Mortgage News Daily

Quiet Conclusion to a Raucous Week

No Help From Data Today

Data Calling Fed's Confidence Into Question

2 Out of 3 Reports Agree Rates Should be Higher Today

Calmer Day of Losses. Data Resumes on Thursday

Quiet, Data-Free Session Leaves Focus on Treasury Auction

Volatility After CPI, But Only Moderate Weakness

Paradoxical Initial Reaction to Hotter CPI, But The Day is Young

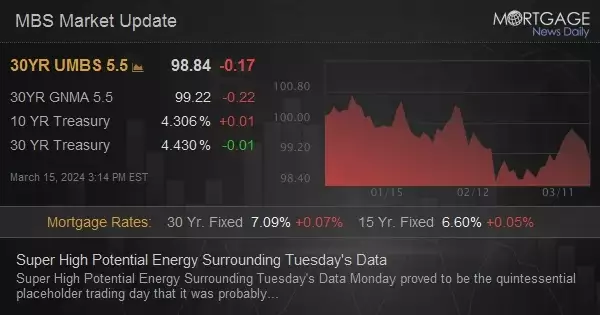

Super High Potential Energy Surrounding Tuesday's Data

Time to Find Out if The Last CPI Report Was an Outlier or Warning Shot

Resilience Threatened by Data at Home and Abroad

More Signs of Resilience Amid Month-End Buying Spree

More Signs of Resilience Amid Month-End Buying Spree

It was a generally resilient day for the bond market after a bit of a scare in the morning. European inflation data caused a sell-off in EU bonds that spilled over to Treasuries overnight. Selling continued in the first few hours, but bonds began to recover after a slightly weaker Chicago PMI report. A calm, sideways mid-day gave way to stronger buying as month-end trades crowded in before the 3pm CME closing bell. Month-end buying aside,

... moreMore Signs of Resilience Amid Month-End Buying Spree

It was a generally resilient day for the bond market after a bit of a scare in the morning. European inflation data caused a sell-off in EU bonds that spilled over to Treasuries overnight. Selling continued in the first few hours, but bonds began to recover after a slightly weaker Chicago PMI report. A calm, sideways mid-day gave way to stronger buying as month-end trades crowded in before the 3pm CME closing bell. Month-end buying aside, bonds were already showing a good amount of resilience by holding their ground in spite of the European influence.

Moderately weaker overnight with Europe leading the way. Slight recovery early. 10yr up 2bps at 3.943. MBS down 3 ticks (.09).

Nice bounce back after 10am. 10yr up only 1.2bps at 3.934. MBS down only 1 tick (0.03).

Progressively stronger into the 3pm CME close with month-end buyer helping yields turn green. 10yr near unchanged on the day. MBS down only 1 tick (0.03).

less

US Bonds Fighting Against European Weakness

The message from today's overnight trading session is clear: European yields have broken well above their most recent ceiling after hotter inflation data in Spain and France. That ceiling had seen similar activity to the US version at 3.98% in 10yr yields. Today begins with US bonds fighting to stay inside the sort of range that EU yields just abandoned.

In other news,

... moreThe message from today's overnight trading session is clear: European yields have broken well above their most recent ceiling after hotter inflation data in Spain and France. That ceiling had seen similar activity to the US version at 3.98% in 10yr yields. Today begins with US bonds fighting to stay inside the sort of range that EU yields just abandoned.

In other news, home price indices were updated for both FHFA and Case Shiller this morning. No major surprises. Annual totals remain in positive territory. Monthly changes are slightly negative.

Bonds Hold Ground Despite Onslaught of Corporate Issuance

Sell-Off Finally Showing Signs of Fatigue

Weaker After PCE Data, But it Could Have Been Worse

Weaker After PCE Data, But it Could Have Been Worse

PCE Inflation data has been relegated to an "occasional and modest" market mover in the current environment. Traders have been doing whatever they need to do in response to the comparable CPI data that comes out much earlier in any given month. But exceptions are made for PCE data that sings a decidedly different tune, such as today's. It matched a decades-high reading at the core level (month-over-month) and thus sent yields higher. Despite

... moreWeaker After PCE Data, But it Could Have Been Worse

PCE Inflation data has been relegated to an "occasional and modest" market mover in the current environment. Traders have been doing whatever they need to do in response to the comparable CPI data that comes out much earlier in any given month. But exceptions are made for PCE data that sings a decidedly different tune, such as today's. It matched a decades-high reading at the core level (month-over-month) and thus sent yields higher. Despite the unpleasant motivation and the 10yr almost hitting 4.0%, things definitely could have been worse. If traders were determined to squeeze rates highs as fast as possible, it didn't show up in today's fairly moderate selling pressure (not to mention the afternoon recovery).

Slight weaker overnight with additional losses after PCE data (not extreme though). MBS down a quarter point and 10yr up 3.5bps at 3.924

Weakness back on track with another 2 steps backward after a brief step forward right after the initial sell-off. MBS down half a point. 10yr up 5.5bps at 3.945

Bonds hit weakest levels around 1pm and have bounced back slightly. MBS down only 3/8ths. Treasuries are underperforming, up 6bps on the day at 3.95%

MBS drifted modestly stronger into the close, ending the day down only 10 ticks (.31). 10s stayed mostly sideways, rising 5.7bps on the day to 3.947.

less

There's Still a Chance, But...

Ceiling Signs or Is It a Trap?

Mixed Start as Bonds Feel Out New Range

At some point during the current selling spree, bonds will find a point of equilibrium where traders feel they've adequately protected themselves from the prospect of sticky inflation and economic resilience. They clearly didn't feel protected with 10yr yields under 3.5% several weeks ago. While we started the week with more selling, the past 2 days have been more balanced (and largely trading inside Tuesday's range). Patterns like this can simply be consolidations before more selling, but they can

... moreAt some point during the current selling spree, bonds will find a point of equilibrium where traders feel they've adequately protected themselves from the prospect of sticky inflation and economic resilience. They clearly didn't feel protected with 10yr yields under 3.5% several weeks ago. While we started the week with more selling, the past 2 days have been more balanced (and largely trading inside Tuesday's range). Patterns like this can simply be consolidations before more selling, but they can also be the first sign of settling into a new range.

This Is How They Get Ya!

Do Today's Fed Minutes Matter?

Data Fuels Ongoing Scramble Toward Higher Rates

Data Fuels Ongoing Scramble Toward Higher Rates

Almost the entire month of February has been a mad dash from the lowest rates in months to the highest rates in months. The whole ordeal can be traced back to several key economic reports with mid-tier reports occasionally piling on. Today saw a surprisingly large reaction to mid-tier data (S&P/Markit PMI). The only way to reconcile the disproportionate reaction would be to add some extra overseas selling from the holiday closure and the overnight

... moreData Fuels Ongoing Scramble Toward Higher Rates

Almost the entire month of February has been a mad dash from the lowest rates in months to the highest rates in months. The whole ordeal can be traced back to several key economic reports with mid-tier reports occasionally piling on. Today saw a surprisingly large reaction to mid-tier data (S&P/Markit PMI). The only way to reconcile the disproportionate reaction would be to add some extra overseas selling from the holiday closure and the overnight session (which also saw similarly strong PMIs in Europe). MBS jettisoned almost a full point and 10s spiked almost 14bps to 3.95+ by the 3pm close.

Weaker overnight with additional selling after Eurozone services PMI data. 10yr up 8bps at 3.904 and MBS down 5/8ths of a point.

Sharper selling after PMI data. 10yr up 10bps to 3.919. MBS down nearly 3/4ths.

Additional weakness in the PM hours, now leveling off in the after hours session. 10yr up 13bps to 3.951. MBS down 7/8ths of a point.

less

February Has Quickly Changed The Rate Outlook

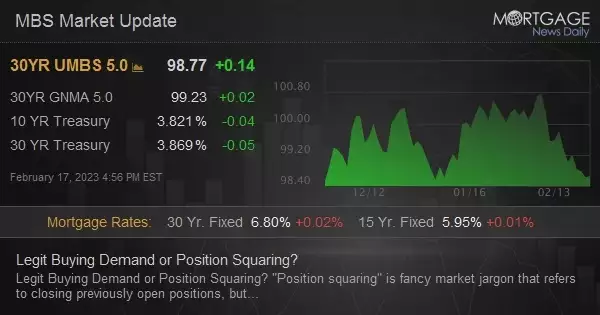

Legit Buying Demand or Position Squaring?

Legit Buying Demand or Position Squaring?

"Position squaring" is fancy market jargon that refers to closing previously open positions, but it can also refer to taking opposing positions to square up one's risk exposure. A "position" is just a bet on rates moving higher or lower. Traders have been in short positions on rates this week (i.e. betting on rates going higher). Is the squaring of these positions for the 3-day weekend the only way to explain today's moderate mid-day improvement or

... moreLegit Buying Demand or Position Squaring?

"Position squaring" is fancy market jargon that refers to closing previously open positions, but it can also refer to taking opposing positions to square up one's risk exposure. A "position" is just a bet on rates moving higher or lower. Traders have been in short positions on rates this week (i.e. betting on rates going higher). Is the squaring of these positions for the 3-day weekend the only way to explain today's moderate mid-day improvement or were there legitimate sources of inspiration?

Slightly weaker out of the gate in Asia with additional weakness in Europe, but some resilience heading into domestic hours. 10yr up 2.5bps at 3.886. MBS down a quarter point.

Bonds bouncing back with 10yr yields unchanged at 3.857. MBS still slightly weaker, but well off their AM lows.

MBS edging into positive territory in the PM hours with 5.0 coupons up 1 tick (0.03). 10yr yields down 3.5bps at 3.828.

Best levels of the day in after hours trading. 10yr down 4.8bps at 3.815 and MBS up 5 ticks (.16).

less

Limited Data and Events; Limited Inspiration For Rallies

The current landscape is fairly simple. The bond market has been in the midst of a "repricing" event following the jobs report at the beginning of the month. Traders are "repricing" expectations for the Fed rate hike outlook. This has spilled over into longer-term rates. Until we have clear momentum heading in a friendly direction, the path of least resistance is for rates to continue redefining a new, higher range after failing to break through the new, lower range that was seen in December and January.

... moreThe current landscape is fairly simple. The bond market has been in the midst of a "repricing" event following the jobs report at the beginning of the month. Traders are "repricing" expectations for the Fed rate hike outlook. This has spilled over into longer-term rates. Until we have clear momentum heading in a friendly direction, the path of least resistance is for rates to continue redefining a new, higher range after failing to break through the new, lower range that was seen in December and January.

How do we know when we're witnessing a capitulatory "repricing" event (not to be confused with mortgage lender reprices) for the broader bond market? We've posted charts on Fed Funds Futures over the past several days showing how longer term rate expectations have moved to match the peak/ceiling/terminal rates seen in the March/June Fed meetings. We've also clearly seen some abrupt selling in longer-term bonds and MBS. One thing that differentiates "repricing events" is the present of a slower grind that follows the bigger initial sell-offs.

This can be seen in the chart of this week's movement in 10yr Treasury yields. Sure, we can break down some of the smaller moves inside the trend in the yellow lines, but most honest analysts will tell you that the general trend this week is NOT tied to the individual events that we connect to the small individual movements. Those same movements could result in a sideways trend or even a stronger trend in another market situation. In this case, the trading that surrounds those individual moves has been pervasively and mechanically weaker--as if the market were being guided by some robotic directive to make its way to higher yields in an orderly fashion.

Repricing events can be somewhat less orderly as well, especially when the revelations are bigger and/or more out of the blue. Some market participants would classify the Fed's early 2022 tone shift as one of those less orderly events. Thankfully, the present repricing is more mild by comparison and should only continue to have serious legs if incoming economic data continues to justify concern over the inflation outlook or an overly hot labor market. Between now and whenever we get that data, all we can do is wait to see the point at which sellers have had their fill. This could happen at any moment--even today, but is only something we'll be able to confirm after it's already in progress.

less

Another Day, Another Sell-Off

Another Day, Another Sell-Off

Bonds may not have sold off in an overly excessive manner today, but they sold off nonetheless. In other words, rates went higher. The early culprits were twofold: a surprisingly hot Producer Price Index and some comments from Fed's Mester on the prospect of a 50bp rate hike. Then in the afternoon, Fed's Bullard said similar stuff and went a step further, saying he wouldn't rule anything out for the next meeting. All this after Fed members spent the past 3 weeks

... moreAnother Day, Another Sell-Off

Bonds may not have sold off in an overly excessive manner today, but they sold off nonetheless. In other words, rates went higher. The early culprits were twofold: a surprisingly hot Producer Price Index and some comments from Fed's Mester on the prospect of a 50bp rate hike. Then in the afternoon, Fed's Bullard said similar stuff and went a step further, saying he wouldn't rule anything out for the next meeting. All this after Fed members spent the past 3 weeks sounding unified on "25bps is all we need." The sudden shift in tone spooked bonds a bit, but it's still up to data to drive the decision. Fed Funds Futures suggest we haven't yet seen enough data to price in a 50bp hike. The result is intraday volatility that gives way to moderate additional weakness.

Flat overnight and weaker after data and Fed's Mester. 10yr up 2.7bps at 3.832. MBS down just under a quarter point.

Additional selling momentum in Treasuries with 10yr up 5.6bps at 3.859. MBS down just over a quarter point.

Nice bounce back underway since 10am. MBS down only 2 ticks (0.06). 10yr up only 3.5bps at 3.838 (down from 3.869).

Some quick selling pressure after Bullard comments on 50bp hikes. 10yr up 5.2bps at 3.855. MBS down just over a quarter point.

less

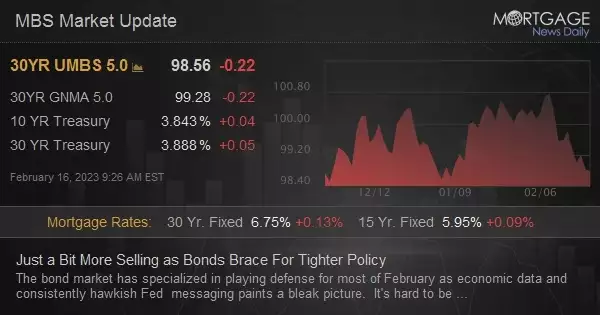

Just a Bit More Selling as Bonds Brace For Tighter Policy

More Yield Curve Musings and Retail Sales Reaction

Retail Sales Data Not Doing Rates Any Favors

More Data to Prove The Fed's Point; Rates Don't Like It

More Data to Prove The Fed's Point; Rates Don't Like It

It will take one of two things for the current rising rate trend to run its course. Either the economic data needs to shift in a compelling way or the selling needs to take rates back up to 2022's highest rates at which point markets will conclude a compelling economic shift is imminent. Neither option is "fun" for the mortgage/housing market. Today's CPI wasn't as much of a barn burner as the jobs report 2 weeks ago, but it was high enough

... moreMore Data to Prove The Fed's Point; Rates Don't Like It

It will take one of two things for the current rising rate trend to run its course. Either the economic data needs to shift in a compelling way or the selling needs to take rates back up to 2022's highest rates at which point markets will conclude a compelling economic shift is imminent. Neither option is "fun" for the mortgage/housing market. Today's CPI wasn't as much of a barn burner as the jobs report 2 weeks ago, but it was high enough to prove the Fed's persistent point regarding stubbornly elevated inflation.

First move was weaker after CPI, followed by a quick recovery and now back to slightly weaker territory. 10yr up 2.9bps at 3.732. MBS down an eighth of a point.

Weakest levels now with 10s up 6+ bps at 3.768 and MBS down almost 3/8ths of a point. No new motivations, just an ongoing reaction.

Decent recovery since noon, but still down 3/8ths on the day in MBS. 10yr still up 5bps at 3.75+ (off previous highs of 3.80).

Little-changed from previous update with 10yr up 6bps at 3.764 and MBS down just over 3/8ths. No major reaction to Fed speakers.

less