3 Followers

757 Views

RateSpy

3 Followers

757 Views

Share

Share

10

Posts

Down payment assistance programs in every state for 2022

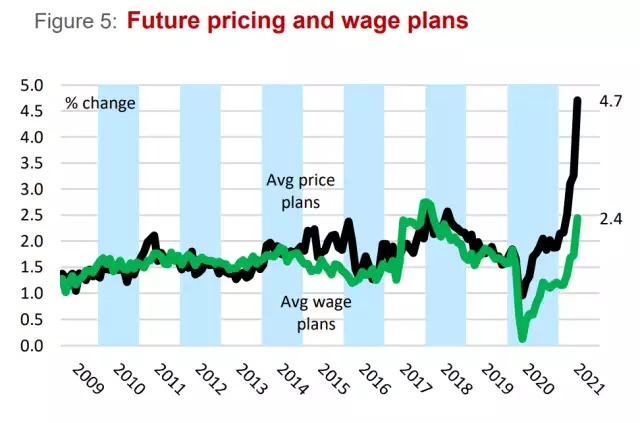

There's a widening chasm between what the Bank of Canada is telling

Canadians about inflation and what corporate leaders expect. The

Crux of the Matter is possible. If we get five to five-plus

inflation is going to see central bankers turn hawkish “fast,

hawkish 'fast,” Chair Alan Blinder. Let’s see what happens. Like

news like this? Join our ratespy update list and get the latest

news. Unsubscribe anytime. Click here. Follow our Ratespy update

lists and get your latest news as it happens. Back to Mail... more There's a widening chasm between what the Bank of Canada is telling Canadians about inflation and what corporate leaders expect. The Crux of the Matter is possible. If we get five to five-plus inflation is going to see central bankers turn hawkish “fast, hawkish 'fast,” Chair Alan Blinder. Let’s see what happens. Like news like this? Join our ratespy update list and get the latest news. Unsubscribe anytime. Click here. Follow our Ratespy update lists and get your latest news as it happens. Back to Mail Online.com. Click to share your news in the Daily Discussion. For more information on our weekly Newsquiz.com/Newsquiz and newsquiz, or visit www.cmegroup.com and http://www.cMEgroup.co.com /newsquiz/newsququirky-newsquirki-to-report. Back in the U.S. Newsquirking. Back on the news. Back at the front of the back to the back of the less

You can contact us to get more choices

Mortgage And Refinance Rates, March 31 | Rates falling today

U.S. core inflation, for example, recently jumped the most in four

decades, 0.9% on a monthly basis. The Bank of Canada said this week

that inflation will ease up by year end, and markets believe it.

But the bond market, which is normally hyper-sensitive to rising

inflation, did something unexpected this week. Instead of pushing

rates up, investors drove them to their lowest level in three

months. ‘The speed of this economic recovery. is like no other. But

we anticipate that few, if any, major fixed-rate cuts... more U.S. core inflation, for example, recently jumped the most in four decades, 0.9% on a monthly basis. The Bank of Canada said this week that inflation will ease up by year end, and markets believe it. But the bond market, which is normally hyper-sensitive to rising inflation, did something unexpected this week. Instead of pushing rates up, investors drove them to their lowest level in three months. ‘The speed of this economic recovery. is like no other. But we anticipate that few, if any, major fixed-rate cuts are on the near-term horizon. The market believes it’s just a few,if any, that is on theNear-term horrific horizon. less

You can contact us to get more choices

Canadian Mortgage News Daily — June 1, 2021

RateSpy's breaking mortgage news is now at RATESDOTCA. Here's a

daily helping of fresh Canadian mortgage news: Can the BoC Manage

Inflation Expectations? Three Cities Have Exuberant Home Prices:

BoC Government's mortgage policy will hurt lower-income Canadians

even more New stress test level makes it harder to qualify for a

mortgage in Canada Hoping for higher interest rates, to tame home

prices? Be careful Is it a good idea to sell your house and start

renting? Canada Is Running Out of Land. It Does That Every... more RateSpy's breaking mortgage news is now at RATESDOTCA. Here's a daily helping of fresh Canadian mortgage news: Can the BoC Manage Inflation Expectations? Three Cities Have Exuberant Home Prices: BoC Government's mortgage policy will hurt lower-income Canadians even more New stress test level makes it harder to qualify for a mortgage in Canada Hoping for higher interest rates, to tame home prices? Be careful Is it a good idea to sell your house and start renting? Canada Is Running Out of Land. It Does That Every Few Years Frugal Canadians diligently cut non-mortgage debt even as household net worth climbs to $12.8 trillion Profit sweep for Big Six as Scotia beats in Q2 as credit improves What do Canadians want from mortgage brokers? Exports, housing bolster Canada's economy in face of lockdowns OECD raises outlook for Canadian economic growth this year Land speculation shifts from residential to commercial Latest Mortgage Rate Outlook More Canadian Mortgage News.. less

You can contact us to get more choices

Canadian Mortgage News Daily — May 31, 2021

Here's a daily helping of fresh Canadian mortgage news (the ita

You can contact us to get more choices

Fannie Mae HomeReady mortgage: 2022 Guidelines

The Fannie Mae HomeReady loan helps low-income buyers get into a house with 3% down.

You can contact us to get more choices

California first-time home buyer: 2022 programs & grants

California has countless sources of advice, education, and financial help for first-time home buyers. Learn about programs, grants, and loan options.

You can contact us to get more choices

Self-employed mortgage borrower? Here are the rules

Just about any lender can do self-employed mortgages. But there are additional requirements for self-employed borrowers. Here's what you should know.

You can contact us to get more choices

How to qualify for first-time home buyer loans and grants: 2022

Learn how to qualify for first-time home buyer grants and loan programs that make home buying more affordable.

You can contact us to get more choices

What Will Canadians do With All Their New Equity?

Millions of Canadians have “won” the Canadian housing lottery in the last year. Of the three quarters of homeowners who have owned for more than five years, they’ve amassed over $175,000 of equity, on average. Many, including those most able to spend their equity, have accumulated far more thanks to incessantly rising home values. “Canadians...

You can contact us to get more choices

Mortgage Rates: Give Them Time

Bond yields have sunk this month. And it’s taken no time for skeptics to pronounce that inflation fe

You can contact us to get more choices