keepingcurrentmatters

Why Today’s Seller’s Market Is Good for Your Bottom Line

Your Home Is a Powerful Investment

What Mortgage Rate Do You Need To Move?

Finding Your Perfect Home in a Fixer Upper

If you’re trying to buy a home and are having a hard time finding one you can afford, it may be time to consider a fixer-upper. That’s a house that needs a little elbow grease or some updates, but has good bones. Fixer-uppers can be a really great option if you’re looking to break into the housing market or want to stretch your budget further. According to NerdWallet:

... more“Buying a fixer-upper can provide a path to homeownership for first-time home buyers or a way

If you’re trying to buy a home and are having a hard time finding one you can afford, it may be time to consider a fixer-upper. That’s a house that needs a little elbow grease or some updates, but has good bones. Fixer-uppers can be a really great option if you’re looking to break into the housing market or want to stretch your budget further. According to NerdWallet:

“Buying a fixer-upper can provide a path to homeownership for first-time home buyers or a way for repeat buyers to afford a larger home or a better neighborhood. With the relatively low inventory of homes for sale these days, a move-in ready home can be hard to find, especially if you’re on a budget.”

Basically, since the number of homes for sale is still so low, if you’re only willing to tour homes that have all your dream features, you may be cutting down your options too much and making it harder on yourself than necessary. It may be time to cast a wider net.

Sometimes the perfect home is the one you perfect after buying it.

Here’s some information that can help you pinpoint what you truly need so you can be strategic in your home search. First, make a list of all the features you want in a home. From there, work to break those features into categories like this:

Once you’ve sorted your list in a way that works for you, share it with your real estate agent. They’ll help you find homes that deliver on your top needs right now and have the potential to be your dream home with a little bit of sweat equity. Lean on their expertise as you think through what’s possible, what features are easy to change or add, and how to make it happen. According to Progressive:

“Many real estate agents specialize in finding fixer-uppers and have a network of inspectors, contractors, electricians, and the like.”

Your agent can also offer advice on which upgrades and renovations will set you up to get the greatest return on your investment if you ever decide to sell down the line.

Bottom Line

If you haven’t found a home you love that’s in your budget, it may be worth thinking through all your options, including fixer-uppers. Sometimes the perfect home for you is the one you perfect after buying it. To see what’s available in your area, connect with a local real estate agent.

less

The Spring Market Is a Sweet Spot if You’re Looking To Sell [INFOGRAPHIC]

Some Highlights

![The Spring Market Is a Sweet Spot if You’re Looking To Sell [INFOGRAPHIC]](https://realiff.com/assets/uc/Post/gODSkxb6HFUN/1/thumbnail_default_1.webp?7M7hUQ3eK4Jd)

The Benefits of Downsizing When You Retire

If you’re taking a look at your expenses as you retire, saving money where you can has a lot of appeal. One long-standing, popular way to do that is by downsizing to a smaller home.

When you think about cutting down on your spending, odds are you think of frequent purchases, like groceries and other goods. But when you downsize your house, you often end up downsizing the bills that come with it, like your mortgage payment, energy costs, and maintenance requirements. Realtor.com shares:

... moreIf you’re taking a look at your expenses as you retire, saving money where you can has a lot of appeal. One long-standing, popular way to do that is by downsizing to a smaller home.

When you think about cutting down on your spending, odds are you think of frequent purchases, like groceries and other goods. But when you downsize your house, you often end up downsizing the bills that come with it, like your mortgage payment, energy costs, and maintenance requirements. Realtor.com shares:

“A smaller home typically means lower bills and less upkeep. Then there’s the potential windfall that comes from selling your larger home and buying something smaller.”

That windfall is thanks to your home equity. If you’ve been in your house for a while, odds are you’ve built up a considerable amount of equity. And that equity is something you can use to help you buy a home that better fits your needs today. Daniel Hunt, CFA at Morgan Stanley, explains:

“Home equity can be a significant source of wealth for retirees, often representing a large portion of their net worth. . . . Retirement planning can be complex, but your home equity shouldn’t be overlooked.”

And when you’re ready to use that equity to fuel your next move, your real estate agent will be your guide through every step of the process. That includes setting the right price for your current house when you sell, finding the home that best fits your evolving needs, and understanding what you can afford at today’s mortgage rate.

What This Means for You

If you’re thinking about downsizing, ask yourself these questions:

Then, meet with a real estate agent to get an answer to this one: What are my options in the market right now? A local real estate agent can walk you through how much equity you have in your house and how it positions you to win when you downsize.

Bottom Line

Want to save money in retirement? Consider downsizing – it could really help you out. When you’re ready, connect with a local real estate agent about your goals in the housing market this year.

less

Why Access Is So Important When Selling Your House

An Expert Makes All the Difference When You Sell Your House

What You Should Know About Rising Mortgage Rates

One Major Benefit of Investing in a Home

One of the many reasons to buy a home is that it’s a major way to build wealth and gain financial stability. According to Freddie Mac:

“Building equity through your monthly principal payments and appreciation is a critical part of homeownership that can help you create financial stability.”

With spring approaching, now’s a great time to consider if buying a home makes sense for you. The best way to figure that out is to talk with a trusted real

... moreOne of the many reasons to buy a home is that it’s a major way to build wealth and gain financial stability. According to Freddie Mac:

“Building equity through your monthly principal payments and appreciation is a critical part of homeownership that can help you create financial stability.”

With spring approaching, now’s a great time to consider if buying a home makes sense for you. The best way to figure that out is to talk with a trusted real estate professional.

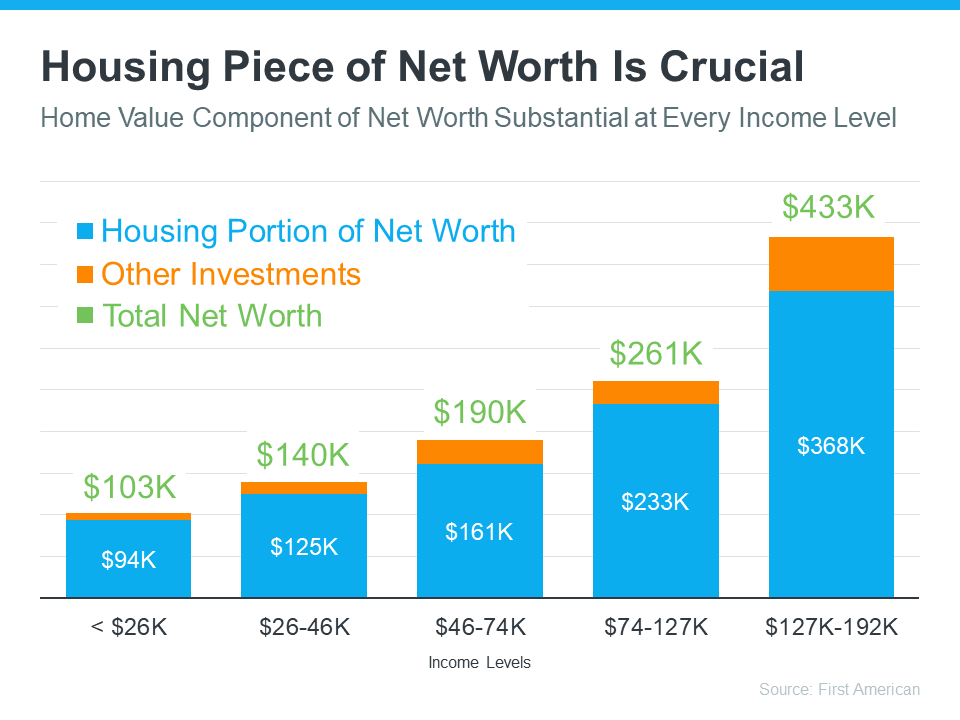

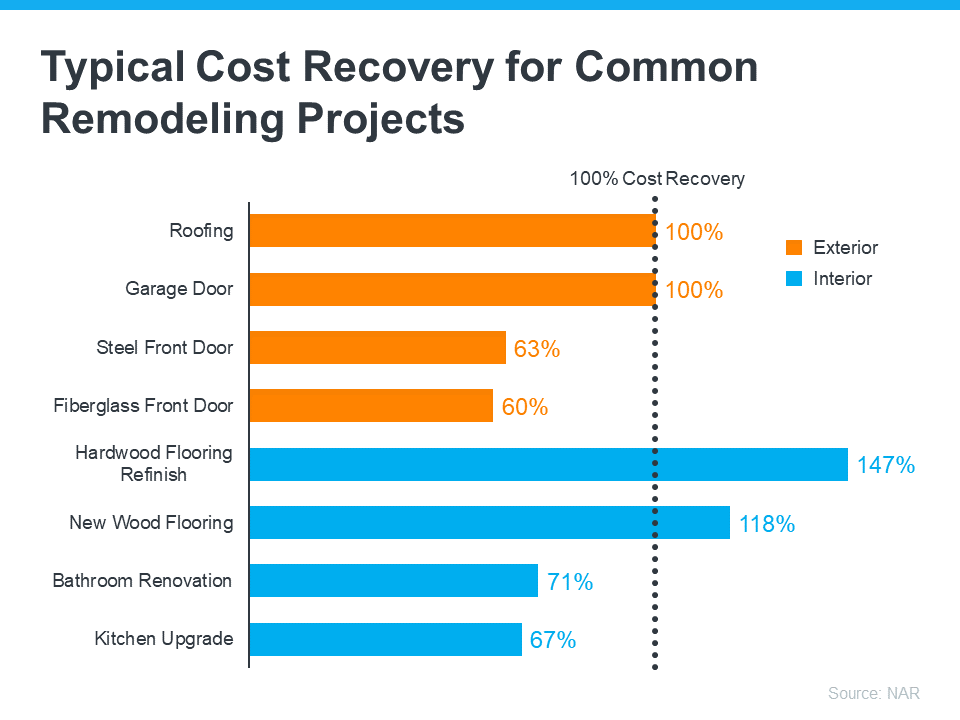

The Largest Part of Most Homeowners’ Net Worth Is Their Equity

You may be surprised to learn just how much of a homeowner’s net worth actually comes from owning their home. The National Association of Realtors (NAR) shares:

“Homeownership is the largest source of wealth among families, with the median value of a primary residence worth about ten times the median value of financial assets held by families. Housing wealth (home equity or net worth) gains are built up through price appreciation and by paying off the mortgage.”

In other words, home equity does more to build the average household’s wealth than anything else. And according to data from First American, this holds true across different income levels (see graph below):

Bottom Line

One of the biggest benefits of owning a home, regardless of your income level, is that it provides financial stability and an avenue to build wealth. Connect with a local real estate agent today so you can start investing in homeownership.

less

How To Make Your Dream of Homeownership a Reality

A Smaller Home Could Be Your Best Option

Many people are reaching the point in their lives when they need to decide where they want to live when they retire. If you’re a homeowner approaching this stage, you have several options to explore. Jessica Lautz, Deputy Chief Economist and Vice President of Research at the National Association of Realtors (NAR), says:

... more“As we see the transition of the large Baby Boomer generation age into retirement, it will be interesting to see if they move in with their Millennial and

Many people are reaching the point in their lives when they need to decide where they want to live when they retire. If you’re a homeowner approaching this stage, you have several options to explore. Jessica Lautz, Deputy Chief Economist and Vice President of Research at the National Association of Realtors (NAR), says:

“As we see the transition of the large Baby Boomer generation age into retirement, it will be interesting to see if they move in with their Millennial and Gen Z children or if they stay put in their own homes.”

Lautz lists two options: move into a multigenerational home with loved ones, or stay in your current house. Multigenerational living is rising in popularity, but it isn’t an option for everyone. And staying put may fit fewer and fewer of your needs. There’s a third option though, and for some, it’s the best one: downsizing.

When you sell your house and purchase a smaller one, it’s known as downsizing. Sometimes smaller homes are more suited to your changing needs, and moving means you can also land in your ideal location.

In addition to the personal benefits, downsizing might be more cost effective, too. The New York Times (NYT) shares:

“Many downsizers expect to improve their retirement income stream if their new home costs less than what their old house sells for. Lower utility costs, insurance and property taxes — as well as investment returns on the proceeds — can also improve the bottom line.”

Being in a strong financial position is one of the most important parts of retirement, and downsizing can make a big difference.

A key part of why downsizing is still cost effective today, even when mortgage rates are higher than they were a year ago, is the record-high level of equity homeowners have. Leveraging your equity when you downsize can lower or maybe even eliminate the mortgage payment on your next home.

So, not only is the upkeep of a smaller home likely more affordable, but leveraging your home equity could make a big difference too. Your local real estate advisor is the best resource to help you understand how much equity you may have in your current home and what options it can provide for your next move.

Bottom Line

If you’re a homeowner getting ready for retirement, part of that transition likely includes deciding where you’ll live. Work with a trusted advisor to understand your options and explore your downsizing opportunities.

less

The Two Big Issues the Housing Market’s Facing Right Now

Spring into Action: Boost Your Home’s Curb Appeal with Expert Guidance

To sell your home this spring, it may need more preparation than it would have a year or two ago. Today’s housing market has a different feel. There are more homes for sale than there were at this time last year, but inventory is still historically low. So, if a house has been sitting on the market for a while, that’s a sign it may not be hitting the mark for potential buyers. But here’s the thing. Right now, homes that are updated and priced at market value

... moreTo sell your home this spring, it may need more preparation than it would have a year or two ago. Today’s housing market has a different feel. There are more homes for sale than there were at this time last year, but inventory is still historically low. So, if a house has been sitting on the market for a while, that’s a sign it may not be hitting the mark for potential buyers. But here’s the thing. Right now, homes that are updated and priced at market value are still selling fast.

Today, homes with curb appeal that are presented well are still selling quickly, and sometimes over asking price. According to Danielle Hale, Chief Economist at realtor.com:

“In a market where costs are still high and buyers can be a little choosier, it makes sense they’re going to really zero in on the homes that are the most appealing.”

With the spring buying season just around the corner, now’s the time to start getting your house ready to sell. And the best way to determine where to spend your time and money is to work with a trusted real estate agent who can help you understand which improvements are most valuable in your local market.

Curb Appeal Wins

One way to prioritize updates that could bring a good return on your investment is to find smaller projects you can do yourself. Little updates that boost your curb appeal usually work well. Investopedia puts it this way:

“Curb-appeal projects make the property look good as soon as prospective buyers arrive. While these projects may not add a considerable amount of monetary value, they will help your home sell faster—and you can do a lot of the work yourself to save money and time.”

Small cosmetic updates, like refreshing some paint and power washing the exterior of your home, create a great first impression for buyers and help it stand out. Work with a real estate professional to find the low-cost projects you can tackle around your house that will appeal to buyers in your area.

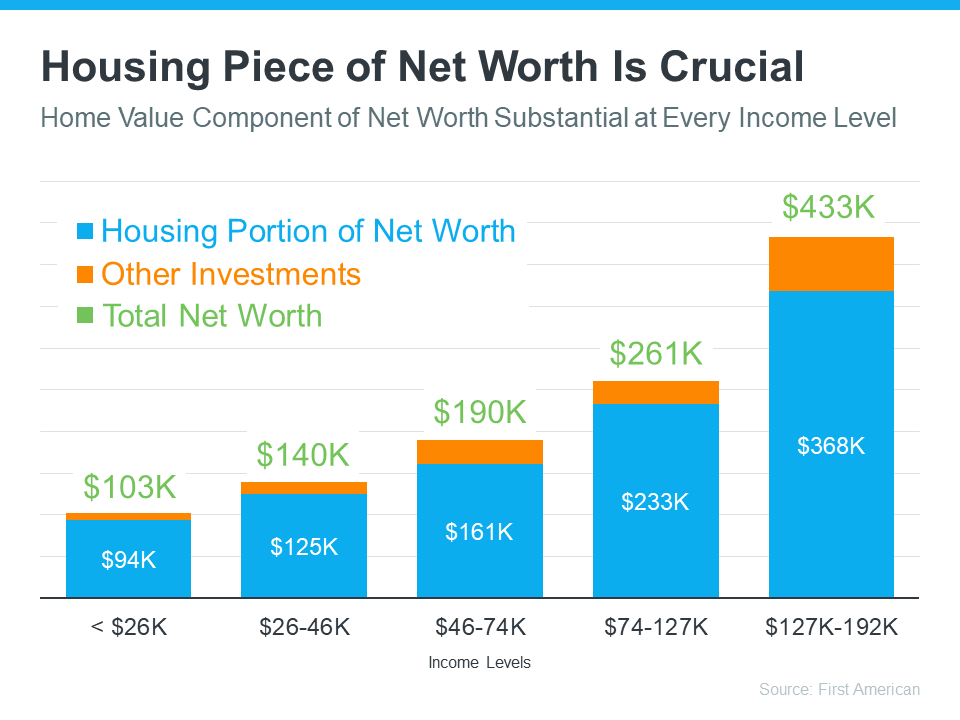

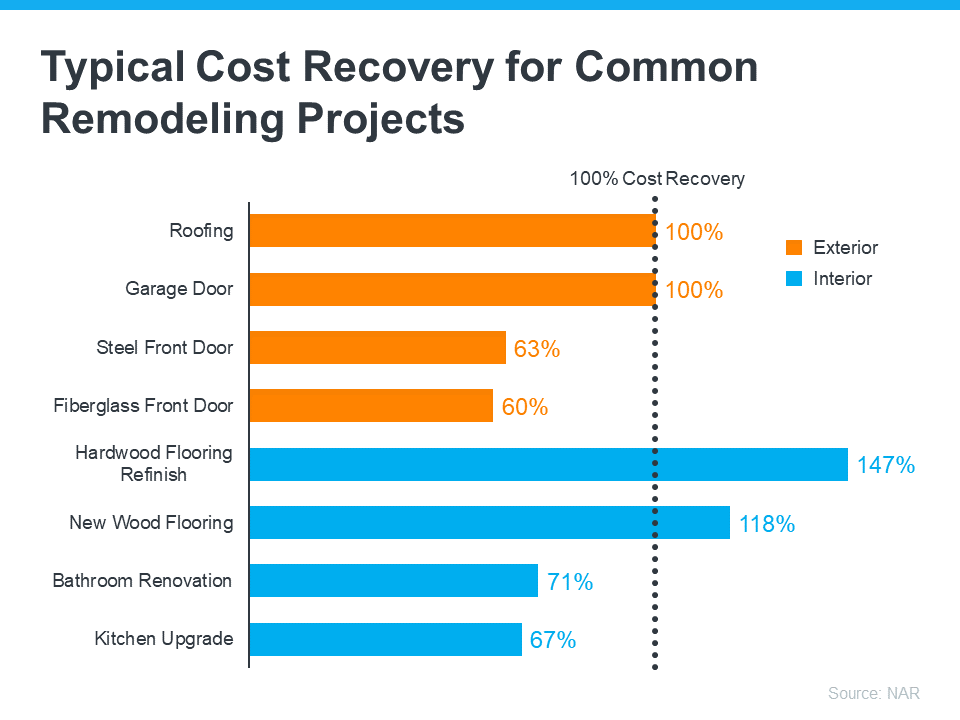

Not All Updates Are Created Equal

When deciding what you need to do to your house before selling it, remember you’re making these repairs and updates for someone else. Prioritize projects that will help you sell faster or for more money over things that appeal to you as a homeowner.

The 2022 Remodeling Impact Report from the National Association of Realtors (NAR) highlights popular home improvements and what sort of return they bring for the investment (see graph below):

Remember to lean on your trusted real estate advisor for the best advice on the updates you should invest in. They’ll know what local buyers are looking for and have the latest insights of what your house needs to sell quickly this spring.

Bottom Line

As we approach the spring season, now’s the time to get your house ready to sell. Connect with a local real estate agent today so you can find out which updates make the most sense.

less

The Spring Housing Market Could Be a Sweet Spot for Sellers [INFOGRAPHIC]

![The Spring Housing Market Could Be a Sweet Spot for Sellers [INFOGRAPHIC]](https://realiff.com/assets/uc/Post/5LOiKiur2kp7/1/thumbnail_default_1.webp?qh5fDi8BkAhJ)

Wondering What’s Going on with Home Prices?

Should You Consider Buying a Newly Built Home?

If you’re thinking about buying a home, you might be focusing on previously owned ones. But with so few houses for sale today, it makes sense to consider all your options, and that includes a home that’s newly built.

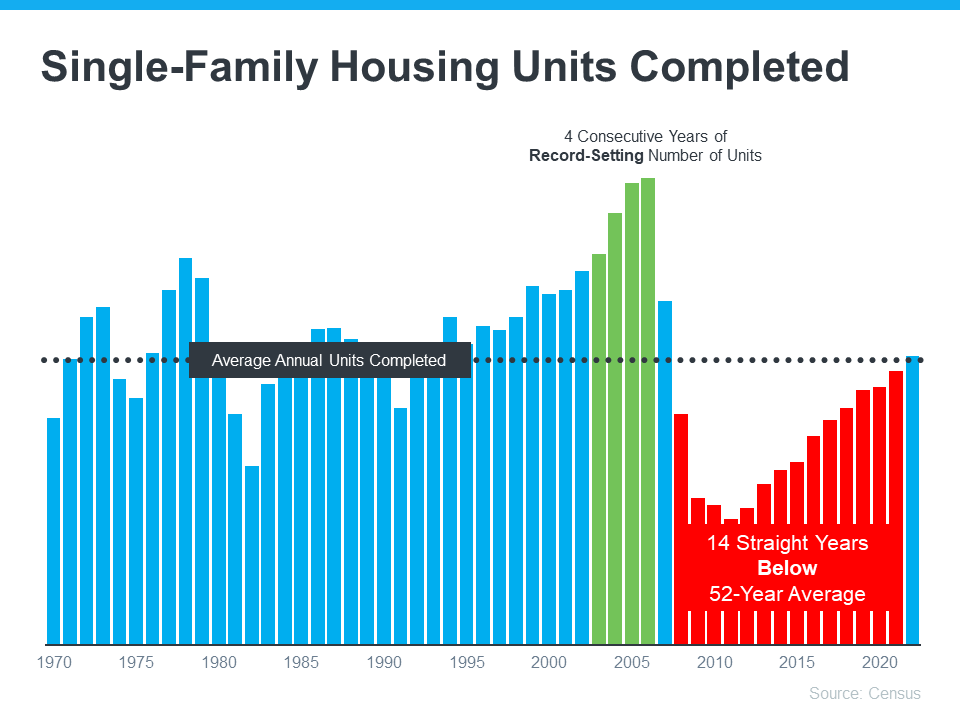

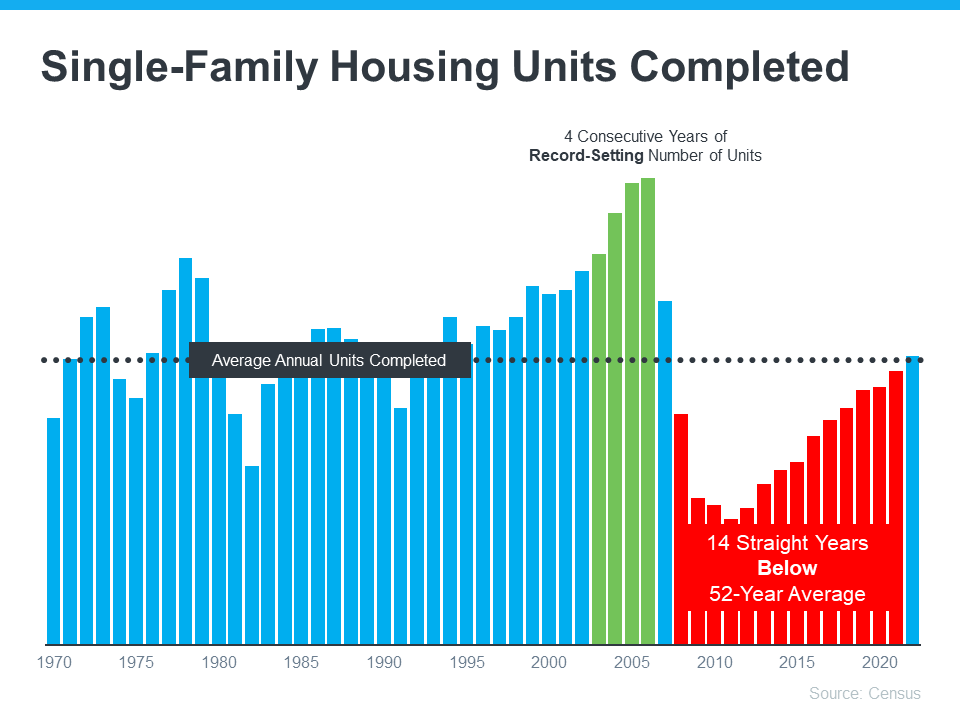

The Number of Newly Built Homes Is on the Rise

While there are more houses for sale right now than there were at this time last year, there’s still a historically low number of homes available on the market. One reason for that is years of underbuilding—meaning

... moreIf you’re thinking about buying a home, you might be focusing on previously owned ones. But with so few houses for sale today, it makes sense to consider all your options, and that includes a home that’s newly built.

The Number of Newly Built Homes Is on the Rise

While there are more houses for sale right now than there were at this time last year, there’s still a historically low number of homes available on the market. One reason for that is years of underbuilding—meaning there haven’t been enough new homes built to keep up with demand.

The graph above shows how low the production of newly constructed homes has been over the past 14 years. But it also shows another important trend: the number of new homes being built each year is on the rise. As Mark Fleming, Chief Economist at First American, shares, that’s good news for buyers:

“While existing-home inventory remains limited, the silver lining for home buyers is that new-home inventory is on the rise, and a new home at the right price is a pretty good substitute.”

Builder Incentives Can Provide a Boost

While there a growing number of new homes for sale, builders are slowing that pace until they sell more of their current inventory. According to Logan Mohtashami, Lead Analyst at HousingWire:

“The builders have to work off the backlog of homes, but instead of 3%-4% mortgage rates, they’re dealing with 6% plus mortgage rates, which means they have to provide many incentives to make sure those homes sell.”

Many builders are now offering incentives to help buyers purchase these homes. Fleming also explains:

“The National Association of Home Builders reported that nearly two-thirds of builders were offering incentives, including mortgage rate buydowns, paying points for buyers and price reductions, which could entice potential home buyers.”

A builder who’s willing to pay to reduce your mortgage rate could be a game changer. Ksenia Potapov, Economist at First American, puts it this way:

“A one percentage-point decline in mortgage rates has the same impact on affordability as an 11 percent decline in house prices.”

Should You Buy a Brand-New Home?

The best way to decide what type of home to buy is to work with a trusted real estate professional who can help you weigh the pros and cons of each option. They know which homes are available in your local market, and which builders might be offering incentives that make sense for you.

Bottom Line

Even though there aren’t a lot of homes for sale today, new home inventory is on the rise, and many builders are offering incentives. Work with a local real estate agent who can help you weigh the pros and cons of shopping for a new home versus an existing one.

less

Why It’s Easy To Fall in Love with Homeownership

What You Should Know About Closing Costs

Before you buy a home, it’s important to plan ahead. While most buyers consider how much they need to save for a down payment, many are surprised by the closing costs they have to pay. To ensure you aren’t caught off guard when it’s time to close on your home, you need to understand what closing costs are and how much you should budget for.

What Are Closing Costs?

People are sometimes surprised by closing costs because they don’t know what

... moreBefore you buy a home, it’s important to plan ahead. While most buyers consider how much they need to save for a down payment, many are surprised by the closing costs they have to pay. To ensure you aren’t caught off guard when it’s time to close on your home, you need to understand what closing costs are and how much you should budget for.

What Are Closing Costs?

People are sometimes surprised by closing costs because they don’t know what they are. According to Bankrate:

“Closing costs are the fees and expenses you must pay before becoming the legal owner of a house, condo or townhome . . . Closing costs vary depending on the purchase price of the home and how it’s being financed . . .”

In other words, your closing costs are a collection of fees and payments involved with your transaction. According to Freddie Mac, while they can vary by location and situation, closing costs typically include:

How Much Will You Need To Budget for Closing Costs?

Understanding what closing costs include is important, but knowing what you’ll need to budget to cover them is critical, too. According to the Freddie Mac article mentioned above, the costs to close are typically between 2% and 5% of the total purchase price of your home. With that in mind, here’s how you can get an idea of what you’ll need to cover your closing costs.

Let’s say you find a home you want to purchase for the median price of $366,900. Based on the 2-5% Freddie Mac estimate, your closing fees could be between roughly $7,500 and $18,500.

Keep in mind, if you’re in the market for a home above or below this price range, your closing costs will be higher or lower.

What’s the Best Way To Make Sure You’re Prepared at Closing Time?

Freddie Mac provides great advice for homebuyers, saying:

“As you start your homebuying journey, take the time to get a sense of all costs involved – from your down payment to closing costs.”

Work with a team of trusted real estate professionals to understand exactly how much you’ll need to budget for closing costs. An agent can help connect you with a lender, and together your expert team can answer any questions you might have.

Bottom Line

It’s important to plan for the fees and payments you’ll be responsible for at closing. Work with a local real estate professional who can help you feel confident throughout the process.

less

How To Win as a Buyer in Today’s Housing Market [INFOGRAPHIC]

![How To Win as a Buyer in Today’s Housing Market [INFOGRAPHIC]](https://realiff.com/assets/uc/Post/yqpgcb5V25tG/thumbnail_default.webp?nWWEn3kBujlu)

Why Today’s Housing Market Isn’t Headed for a Crash

Number of Homes for Sale Up from Last Year, but Below Pre-Pandemic Years

How Experts Can Help Close the Gap in Today’s Homeownership Rate

The Top Reasons for Selling Your House

You May Not Need as Much as You Think for Your Down Payment [INFOGRAPHIC]

![You May Not Need as Much as You Think for Your Down Payment [INFOGRAPHIC]](https://realiff.com/assets/uc/Post/2WNTJKpZcryK/thumbnail_default.webp?RwexgPbKofKu)

Experts Forecast a Turnaround in the Housing Market in 2023

Should You Rent Your House or Sell It?

Lower Mortgage Rates Are Bringing Buyers Back to the Market

![The Latest Trends in Housing [INFOGRAPHIC]](https://realiff.com/assets/uc/Post/OMymPZWqTTW4/1/thumbnail_default_1.webp?8igGtme0drYl)

![Checklist for Selling Your House This Spring [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2023/02/22133439/Checklist-For-Selling-This-Spring-MEM.png)

![Checklist for Selling Your House This Spring [INFOGRAPHIC]](https://realiff.com/assets/uc/Post/MXVEzIsFzXx7/1/thumbnail_default_1.webp?R3tXr0FZwAcd)

![The Spring Housing Market Could Be a Sweet Spot for Sellers [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2023/02/16105224/The-Spring-Housing-Market-Could-Be-A-Sweet-Spot-For-Sellers-MEM.png)

![How To Win as a Buyer in Today’s Housing Market [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2023/02/09132527/How-To-Win-As-A-Buyer-In-Todays-Housing-Market-MEM-scaled.jpg)

![You May Not Need as Much as You Think for Your Down Payment [INFOGRAPHIC] | Simplifying The Market](https://api.simplifyingthemarket.com/wp-content/uploads/2023/02/You-May-Not-Need-As-Much-As-You-Think-For-Your-Down-Payment-MEM.png)