Awesome Females in Real Estate.

Courtney explains the pros, cons, and risks of property flipping in a cooling real estate market.

Video Broadcast Version

Audio Podcast Version

Also available on iTunes, Stitcher, and wherever else you listen 🙂

Want to compare investment property loans?

Deni interviews Courtney Poulos, hos of Season 2 of The American Dream TV, a former member of the Forbes Real Estate Council, and a recurring panelist at Inman Connect, Awesome Females in Real Estate.

Courtney explains the pros, cons, and risks of property flipping in a cooling real estate market.

Video Broadcast Version

Audio Podcast Version

Also available on iTunes, Stitcher, and wherever else you listen 🙂

Want to compare investment property loans?

What short-term fix-and-flip loan options are available nowadays?

What short-term fix-and-flip loan options are available nowadays?

How about long-term rental property loans?

We compare several buy-and-rehab lenders and several long-term landlord loans on LTV, interest rates, closing costs, income requirements and more.

Deni: Welcome everyone to Spark Rental Facebook Live and podcast. Brian is having technical issues, as we all do lately in this tech world that we live in. I am really excited though today! We have a guest. We have Courtney Polos and we are going to be talking about flipping houses and this kind of cool or cooling, I should say, home market. If you guys have any questions, anything, please just throw your comments in the chat. This is a very relaxed format, as everybody knows me. Courtney and I were speaking about our dogs. And you have anybody who’s been watching this long enough has seen my dogs or heard my dogs barking in the background.

Courtney: Anything could happen. And a dog situation any moment.

Deni: It’s so true. So before we move on, I want to let everybody know about you. Courtney, you’re very impressive. You have you currently co hosts a podcast called Under All is the Land. Is that weekly or…

Courtney: It is weekly. We are just about to start season two. We’re recording our first season too. So this Friday it’s available on our YouTube channel and then all of the other [platforms]: Apple, Spotify and all the other jazzy distribution networks out there. But our YouTube channel is YouTube.com/ACMERealEstate.

Deni: Okay. And I am going to be putting Courtney’s website address. is this information there as well?

Courtney: Yeah. Yeah, there are links to the podcast on the website as well.

Deni: Perfect. Perfect. And then you host season two of the American Dream TV.

Courtney: The American Dream. Do you watched it?

Deni: I think I have seen it. Yes, that’s crazy.

Courtney: Luckily, like, you know, there’s an LA show, there’s a Philly show, there’s a miami show. So it’s all over the country. And they take five real estate and lifestyle experts and they give us free permission to pursue whatever kind of interviews we want all over the city and really get get allow viewers to get an inside look at things that you might not see from a real estate agent on their day to day Instagram or social media.

Deni: Right! Wow. Very cool. Very cool. Oh, there’s so much. There’s so much. But I want to get into our subject. If you guys really you have to visit the website. I’m actually going to pop it up now. And you know, when we’re done here, check Courtney out. There’s a lot, a lot to her. I find it interesting we were talking to beforehand. We all know that I’m a most of us know most of you know that I’m a realtor. But Courtney also is a… You’re a broker actually.

Courtney: I am. Yeah.

Deni: And you’re in Florida and California.

Courtney: That’s right. So in Florida, I have a co founder who’s a broker in Florida, Heather Unger. So we have Acme, Florida. And then I run the LA office, which has 60 agents and two locations in LA. And the reason why I love our podcast topic today is because we actually started during the last crisis recovery, right, when people were very uncertain about the market and I built my business on renovation resale. So I worked with a lot of flippers and you know, in a changing market. So kind of a similar circumstance that we’re having right now.

Deni: I love that.

Courtney: [Inaudible: Response when Deni’s dog is barking]

Deni: No, don’t even worry about it. The other thing that I really like, Courtney, is that you have a passion for empowering women to achieve financial independence, and I’m seeing that increase more and more. I have friends that are in the business in different facets and they too are catering to women because, you know, it’s good that we all do this to empower. It was a man’s field I started way back in the eighties, so I’ve been in for a while. And I remember when I first entered into real estate, it was a man’s world.

Courtney: Well, it’s interesting because in California, especially, there are more female licensees than male. But the amount of people who are actually broker owners as females is very, very small. So, you know, so that’s one part that’s changing in our industry environment. But when it comes to actual financial stability, this is the transition from what I call like the Cinderella story that maybe our grandparents narrative, we wait to buy a house until we get married and we have kids and dah and we stay in the same house for 30 years and we pay off our mortgage. That mentality of normalcy era thinking has been what we’ve been living on for many years, probably until the seventies, when women could actually get a loan without a husband. Cosigner. Thank you, Ginsburg! But now we’re in this moment where most women for probably the past 30 years that I know are capable of buying earlier in their professional careers, sometimes straight out of college and we shouldn’t wait. I think that starting your real estate investing, even if it’s just buying what you can, where you can, allows you a better platform. When it comes to choosing partners, when it comes to making bigger decisions about your future, you want that dream house. Maybe you don’t come from money, don’t know how to get it. And home ownership feels very out of reach for many people. It still does, right? But starting where you’re at when you can allows you to incrementally get there. And that’s something that I think has been lost on the narrative, especially in reality television. Real estate shows. You see people who have the money, but you don’t see how the people got there, you know? And it does take a little effort at the beginning and and it’s achievable. I don’t know any other thing you can do in America right now reliably to make hundreds of thousands of dollars just scraping $200 out of your paycheck every week isn’t going to do it. You know…

Deni: You know, it’s interesting too. I think that we have a lot of fear, men and women. And when we hear about flipping and, you know, I think so often we focus on the possibilities of what could happen. Bad. And I think that it’s good to hear good, positive stories because there are many of them, obviously, because people do.

Courtney: This is not for the faint of heart. This is where people get confused. Somewhere along the line when it’s kind of a seller’s market. And really seller’s market just means interest rates are low. There are more buyers than there are inventory and sellers feel like they have some power. These flippers were making money hand over fist quality or not when it comes to their product. So, you know, that is something that happens with every cycle whenever the conditions are like that. That’s why I actually think it’s an amazing time to buy right now for buyers, they have more power than ever. But when it comes to the flippers, yes, they are going to have to adjust a few things in order to accommodate the fact that now buyers do have some inventory to choose from. Their money is more expensive, so they’re going to be making different choices. The quality of the renovations that you put in the house are going to matter more, and they’re still hunting for the perfect house. So in fact, your opportunity to deliver a high quality product is really high. Flippers make a mistake in this market when they think that they can cheap out because the returns are not going to be as high. I think it always takes about six months for sellers to accommodate a change in interest rates. That’s dramatic, you know, so buyers 2% got you one thing a couple of months ago and now it’s 6%. So it doesn’t go as far.

Courtney: So, of course, you’re not going to be paying the same price for that house if you don’t have to write your monthly payments going on. So sellers might have to take a little bit less profit on the homes they have listed right now, where they were using six months ago projections for the future market value. But as you go into this next moment, you are able to acquire homes more easily now too, because a lot of investors have gotten out of the market. So now you can get a better acquisition price and you have an opportunity to choose and make a more unique, beautiful home that’s going to attract those buyers who are being picky. And that’s where the money is. It’s in quality. So it’s the exact opposite space of what most… I don’t mean to offend anybody, but I’ve learned in my 17 years of doing renovation resale that there’s a masculine mindset to bottom line numbers for a lot of flippers, and they don’t look at the emotional touches that make buyers fall in love. I feel like a lot of women make buyer’s buying decisions for families, but a lot of the work, contracting work and flipping kind of investment stuff is done by men. So the most successful flips are the ones that marry those two, no pun intended, that actually have a sensibility about spending, but a design sensibility that accommodates making a unique product, that has an emotional composition, you know?

Deni: Yes, that’s that’s a great point. And out of curiosity, just in California, I mean, I know the prices there are completely different than where I am and people complain about how high they are here. So how do you find, you know, a worthwhile flip in California.

Courtney: So they’re actually everywhere. People will tell you it’s very hard. I mean, obviously, I don’t work all of California, so I’m just looking at Los Angeles. There are a lot of opportunities that are sitting on the MLS. So I look for hidden value. That means big lots that are underutilized, extra spaces like detached garages that can be converted into accessory dwelling units. I look for properties that are duplexes that are vacant that could potentially be combined to make one house because a lot of flippers forget to look for duplex.

Deni: Wow!

Courtney: Yep. I look for properties that have a hurdle that is jumpable. So one thing you want to stay away from and they’re usually the cheapest properties on the market are the ones on busy streets or the ones that are adjacent to commercial or where you hear some kind of noise, some kind of freeway noise or busy street noise or something. There’s some kind of distracting noise. Those hurdles buyers can add 100,000, 200,000 value, too. So we want to stay away from those. But if there’s a hurdle like an underutilized backyard that I know could be magic, if we just added a fence to go to add some privacy, or if we planted some olive trees or added a hot tub and some twinkle lights or something to make it feel magical and it jumps the hurdle. Those properties are opportunity properties, also properties that are listed with like shitty photos. Love those!

Deni: *Giggling*

Courtney: And getting Flipper. I’ll be honest. Crappy flips are a great place to start! So if you see a house that’s been sitting on the market because buyers are pickier now. Right. And it has laminate floors and cheap finishes, Home Depot fixtures and whatever. And you think, hmm, this place could benefit even though it’s been remodeled, like the systems are all done right. It just needs cosmetic help. Then you have an opportunity to save a lot of money because that systems work is what takes $60,000 to $80,000 worth of renovation budget. And you can just focus on the cosmetics, right? That allows you to flip that flip. And believe it or not, the buyers will come for high quality design. That’s what I learned during the last cycle, and that’s the most important lesson for going into the flipping market right now.

Deni: Now, tell me something that a flip that you have, I’m assuming you’ve been involved in flips yourself.

Courtney: I don’t do a ton of flips myself, believe it or not. We just represent them. I’ve done them. I’ve done one. I mean, I’ve done 1/2, but I don’t compete with my clients. We really focus on finding them deals, giving them design guidance, project management and then resale.

Deni: I love that you add design guidance in there as well because a lot of people need that and it’s nice to have that piece.

Courtney: It’s the most important piece. It’s the most underutilized piece. And I think, again, like you have to understand as a real estate agent, you know, because we’re on the ground, we hear what buyers are saying when they’re walking through houses. They’re not saying, oh, I wish I had a mirror in the like in the bathroom that had fluorescent lights on it. Nobody’s saying that. They want a kitchen where they can prep food. They want a family room that’s open. So if they have kids, the kids are running outside to the yard. They can watch the kids while they do the wash by washing up the dishes. Or something it’s functionality of key piece of design that gets missed on finish that someone decided this is what they think a flip looks like. But let me tell you, nobody likes laminate floors, nobody likes them. They’re bouncy, they’re cheap, they feel cheap. And the difference between a good engineered floor and a laminate floor for a flipper should be nominal. You know, you should have access to people who are giving you wholesale deals. You should be buying in bulk so you can use those hardwood floors on multiple different properties, but get good quality floors. It matters. It just makes it look like you. You care more.

Deni: It’s funny, as an as an agent myself, it’s one of the first things people notice when they walk into a place. You know what I mean? It’s just I mean, I still see really horrible carpeting. And I as soon as it turns, it turns. It could be a great house. But that.

Courtney: Just because a lot of buyers don’t see beyond what is actually there. That’s why when I’m advising my clients and they have a small third bedroom, but it still fits a full bed. Like, don’t say it as an office, stage it as a bedroom. Anybody can look at a bedroom and say, I could use that as an office, but a lot of people can’t look at a room that’s staged as an office and think, I can see that as a bedroom. So you have to remember what buyers are looking for when they’re walking through the property. And if you see a hurdle as a buyer, which is what your reptile brain is trying to tell you, to see all the things that could be wrong. Right? Like we don’t want to make any bad moves. Nobody wants to be made a fool of by the buying process. You know, you see dirty carpet or you see carpet anyway and you’re like, Oh, we’d have to do the floors. Like, that’s just going to cost too much money, you know, or something. It just checks off something in your head like, Yeah, that’s not going to work. I can’t move right in there. It’s a really simple fix.

Deni: It actually is. It’s probably one of the more simple ones. So you have a client brand new wants to flip never has done before. What is the first thing that you do?

Courtney: Well, the first thing we do is we figure out how much money they have. So I’ve had people come to me where they say they want to flip, but then I ask them how much money they have for the renovation and they don’t even have 20% for the down payment on the loan. Not that you have to have 20%, but remember this is a non owner occupier loan that you’re probably getting if you are a flipper. So that means that there are different down payment requirements. You might want to go into hard money financing, which is high interest rate, short term loans where they’re some of them are kind of like construction loans where there’s a distribution situation. Like as you proceed through construction, some of them want to see that you have a track record. So we have to make sure we understand the financing first.

Deni: Right. There are ways to get in through those barriers, even with I’ve seen it with FHA and whatnot to buy a duplex, live on one side, flip the other.

Courtney: Thaht’s a very good point! That’s a good point. With FHA, you have to technically live in one and then you, of course, could renovate the other. Fha has an owner occupier renovation loan, so there’s nothing stopping you from doing a three and a half percent down 203k loan, getting it, renovating it, living in it and then deciding to sell it. I mean, that’s okay too. But for most flippers that come to me, they usually have some maybe they have some money set aside. They have some money for the acquisition cost and some money for the renovation. So then we look at what their budget can get them and where. Looking at comps when you are working with a flipper is a skill that a lot of real estate agents actually don’t know how to do. So we’ve learned over the years how to accurately project what a good looking product in a particular area will net by being able to read the comps in between the lines. So the mistake a lot of people make is that they comp the fixer. Well, there’s no sense in being the fixer because it doesn’t matter really what you acquire it for. What matters is how much work it needs, what your budget is, your good contracting team, and how much it will potentially resale for. How much value can you add?

Deni: So you have to project.

Courtney: …Have to project. So we start with what their numbers are and then I look at where what emerging neighborhoods could be good fits for that budget. On the acquisition side, given those individual properties that I find, I look at each one and say, Could this have an ADU added? Could this have an extra 300 square foot master bedroom addition at it? Could we bolt those ceilings? Is this a historic home? Does it have any regulations? Is it an iPod? Does it have a court ordered probate? Like what is it specific conditions? Does it have a tenant in it? What’s what’s its trouble? And then I say, okay, can we solve this? And if we do solve this, how does it look now? It’s a two bedroom, one bath. How does it look as a32 in this neighborhood and renovate it renovated. Okay, then I back it out. So there’s a formula that I use to assess whether or not there’s money in the deal. So you take the future market value, essentially, you multiply it by we usually use like 7% commission and closing costs as a rough conservative like more than enough estimates. So say I multiply the future market value by 93%, then I deduct the acquisition cost, the carrying costs and the projected renovation costs and add a 10% contingency for change orders. So if you’re doing it with permits possible, the inspector could come in and say, Look, I know you wanted to save this ductwork, but it has asbestos, can’t save it. You’ve got to go to that. Whatever. So add that and then and then at the end of that, that should be your profit.

Courtney: So if in a hot market, there were some flippers who were looking for a 200 or 300,000 minimum return on any property, now it might be a quantity game, so maybe you’re going to make 50 to $100,000 but you can do a shorter flip, like carry it for six months instead of a year. So you have to figure out like what you’re carrying costs are and how that eats into your profit. Because really time is what costs most flippers, the most amount of money. It’s the carrying costs and the high interest home renovation loan or loan. So if they can make 50 to $100,000 on multiple houses, that’s probably the easier way to get through a changing market. If you’re kind of doing your first one with first, first time flippers, I think you should start gently. Like I said at the beginning, it is not for the faint of heart. People don’t understand how much anxiety renovation causes, even for flippers. You cut open the wall and you’re like, What’s in there? Know, it could be old wiring, it could be something. Fire hazard, dead animals, who knows what? But timeline’s matter. Contractors quit. You have to have a good contracting team, the backup team. You have to order your materials so far in advance because of supply chain challenges. That’s another place where a lot of flippers get stuck. They wait till the last minute to order their light fixtures and then they’re not able to get the ones they want. And then they settle for something at Lowes.

Deni: Which is this, that also has been more of an issue after COVID. I hate to say it, but…

Courtney: Yeah, and remember, wood prices have been going up and then the door and there are all kinds of of increased costs associated with supply chain problems and COVID problems, supposedly. I don’t know how much longer we can blame stuff on COVID. I think by now people need to get their shit together, but there are things that are out of people’s control. So you have to have a good plan at the beginning and really execute on multiple levels at once. And a lot of flippers don’t do that. They want to focus on construction, but they forget the bigger picture planning. So that’s definitely, I think that like for beginning flippers, if they can find a house that is kind of a unicorn, but a house that maybe has had some systems updates over the years, like the roof still has some life in it. You know, the electricity was updated in 96, something like that. And then they can improve on what’s already there as opposed to doing a teardown or having to do a big addition. Then you might find yourself getting more familiar in so that you can get comfortable with doing the heavier renovation projects. When people dive head first into teardowns, they. Frequently lose money or get super overwhelmed and stressed out, and they didn’t realize what they were getting into. So, yeah, people out of that.

Deni: That’s a whole different ball game.

Courtney: A whole different ball game!

Deni: Well, I mean, we’re running out of time, so I just wanted to let everybody know that if you have any questions or you want to get a hold of Courtney. Her website is in the chat box and you can always reach out to Brian or I or Tara and we will make sure and put you in touch. I want to thank you, Courtney, for all the information.

Courtney: And thank you so much for having me!

Deni: Yeah, and maybe we could do this again on another subject. I would love to do that!

Courtney: That would be great. That would be wonderful!

Deni: Thanks, everybody! And I’ll see you next Tuesday and have a good day.

Courtney: Bye!

Keep Learning More, Keep Earning More!

What Is Savings Rate? Retirement Numbers, Saving Rate Calculator & More

5 Fundamentals of FIRE from Real Estate

The Debt Snowball Method, FIRE, and Real Estate Investing

Ditch Your Day Job: How to Retire Early with Rental Income (Free 8-Video Course)

I want to know more about…

Connect with us on social!

less

The Real Estate Cycle: How to Invest Through Housing Market Corrections

IRR Calculator Online: What’s Internal Rate of Return in Real Estate?

Heard the term “internal rate of return” or IRR thrown around, but not sure what it means?

Don’t sweat it. I worked in real estate investing for two decades before I completely understood it.

But don’t follow my example on that front — you should understand what internal rate of return is, how IRR is calculated, and how to use an IRR calculator online to evaluate real estate investments much sooner than I did.

Fortunately, it’s not as complicated as most explanations make

... moreHeard the term “internal rate of return” or IRR thrown around, but not sure what it means?

Don’t sweat it. I worked in real estate investing for two decades before I completely understood it.

But don’t follow my example on that front — you should understand what internal rate of return is, how IRR is calculated, and how to use an IRR calculator online to evaluate real estate investments much sooner than I did.

Fortunately, it’s not as complicated as most explanations make it sound.

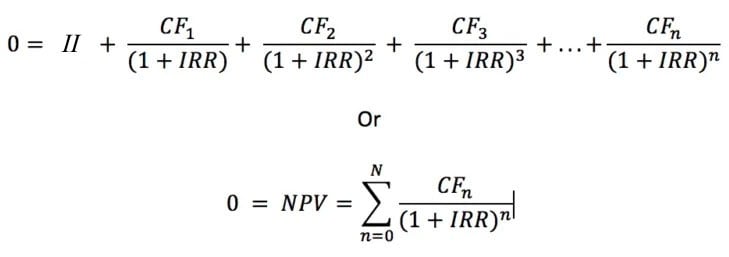

What Is Internal Rate of Return?