National Mortgage News

Pending home sales fall to second-lowest level on record

Pending home sales fall to second-lowest level on record

U.S. pending home sales fell for a sixth month in November to the second-lowest on record as higher borrowing costs and an uncertain economic outlook kept many potential buyers out of the market.

The National Association of Realtors index of contract signings to purchase previously owned homes decreased 4% last month to 73.9, the lowest outside of the pandemic in data back to 2001, according to a release Wednesday. The drop was worse than all estimates in a Bloomberg survey of economists.

The

... moreU.S. pending home sales fell for a sixth month in November to the second-lowest on record as higher borrowing costs and an uncertain economic outlook kept many potential buyers out of the market.

The National Association of Realtors index of contract signings to purchase previously owned homes decreased 4% last month to 73.9, the lowest outside of the pandemic in data back to 2001, according to a release Wednesday. The drop was worse than all estimates in a Bloomberg survey of economists.

The Federal Reserve's aggressive tightening campaign to cool inflation has had an outsize impact on the housing market in 2022. With borrowing costs roughly double where they were at the start of the year, home sales, and therefore prices, have been declining for months.

Consumers rate current home-buying conditions as the worst since the early 1980s, according to a survey by the University of Michigan. That said, mortgage rates have been retreating after spiking to a two-decade high earlier this year.

"There are approximately two months of lag time between mortgage rates and home sales," Lawrence Yun, NAR's chief economist, said in a statement. "With mortgage rates falling throughout December, home-buying activity should inevitably rebound in the coming months and help economic growth."

Contract signings were down nearly 39% in November from a year ago on an unadjusted basis. Pending sales fell in all four regions in the month, led by the Northeast and Midwest.

Pending home sales are often looked to as a leading indicator of existing-home purchases as properties typically go under contract a month or two before they're sold. The index is based on a sample that covers about 40% of multiple listing service data each month.

less

Surfside safety reforms could spell trouble for Florida condo market

Surfside safety reforms could spell trouble for Florida condo market

From retirees looking to downsize, young professionals trying to snag a starter home or snowbirds in search of a winter getaway, condominiums have long been a staple for anyone seeking a slice of Florida real estate on a budget. But safety legislation that passed earlier this year in the wake of the deadly Surfside building collapse could plunge the condo market into turmoil.

For years, condo associations across the state have deferred routine maintenance and put off budgeting for future repairs in

... moreFrom retirees looking to downsize, young professionals trying to snag a starter home or snowbirds in search of a winter getaway, condominiums have long been a staple for anyone seeking a slice of Florida real estate on a budget. But safety legislation that passed earlier this year in the wake of the deadly Surfside building collapse could plunge the condo market into turmoil.

For years, condo associations across the state have deferred routine maintenance and put off budgeting for future repairs in order to minimize costs for unit owners.

"Whether or not there was enough money to fix the building at some point in the future, that would be somebody else's problem," said Martin Schwartz, a partner at Miami's Bilzin Sumberg law firm, who specializes in condo law.

The new Florida legislation mandates regular inspections for older buildings and requires condo associations to set aside funds for building upkeep.

Some buildings have decades-long maintenance backlogs to rectify.

"Right out of the box it means that everybody who has been waiving reserves, their assessments are going to go up," Schwartz said.

Senate Bill 4-D passed unanimously during a special legislative session in May.

Any building that's 30 years or older must undergo an inspection before Dec. 31 2024 and then every 10 years after. From that point on, condos must perform professional reserve studies every 10 years. They'll also be barred from waiving reserves.

When Scott Rasbach, 64, moved to the Paradise Shores condominium in St. Petersburg three years ago, he paid just $430 a month in maintenance fees. Next year he'll be on the hook for a $600 monthly payment.

The condo association has raised maintenance fees by 30% over the past two years to help replenish its reserves after years of neglect, said Rasbach, the current association president. It also approved a special assessment to replace some of the roofs on the property. That will cost residents an additional $8,000 on average.

Schwartz said the buildings that are in the worst shape tend to be populated by people living on fixed and low incomes. He's concerned that the new law could make housing unaffordable for them.

"I literally have a woman that lives in the building across from me who's 80-some years old, who went and got a job working in some sort of manufacturing plant in order to make the money to pay for the special assessment," Rasbach said.

Others have decided to sell their condos. Over the past year Paradise Shores has seen nearly 50% turnover, mainly from snowbirds who can't justify the cost of a second home given the new fees, Rasbach said.

When the new law goes into effect in 2025, roughly 28,000 condo associations across the state will face the same predicament as Paradise Shores. Some fear it could trigger a fire sale from condo owners trying to cut their losses.

"If your building has been hit with a major assessment, you better be willing to drop your price," said Greg Main-Baillie, executive managing director for the Florida Development Services Group at Colliers.

If too many discounted condos flood the market, it could cause values to plummet across the board.

Some condo associations may decide it's not worth it to try and bring the property up to standard.

"For a lot of these aging buildings, the land that they're on is more valuable than the building itself," said Taylor Collins, a managing partner and co-founder of South Florida real estate group Two Roads Development.

His company works to terminate struggling condo associations so it can buy the buildings and redevelop the land. He said condo owners can get a better price for each unit when the whole association comes together to do a bulk sale.

Still, not every condo is a good candidate for redevelopment. Waterfront properties and buildings in dense downtown areas are more desirable than those off the coast and away from growth.

Though the law may force some condo associations to make difficult decisions in the short term, Collins said it's a necessary step toward improving the safety and longevity of Florida's condos. He noted that many insurance providers are already updating their standards in accordance with the law.

Last year, Paradise Shores saw its insurance premium increase by 29%. This year, their insurer has refused to renew its policy due to a number of lingering maintenance issues. Now they are scrambling to find a new insurer before the policy lapses in April.

Main-Baillie said he expects to see a mad dash from condos trying to secure the capital and labor needed to come into compliance with the new law before 2025.

"Unfortunately board members don't always have the experience or knowledge of construction management to be able to keep the community out of risk," he said. "The engineers and contractors in this environment take advantage of the scenario pretty often."

He said condo associations should consider hiring a professional manager to protect themselves as they embark toward an uncertain future.

less

PrimeLending launches new mortgage business with Texas homebuilder

PrimeLending launches new mortgage business with Texas homebuilder

Bomb cyclone highlights need for remote access to properties

Bomb cyclone highlights need for remote access to properties

The recent winter storm imposing a deep freeze across the United States has done things like cut power and close off roads, raising a challenge for servicers that need home inspections.

"The bomb cyclone is front-and-center in my mind right now…There are going to be a lot of areas that are inaccessible," said Mark Walser, president, Incenter Appraisal Management, a unit that also works with inspectors and offers remote technology.

The sudden storm, like other types of disasters that

... moreThe recent winter storm imposing a deep freeze across the United States has done things like cut power and close off roads, raising a challenge for servicers that need home inspections.

"The bomb cyclone is front-and-center in my mind right now…There are going to be a lot of areas that are inaccessible," said Mark Walser, president, Incenter Appraisal Management, a unit that also works with inspectors and offers remote technology.

The sudden storm, like other types of disasters that create home-access issues for third parties, highlights how remote automation tools that helped mortgage companies work with owners to get property information during the pandemic keeps evolving.

It was too early to know the full scope of need for such automation in response to the bomb cyclone at deadline, but some mortgage companies confirmed that they've used the technology to handle access challenges in other disasters and would employ it again.

"The inspections were quick, easy for the customer because they just had to hold their phone and point it at the home while the remote inspector took the picture," said Lori Reische, chief appraiser, American Pacific Mortgage. APM used the technology during Hurricane Ian.

An interesting interplay between inspections and appraisals has emerged as government-sponsored enterprises that buy a significant number of U.S. mortgages have allowed for the use of some tech-enabled hybrids in certain circumstances. It's not so much an option in the also-large Federal Housing Administration and Department of Veterans Affairs markets, but with a VA modernization bill moving forward, Walser thinks it's possible it could be in the future.

The inspections servicers need to assess properties after a disaster or weather event generally aren't quite as rule-bound and restricted as appraisals or hybrid forms of valuations where an inspector gets involved, so servicers may have more leeway to broadly use automation for them. Incenter's Remote Inspection Technology, which allows the borrower to grant permission and assist the inspector in gathering property information, was adapted from appraisal automation, but is used for a separate purpose.

Incenter

Incenter Mortgage companies generally will have the most luck getting on-site information quickly after a weather event or disaster if they have automation that helps borrowers partner with them on reporting or can help them access an area not otherwise possible to enter in person, according to Jane Mason, CEO of servicing technology provider Clarifire.

"If their bank or nonbank's website has automated workflow, they can click on and say, 'Hey, I'm in a disaster. I've got flooding, I've got snow,'" she said, noting that some servicers still lack this.

"Drones also can go in and give you the basics as to what's happening, which moves the cycle along very rapidly," she added.

"If you think about the bomb cyclone and, and everything everyone's experiencing outdoors, we really have to remember that automation is the way to get everybody the relief that they need," said Mason. "This is just another lesson for servicers that don't have the right technology in place to automate these types of demands."

less

Rocket rolls out special-purpose credit program

Rocket Mortgage rolled out a special-purpose credit program in half a dozen cities across the nation on Tuesday aimed at attracting first-time home buyers in underserved communities. The company noted this is the first phase of its program.

The program, dubbed Purchase Plus, offers up to $7,500 in credits for first-time buyers to use toward their mortgage costs.

Borrowers in designated neighborhoods of Atlanta, Baltimore, Chicago, Detroit, Memphis and Philadelphia, as well as surrounding metropolitan

... moreRocket Mortgage rolled out a special-purpose credit program in half a dozen cities across the nation on Tuesday aimed at attracting first-time home buyers in underserved communities. The company noted this is the first phase of its program.

The program, dubbed Purchase Plus, offers up to $7,500 in credits for first-time buyers to use toward their mortgage costs.

Borrowers in designated neighborhoods of Atlanta, Baltimore, Chicago, Detroit, Memphis and Philadelphia, as well as surrounding metropolitan areas will be able to access the program. The pilot was introduced in specific census tracts because they are areas "where the initiative can make the largest impact."

Emily Elconin/Bloomberg

Emily Elconin/Bloomberg The credits can be put specifically towards a down payment, which eliminates a significant hurdle towards homeownership, the company said.

"[We're] addressing a concern we've heard time and again – the difficulty of saving for out-of-pocket expenses when buying a home," said Bob Walters, CEO of Rocket Mortgage, in a written statement.

Rocket's special-purpose credit program, which it calls a "catalyst" for helping to narrow the homeownership gap, provides eligible home buyers a base credit of $5,000 and an additional lender credit totaling 1% of the home's purchase price (up to $2,500).

A similar pilot program was introduced by Legacy Home Loans in September.

Legacy's SPCP is similarly being tested in Atlanta, Baltimore, Chicago, Detroit, Memphis and Philadelphia. The program features free home appraisals, warranty and counseling. Financial assistance for closing costs is also available.

Special-purpose credit programs are likely to gain momentum in 2023, as the federal government continues to stress the importance of narrowing the homeownership gap.

Although in existence for decades, SPCPs received renewed attention this summer after government-sponsored enterprises featured them prominently as part of their equitable housing finance plans. Fannie Mae and Freddie Mac both indicated their intent to increase acquisitions of loans originated through such programs.

Meanwhile, depository institutions, including JPMorgan Chase, Bank of America and Wells Fargo, have also jumped on board this year, pledging to develop or expand their versions of the program.

less

Home prices slip for fourth month with U.S. sales market slowing

Home prices slip for fourth month with U.S. sales market slowing

The U.S. housing market continued to sag in October as the impact of higher mortgage rates and concerns over the economy rattled buyers and sellers.

Prices fell 0.5% from September, the fourth consecutive monthly decline for a seasonally adjusted measure of home prices in 20 large cities, according to the S&P CoreLogic Case-Shiller index.

The market began downshifting earlier this year as the Federal Reserve started hiking its benchmark interest rate, with the goal of easing high inflation that's

... moreThe U.S. housing market continued to sag in October as the impact of higher mortgage rates and concerns over the economy rattled buyers and sellers.

Prices fell 0.5% from September, the fourth consecutive monthly decline for a seasonally adjusted measure of home prices in 20 large cities, according to the S&P CoreLogic Case-Shiller index.

The market began downshifting earlier this year as the Federal Reserve started hiking its benchmark interest rate, with the goal of easing high inflation that's been driven in part by skyrocketing housing costs.

Rates for 30-year, fixed mortgages reached 7.08% in October — and again in November — though they have since retreated, Freddie Mac data show. With borrowing costs roughly double where they were at the start of the year, and inflation leaving less savings to put toward a down payment, homebuyers have pulled back. Sellers are also reluctant to list their properties, yet houses that are on the market are lingering and getting discounted as demand slumps.

"As the Federal Reserve continues to move interest rates higher, mortgage financing continues to be a headwind for home prices," Craig Lazzara, managing director at S&P Dow Jones Indices, said in a statement Tuesday. "Given the continuing prospects for a challenging macroeconomic environment, prices may well continue to weaken."

Even as prices fall on a monthly basis, they're still higher than they were a year ago, though the rate of gains has declined. A nationwide gauge was up 9.2% in October from a year earlier, down from 10.7% in September.

The largest annual price increases were in Miami; Tampa, Florida; and Charlotte, North Carolina. In Miami, prices gained 21% year over year.

less

Banks expanding special-purpose credit programs

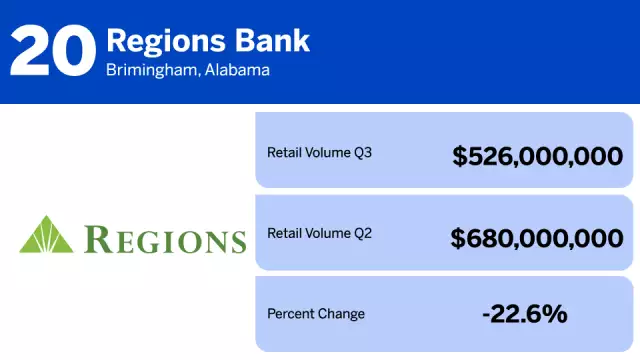

20 bank mortgage lenders with the largest retail volume in Q3

20 bank mortgage lenders with the largest retail volume in Q3

The 10 best cities for first-time homebuyers in 2023

The Fed's actions and how they transformed mortgages: a timeline

The Fed's actions and how they transformed mortgages: a timeline

Concerns from Federal Reserve officials about inflation, and their actions taken to address it, have markedly changed housing finance in 2022.

These developments have resulted in the sharpest run-up in mortgage rates seen in over three decades, slashing mortgage origination volumes, and generally contributing to a volatile market. However, they also finally gave the servicing side of the market a chance to exercise its countercyclical benefits after years of lower rates.

Some examples of the various

... moreConcerns from Federal Reserve officials about inflation, and their actions taken to address it, have markedly changed housing finance in 2022.

These developments have resulted in the sharpest run-up in mortgage rates seen in over three decades, slashing mortgage origination volumes, and generally contributing to a volatile market. However, they also finally gave the servicing side of the market a chance to exercise its countercyclical benefits after years of lower rates.

Some examples of the various ways the Fed's actions reverberated throughout the mortgage market in the past year can be found in the National Mortgage News retrospective that follows.

less

Consumer groups defend CFPB's anti-discrimination policy in brief

Consumer groups defend CFPB's anti-discrimination policy in brief

U.S. new-home sales unexpectedly increase for a second month

U.S. new-home sales unexpectedly increase for a second month

Lenders expand use of temporary rate buydown programs

Dynex Capital took a loss as market volatility grew in 3Q

Dynex Capital took a loss as market volatility grew in 3Q

PulteGroup stock price rises after builder's results 'better than feared'

PulteGroup stock price rises after builder's results 'better than feared'

Pricing promos are impacting wholesale's profits: MBA

MBA's president calls CFPB's director out for regulatory overreach

MBA's president calls CFPB's director out for regulatory overreach

The Mortgage Bankers Association's President Bob Broeksmit took aim at the Consumer Financial Protection Bureau on Monday, calling its independent directorship a key example of "regulatory overreach."

"The main threat we see is coming from the CFPB, where the single director can act as judge, jury, and executioner, all in one," said Broeksmit during MBA's annual conference in Nashville.

The Mortgage Bankers Association's President Bob Broeksmit took aim at the Consumer Financial Protection Bureau on Monday, calling its independent directorship a key example of "regulatory overreach."

"The main threat we see is coming from the CFPB, where the single director can act as judge, jury, and executioner, all in one," said Broeksmit during MBA's annual conference in Nashville.

Ting Shen/Bloomberg

Ting Shen/Bloomberg Broeksmit called for the CFPB to establish clear and consistent standards, and criticized the bureau for "circumventing the rulemaking process."

The CFPB did not immediately respond to a request for comment.

MBA's president said the government watchdog has evaded the established status quo of rulemaking by not always providing a notice and commentary period for stakeholders. His comments come in the wake of a court decision that lawyers have said could open all the bureau's past actions up to legal challenges.

Broeksmit noted that the CFPB is "also enforcing novel and untested legal theories, making it very difficult for firms to understand their legal obligations," thereby exacting a high cost on markets, which gets passed on to consumers.

However, he also said that the industry is willing to parley with the CFPB.

"Now is no time to make you hire more lawyers to try to understand what the bureau is doing," he said. " You need relief and you need certainty. We will work with the bureau and others to ensure they understand the need for clear rules and lower costs to consumers."

MBA's president promised to "fight" against bad policies "that have a habit of rearing their ugly head," and that raise costs instead of lowering them.

The mortgage industry's main gripe with the CFPB is that it pushes aggressive legal theories in enforcement actions rather than trying to put them into law by a rulemaking process, according to Richard Horn, partner at Garris Horn LLP.

"This is problematic because it's basically an agency that's ignoring its own responsibilities and guardrails," said Horn. " The Administrative Procedures Act is a guardrail against the CFPB abusing its authorities because if it wants to expand legal theories, it has to give notice and allow for commentary from the public. "

"The CFPB is ignoring the APA and they're ignoring their responsibilities," he added.

The bureau has faced multiple legal challenges. In September, the Chamber of Commerce and six trade groups sued the government watchdog alleging that it exceeded its authority in March when it adopted a policy that claimed discrimination on the basis of age, race or sex violates "unfair, deceptive or abusive acts or practices," or UDAAP.

Under the new policy, which was announced via a blog, the CFPB sought to look for discrimination in a wide range of noncredit financial products including deposit and checking accounts, payments, prepaid cards, remittances and debt collection practices.

The trade groups alleged the change amounted to a power grab that was "arbitrary" and "capricious," as well as in violation of the APA.

Meanwhile, last week, a panel of three judges on the U.S. Court of Appeals for the 5th Circuit ruled that the CFPB's funding source, which comes from the Federal Reserve's operating budget violates the Constitution's separation of powers because it gives the executive branch too much, and the legislative branch too little, control of a federal agency.

The appeals court decision could have far broader implications, potentially opening all of the agency's past rules and other actions to legal challenges, said Horn.

He noted that despite pending lawsuits and criticisms from the mortgage industry, the CFPB "will just go on business as usual until they're reined in by Congress."

"I think the only thing that would really rein in the CFPB is a structural change under appropriations and making it a commission." Horn said.

less

Bilt, startup turning rent into points, valued at $1.5 billion

Bilt, startup turning rent into points, valued at $1.5 billion

Bilt Rewards, which operates a loyalty program and credit card that converts rent payments into points, said its valuation more than quadrupled to $1.5 billion.

Left Lane Capital led the $150 million equity funding round, which featured Wells Fargo & Co, Greystar, Invitation Homes Inc., Camber Creek, Fifth Wall, Smash Capital, Prosus and Kairos, Bilt Chief Executive Officer Ankur Jain said in an interview.

Bilt Rewards, which operates a loyalty program and credit card that converts rent payments into points, said its valuation more than quadrupled to $1.5 billion.

Left Lane Capital led the $150 million equity funding round, which featured Wells Fargo & Co, Greystar, Invitation Homes Inc., Camber Creek, Fifth Wall, Smash Capital, Prosus and Kairos, Bilt Chief Executive Officer Ankur Jain said in an interview.

The New York-based startup, which launched last year, processes $3 billion in annualized rent payments, and its Bilt Mastercard customers are spending at an annualized rate of $1.6 billion, Jain said. Bilt is profitable and has more than 500,000 active members, a figure Jain said he expects to grow dramatically as the company's landlord partners direct tenants to Bilt as a primary payment platform.

These real estate firms, including AvalonBay Communities Inc., Blackstone Inc., Related Cos. and Equity Residential, own more than 2.5 million apartments. Bilt plans to expand its multifamily ties and deepen its foray into single-family rentals beyond Invitation Homes, Jain said. Other U.S. apartment dwellers outside Bilt's landlord network also can use the company's card to pay rent.

"Programs like Bilt are key to delivering the resident experience renters want and expect," Greystar CEO Bob Faith said. "We're excited to join as partners and investors in this venture."

In an effort to make homebuying easier, the startup launched Bilt Homes, which shows renters which homes they can own with a mortgage payment equal to their monthly rent. Bilt customers can use points toward down payments and closing costs and, ahead of any purchase, can bolster their credit history by having on-time rent payments reported to credit bureaus Equifax, Experian and TransUnion.

"Bilt gives us another way to be there for our customers during their biggest life purchases, including a unique solution to help customers build credit from on-time rent payments, ultimately creating an easier path to homeownership," Wells Fargo CEO Charlie Scharf said in an emailed statement.

Jain said Bilt has gained traction with 21-to-35-year-olds in major metropolitan US cities including New York and Los Angeles, which together account for 21% of its users, as well as Houston, San Francisco, Atlanta, Seattle and Austin, Texas.

The company plans to retain most of its newly raised capital in reserves, though it will invest in brand-building and product education, Jain said.

"Housing represents the largest monthly expense for over 100 million renters in the US and yet consumers have never received any incremental value in return," said Harley Miller, a Left Lane managing partner who is joining Bilt's board.

less

GSEs focus on increased affordability efforts, risk concerns

GSEs focus on increased affordability efforts, risk concerns

Affordability initiatives, including special-purpose credit programs, and risk management are at the forefront of both government-sponsored enterprises' priorities as the year ends, leaders said at the Mortgage Bankers Association annual convention in Nashville on Monday.

Following the announcement of Freddie Mac's intent to offer a special-purpose credit program aimed at increasing homeownership in the Black population, Fannie Mae Interim CEO David Benson said his organization had recently introduced

... moreAffordability initiatives, including special-purpose credit programs, and risk management are at the forefront of both government-sponsored enterprises' priorities as the year ends, leaders said at the Mortgage Bankers Association annual convention in Nashville on Monday.

Following the announcement of Freddie Mac's intent to offer a special-purpose credit program aimed at increasing homeownership in the Black population, Fannie Mae Interim CEO David Benson said his organization had recently introduced a similar pilot in six cities: Atlanta, Baltimore, Chicago, Detroit, Memphis and Philadelphia. The program is intended to measure ease of use and iron out potential problems lenders might encounter with SPCPs.

"We're testing things like down payment assistance, closing costs, appraisal. We're trying to kind of see what works, both in terms of how borrowers take up on these pilots and what happens," Benson said.

Michael DeVito, Benson's counterpart at Freddie Mac also said his agency would support the growth of SPCPs with lenders and expedite the review of newly created programs to determine whether loans originated through them could ultimately be bought by the agency.

Consideration of alternative criteria, including household cash flow and history of rental payments, are also set for further development, having proven their value toward opening up opportunities to new home buyers, the two leaders said.

"Over the last year we've had 100,000 families have their rent reported for the first time, DeVito said. "So 20% of those now having rent reported have scores for the first time — they didn't have a FICO score before."

Among those who previously had scores, two-thirds went up by 40 points when rental payment were included, DeVito added.

Cash flow underwriting, particularly, is "where the future lies to credit qualify a lot of folks you wouldn't necessarily be able to capture," DeVito said.

While privacy issues and protections will need to be addressed, the data science is ready for increased uptake of newer criteria. "I think that this is going to be the space of innovation that we will be working with," Benson said.

At the top of the list of priorities at the GSEs, though, is mitigation of market risk, given the year's rapid changes in interest rates and housing market conditions. Both Benson and Devito highlighted their agencies' concerns about liquidity risks, underscoring ongoing efforts made by the Federal Housing Finance Agency this year to address them, which have received their share of pushback .

"We're buying billions of dollars in order to guarantee and we're buying from thousands of sellers," DeVito said. "That counterparty risk management evaluation becomes very important."

less

Housing market hits brakes as U.S. prices fall most since 2009

Housing market hits brakes as U.S. prices fall most since 2009

The U.S. housing market's sudden reversal is sapping demand and pushing prices down the most since 2009.

A measure of prices in 20 large U.S. cities in August fell 1.3% on a month-over-month basis, the most since March 2009, according to the S&P CoreLogic Case-Shiller index. That's the second-straight month of declines.

The housing market has started to slump as the Federal Reserve hikes interest rates to curb the hottest inflation in decades. Even with the deceleration, prices remain high in many cities compared to last year. Coupled with mortgage rates that are edging closer to 7%, many would-be buyers have been shut out, while some sellers have retreated.

"The forceful deceleration in US housing prices that we noted a month ago continued," Craig Lazzara, a managing director at S&P Dow Jones Indices, said in the statement. "Given the continuing prospects for a challenging macroeconomic environment, home prices may well continue to decelerate."

While prices are still up year-over-year, they're slowing at a record pace. A national measure of prices increased 13% in August from a year earlier, down from a 15.6% gain in July, the biggest deceleration in the history of the index.

Cities on the West Coast have been among those hit the hardest by the real estate cooldown, in part because of the affordability issues that have ratcheted up in recent months with higher rates. On a month-over-month basis, cities on the West Coast including San Francisco, Seattle and San Diego fell the most.

The market's shift in recent months has started to cool the pandemic boom, when houses were quickly snapped up. Sales of existing homes fell for an eighth straight month in September, according to National Association of Realtors data, while new home construction also dropped in September, according to recent government data.

"As we move into the colder months of the year, we can expect further declines in home sales and continued downward adjustment in prices," said George Ratiu, manager of economic research at Realtor.com.

Homebuilders have been hit by the sudden market slowdown. PulteGroup Inc. reported Tuesday that canceled deals spiked and third-quarter orders plunged as demand faltered.

less

The benefits of blockchain-based mortgages

A second Iowa credit union cuts staff, citing weak mortgage market

A second Iowa credit union cuts staff, citing weak mortgage market

FHFA to make Fannie, Freddie appraisal data public

Will tumult in the housing market change the Fed's trajectory?

Will tumult in the housing market change the Fed's trajectory?

Freddie Mac's new condo tech aims to offer quick building assessment

Freddie Mac's new condo tech aims to offer quick building assessment

Don't expect a premium cut anytime soon, FHA head says

FHFA to waive some upfront fees and update credit score model

FHFA to waive some upfront fees and update credit score model

Ginnie Mae to shorten repooling time for reperforming loans

Ginnie Mae to shorten repooling time for reperforming loans

Ginnie Mae on Monday announced that it is preparing to halve the time issuers must wait to put reperforming loans back into securitized mortgage pools.

The government bond insurer, an arm of the Department of Housing and Urban Development, plans to cut the seasoning requirement to three months from six, and transition away from temporary rules around custom pooling for reperforming loans introduced during the pandemic.

"By the end of the first quarter of 2023, Ginnie Mae will be changing

... moreGinnie Mae on Monday announced that it is preparing to halve the time issuers must wait to put reperforming loans back into securitized mortgage pools.

The government bond insurer, an arm of the Department of Housing and Urban Development, plans to cut the seasoning requirement to three months from six, and transition away from temporary rules around custom pooling for reperforming loans introduced during the pandemic.

"By the end of the first quarter of 2023, Ginnie Mae will be changing our policy and requirements for these reperforming loan pools, and making RG pooling optional," President Alanna McCargo said in remarks prepared for the Mortgage Bankers Association's annual conference taking place in Nashville this week.

McCargo also provided an updated figure for the total electronic notes in its digital collateral program, noting that it has climbed to $15 billion. At the end of August, it was $11 billion.

McCargo additionally noted that Ginnie is on track to complete its transition to the cloud on Tuesday as scheduled.

"When our planned business outage ends tomorrow, we will be fully operational," McCargo said.

Brad Finkelstein

Brad Finkelstein She also reconfirmed Ginnie's commitment to its controversial risk-based capital rule for nonbanks. On Friday, the agency announced that it would give mortgage companies an additional year to comply with the new risk weighting, which is particularly high for mortgage servicing rights.

"Our requirements, particularly the RBC element, has started an important conversation at a really critical time, and it's been a very healthy conversation for government lending and the system overall," McCargo said. "Ginnie intends to continue leading this conversation for the benefit of taxpayers, borrowers and market participants."

Ginnie recently added the rule as part of a broader set of updated requirements for its counterparties. The agency counts on approved mortgage companies to ensure payments from securitized loans backed by other government agencies get passed on to mortgage-backed securities investors.

less

Fed's rate hikes are tanking the mortgage market

Plus Platform announces integration with Encompass