Update From Jake: Some Amazing News, Coming Podcasts

Update From Jake: Some Amazing News, Coming Podcasts

!!!!SOME AMAZING NEWS COMING!!!!

You can contact us to get more choices

0

You can contact us to get more choices

Related posts

!!!!SOME AMAZING NEWS COMING!!!!

!!!!SOME AMAZING NEWS COMING!!!!

Market Update: Rates Unchanged; Consumer Price Index Coming Up This Week Blog posted On September 12, 2022

Mortgage rates ended last week relatively unchanged from the week before, or slightly lower in some cases. This week’s rate volatility could be higher as the consumer price index is scheduled for release and the Federal Reserve is it its usual public comment ‘blackout’ prior to the Federal Open Market Committee (FOMC) meeting next week. The consumer pric...

Market Update: Rates Unchanged; Consumer Price Index Coming Up This Week Blog posted On September 12, 2022

Mortgage rates ended last week relatively unchanged from the week before, or slightly lower in some cases. This week’s rate volatility could be higher as the consumer price index is scheduled for release and the Federal Reserve is it its usual public comment ‘blackout’ prior to the Federal Open Market Committee (FOMC) meeting next week. The consumer pric...

Mortgage rates trended upward last week for different reasons. Although the Federal Reserve hiked the benchmark interest rate, the market reacted more positively to Fed Chairman Jerome Powell’s statement that “the committee isn't even considering raising rates by more than 0.50% at any subsequent meeting,” writes Mortgage News Daily Chief Operating Officer Matthew Graham. Towards the end of the week, they began trending upward again. “In the case of the bond market, unwinding th...

Mortgage rates trended upward last week for different reasons. Although the Federal Reserve hiked the benchmark interest rate, the market reacted more positively to Fed Chairman Jerome Powell’s statement that “the committee isn't even considering raising rates by more than 0.50% at any subsequent meeting,” writes Mortgage News Daily Chief Operating Officer Matthew Graham. Towards the end of the week, they began trending upward again. “In the case of the bond market, unwinding th...

Be Sure You Have Ordinance and Law Coverage By Paul J. Smith, Founder and President, SoCal Commercial Insurance Services, Inc. So, here’s the scenario…let’s assume the unthinkable has happened – there’s been a fire and your building has sustained heavy damage! At least no one was injured. It’s going to be okay – you’d purchased insurance with a reputable company and made sure that you insured the building at its full replacement value. The only problem is that insurance po...

Be Sure You Have Ordinance and Law Coverage By Paul J. Smith, Founder and President, SoCal Commercial Insurance Services, Inc. So, here’s the scenario…let’s assume the unthinkable has happened – there’s been a fire and your building has sustained heavy damage! At least no one was injured. It’s going to be okay – you’d purchased insurance with a reputable company and made sure that you insured the building at its full replacement value. The only problem is that insurance po...

Podcasts are a great resource for mortgage professionals to continue learning, with shows covering industry updates, business advice and the experiences of other pros in the mortgage industry.

The post 21 podcasts mortgage professionals should be learning from appeared first on HousingWire.

Podcasts are a great resource for mortgage professionals to continue learning, with shows covering industry updates, business advice and the experiences of other pros in the mortgage industry.

The post 21 podcasts mortgage professionals should be learning from appeared first on HousingWire.

As Tim and Julie Harris predicted there are MORE bailout programs coming. More 'lifelines' that every agent (and small business owner) needs to be embracing. Question for you: If the Government really believed there was going to be a V shaped, fast recovery in the economy why would they be creating more stimulus? For example, it appears that UNEMPLOYMENT will be extended through the end of the year! What will happen in housing for the remainder of 2020..listen now.

Schedule A Free Coaching CallL...

As Tim and Julie Harris predicted there are MORE bailout programs coming. More 'lifelines' that every agent (and small business owner) needs to be embracing. Question for you: If the Government really believed there was going to be a V shaped, fast recovery in the economy why would they be creating more stimulus? For example, it appears that UNEMPLOYMENT will be extended through the end of the year! What will happen in housing for the remainder of 2020..listen now.

Schedule A Free Coaching CallL...

Market Update: Rates Fall; Job Openings Coming Up This Week Blog posted On July 04, 2022

Last week, mortgage rates trended downward to reach their lowest level in over a week. A large contributor was the personal consumption expenditures (PCE) index, which is the Federal Reserve’s preferred method of measuring inflation. May’s PCE index revealed that spending was slightly cooler than expected. Inflation is the enemy of bonds, and mortgage rates closely follow the b...

Market Update: Rates Fall; Job Openings Coming Up This Week Blog posted On July 04, 2022

Last week, mortgage rates trended downward to reach their lowest level in over a week. A large contributor was the personal consumption expenditures (PCE) index, which is the Federal Reserve’s preferred method of measuring inflation. May’s PCE index revealed that spending was slightly cooler than expected. Inflation is the enemy of bonds, and mortgage rates closely follow the b...

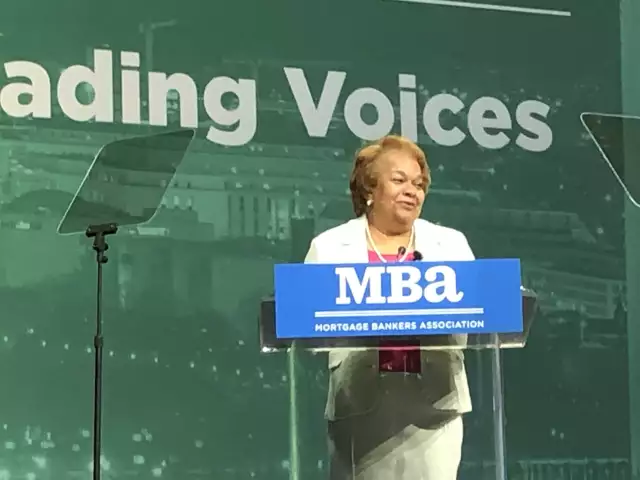

The Federal Housing Finance Agency announced Monday that it will waive upfront fees for certain borrowers and affordable mortgage products. The agency is also moving to replace the outdated credit score model used by Fannie Mae and Freddie Mac. The elimination of upfront fees for underserved borrowers will go into effect as soon as possible, FHFA Director Sandra Thompson said during the Mortgage Bankers Association's annual convention in Nashville.The transition from Classic FICO, which has bee...

The Federal Housing Finance Agency announced Monday that it will waive upfront fees for certain borrowers and affordable mortgage products. The agency is also moving to replace the outdated credit score model used by Fannie Mae and Freddie Mac. The elimination of upfront fees for underserved borrowers will go into effect as soon as possible, FHFA Director Sandra Thompson said during the Mortgage Bankers Association's annual convention in Nashville.The transition from Classic FICO, which has bee...

Your home can harbor different odors for different reasons. One of the most common reasons your home may have an odor is because of your HVAC system. Other reasons for house odors coming through the air ducts in your home could be a gas leak or other malfunction. There could be a more serious reason …

The post Bad Smell Coming From One Vent in House appeared first on Millennial Homeowner.

Your home can harbor different odors for different reasons. One of the most common reasons your home may have an odor is because of your HVAC system. Other reasons for house odors coming through the air ducts in your home could be a gas leak or other malfunction. There could be a more serious reason …

The post Bad Smell Coming From One Vent in House appeared first on Millennial Homeowner.

Update on distressed property...

-22 million jobs lost

-Peak of Forbearance requests was March of 2020 when 8% of mortgages were in forbearance.

-Averaging more coming OUT of Forbearance than going IN.

-87% of Forbearances are successful

-400,000 new ones expected to default plus 250,000 already in system = 650,000 total. During housing crash there were 2 million total.

Are you ready to join EXP REALTY? Choose Tim and Julie Harris as your sponsor! Text Tim directly 512-758-0206.

Will there be ...

Update on distressed property...

-22 million jobs lost

-Peak of Forbearance requests was March of 2020 when 8% of mortgages were in forbearance.

-Averaging more coming OUT of Forbearance than going IN.

-87% of Forbearances are successful

-400,000 new ones expected to default plus 250,000 already in system = 650,000 total. During housing crash there were 2 million total.

Are you ready to join EXP REALTY? Choose Tim and Julie Harris as your sponsor! Text Tim directly 512-758-0206.

Will there be ...