Dr. Housing Bubble Blog

The Housing Correction is In Full Swing – Gear up For Years of Housing Challenges as Inventory Grows and Low-Rate Years are Over. 4 Charts Showing Housing Correction Just Started.

The housing correction has started: The entire US market will face a correction in the next 12-months. 183 markets forecasted to fall up to 20%.

The housing correction has started: The entire US market will face a correction in the next 12-months. 183 markets forecasted to fall up to 20%.

The market has hit a rather significant wall in the last few months as the Federal Reserve has decided that there is no longer any containing inflation from the public, no matter how much economist and financial wizards try to massage the data. The correction was largely

... moreThe housing correction has started: The entire US market will face a correction in the next 12-months. 183 markets forecasted to fall up to 20%.

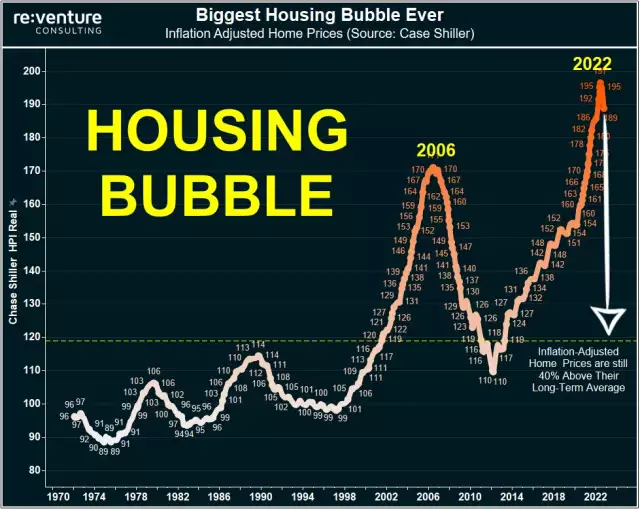

The market has hit a rather significant wall in the last few months as the Federal Reserve has decided that there is no longer any containing inflation from the public, no matter how much economist and financial wizards try to massage the data. The correction was largely inevitable as the US economy fell in love with artificially low rates that were injecting insane amounts of money into the economy because of the pandemic and even before it. There was so much money injected including wasteful spending on PPP loans from corporate welfare recipients that suddenly go on Twitter to lambast the “poor” for a few thousand dollars while they were taking millions in dollars in a raid under the cover of the pandemic. Remember the banking bailouts from the last crisis? Sounds very familiar from pointing fingers to “subprime mortgages” when there were larger reasons why the market imploded. Yet the repercussions today caused wild inflation and the Fed has no choice but to tighten debt and housing is going to take it on the chin for the short-term given housing is the biggest line item in the CPI. Even the conservative rating agency Moody’s is forecasting a market correction. Where is housing heading?

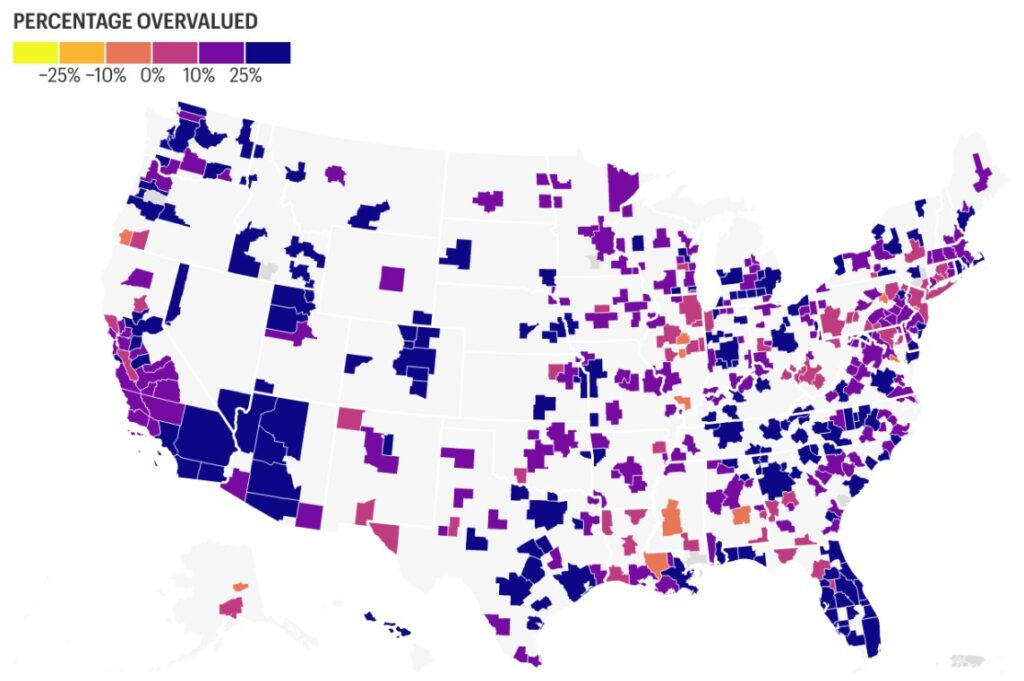

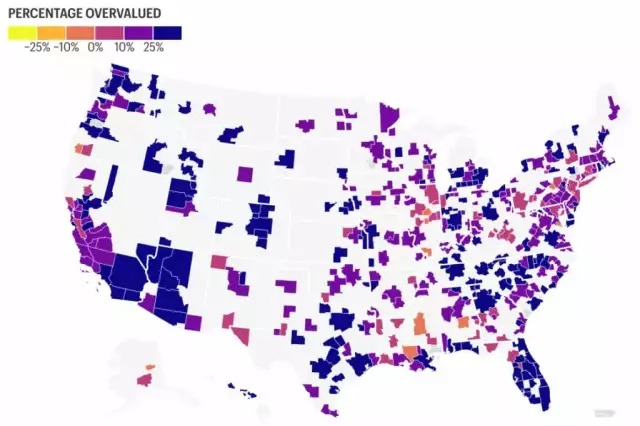

183 markets forecasted to drop by 20% or more

Moody’s recently highlighted 183 markets that are set to go down by 20% or more in the upcoming 12 to 24 months. Here is the map:

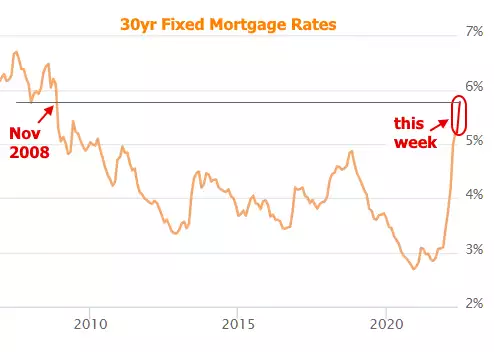

This is a significant correction. Take Orange County where the median price is now above $1 million for a crap shack. A 20% correction is going to wipe out at least $200,000. I’ve had the chance to speak with people that have been saving for a few years and working hard, professionals in many cases, and I know that losing $200,000 will sure get their attention. You also need to realize that all of the financial models were being built with 2.75% to 3.5% mortgage rates and those are now in the rearview mirror:

Do the math here. Let us assume a $1 million home with 20% down with a 3% mortgage rate and a 6% rate:

Purchase Price: $1,000,000

Down payment: $200,000

Mortgage: $800,000

PITI at 3%: $4,119

PITI at 6% $5,543 (35% increase in monthly payment)

So in a few short months, that monthly payment went up by 35%. As so many commenters like to point out, it is all about the monthly nut. So what home price do we need to get to arrive at our previous 3% monthly nut? That $1,000,000 home will need to be $738,000 to get to that previous PITI amount.

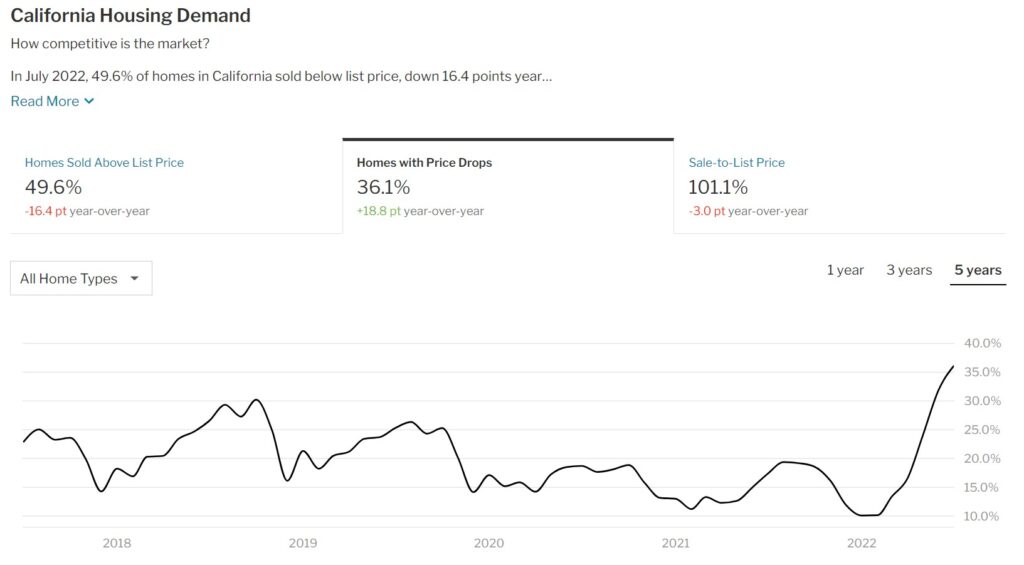

And even in California where real estate bulls drink maximum price appreciation Kool-Aid, price drops are at the highest level in half a decade:

So the correction is here. Will Moody’s be right in forecasting a 20% decline across many US markets? Time will tell but keep in mind that the last housing correction took 3 to 5 years to bottom out. We are merely in the first year of this correction.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

11 Sep, 2022 Uncategorized

less

The housing correction has started: The entire US market will face a correction in the next 12-months. 183 markets forecasted to fall up to 20%.

Record Number of Young Adults Living at Home: Active Listings Rising, Price Cuts, and New Inventory Coming Online.

Record Number of Young Adults Living at Home: Active Listings Rising, Price Cuts, and New Inventory Coming Online.

Gear up for the 2022 and 2023 Housing Correction: 5 Charts Highlighting the Pain Ahead for the Housing Market.

Gear up for the 2022 and 2023 Housing Correction: 5 Charts Highlighting the Pain Ahead for the Housing Market.

Real Homes of Genius: Paramount with a Median Household Income of $55,000 but Selling a Home for $800,000+

Real Homes of Genius: Paramount with a Median Household Income of $55,000 but Selling a Home for $800,000+

Rates are increasing to more normal levels and the hysteria in the market just highlights how juiced and stretched we have played this low interest rate environment. Inflation is now out of control and the Fed will have no choice but to act and this of course will cool the housing market. Last year the market

... moreReal Homes of Genius: Paramount with a Median Household Income of $55,000 but Selling a Home for $800,000+

Rates are increasing to more normal levels and the hysteria in the market just highlights how juiced and stretched we have played this low interest rate environment. Inflation is now out of control and the Fed will have no choice but to act and this of course will cool the housing market. Last year the market was driven by FOMO and people were bidding junk up because in many cases, they were desperate. There is now talk of another housing bubble and people counter with – what about subprime? Let us remember that with the 7,000,000+ foreclosures in the last debacle, about 1 to 1.5 million of those were subprime. The rest were vanilla 30-year fixed rate loans that hit households that lost jobs and they simply could not pay their mortgage. Venture Capital is getting more restrictive, and we are seeing ridiculous companies implode with valuations that only “Web 3.0” would love. But let us look at some insane prices in working class areas of Southern California.

Paramount Example

Paramount is located right next to Compton and is a working-class area. The median household income is $55,000 for the city. So let us take a look at what a regular home is going for right now:

Okay. So this home is selling for $825,000 and last sold in 2005 for $425,000 (a bubble price at that time). So is this a good deal? The elementary school is rated 4/10 and the middle school is 5/10. Not exactly ratings you expect when you are shelling out nearly $1 million.

The monthly payment on this place will be close to $5,000 or you can rent a house in the area for $3,000. But again, the median household income points to people stretching to the absolute max with multiple incomes supporting rent or house payments. Inflation is already eating away purchasing power via energy, food, and other consumer goods. What if we enter into a recession? How will people cover the mortgage? And guess what? Rates are going up so it should be apparent what the next step will be.

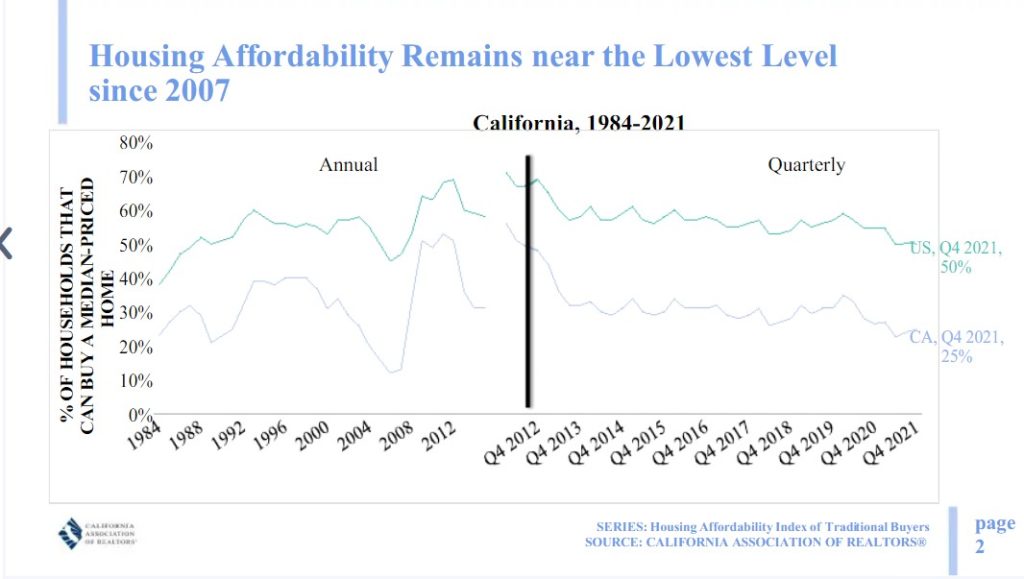

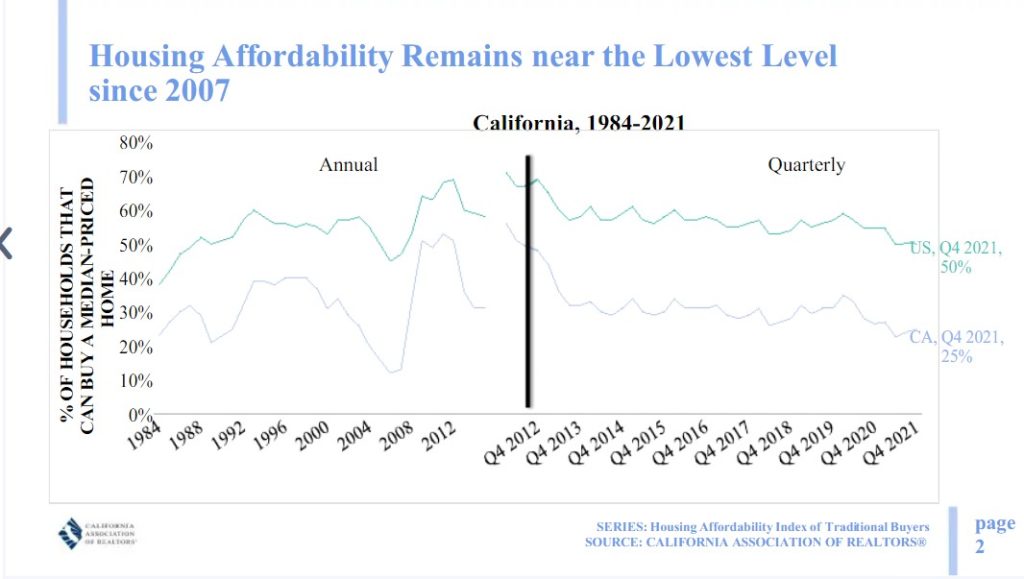

Even the California Association of Realtors, not exactly someone to talk about a housing bubble, shows with their data an affordability crisis:

Yes, all of this is completely normal and they even point to levels last seen in 2007. What happened in the subsequent years? Of course, a 4 bedroom in Paramount for $825,000 makes total sense. This market is completely unhinged and there are signs of over heating everywhere. For the housing drunkards, are you going to buy this house? If you truly believe in your thesis, it should be an easy move and you should plunk down some money on this “no lose” deal. Keep us posted.

The inflation numbers we are seeing right now are off the charts. Something is going to give this year simply because household incomes do not support these prices and low rates are maxed out and causing said inflation. Irrational Exuberance once again.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

9 Apr, 2022 housing valuation

less

Real Homes of Genius: Paramount with a Median Household Income of $55,000 but Selling a Home for $800,000+

Real Homes of Genius: Paramount with a Median Household Income of $55,000 but Selling a Home for $800,000+

Rates are increasing to more normal levels and the hysteria in the market just highlights how juiced and stretched we have played this low interest rate environment. Inflation is now out of control and the Fed will have no choice but to act and this of course will cool the housing market. Last year the market

... moreReal Homes of Genius: Paramount with a Median Household Income of $55,000 but Selling a Home for $800,000+

Rates are increasing to more normal levels and the hysteria in the market just highlights how juiced and stretched we have played this low interest rate environment. Inflation is now out of control and the Fed will have no choice but to act and this of course will cool the housing market. Last year the market was driven by FOMO and people were bidding junk up because in many cases, they were desperate. There is now talk of another housing bubble and people counter with – what about subprime? Let us remember that with the 7,000,000+ foreclosures in the last debacle, about 1 to 1.5 million of those were subprime. The rest were vanilla 30-year fixed rate loans that hit households that lost jobs and they simply could not pay their mortgage. Venture Capital is getting more restrictive, and we are seeing ridiculous companies implode with valuations that only “Web 3.0” would love. But let us look at some insane prices in working class areas of Southern California.

Paramount Example

Paramount is located right next to Compton and is a working-class area. The median household income is $55,000 for the city. So let us take a look at what a regular home is going for right now:

Okay. So this home is selling for $825,000 and last sold in 2005 for $425,000 (a bubble price at that time). So is this a good deal? The elementary school is rated 4/10 and the middle school is 5/10. Not exactly ratings you expect when you are shelling out nearly $1 million.

The monthly payment on this place will be close to $5,000 or you can rent a house in the area for $3,000. But again, the median household income points to people stretching to the absolute max with multiple incomes supporting rent or house payments. Inflation is already eating away purchasing power via energy, food, and other consumer goods. What if we enter into a recession? How will people cover the mortgage? And guess what? Rates are going up so it should be apparent what the next step will be.

Even the California Association of Realtors, not exactly someone to talk about a housing bubble, shows with their data an affordability crisis:

Yes, all of this is completely normal and they even point to levels last seen in 2007. What happened in the subsequent years? Of course, a 4 bedroom in Paramount for $825,000 makes total sense. This market is completely unhinged and there are signs of over heating everywhere. For the housing drunkards, are you going to buy this house? If you truly believe in your thesis, it should be an easy move and you should plunk down some money on this “no lose” deal. Keep us posted.

The inflation numbers we are seeing right now are off the charts. Something is going to give this year simply because household incomes do not support these prices and low rates are maxed out and causing said inflation. Irrational Exuberance once again.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

9 Apr, 2022 housing valuation

less

Selling the Real Estate Mania Hype: Real Estate Agent Most Googled Job. Looking at the Future of Real Estate.

Housing Unit Permits Reach Pre-Housing Crash Levels: Rising Interest Rates, Forbearance Moratoriums, and Interest Rates.

The Home Equity Machine is Back on the Menu: Equity Withdrawals Reach Post-Financial Crisis Highs

- HELOC |

- home equity |

- heloc