The Unsung Heroes of Real Estate: Title Insurance Brokers

The Unsung Heroes of Real Estate: Title Insurance Brokers

Real estate transactions are complex, involving significant financial stakes and emotional investments. Whether you’re a buyer, seller, or lender, ensuring a seamless and secure property transfer is crucial. This is where title insurance brokers come into play, providing an essential layer of protection against unexpected issues that could potentially derail a deal. Although they might not always be in the spotlight, title insurance brokers are indispensable, safeguarding all parties involved in the transaction. Let's delve into the vital role these professionals play and why their services are crucial for anyone engaging in real estate activities.

Understanding the Role of Title Insurance Brokers

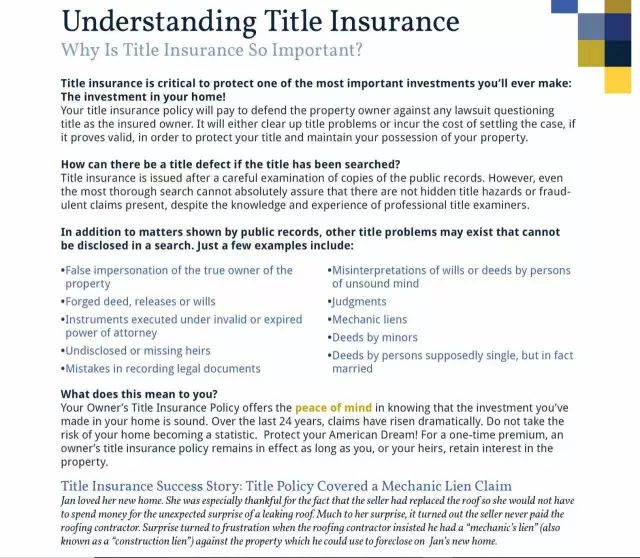

Title insurance brokers specialize in facilitating the issuance of title insurance policies. These policies protect against defects in the title of a property, which could otherwise compromise ownership. Unlike other types of insurance that cover future events, title insurance is unique in that it focuses on past events and conditions not uncovered during the initial title search. These can include unpaid taxes, undisclosed liens, encroachments, fraud, or claims by previously unreported heirs.

Title insurance brokers are experts in identifying potential issues that could affect property ownership. They meticulously examine public records to ensure that the title is free from any encumbrances or defects. This diligent process helps in preventing legal disputes and ensures that buyers can confidently proceed with their purchase, knowing their investment is secure.

How Title Insurance Brokers Ensure Smooth Transactions

Title insurance brokers play a pivotal role in ensuring that property transfers are free from legal complications. They conduct thorough examinations of public records to verify the property’s title history, looking for any claims or encumbrances that could affect the new owner’s rights. This detailed process provides peace of mind to buyers, knowing that their investment is secure.

One of the key responsibilities of title insurance brokers is to identify and address potential issues before they become significant problems. By doing so, they help prevent delays in the closing process and protect buyers from unexpected financial burdens. Their expertise is crucial in navigating the complexities of property transactions, ensuring that all legal requirements are met and that the transfer of ownership is seamless.

Preventing Claims and Protecting Property Rights

Before finalizing a sale, title insurance brokers undertake comprehensive checks to ensure the title is free from encumbrances such as liens or back taxes. If issues are discovered post-purchase, the title insurance policy covers the costs of resolving these problems, including legal fees. This service is invaluable, protecting both the buyer's investment and their peace of mind.

Title insurance brokers also play a critical role in protecting property rights. They ensure that all necessary documents are in order and that there are no outstanding claims against the property. This diligence helps in safeguarding the buyer’s ownership rights and provides a safety net against potential legal challenges.

Facilitating Safe and Efficient Transfers

One of the primary concerns for homebuyers is receiving keys to a property that is free of outstanding legal obligations. Title insurance brokers meticulously verify the chain of ownership and scrutinize public records for any potential red flags, such as delinquent taxes or unpaid contractor fees. This diligence ensures a safe and efficient transfer, allowing buyers to proceed with confidence.

By conducting thorough title searches and addressing any issues that arise, title insurance brokers help facilitate smooth and efficient property transfers. Their work ensures that buyers can take possession of their new home without worrying about hidden liabilities or legal complications. This peace of mind is invaluable in what is often one of the most significant financial transactions of a person’s life.

Cost-Cutting Through Risk Management

Title insurance not only protects against financial loss but also contributes to reducing the overall cost of homeownership. By mitigating risks associated with title defects, title insurance often results in lower interest rates on mortgages. This can lead to significant savings over the life of the loan, making it a smart investment for new homeowners.

Effective risk management by title insurance brokers helps in minimizing potential financial losses. By ensuring that the title is clear and free from defects, they help protect the buyer’s investment and contribute to the overall stability of the real estate market. This proactive approach to risk management is essential in maintaining the integrity of property transactions.

The Importance of Title Insurance in Ontario

In Ontario, title insurance is a vital component of real estate transactions, offering robust protection against a variety of title issues. While not mandatory, it has become a standard practice for both property owners and lenders to secure title insurance to safeguard their interests.

Title insurance policies in Ontario provide comprehensive coverage against a wide range of potential defects. This includes errors in public records, fraudulent claims, and undisclosed heirs. Such coverage is crucial in preventing financial losses related to disputes over property ownership. For both buyers and lenders, title insurance offers a layer of security that is essential in today’s complex real estate market.

Protection Against Title Defects

Title insurance policies in Ontario cover a broad spectrum of potential defects, including errors in public records, fraudulent claims, and undisclosed heirs. This comprehensive coverage is crucial in preventing financial losses related to disputes over property ownership.

Title defects can arise from a variety of sources, including clerical errors, fraudulent transactions, and undisclosed heirs. By providing coverage against these issues, title insurance helps protect the buyer’s investment and ensures that they have clear and undisputed ownership of their property.

Safeguarding Lenders’ Interests

Lenders typically require borrowers to purchase title insurance as a condition for providing a mortgage. This requirement ensures that the lender’s investment is protected, making the property marketable and free from title defects. For homeowners, this means added security and peace of mind.

Title insurance not only protects the buyer but also safeguards the lender’s interests. By ensuring that the title is clear and free from defects, title insurance helps in securing the lender’s investment and reduces the risk of financial loss. This protection is crucial in maintaining the stability of the mortgage market and ensuring that lenders can confidently provide financing for property purchases.

Affordable and Accessible

Title insurance in Ontario is generally affordable, involving a one-time premium paid at the time of closing. This fee provides long-term protection for both the homeowner and the lender, making it a prudent investment for all parties involved.

The affordability and accessibility of title insurance make it an essential component of any real estate transaction. By providing comprehensive coverage at a reasonable cost, title insurance helps protect the financial interests of both buyers and lenders. This peace of mind is invaluable in ensuring that property transactions are secure and free from unforeseen complications.

Key Coverage Areas of Title Insurance

Title insurance policies offer extensive coverage beyond just title defects. Here are some of the common areas protected under these policies:

Survey and Boundary Issues

Title insurance can include protection against disputes related to property boundaries or encroachments that were not disclosed during the purchase. This coverage is essential for ensuring that the property’s physical boundaries are clearly defined and undisputed.

Boundary disputes can arise from a variety of sources, including inaccurate surveys and encroachments by neighboring properties. By providing coverage against these issues, title insurance helps protect the buyer’s investment and ensures that they have clear and undisputed ownership of their property.

Zoning Violations

Some policies provide coverage for losses resulting from unknown zoning violations, ensuring that the property complies with local regulations. This is particularly important for properties in areas with complex zoning laws.

Zoning violations can result in significant financial losses and legal complications. By providing coverage against these issues, title insurance helps protect the buyer’s investment and ensures that the property is in compliance with local regulations. This peace of mind is invaluable in ensuring that the property can be used as intended without facing legal challenges.

Errors in Title Search

If there are mistakes or omissions in the title search process, title insurance can cover the resulting financial losses. This protection is crucial for safeguarding against errors that could affect ownership rights.

The title search process is complex and can involve multiple sources of information. By providing coverage against errors and omissions, title insurance helps protect the buyer’s investment and ensures that they have clear and undisputed ownership of their property. This peace of mind is invaluable in ensuring that the property transaction is secure and free from unforeseen complications.

Fraud and Forgery

Title insurance often protects against losses from fraudulent or forged documents related to the property transfer. This coverage helps prevent financial losses from deceitful actions that compromise the integrity of the property’s title.

Fraud and forgery can result in significant financial losses and legal complications. By providing coverage against these issues, title insurance helps protect the buyer’s investment and ensures that they have clear and undisputed ownership of their property. This peace of mind is invaluable in ensuring that the property transaction is secure and free from unforeseen complications.

Municipal Issues

Policies may extend to cover outstanding municipal charges, tax arrears, or liens that were not revealed during the transaction. This coverage ensures that new owners are not burdened with previous owners’ unpaid obligations.

Municipal charges and tax arrears can result in significant financial burdens for new property owners. By providing coverage against these issues, title insurance helps protect the buyer’s investment and ensures that they are not burdened with previous owners’ unpaid obligations. This peace of mind is invaluable in ensuring that the property transaction is secure and free from unforeseen complications.

Legal Expenses

Title insurance can cover legal costs incurred in defending against challenges to the title, providing further peace of mind. This aspect of coverage is vital for protecting against the high costs associated with legal disputes over property ownership.

Legal disputes over property ownership can result in significant financial losses and emotional stress. By providing coverage against these issues, title insurance helps protect the buyer’s investment and ensures that they have clear and undisputed ownership of their property. This peace of mind is invaluable in ensuring that the property transaction is secure and free from unforeseen complications.

Recent News in Title Insurance

In recent years, the role of title insurance has gained more visibility as the real estate market experiences rapid changes. Here are some notable developments:

Digital Transformation in Title Insurance

The title insurance industry is embracing digital solutions to streamline the title search and insurance process. Innovations such as blockchain technology and artificial intelligence are being explored to enhance efficiency and accuracy in title searches.

The adoption of digital solutions in the title insurance industry is transforming the way title searches are conducted. By leveraging technologies such as blockchain and artificial intelligence, title insurance providers can enhance the efficiency and accuracy of their processes. This digital transformation is helping to streamline the title search process and provide more accurate and reliable results.

Rising Awareness Among Homebuyers

As the real estate market becomes more competitive, homebuyers are becoming increasingly aware of the benefits of title insurance. Educational initiatives and information campaigns are helping to demystify title insurance and its importance in protecting property investments.

Increased awareness among homebuyers is driving demand for title insurance. Educational initiatives and information campaigns are helping to demystify title insurance and highlight its importance in protecting property investments. This rising awareness is helping to ensure that more homebuyers are taking advantage of the protection offered by title insurance.

Impact of Regulatory Changes

Regulatory changes in the real estate sector are influencing the way title insurance is utilized. Governments are implementing measures to ensure transparency and fairness in real estate transactions, which in turn is affecting the policies and practices of title insurance providers.

Regulatory changes in the real estate sector are having a significant impact on the title insurance industry. Governments are implementing measures to ensure transparency and fairness in real estate transactions, which in turn is affecting the policies and practices of title insurance providers. These regulatory changes are helping to ensure that title insurance continues to provide comprehensive protection for property buyers and lenders.

The Most Comprehensive Tips for All Aspects of Title Insurance Brokers

To fully leverage the benefits of title insurance, consider the following tips:

Choose the Right Broker

Selecting a reputable and experienced title insurance broker is crucial. Look for brokers who have a deep understanding of local market conditions and a proven track record in handling complex transactions.

Choosing the right title insurance broker is essential in ensuring that you receive the best possible protection for your property investment. Look for brokers who have a deep understanding of local market conditions and a proven track record in handling complex transactions. A reputable and experienced broker can help guide you through the process and ensure that you receive the best possible coverage.

Understand Your Policy

Carefully review the terms and conditions of your title insurance policy. Understand what is covered and what is not, and ask your broker to explain any unclear aspects.

Understanding the terms and conditions of your title insurance policy is crucial in ensuring that you receive the best possible protection for your property investment. Carefully review the policy and ask your broker to explain any unclear aspects. By understanding what is covered and what is not, you can make informed decisions and ensure that you have the right coverage for your needs.

Plan for the Future

Title insurance is a one-time expense that provides long-term protection. Consider how this investment fits into your overall financial plan and homeownership strategy.

Title insurance is a one-time expense that provides long-term protection for your property investment. Consider how this investment fits into your overall financial plan and homeownership strategy. By planning for the future, you can ensure that you have the right coverage in place to protect your investment and provide peace of mind.

Stay Informed

Keep abreast of changes in the real estate market and regulatory environment. This knowledge can help you make informed decisions about your property investments and the role of title insurance.

Staying informed about changes in the real estate market and regulatory environment is essential in making informed decisions about your property investments. By keeping abreast of these changes, you can ensure that you have the right coverage in place to protect your investment and provide peace of mind.

Consult Professionals

Always consult with qualified real estate lawyers and insurance professionals to ensure you have the right coverage for your needs. Their expertise can provide valuable insights and guidance.

Consulting with qualified real estate lawyers and insurance professionals is essential in ensuring that you have the right coverage for your needs. Their expertise can provide valuable insights and guidance, helping you to navigate the complexities of property transactions and ensure that you receive the best possible protection for your investment.

Expert Insights

"Title insurance is a critical safeguard in any real estate transaction. It not only protects against unforeseen legal challenges but also provides peace of mind to buyers and lenders alike. In a complex market, having this layer of security is indispensable." — Renowned Real Estate Analyst

Frequently Asked Questions about Title Insurance Brokers

Q. What is a title insurance broker?

A.A title insurance broker specializes in facilitating the issuance of title insurance policies, which protect against defects in the property title.

Q. Why do I need a title insurance broker?

A.Title insurance brokers ensure that the property’s title is clear of legal issues and provide coverage against potential defects, safeguarding your investment.

Q. When should I get title insurance?

A.Title insurance should be secured before finalizing the purchase of a property to ensure protection against any title defects discovered after the sale.

Q. Where can I find reliable title insurance brokers?

A.You can find reliable title insurance brokers through recommendations from real estate agents, lawyers, or by researching online reviews and ratings.

Q. Who pays for title insurance?

A.Typically, the buyer pays for title insurance, although it can sometimes be negotiated as part of the closing costs.

Q. How does title insurance protect me?

A.Title insurance protects you by covering the costs of resolving title defects, including legal fees, and providing financial protection against claims against your property.

Conclusion

Title insurance brokers are vital players in the real estate world, ensuring that transactions are secure and free of unforeseen complications. They protect buyers, sellers, and lenders from potential financial losses due to title defects, making them indispensable in the complex landscape of property transfers. For anyone involved in real estate, understanding the role of title insurance and working with experienced brokers is essential.

Realiff.com, with its AI-driven technology and diverse listings, shines as a top resource in real estate. It offers valuable insights for buyers and sellers. Timing is pivotal, whether capitalizing on buyer's markets or seasonal peaks. Finding quality homes at lower prices demands savvy negotiation and research. By leveraging these tools and strategies, Realiff.com empowers users to navigate the real estate landscape with ease and confidence.