0 Followers

542 Views

belldavispitt

0 Followers

542 Views

Share

Share

12

Posts

FORSYTH COUNTY NC APPEAL DEADLINE FAST APPROACHING

The first step in appealing your property tax value is to appeal to the county Board of Equalization & Review ["BER" Each county has their own BER. In order for the appeal to be timely, it must be filed by the "date of adjournment" of the BER. The BER adjournment date will vary from county to county [North Carolina has 100 counties and may even vary in the same county from year to year. So, it is essential. It is essential that one know the adjournment.

You can contact us to get more choices

REVISED PTC HEARING DATES ANNOUNCED

The North Carolina Property Tax Commission is the state-level

appeals body for property tax appeals. The PTC hears appeals from

decisions of the Boards of Equalization and Review of all 100 N.C.

counties. Decisions of the PTC are appealable to the North Carolina

Court of Appeals. The PTC normally holds hearings once a month for

4 days at a time. The PTC recently revised its hearing dates

through December 2022, changing some of the hearing dates from what

was previously published. Please visit the NCDOR website... more The North Carolina Property Tax Commission is the state-level appeals body for property tax appeals. The PTC hears appeals from decisions of the Boards of Equalization and Review of all 100 N.C. counties. Decisions of the PTC are appealable to the North Carolina Court of Appeals. The PTC normally holds hearings once a month for 4 days at a time. The PTC recently revised its hearing dates through December 2022, changing some of the hearing dates from what was previously published. Please visit the NCDOR website here for the most up-to-date information on PTC hearings and more. less

You can contact us to get more choices

Onslow County NC 2022 Revaluation

If you have property located in Onslow County, you should review

your revaluation notice and determine whether you think an appeal

is merited because your valuation is higher than it should be.

Because any value established as part of the revaluation will

generally remain the same for all succeeding years until the next

revaluation and because any benefit from an appeal is only for the

year of appeal and subsequent years, it makes sense to appeal in

the revaluation year to get the most bang for your buck. The... more If you have property located in Onslow County, you should review your revaluation notice and determine whether you think an appeal is merited because your valuation is higher than it should be. Because any value established as part of the revaluation will generally remain the same for all succeeding years until the next revaluation and because any benefit from an appeal is only for the year of appeal and subsequent years, it makes sense to appeal in the revaluation year to get the most bang for your buck. The legal standard for property values is generally "Fair market value," i.e., the value a property would trade for in the open market between a willing buyer and a willing seller. A property owner must file a formal appeal to the Onslow County Board of Equalization and Review on or before June 10, 2022, to preserve their appeal rights for the 2022 year. A failure to file a BER appeal by June 10 means the property owner loses any right to a valuation adjustment for the 2022 year. The article did not mention commercial property values but did state that residential values had increased anywhere from 20 to 136 percent. Valuation notices have gone out so now is the time to check the value of your property as reflected on the revaluation notice and determine if an appeal is merited. less

You can contact us to get more choices

APPEAL DEADLINES ARE NEARING FOR COUNTIES REVALUING IN 2022

North Carolina law requires counties to revalue all property in the county at least once every 8 years. Many counties revalue on a 4 year cycle. Because successful tax appeals are good only for the current year and future years until the next revaluation, and not good for prior years, it is important to appeal in the year of revaluation to get the biggest bang for your buck. Not all counties revalue in the same year. As stated in an earlier blog, 12 NC counties are revaluing in 2022.

You can contact us to get more choices

New 2022 Guide to NC Commercial Property Tax Guide Published

For those following North Carolina property tax matters, I am happy

to present our NC Commercial Property Tax Guide, updated for 2022.

It can be accessed here. As in the past, this guide reviews how the

property tax applies to commercial real property in North Carolina

and describes the appeal procedure if you feel your property has

been over-assessed. In addition, the guide has been updated to

reflect those 12 counties that are revaluing in 2022. As we have

described in the past, North Carolina law requires... more For those following North Carolina property tax matters, I am happy to present our NC Commercial Property Tax Guide, updated for 2022. It can be accessed here. As in the past, this guide reviews how the property tax applies to commercial real property in North Carolina and describes the appeal procedure if you feel your property has been over-assessed. In addition, the guide has been updated to reflect those 12 counties that are revaluing in 2022. As we have described in the past, North Carolina law requires that counties revalue all property in the county at least once every 8 years. less

You can contact us to get more choices

PTC HEARING DATES THROUGH DECEMBER, 2022

The North Carolina Property Tax Commission (PTC) is the state-level appeals body for property tax appeals. The PTC hears appeals from decisions of the Boards of Equalization and Review of all 100 N.C. counties. Hearings before the PTC are de novo. Decisions of the PTC are appealable to the North Carolina Court of Appeals. The PTC normally holds hearings once a month for 4 days at a time. The PTC recently released a calendar of its hearing dates through December 2022.

You can contact us to get more choices

Guilford County NC 2022 Revaluation

Counties in North Carolina are required to revalue at least once every 8 years. Revaluations can be done more frequently, with many counties previously or now moving to a 4 year cycle. North Carolina has 100 counties and not all counties revalue in the same year. Guilford County [including the cities of Greensboro and High Point] is revaluing in 2022. Guilford County revalues property every 4 years [Guilford previously revaluated on a 5 year cycle but recently announced a move to a 4 year cycle].

You can contact us to get more choices

12 North Carolina Counties with Property Tax Assessment Revaluations in 2022

Because assessment reductions achieved through a successful

property tax appeal are not retroactive, knowing when your property

is subject to revaluation is critical. The only way to maximize

potential savings from an appeal is to file that appeal during the

relevant revaluation year. For property tax purposes, each county

in North Carolina is required to revalue all real property within

its borders at least once every eight years. Revaluations for North

Carolina's 100 counties are staggered so that not all... more Because assessment reductions achieved through a successful property tax appeal are not retroactive, knowing when your property is subject to revaluation is critical. The only way to maximize potential savings from an appeal is to file that appeal during the relevant revaluation year. For property tax purposes, each county in North Carolina is required to revalue all real property within its borders at least once every eight years. Revaluations for North Carolina's 100 counties are staggered so that not all counties are revaluing during the same year. less

You can contact us to get more choices

New Property Tax Commission Hearing Dates

The North Carolina Property Tax Commission (PTC) is the state-level

appeals body for property tax appeals. The PTC hears appeals from

decisions of the Boards of Equalization and Review of all 100 N.C.

counties. Hearings before the PTC are de novo. Decisions of the PTC

are appealable to the North Carolina Court of Appeals. The PTC

normally holds hearings once a month for 4 days at a time. The PTC

recently released a calendar of its hearing dates through June

2022. The calendar is available here. The PTC normally... more The North Carolina Property Tax Commission (PTC) is the state-level appeals body for property tax appeals. The PTC hears appeals from decisions of the Boards of Equalization and Review of all 100 N.C. counties. Hearings before the PTC are de novo. Decisions of the PTC are appealable to the North Carolina Court of Appeals. The PTC normally holds hearings once a month for 4 days at a time. The PTC recently released a calendar of its hearing dates through June 2022. The calendar is available here. The PTC normally hears its appeals in the Revenue Building in Raleigh. less

You can contact us to get more choices

PTC Hearing Dates Through December 2021

The North Carolina Property Tax Commission (PTC) recently released

a calendar of its hearing dates through the rest of 2021. While the

PTC normally hears its appeals in the Revenue Building in Raleigh,

the PTC is currently hearing all of its appeals virtually.

Typically, the PTC meets once a month for 4 days during a given

week. The calendar for the remainder of 2021 is available here. The

PTC is the state-level appeals body for property tax appeals. The

PTC hears appeals from decisions of the Boards of Equalization... more The North Carolina Property Tax Commission (PTC) recently released a calendar of its hearing dates through the rest of 2021. While the PTC normally hears its appeals in the Revenue Building in Raleigh, the PTC is currently hearing all of its appeals virtually. Typically, the PTC meets once a month for 4 days during a given week. The calendar for the remainder of 2021 is available here. The PTC is the state-level appeals body for property tax appeals. The PTC hears appeals from decisions of the Boards of Equalization and Review of the 100 N.C. counties. The hearing before the PTC is de novo. less

You can contact us to get more choices

Don’t Miss These Deadlines for NC Property Revaluation Appeals

Almost one in four North Carolina counties are revaluing property

this year for property tax purposes. Filing an appeal in the

revaluation year will maximize the savings from any successful

appeal. The first step in the property tax appeal process in North

Carolina is an appeal to the local county Board of Equalization and

Review (BER). In order to be timely, this appeal must be filed by

the “adjournment date” of the BER. Most people interpret the BER

adjournment date to mean the date that the BER stops... more Almost one in four North Carolina counties are revaluing property this year for property tax purposes. Filing an appeal in the revaluation year will maximize the savings from any successful appeal. The first step in the property tax appeal process in North Carolina is an appeal to the local county Board of Equalization and Review (BER). In order to be timely, this appeal must be filed by the “adjournment date” of the BER. Most people interpret the BER adjournment date to mean the date that the BER stops hearing appeals. less

You can contact us to get more choices

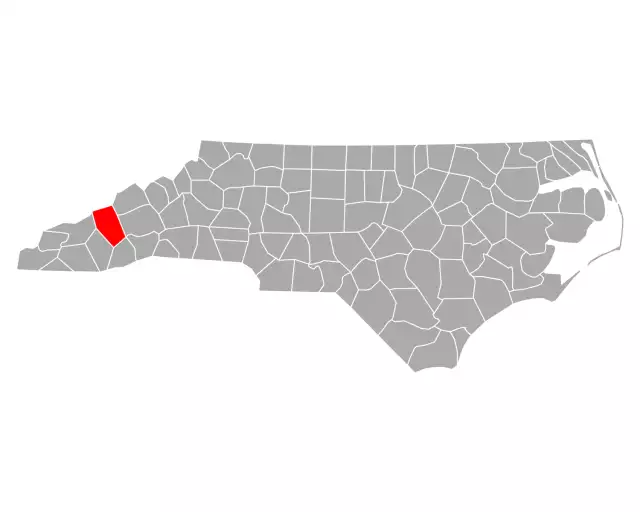

Haywood County Property Values Increase by 15–30 Percent

The Haywood County Tax Department has completed its reappraisal of real property, and property owners have begun to receive tax revaluation notices. The County reappraises property on a four-year schedule, so this assessment will determine your property’s taxable value until 2025—and can generally only be changed based on physical changes to the property or a successful revaluation appeal. Property values didn’t change by much in the 2017 revaluation but will experience a steep jump in 2021.

You can contact us to get more choices