How Rent-to-Own Housing Agreements Operate

If you're in the market for a new home, you may have come across the term "rent to own." This type of agreement allows renters to pay rent for a certain period and then have the option to buy the propertyat the end of the lease. In this blog post, we'll dive into the specifics of how rent-to-own homes work.

What is a rent-to-own Home?

A rent-to-own home is a type of housing agreement that allows a tenant to live in a property for a specified period and eventually purchase the property if they choose to. This type of agreement combines aspects of renting and buying, offering tenants the opportunity to build equity in a property while they live in it.

Rent-to-own agreements are typically structured so that a portion of the rent paid by the tenant goes toward the purchase price of the property. The percentage of the rent that goes towards the purchase price is negotiated between the tenant and landlord at the outset of the agreement. The total amount of rent that goes towards the purchase price is often referred to as the "rent credit."

In addition to the rent credit, the tenant may be required to pay an option fee at the outset of the agreement. The option fee gives the tenant the right to purchase the property at the end of the lease. This fee is typically non-refundable and can range from a few hundred to several thousand dollars.

Rent-to-own agreements typically last between one and three years, although the duration can be longer or shorter depending on the agreement. At the end of the lease, the tenant has the option to purchase the property at the agreed-upon price. If the tenant chooses not to purchase the property, they forfeit the option fee and any rent credits they have accumulated.

Rent-to-own agreements are legally binding contracts, and both parties need to understand the terms of the agreement before signing. It's advisable to work with a real estate attorney to ensure the agreement is fair and legally sound.

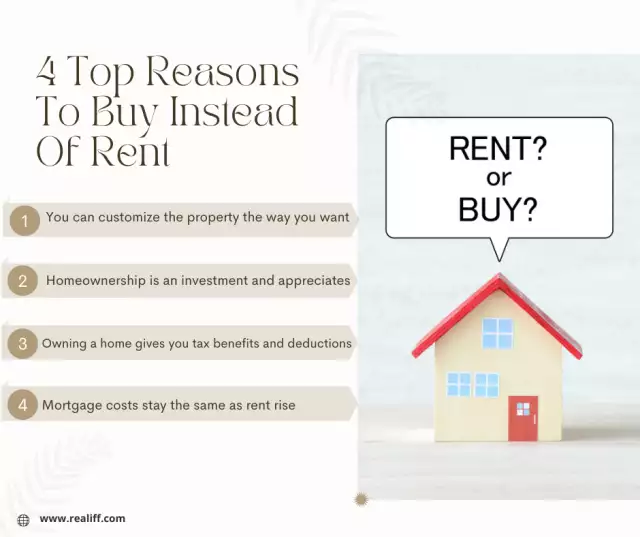

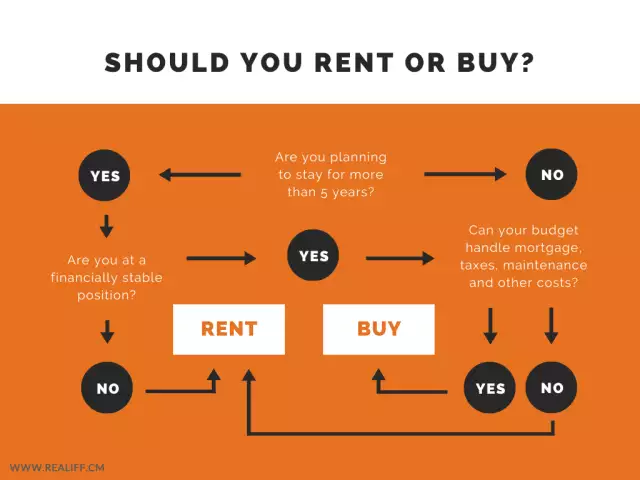

Rent-to-own homes can be an attractive option for people who are not yet ready to commit to a mortgageor who may not have a large down payment saved up. However, it's important to carefully consider the terms of the agreement and weigh the potential benefits and drawbacks before entering into a rent-to-own agreement.

How Does it Work?

The rent-to-own process typically involves the following steps:

- Agreement and Terms: The tenant and landlord agree on the purchase price of the home, the duration of the lease, the option fee (if any), and the percentage of the rent that will go toward the purchase price.

- Rent Payments: The tenant pays rent every month, with a portion of the rent going toward the purchase price. The portion of the rent that goes towards the purchase price is known as the "rent credit."

- Option Fee: The tenant may be required to pay an option fee, which gives them the right to purchase the property at the end of the lease. This fee is typically non-refundable and can range from a few hundred to several thousand dollars.

- Purchase Option: At the end of the lease, the tenant has the option to purchase the property at the agreed-upon price. If the tenant chooses not to purchase the property, they forfeit the option fee and any rent credits they have accumulated.

Benefits of Rent-to-own Homes

There are several benefits to renting to own a home, including:

- Opportunity to Build Equity: A portion of the rent goes towards the purchase price of the home, allowing the tenant to build equity over time.

- Flexibility:rent-to-own agreements typically offer more flexibility than traditional mortgages, allowing tenants to move in with less money down and giving them the option to purchase the property at the end of the lease.

- Time to Save for a Down Payment:rent-to-own agreements give tenants time to save up for a down payment on the property.

- Test Drive the Home:rent-to-own agreements allow tenants to "test drive" the property before committing to a purchase.

Considerations forrent-to-own Homes

While there are benefits to renting to own a home, there are also several considerations to keep in mind, including:

- Higher Monthly Payments:rent-to-own agreements typically have higher monthly payments than traditional rental agreements.

- Potential for Lost Money: If the tenant chooses not to purchase the property at the end of the lease, they forfeit the option fee and any rent credits they have accumulated.

- Responsibility for Maintenance: In most rent-to-own agreements, the tenant is responsible for the maintenance and repairs of the property.

- Legal Considerations:rent-to-own agreements are legally binding contracts, and it's important to work with a real estate attorney to ensure the agreement is fair and legally sound.

Frequently asked questions about rent-to-own homes:

- How is rent-to-own different from traditional renting?

In a traditional rental agreement, the tenant pays rent to the landlord but has no ownership interest in the property. In an arent-to-own agreement, a portion of the rent paid by the tenant goes towards the purchase price of the property, and the tenant has the option to purchase the property at the end of the lease.

- Is rent-to-own a good option for people with bad credit?

Rent-to-own agreements can be a good option for people with bad credit who are not yet ready to commit to a mortgage. However, it's important to carefully consider the terms of the agreement and ensure that the monthly payments are affordable.

- Can a tenant back out of a rent-to-own agreement?

If the tenant decides not to purchase the property at the end of the lease, they forfeit the option fee and any rent credits they have accumulated. However, if the tenant is unable to continue making the monthly payments, they may be able to terminate the agreement early.

- Who is responsible for repairs and maintenance in a rent-to-own agreement?

In most rent-to-own agreements, the tenant is responsible for the maintenance and repairs of the property, as they would be in a traditional rental agreement.

- How is the purchase price of the property determined in the rent-to-own agreement?

The purchase price of the property is typically negotiated between the tenant and landlord at the outset of the agreement. The purchase price may be based on the current market value of the property or may be set at a predetermined amount.

Conclusion

Rent-to-own homes offer a unique opportunity for renters to become homeowners. By paying rent towards the purchase price of the home, tenants can build equity over time and potentially become homeowners at the end of the lease. However, it's important to carefully consider the terms of the agreement and work with a real estate attorney to ensure the agreement is fair and legally binding.