President Biden Plans To Bring Down Housing Costs, but Will He Be Successful?

President Biden Plans To Bring Down Housing Costs, but Will He Be Successful?

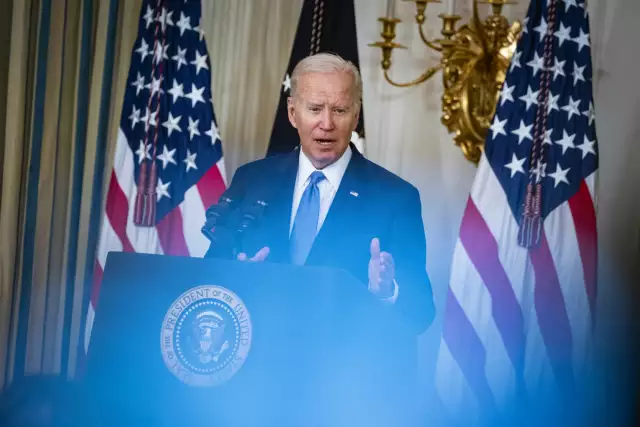

President Joe Biden has a new plan to fix the severe housing shortage that is plaguing America, leading to record-high home and rental prices. The fate of the nation’s housing market hangs in the balance.

The administration’s Housing Supply Action Plan, released on Monday, has an ambitious stated goal: It aims to increase the supply of housing enough to end the inventory shortage within five years.

Much of the plan focuses on providing financial incentives for communities to allow more smaller homes to go up and offer financing for builders who put up more lower-priced housing. The president anticipates the result will be more affordably priced housing available for homebuyers and renters.

“There are some creative ways of tackling the housing shortage. … This plan tries to make it easier to fund building smaller, more affordable units so they actually get built,” says Realtor.com Chief Economist Danielle Hale. However, “it’s unclear how much of a difference all of this will make, especially in the short term.”

Based on demand, the nation is short about 5.8 million single-family homes—which don’t include condos, rental apartments, and other forms of housing, says Hale.

Biden’s plan would make it easier for communities that allow more home construction, including smaller homes and rentals, to receive federal grants. It is also attempting to increase the construction of single-family homes in rural areas.

The president hopes to provide more financing options for builders who preserve and construct affordably priced housing. It would also encourage more manufactured housing, which can include mobile homes, smaller multifamily buildings, and accessory dwelling units. ADUs are usually smaller, standalone dwellings on a homeowner’s property that are often rented out or used for aging parents.

“The Plan will help renters who are struggling with high rental costs, with a particular focus on building and preserving rental housing for low- and moderate-income families,” according to the administration’s document. “The Plan’s policies to boost supply are an important element of bringing homeownership within reach for Americans who, today, cannot find an affordable home because there are too few homes for sale in their communities.”

And the administration hopes new regulations would give homebuyers an edge over investors in many foreclosure auctions. More homes that go into foreclosure that have government-backed loans would be available to buyers who want to live in them and nonprofit organizations for 30 days before the sales would open to large investors. That is an increase from the current 10-day period.

The housing crisis is so pronounced because few homes went up in the aftermath of the Great Recession, when the housing bubble burst. Fast-forward to today, and many millennials are hitting peak homebuying years. They’re a larger generation than Generation X, which came before them.

That means there are more buyers and not enough homes for sale—causing prices to spike.

Renters are feeling financial pain as well. Since many renters can’t find homes for sale, or can’t afford what little is available, they’re forced to continue renting. That extra demand for rentals has boosted prices to all-time highs.

“The housing shortage is a problem that affects Main Street. Most people pay a mortgage or rent every month,” says Hale. “If you want to benefit everyday Americans, tackling the housing shortage is a way to do it.”

Will Biden’s plan solve the housing shortage?

While it’s unclear whether the president will achieve his goal of ending the housing shortage in five years, many believe these new policies can’t hurt.

“It will make a big difference in housing in the very low-income space and government-subsidized space,” says Jerry Howard, CEO of the National Association of Home Builders. But he isn’t convinced it will help most middle-class homebuyers.

“I’m not sure that it’s geared toward what we think is the linchpin of the market: first-time homebuyers,” says Howard.

He would like to see the federal government ease some of the regulations, such as environmental and labor rules, which make it more expensive to put up homes. Many were rolled back under President Donald Trump and then reinstated under Biden.

This newest plan comes on the heels of Biden’s proposed 2023 federal budget. In it, his administration wanted to increase the funding of the U.S. Department of Housing and Urban Development by 21% to expand rental assistance to more low-income tenants, increase the number of affordable housing units available, and help more Americans become homeowners.

The budget, which was released in March, has yet to be approved by Congress.

Biden’s administration is still urging Congress to pass legislation to offer tax credits to build and rehab homes for lower- and middle-income buyers. These properties would not be available to big investors.

The administration has already taken steps to affect the housing market by reducing the duties charged on softwood lumber from Canada. This makes the lumber, used to build homes in the U.S., a little less expensive for builders. Biden has also been fighting racist appraisals and other policies that disproportionately hurt communities of color.

“This is the first time since 1990 that anyone has made housing a federal [priority],” says NAHB’s Howard of the newly produced plan. “We applaud a lot of what’s in there. We think there is more that can be added in it.”