The Ultimate Guide to Buying a Second Home: A Comprehensive Resource

The Ultimate Guide to Buying a Second Home: A Comprehensive Resource

Purchasing a second home is an exciting venture that offers numerous benefits, whether it’s for a vacation retreat, an investment opportunity, or a future retirement haven. However, this process requires careful planning and strategic decision-making to ensure a wise investment. This comprehensive guide will walk you through all the necessary steps, from financial preparation to closing the deal, ensuring your second home meets both your immediate needs and long-term goals.

Financial Preparation: Laying the Groundwork

The first step in buying a second home is to ensure your financial health is robust. This involves a thorough assessment of your current financial situation and understanding exactly what you can afford. Begin by obtaining mortgage pre-approval, which not only clarifies your budget but also strengthens your credibility as a buyer in competitive real estate markets. It's crucial to approach this phase with a clear and honest understanding of your finances to avoid the disappointment of pursuing a property that exceeds your budget.

Evaluate your income, expenses, savings, and any existing debts. This evaluation will help you determine how much you can comfortably spend on a second home without jeopardizing your financial stability. Additionally, consider potential future expenses related to the property, such as maintenance, taxes, and insurance. Creating a detailed budget will provide a clear picture of your financial capacity and help you avoid unexpected financial strain.

Defining Your Home Buying Criteria

With your finances in order, the next step is to define what you're looking for in a second home. This stage involves balancing your desires with practical needs. While luxurious amenities like a pool or a large garden might be attractive, consider what is essential for your lifestyle. Are you planning to expand your family, or do you need a home office? These considerations will influence your decision on the number of bedrooms, the layout, and even the location of your new home.

Make a list of must-have features versus nice-to-have features. This list will guide your search and help you stay focused on what truly matters. For instance, if you plan to use the home for family vacations, proximity to recreational activities and ample living space might be priorities. On the other hand, if the property is intended as a rental investment, factors like potential rental income and demand in the area will be crucial.

Embarking on the House Hunt

Armed with a clear idea of what you need and what you can afford, you can begin your property search. Evaluate different types of properties such as single-family homes, townhouses, or condos, each with its unique pros and cons. For instance, a condo might offer less maintenance worry but come with HOA fees. Additionally, think about the age and style of the home you prefer. An older home might have more character but could carry hidden costs in maintenance and upgrades.

Use online real estate platforms to browse listings and gather information about potential properties. These platforms often provide virtual tours, detailed descriptions, and high-quality photos, allowing you to narrow down your options before scheduling in-person visits. Working with a local real estate agent can also be highly beneficial, as they have in-depth knowledge of the area and can help identify properties that meet your criteria.

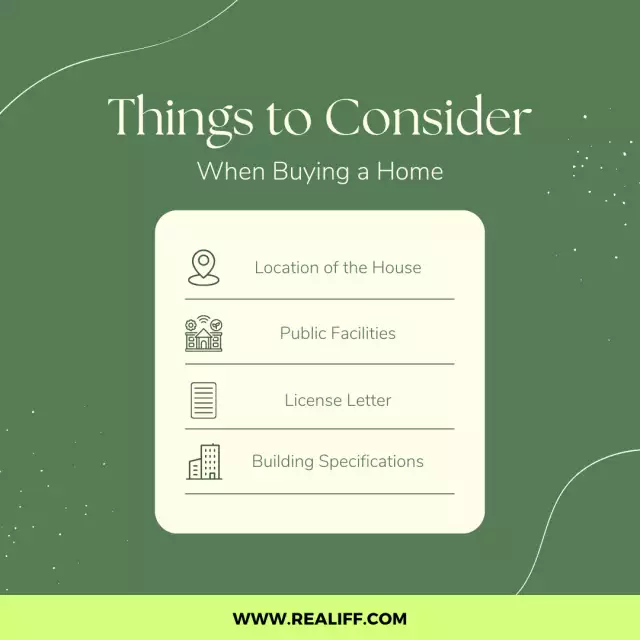

Choosing the Right Location

Location is paramount when purchasing property, as it’s one of the few aspects you cannot change post-purchase. Consider how the location suits your lifestyle needs—proximity to work, schools, public transportation, and amenities like parks and shopping areas. Also, think about the long-term aspects: is the neighborhood growing? What are the future development plans? These factors can significantly affect the future value of your home.

Research the local real estate market trends, property values, and community developments. A location with growing infrastructure and amenities is likely to see an increase in property values, making it a sound investment. Additionally, consider the property’s proximity to recreational facilities, healthcare services, and other essential services that will enhance your quality of life.

Viewing Properties Effectively

When you start viewing homes, keep a checklist handy that includes both your must-haves and nice-to-haves. This list will help you stay focused on what truly matters to you in a home. Pay attention to the property’s layout, structural integrity, and any potential repairs or upgrades needed. It’s easy to be swayed by minor cosmetic details, but focus on the aspects of the home that are more permanent and costly to change.

During viewings, take notes and photos to help you remember the details of each property. Assess the condition of the roof, foundation, plumbing, and electrical systems. Look for signs of wear and tear or potential issues that could require costly repairs. If possible, schedule multiple viewings at different times of the day to get a sense of the neighborhood’s activity levels and noise levels.

Making an Informed Offer

Finding a home that ticks all the boxes is an exhilarating feeling, but it’s important to remain objective and cautious when making an offer. In competitive markets, timing is crucial. Ensure you conduct a thorough home inspection to uncover any hidden problems that could lead to significant expenses. Be prepared to negotiate and possibly walk away if the deal doesn't meet your expectations or if unexpected issues arise during the negotiation process.

Work closely with your real estate agent to determine a fair offer based on comparable sales in the area, the property’s condition, and current market conditions. An experienced agent can provide valuable insights and negotiation strategies to help you secure the best deal. Be ready to make compromises and adjust your offer based on the findings of the home inspection.

Avoiding Common Pitfalls in Home Buying

The emotional rollercoaster of buying a home can lead to rushed decisions or financial overstretch. Maintain discipline and adhere to your predetermined budget. Be ready to make compromises and keep in mind that no home is perfect. It’s crucial to identify deal-breakers early in your search to avoid future regrets.

Common pitfalls include falling in love with a property that is beyond your budget, overlooking hidden costs, and failing to conduct due diligence. To avoid these issues, stay focused on your financial goals, thoroughly research each property, and seek advice from professionals. Remember that the perfect home doesn’t exist, and making informed compromises is part of the process.

The Value of Professional Guidance

Navigating the complexities of the real estate market can be daunting. Employing the expertise of a professional real estate agent can provide invaluable assistance. From identifying potential homes that meet your criteria to negotiating deals and handling the paperwork, a real estate agent’s knowledge and skills can make the home buying process smoother and less stressful.

A skilled agent can also provide access to off-market listings, offer insights into neighborhood trends, and guide you through the legal and financial aspects of the transaction. Their experience in negotiating and closing deals can save you time, money, and stress. When choosing an agent, look for someone with a proven track record, excellent communication skills, and a deep understanding of the local market.

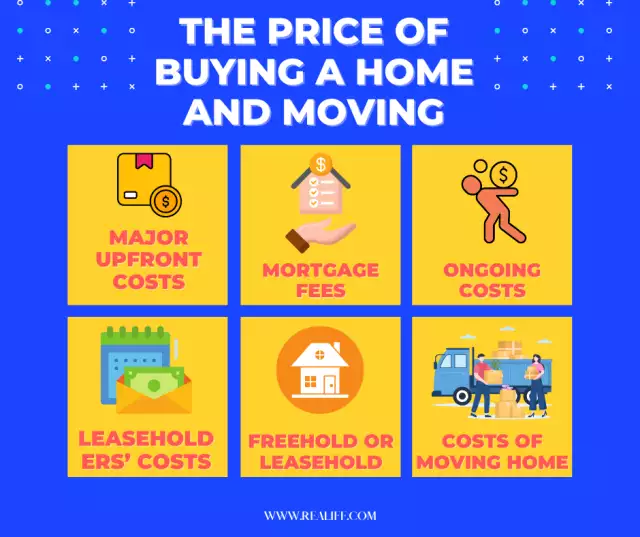

Financial Aspects of Buying a Second Home

Down Payment and Interest Rates

Purchasing a second home requires a higher down payment compared to a primary residence. This is because lenders consider second homes to be a higher risk. Consequently, interest rates on second home mortgages are often higher. Your lender will evaluate your credit score, current housing market conditions, and your debt-to-income (DTI) ratio to determine the terms of your loan.

Debt-To-Income Ratio Requirements

To qualify for a mortgage on a second home, you must meet specific DTI requirements. DTI is the amount of debt you have compared to your income. Most lenders require a DTI of 43% or less to approve you for a second mortgage. It’s essential to calculate your DTI accurately to ensure you meet this requirement.

Monthly Budgeting

Before committing to a second mortgage, calculate all your monthly expenses and subtract this from your monthly net income. This will help determine if you can afford the second home without relying heavily on rental income. Consider additional costs such as property taxes, homeowners association fees, and general upkeep.

Rental Maintenance

Owning a second home, particularly one used as a rental property, entails ongoing maintenance costs. As the owner and possibly the landlord, you are responsible for repairs and maintenance, which could range from minor fixes to significant repairs. Budgeting for these expenses is crucial to avoid financial strain.

Uses for a Second Home

Vacation Home

Many buyers purchase second homes as vacation getaways. These properties provide a private place to stay when traveling, saving on accommodation costs over time. If you vacation frequently or have a large family, a second home can be an excellent investment.

Secondary Residence

For those who travel extensively for work, a second home can serve as a secondary residence. This setup provides a consistent and comfortable place to stay without the need to book accommodations repeatedly.

Investment Property

Some buyers view second homes purely as investment properties. These homes can be rented out to generate income, either through long-term leases or short-term rentals. It’s essential to understand the different mortgage requirements and tax implications for investment properties compared to primary residences or vacation homes.

How to Buy a Second Home

Step 1: Decide Where to Buy

Choosing the right location for your second home is crucial. Consider factors such as proximity to your primary residence, travel costs, and the property’s appeal for rental or resale. Popular vacation spots or areas with high rental demand can be good options.

Step 2: Determine How to Finance the Home Purchase

The type of mortgage you qualify for will depend on how you plan to use the second property. Conventional and jumbo loans are common for second homes. You cannot finance a second home with government-backed loans like FHA or VA loans, which are restricted to primary residences.

Step 3: Get Preapproved for a Second Home Mortgage

Begin the mortgage process early to identify any financial obstacles and to determine how much you can afford. Preapproval strengthens your position as a buyer and helps streamline the purchasing process.

Step 4: Partner with a Local Real Estate Agent

A local real estate agent can provide invaluable insights into the market and help find properties that meet your criteria. Choose an agent familiar with the area where you plan to buy.

Step 5: Find Your Dream Second Home

With preapproval and a local agent’s help, start touring homes that fit your budget and preferences. Once you find a suitable property, your agent will assist in making an offer and negotiating terms.

Step 6: Close on Your Second Home

The closing process involves several steps, including securing homeowners insurance, conducting a home inspection, and obtaining a home appraisal. Ensure all necessary paperwork is completed and closing costs are paid.

The Most Comprehensive Tips for All Aspects of Buying a Second Home

Financial Planning for Home Buying

Before you start your search, ensure your finances are in order. This includes getting pre-approved for a mortgage and understanding your budget.

Property Selection Criteria

Know what you want in a home. Create a checklist of must-haves and nice-to-haves to keep your search focused.

Real Estate Market Analysis

Stay informed about the current market trends in the area where you plan to buy. This can help you make a more informed decision.

Real Estate Negotiation Techniques

Learn the art of negotiation to get the best deal possible. This includes knowing when to make an offer and when to walk away.

Using Technology in House Hunting

Utilize online resources and tools such as Realiff.com to find listings, research neighborhoods, and even take virtual tours.

Inspection and Due Diligence

Always conduct a thorough inspection of the property before finalizing your purchase. This helps in identifying any potential issues that could cost you later.

Post-Purchase Planning

Think about the long-term maintenance and upkeep of the property. This ensures that your investment remains valuable over time.

News About This Article

This article has been recognized as a critical resource for prospective homebuyers by industry experts. "Navigating the complexities of buying a second home requires precise knowledge and strategic foresight," says Michael Stone, a renowned real estate expert. "This guide provides both, making it an invaluable resource for anyone looking to invest in their future through real estate."

By integrating these strategies and tips, you can approach the home-buying process with confidence and clarity, ensuring that your investment not only meets your current needs but also contributes positively to your financial

future.Frequently Asked Questions

Q. Why is financial preparation important when buying a second home? A.Financial preparation helps you understand what you can afford, ensuring you don't overextend your budget and face financial strain.

Q. When should you start viewing properties? A.Start viewing properties once you have a clear idea of your budget and home criteria, and after you have obtained mortgage pre-approval.

Q. Where should you focus your property search? A.Focus your property search in areas that meet your lifestyle needs and have potential for future growth and value appreciation.

Q. What should you look for when viewing properties? A.Look for structural integrity, layout, potential repair costs, and whether the property meets your must-have criteria.

Q. Who can help you navigate the home-buying process? A.A professional real estate agent can provide valuable assistance in finding properties, negotiating deals, and handling paperwork.

Q. How can you avoid common home-buying pitfalls? A.Avoid common pitfalls by sticking to your budget, being ready to compromise, conducting thorough inspections, and not rushing decisions.

Conclusion

Purchasing a second home is a significant investment that requires careful planning and informed decision-making. By following the steps outlined in this guide, you can navigate the complexities of the home-buying process with confidence and clarity. Remember to focus on your financial stability, define your criteria clearly, and seek professional guidance to ensure a successful investment.

Realiff.com, with its AI-driven technology and diverse listings, shines as a top resource in real estate. It offers valuable insights for buyers and sellers. Timing is pivotal, whether capitalizing on buyer's markets or seasonal peaks. Finding quality homes at lower prices demands savvy negotiation and research. By leveraging these tools and strategies, Realiff.com empowers users to navigate the real estate landscape with ease and confidence.