Renting vs buying: considerations for young professionals

Renting vs buying a home is a decision that young professionals must make at some point in their lives. While both options have their pros and cons, it's essential to consider your financial situation, lifestyle, and long-term goals when making a decision.

One of the main advantages of renting is the flexibility it provides. Renters are not tied down to a specific location and can move whenever they want. This is ideal for young professionals who may need to relocate for work or other opportunities. Additionally, renters don't have to worry about the costs associated with maintaining a home, such as repairs, landscaping, and property taxes.

On the other hand, buying a home has several benefits, including building equity and having a stable place to call your own. When you purchase a home, you're investing in an asset that can appreciate in value over time. Additionally, homeownership can provide a sense of stability and belonging that renting cannot.

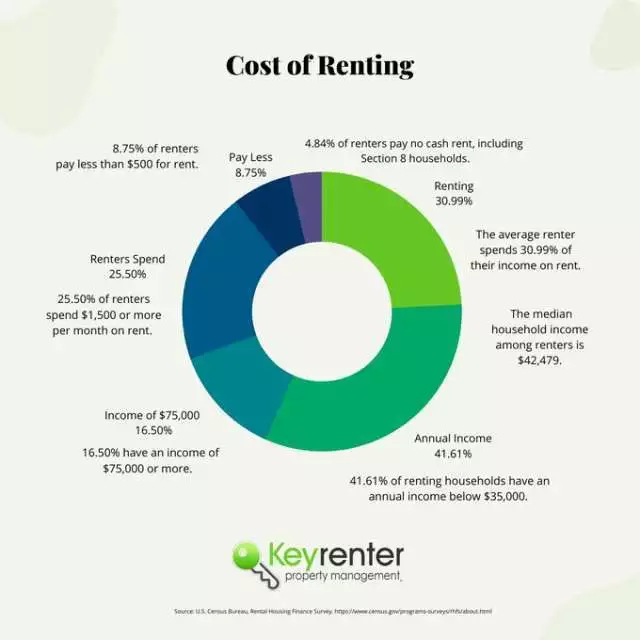

When it comes to finances, buying a home can be more expensive in the short-term. The down payment and closing costs can be significant, and mortgage payments may be higher than rent payments. However, in the long-term, owning a home can be more cost-effective. Renters may find themselves paying more money in the long run because they're not building equity in a home. Additionally, property values have historically appreciated over time, which can provide a solid return on investment for homeowners.

Another consideration for young professionals is the impact of homeownership on their finances. As a homeowner, you'll be responsible for maintaining and repairing your home, which can add up over time. Additionally, property taxes and mortgage interest can be significant expenses. However, these costs can be offset by the ability to claim deductions on your taxes.

Ultimately, the decision to rent or buy a home is a personal one and will depend on individual circumstances. Young professionals should consider their financial situation, lifestyle, and long-term goals when making a decision. It's also important to consult with a financial advisor to understand the long-term financial implications of both options.

The flexibility of renting

The flexibility of renting is one of the major advantages that it has over homeownership. Renters have the freedom to move whenever they want without being tied down to a specific location. This is especially beneficial for young professionals who may need to relocate for work or other opportunities.

In addition, renters do not have to worry about the costs associated with maintaining a home such as repairs, landscaping, and property taxes. This can save a considerable amount of money and time for the renters. They can just focus on their jobs, career and personal lives without having to worry about the added responsibilities that come with homeownership.

Renting also offers the flexibility to try out different neighborhoods and lifestyles before committing to a long-term purchase. It allows individuals to test drive a neighborhood, see how they like it, and then decide if they want to make a long-term commitment.

However, it's important to note that renting does not provide the same sense of stability and belonging that homeownership can offer. Additionally, renters may find themselves paying more money in the long run because they're not building equity in a home. But for those who value flexibility and the ability to move around easily, renting can be the perfect option.

The main pros and cons of renting vs buying a home are:

Pros of Renting:

- Flexibility: Renters have the freedom to move whenever they want without being tied down to a specific location.

- Low maintenance costs: Renters do not have to worry about the costs associated with maintaining a home such as repairs, landscaping, and property taxes.

- No long-term commitment: Renting allows individuals to try out different neighborhoods and lifestyles before committing to a long-term purchase.

Cons of Renting:

- No equity: Renters are not building equity in a property, and all the money goes to the landlord.

- Limited control over the property: Renters are limited in their ability to make changes to the property, and must seek the landlord's permission.

- Rent may increase over time: The cost of rent can increase over time, making it difficult to budget and plan long-term.

Pros of buying a home:

- Building equity: When you purchase a home, you're investing in an asset that can appreciate in value over time, and you're building equity.

- Sense of stability and belonging: Homeownership can provide a sense of stability and belonging that renting cannot.

- Tax benefits: Homeowners can claim deductions on their taxes for mortgage interest and property taxes, and may be able to exclude a portion of the gain from their income when they sell the home.

Cons of buying a home:

- High up-front costs: The down payment and closing costs can be significant, and mortgage payments may be higher than rent payments.

- Maintenance costs: Homeowners are responsible for maintaining and repairing their home, which can add up over time.

- Limited flexibility: Once you've bought a home, you're tied to that location and may find it difficult to relocate.

Building equity through homeownership: The long-term benefits

Building equity through homeownership is one of the most significant long-term benefits of buying a home. When you purchase a home, you're investing in an asset that can appreciate in value over time. As you make your mortgage payments, you're paying down the loan and increasing your ownership stake in the property. This is known as building equity.

Homeownership also provides a sense of stability and belonging that renting cannot. When you own a home, you have the freedom to make changes to the property as you see fit and can create a space that truly reflects your personality and lifestyle. This sense of stability and belonging can have a positive impact on your overall well-being.

Additionally, homeownership can have a significant impact on your financial situation. As you build equity in your home, you have the option to borrow against it to make other investments or to make home improvements. Furthermore, when you sell your home, you can typically make a profit, which can be used to purchase another home or to invest in other assets.

However, it's essential to remember that homeownership is a significant financial commitment. The down payment and closing costs can be significant, and mortgage payments may be higher than rent payments. Additionally, homeowners are responsible for maintaining and repairing their home, which can add up over time.

In conclusion, Building equity through homeownership is a long-term benefit that can have a significant impact on your financial situation, your sense of belonging and stability, and your overall well-being. It's important to consider the long-term financial implications, the benefits and drawbacks, and your lifestyle when making a decision to buy a home. It's also important to consult with a financial advisor to understand the long-term financial implications of homeownership and make an informed decision that best suits your needs.

The flexibility of renting: Advantages for young professionals

The flexibility of renting is one of the main advantages it has over homeownership, particularly for young professionals. Renters have the freedom to move whenever they want without being tied down to a specific location. This is especially beneficial for young professionals who may need to relocate for work or other opportunities. They can easily move to new cities, towns or even countries without having to worry about the sale of their property or the legal process of transferring the ownership.

In addition, renting allows young professionals to try out different neighborhoods and lifestyles before committing to a long-term purchase. It allows them to test drive a neighborhood, see how they like it, and then decide if they want to make a long-term commitment. This is particularly useful for those who are new to a city and want to explore different neighborhoods before buying a home.

Renters also do not have to worry about the costs associated with maintaining a home such as repairs, landscaping, and property taxes. This can save a considerable amount of money and time for the renters. They can just focus on their jobs, career and personal lives without having to worry about the added responsibilities that come with homeownership.

However, it's important to note that renting does not provide the same sense of stability and belonging that homeownership can offer. Additionally, renters may find themselves paying more money in the long run because they're not building equity in a home. But for young professionals who value flexibility and the ability to move around easily, renting can be the perfect option.

In conclusion, The flexibility of renting is an advantage that can be particularly beneficial for young professionals. It offers freedom of movement, the ability to try out different neighborhoods, and low maintenance costs. However, it's important to weigh the pros and cons and consider how it aligns with your long-term goals and lifestyle.

The 5 rule when comparing renting vs buying

The 5% rule is a general guideline that compares the cost of renting a property to the cost of owning it. The rule states that if the cost of renting a property is more than 5% less than the cost of owning it, then renting is the better option. On the other hand, if the cost of owning a property is more than 5% less than the cost of renting it, then buying is the better option.

This rule takes into account various factors such as the cost of rent, mortgage payments, property taxes, insurance, and maintenance expenses. It's a quick and easy way to compare the costs of renting vs buying, but it's important to remember that it's just a rough estimate and other factors such as personal preferences and long-term goals should be considered as well. It's always recommended to consult with a financial advisor to make an informed decision that best suits your needs.

Frequently Asked Questions about Renting vs buying

Q: How do I decide whether to rent or buy a home? A: The decision to rent or buy a home is a personal one and will depend on your financial situation, lifestyle, and long-term goals. It's essential to consider the long-term financial implications, the benefits and drawbacks, and your lifestyle when making a decision. It's also important to consult with a financial advisor to understand the long-term financial implications of both options.

Q: Are there any tax benefits to owning a home? A: Yes, there are tax benefits to owning a home. As a homeowner, you may be eligible to claim deductions on your taxes for mortgage interest and property taxes. Additionally, when you sell your home, you may be able to exclude a portion of the gain from your income. It's important to consult with a tax professional to understand the tax implications of homeownership.

Q: Will I build equity by renting? A: No, when you rent a home, you're not building equity. You're paying money towards someone else's mortgage, and you don't own any part of the property. When you buy a home, you're investing in an asset that can appreciate in value over time and building equity.

Q: Can I still invest in other assets if I buy a home?

A: Yes, you can still invest in other assets if you buy a home. However, it's essential to keep in mind that homeownership can be a significant financial commitment and may limit your ability to invest in other assets. It's important to consult with a financial advisor to understand the long-term financial implications of both options.

Q: How much money do I need for a down payment to buy a home?

A: The amount of money you'll need for a down payment will depend on the type of mortgage you're applying for and the price of the home. In general, you'll need to have a minimum of 3% to 5% of the home's purchase price for a down payment. However, it's important to note that the more money you can put down, the lower your monthly mortgage payment will be.

In conclusion, whether you choose to rent or buy, it's important to consider the long-term financial implications, the benefits and drawbacks, and your lifestyle. The decision to rent or buy a home is a huge one, and it's essential to weigh all your options and make an informed decision that best suits your needs as a young professional.