Homeownership regrets: A glimpse into what buyers wish they knew before getting a home loan and their biggest mistakes

Homeownership regrets: A glimpse into what buyers wish they knew before getting a home loan and their biggest mistakes

Before getting a home loan, homebuyers should be aware of the following:

- Credit Score: Your credit score will play a big role in determining the interest rate and terms of your loan. It's important to check your credit score before applying for a loan and take steps to improve it if necessary.

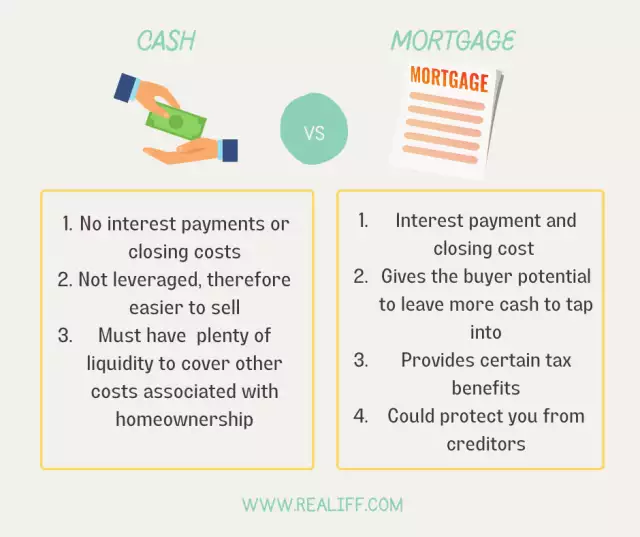

- Down Payment: A down payment is the amount of money you pay upfront when purchasing a home. The size of your down payment can affect the interest rate and terms of your loan.

- Interest Rate: The interest rate on your loan will determine how much you pay over the life of the loan. It's important to shop around and compare rates from different lenders to find the best deal.

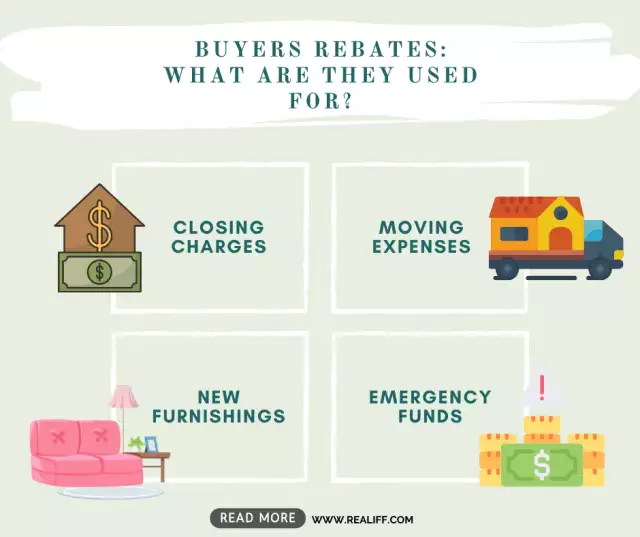

- Closing Costs: Closing costs are the fees associated with closing on a mortgage. These costs can vary depending on the lender and can include appraisal fees, title search fees, and other miscellaneous expenses.

- Pre-approval: Getting pre-approved for a home loan can help you understand how much home you can afford and can also give you an advantage when making an offer on a home.

- Loan terms: Make sure you understand the loan terms, the type of loan, the interest rate, the length of the loan and any other contingencies or fees.

Homebuyers biggest regrets when it comes to getting a home loan

- Not shopping around: Not comparing rates and fees from different lenders can lead to paying more than necessary in interest and fees.

- Not understanding the loan terms: Not fully understanding the terms of the loan can lead to unexpected costs and fees down the line.

- Not considering all the costs: Not factoring in closing costs and other miscellaneous expenses can lead to unexpected costs at closing.

- Not understanding the true cost of the home: Not understanding the true cost of the home can lead to financial strain and difficulty in making payments.

- Not taking into account future changes in income or employment: Not considering the possibility of changes in income or employment can lead to difficulty in making payments in the future.

By being aware of these factors and taking the time to research and compare different options, homebuyers can make a more informed decision and avoid common regrets when it comes to getting a home loan.

You can contact us to get more choices