Should I buy or rent a house in California in 2023?

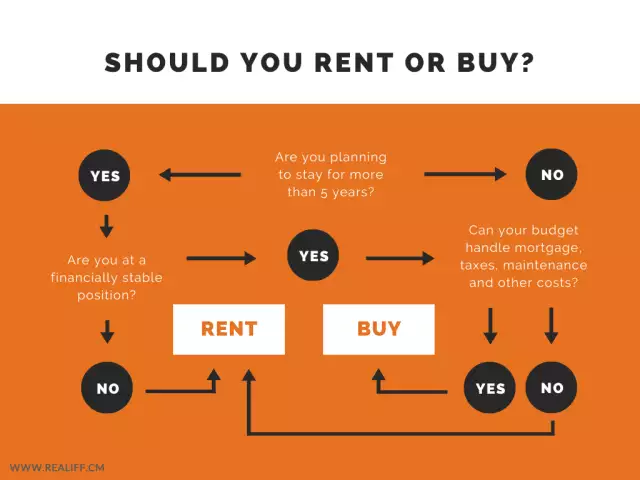

The decision to buy or rent a house in California in 2023 will depend on your personal circumstances and financial situation. Buying a house can be a good investment if you plan to live in the same area for an extended period of time and if the housing market is stable or appreciating. Renting may be a better option if you are not ready for the financial commitment of buying a house, if you are not sure how long you will stay in the area, or if the housing market is not favorable for buyers. It's also important to consider your personal needs, like the size and location of the property, and the cost of living, and taxes, in your area. It would be best to consult a real estate professional or a financial advisor to help you weigh the pros and cons of buying or renting a house in California in 2023 based on your unique situation.

There are several factors that should be considered when deciding whether to buy or rent a house, including:

- Financial stability: Buying a house requires a significant financial investment, so it's important to consider your current financial situation and your ability to make a down payment, pay closing costs, and cover ongoing expenses such as mortgage payments, property taxes, and maintenance.

- Length of stay: If you plan to live in the same area for an extended period of time, buying a house may be a better option, as the costs of renting can add up over time.

- Housing market conditions: If the housing market is stable or appreciating, buying a house may be a good investment. However, if the market is declining or uncertain, it may be wise to rent.

- Flexibility: Renting allows for more flexibility to move when necessary, whereas buying a house typically requires a longer-term commitment.

- Personal needs: Consider the size and location of the property, and the cost of living, and taxes, in your area.

- Tax implications: Owning a house can provide tax benefits, such as deductions for mortgage interest and property taxes, but renting also has its own tax benefits like being able to deduct rental losses.

It's recommended to consult a financial advisor or a real estate professional who can help you evaluate your specific situation and determine whether buying or renting a house is the best option for you based on your specific needs and financial situation.

Here is an example of calculations comparing buying vs renting a house:

Assume that you're considering buying a house for $300,000 with a down payment of 20%, and a 30-year fixed-rate mortgage at 3% interest.

The monthly mortgage payment would be approximately $1,200 (not including property taxes, insurance and other related costs).

If you were to rent the same house, the monthly rent might be $1,500.

If you were to buy, after 30 years, you will have paid a total of around $432,000 for the house, and you'll own the house.

If you were to rent, after 30 years, you will have paid a total of around $547,000 in rent with no assets to show for it.

It is important to note that this is just a hypothetical example, and the actual costs and benefits of buying vs renting will depend on a variety of factors, including the specific housing market, the interest rate of your mortgage, and your personal financial situation. Additionally, there are other expenses to consider when buying a house such as closing costs, property taxes, insurance, and maintenance, which also have to be considered.

Overall we'd suggest using a buy-vs-rent calculator or getting a more detailed insight about this topic.

A buy vs rent calculator is a tool that can help you compare the costs of buying a house with the costs of renting a similar property. The calculator typically takes into account factors such as the purchase price of the house, the down payment, the interest rate on the mortgage, the property taxes, insurance, and any other relevant costs. It also takes into account the rental cost of a similar property, and the length of time you plan to live in the area.

With this information, the calculator can estimate the total costs of buying and renting over a specified period of time, typically over a period of 5, 10, 20 or 30 years. The calculator then compares the total costs of buying with the total costs of renting, and helps you determine which option is financially more viable for you. Some calculators also factor in other expenses such as closing costs, maintenance and home appreciation, which can help you make a more informed decision.

It's important to note that these calculators are based on assumptions and estimates, and the actual costs and benefits of buying vs renting will depend on a variety of factors, including the specific housing market, the interest rate of your mortgage, and your personal financial situation. Additionally, it's recommended to consult a financial advisor or a real estate professional to help you evaluate your specific situation and determine whether buying or renting a house is the best option for you based on your specific needs and financial situation.

Here are some examples of rent-vs-buy calculators:

- https://www.nerdwallet.com/mortgages/rent-vs-buy-calculator

- https://www.nytimes.com/interactive/2014/upshot/buy-rent-calculator.html

- https://smartasset.com/mortgage/rent-vs-buy