American Pacific Mortgage

Setting Financial Resolutions for the New Year

Setting Financial Resolutions for the New Year

American Pacific Mortgage / December 26, 2022 at 8:00 AM

January 1 is coming up fast, and you know what that means: It’s time to set new year’s resolutions! For many people, the turning over of the calendar will involve financial new year’s

... moreSetting Financial Resolutions for the New Year

American Pacific Mortgage / December 26, 2022 at 8:00 AM

January 1 is coming up fast, and you know what that means: It’s time to set new year’s resolutions! For many people, the turning over of the calendar will involve financial new year’s resolutions.

Maybe you want to pay down your credit cards, start making retirement contributions (or start making larger retirement contributions), bulk up your savings account, start that rainy-day emergency fund, or buy some life insurance.

Whether your goals are short term or long term in nature, you’ll want a financial plan to keep you on track. And there’s no better time to evaluate your finances and establish a plan to help get you on that track than at the beginning of the new year.

Setting Good Financial Goals

So what are some good, solid financial goals (also known as financial new year’s resolutions) that you can set for 2023? We’re glad you asked! Your plan may depend on whether you own your own home, want to purchase a home, or want to purchase an investment or vacation home.

Whatever the case, taking a look at your personal finance plan can help you reach your goals more quickly. If you don’t yet have a plan, then that’s a perfect new year’s resolution right there!

Here are a few tips for setting financial goals that will leave you in a better financial position by next December.

Watch your credit report.

It’s imperative that you keep a regular eye on your credit report, ideally once a quarter. If you’re looking to purchase or refinance a home in the coming year, it may be a good idea to review your profile even more often than that. You can get a free credit report at www.freecreditreport.com, as well as through many credit card companies.

While we’re on the subject, a great financial new year’s resolution is to work on building credit. More on that below, but the biggest tip is devoting more of your monthly income to paying off your credit card debt.

You may think avoiding credit cards entirely is the way to go, as you can’t keep an outstanding credit card balance if you don’t own any credit cards. That’s a good idea in theory, but lenders do want to see that you can use credit and acquire debt responsibly.

With that in mind, a better option is obtaining a credit card or two with favorable interest rates, and then paying them off consistently at the end of every month.

Create, keep, and track a monthly budget.

Knowing where your money goes can help you to identify areas where improvements and savings can be made. This is even more important if you want to save money for a big purchase like a home.

Use one column in a spreadsheet to take stock of your monthly income, and then use a second one to record your monthly bills.

Then make a third column that includes everything else you spend on—going out to eat, shopping, groceries, and even gas. This is the column where you can really make some savings headway. Determine what you can reduce and what you can cut out completely.

Finally, create a fourth column where you calculate how much of that reduced spending can go toward your financial goals. Even a couple hundred dollars a month can make a big difference.

And remember, cutting out luxuries doesn’t have to be a long-term lifestyle. Just keep in mind that the financial new year’s resolutions you’re making this year can help you achieve the financial goals that can set you up for life. Those goals are well worth a little short-term pain.

Fast-track debt repayment.

Using the “snowball method” popularized by Dave Ramsey can help you pay debt off more quickly. This strategy involves paying the minimum balance on all your credit cards except for the one with the smallest balance—you pay as much as you can toward that one!

There are other variations of this method: Some people suggest instead choosing the card with the highest interest rate to pay off first.

Whichever method you choose, plan to pay as much money as possible toward the card you’re targeting. Once it’s paid off, move onto the next credit card. As you continue to pay off these credit card balances, the positive momentum “snowballs,” leaving you with a stronger credit score, improved credit report, and less debt!

Automate payments to stay on track.

Automating payments can be an effective strategy to crush your financial resolutions regardless of your financial goals. That’s thanks to the “set it and forget it” nature of this strategy. Whether you’re saving for retirement, paying off credit cards, buying a home, or something else, utilizing your bank’s automation services can get you there faster.

Simply set up automatic bill pay to ensure that you never miss a due date (or a payment). You can also schedule a funds transfer, where a set amount goes into your savings account every month or pay period. (It’s even better if the account is a high-yield savings account.)

One benefit of a higher interest rate environment is that rates are high across the board. This includes the interest rates for certificates of deposit (CDs) and savings accounts at certain banks. Some of these rates can be around 3% to 4%, making it well worth it to lock in a sum you can leave untouched in a CD or in a savings account that remains liquid.

Automate savings and investments to get ahead.

Another way to use automation to your advantage is to “set and forget” a savings or investment option.

Many people fail to take advantage of their employers’ workplace retirement plans, such as 401(k)s. These are worthwhile investments that are usually deducted from your pay pre-tax. You set it up so that a portion of your paycheck goes straight to the retirement account, and you’re never tempted to spend it. Your employer may also match some of the contribution, which means your account will grow even faster without any further effort on your part.

Another option is to set up an automatic savings plan on your own. To do this, you’ll first need a checking account linked to a high-yield savings account. Then you set up direct deposit from your employer so that a portion of your paycheck is automatically sent to the savings account, with the rest going to checking as usual.

Better Habits for 2023

Whatever your specific financial new year’s resolutions, if you can reduce debt, improve your credit, and increase your savings, you’ll be in a stronger position for your financial future. Don’t be afraid to make 2023 the year that you not only reach your goals, but also create long-term habits that can improve or maintain your financial health.

If these plans involve improving your credit, buying a home, refinancing your mortgage, or remodeling your house, we’re here to help. Give APM a call anytime to get started.

less

December: APM Elevate Newsletter

This Is How Interest Rate Buydowns Benefit Home Sellers

This Is How Interest Rate Buydowns Benefit Home Sellers

American Pacific Mortgage / December 13, 2022 at 8:00 AM

Seller concessions almost never sound like a very good idea…to the home seller. For the prospective buyer, on the other hand, a little give here and there may be just what they need to

... moreThis Is How Interest Rate Buydowns Benefit Home Sellers

American Pacific Mortgage / December 13, 2022 at 8:00 AM

Seller concessions almost never sound like a very good idea…to the home seller. For the prospective buyer, on the other hand, a little give here and there may be just what they need to close the deal and pay full asking price for your home. One of the most popular seller concessions in any real estate market is an interest rate buydown.

As you might imagine, in a rising-rate market, anything that a buyer can do to reduce the mortgage interest rate is a huge perk to them. On the flip side, anything a seller can do to attain the highest price possible for their home is also worth exploring. Interest rates can be a huge barrier for many buyers, and removing (or reducing) that barrier can bring many buyers back to the negotiating table.

This is where a rate buydown can be beneficial. There are two types of buydowns: One is permanent; the other is temporary. Both will reduce the interest rate of the loan, allowing the borrower to save money on their monthly mortgage payment.

Permanent Mortgage Rate Buydowns

A seller can help a buyer obtain a permanent mortgage rate buydown by paying a fee (mortgage points), which will lower their interest rate for the life of the loan. A permanent rate buydown is a good strategy for buyers who plan to stay in their new homes long term.

You can purchase as little as 0.125 of a mortgage discount point or as much as 4 mortgage points; the limit varies by the type of loan. Home sellers should keep in mind that each point is equal to 1% of the buyer’s home loan amount. For example, with a $500,000 mortgage loan, 1 point will be $5,000.

Temporary Mortgage Rate Buydowns

There are several types of temporary buydowns, but the 2-1 buydown is the most common.

The 2-1 buydown will reduce the interest rate by 2 percentage points during the first year of the buyer’s loan term, and then reduce it by 1 percentage point the second year. After the first two years, the interest rate returns to the regular note rate for the remaining life of the loan, and the buyer will be responsible for the full monthly payment.

If you offer a temporary interest rate buydown and the buyer agrees, that money will be debited from your sale proceeds and will be placed into an escrow account. It will supplement the buyer’s monthly payment for the first two years of the loan.

The Benefits to Home Sellers

Now that you know more about these types of seller concessions, you may be wondering why a seller would offer them. The answer is simple: to achieve the full asking price on their home for sale.

Think about it this way: An interest rate buydown allows the buyer to save money on their monthly mortgage payments, either temporarily or permanently, for the life of the loan. The temporary savings can be significant when the interest rate is lowered by 1 or 2 percentage points, but the savings over time on a 30-year, fixed-rate mortgage loan can be even greater.

These savings will typically cost the seller several thousand dollars out of their proceeds. But in return for these short- and long-term savings, many buyers will agree to pay the full listing price on the home, making this concession a win-win for both parties. It’s all about the art of negotiation, after all.

Achieving the full listing price means more than simply bragging rights. Paying a slight fee for an interest rate buydown is often significantly less than accepting a reduced offer that could equate to more than what the cost of the concession would be.

The Benefits to the Real Estate Market

These seller concessions also have broader implications for the entire real estate market and home values in the neighborhood.

The sales price of the home is what gets recorded with the county records. Real estate agents use this data to form comps—aka comparables—which help them to determine the price of other homes in the area. A reduction in a purchase price reflects poorly on the entire neighborhood, often resulting in lower valuations when the next home hits the market.

Price reductions are also noted on online real estate sites. There, too, they can be perceived as a negative mark on the listing or even the entire area. Paying for a permanent or temporary buydown allows the property to be sold at a higher price than it might have been otherwise. That keeps the area’s real estate values stable and the neighborhood unmarred by reduced-price homes.

Are you ready to explore the strategy of offering an interest rate buydown when selling your home? We are available to help you explore your options, so give us a call today!

Disclaimer: Programs are subject to change without notice, terms and conditions apply. Equal Housing Lender.

less

Interest Rate Hacks to Reduce Your Monthly Payments

The Best Holiday Dessert Recipes from the APM Family

5 Holiday Home Staging Ideas

November: APM Elevate Newsletter

How to Pull Off the Ultimate Thanksgiving Day Feast

How to Pull Off the Ultimate Thanksgiving Day Feast

American Pacific Mortgage / November 16, 2022 at 8:00 AM

Thanksgiving was one of America’s most cherished festivities even before George Washington began celebrating it in 1789. However,

... moreHow to Pull Off the Ultimate Thanksgiving Day Feast

American Pacific Mortgage / November 16, 2022 at 8:00 AM

Thanksgiving was one of America’s most cherished festivities even before George Washington began celebrating it in 1789. However, it wasn’t always held on the fourth Thursday in November. That happened in 1846, when Sara Josepha Hale campaigned to make Thanksgiving a national holiday that would be held on the last Thursday of November.

There was a problem, though: November had five Thursdays instead of four in 1939. This led President Franklin D. Roosevelt to break with tradition, officially declaring that, regardless of how many Thursdays were in the month, Thanksgiving would always be celebrated on the fourth Thursday of November.

This holiday holds a very rich history for our country and, chances are, for your family as well. The Thanksgiving feast is steeped in traditions and the ritual of giving thanks. If you’re hosting dinner this year, chances are you want to make this the best Thanksgiving Day ever, so let’s get rolling!

Guest List

Knowing how many people you will be hosting for dinner is crucial to planning the rest of the details, including the menu, the shopping list, and the cooking times. After all, you need to know how many cans of cranberry sauce to buy! The number of guests also determines whether you should do a seated or buffet-style dinner, not to mention whether extra chairs, tables, or cutlery will be needed.

Thanksgiving Menu

Most Thanksgiving holidays will revolve around the roast turkey! Add in all your other family favorites, including sweet potato casserole, brussels sprouts, mashed potatoes, green bean casserole, stuffing, and that famous cranberry sauce.

Don’t forget about desserts; pecan pie and pumpkin pie are always favorites. Beverages and appetizers are great items to assign to guests, or you can provide a signature cocktail in an elegant beverage dispenser.

Finally, consider how many children may be joining, and be sure to include enough drinks and snacks that they’ll enjoy as well.

If this all sounds like too much, you can always order a Thanksgiving dinner to go from many national, regional, and local chains. Just be sure to place your order early—and know how many people you’re planning to feed.

Inventory

Start checking your dishes, pantry, refrigerator, and freezer. Do you have enough serving platters, baking dishes, pie plates, and pans?

Take a peek in the pantry and add anything you may be low on to your shopping list. Think about items you don’t use frequently, such as poultry seasoning or pumpkin spice. Those are typically the items that need to be replenished the most.

Shopping List

Separate your shopping list into perishable and nonperishable items. Stock up on the nonperishables well in advance. The perishables list is what you’ll be grabbing within a week of Thanksgiving Day. When in doubt, purchase an extra: No one enjoys a mad dash to the supermarket with a Thanksgiving feast on the stove!

Cleaning and Organizing

Purge your fridge and freezer to create the space you need for the refrigerated items you’ll be picking up, in addition to ingredients and the make-ahead dishes or sauces that can be frozen. Be sure all platters and baking dishes are easily accessible and clean. This is also a great time to pair them with their serving utensils.

Logistical Planning

Whether you have five ovens or one, you can absolutely pull off a fabulous Thanksgiving feast with a little time and planning. Think through the preparation and cooking time and temperature for each dish. This will determine what will go in when.

If you have two dishes that need to go in the oven at the same time, but one calls for 400 degrees and the other 350, split the difference and go with 375 degrees for both. Just check the oven more often, rotating racks if necessary.

You should also think outside the oven. Can you use your pressure cooker, slow cooker, grill, or smoker for any part of the meal? Desserts can be made a few days ahead and simply reheated after dinner.

Create a timeline of what you can do a week ahead, a few days ahead, the night before, and the morning of. Then use that outline as your Bible as you knock tasks off the list.

Cleaning

Don’t add hours of house cleaning to your already-packed checklist on Thanksgiving Day. Carry out a good deep cleaning the week before, and then keep up on maintenance after that. Get the entire family involved with a quick spruce-up the day before the dinner guests arrive.

If you have a hired housekeeper, ask if they’ll come in off schedule for a deep cleaning that Tuesday or Wednesday (it’s not totally necessary, but it certainly helps if you can swing it).

Preparation

Cut, dice, and set aside! Spend a little time pre-cutting bread for stuffing, green beans for a green bean casserole, or apples for apple pie. Store everything in airtight containers or zip-top bags.

Prepare as many make-ahead dishes as you can, such as a sweet potato casserole or pecan pie, and throw them into the refrigerator.

Arrangements

Rearrange furniture as necessary to make room for your guests. Bring in and set up any additional chairs and tables. Identify where everything will be, including beverages, appetizers, and a drop zone for coats and shoes. Pull out those place settings, seating charts, place cards, silverware, napkins, and candles.

Bring your tablescape to life with natural greenery from your yard, local florist, or supermarket, making sure that centerpiece arrangements are low for easy conversations over the table.

Have the dishwasher, trash bins, and sink completely empty before you start cooking. Dinner prep will be much less stressful if you can quickly declutter your working area as you go.

The Day Of

With so many details coming together at once, it’s easy to get distracted. Did you baste the turkey? Did the cranberry sauce get mixed? Refer to your timeline, and set a timer to keep you on track.

Now you want to think about your guests. The smell from the oven will make for a wonderfully inviting first impression. You can complete that welcoming atmosphere by turning on a relaxing playlist, lighting some candles, and greeting your guests with a tasty appetizer and beverage.

Most of all, don’t forget to ENJOY Thanksgiving Day. Don’t let all these tasks cause you to lose sight of what the Thanksgiving holiday is all about: time with family and friends spent reflecting on the many things we’re grateful for. So make time to pause and soak it all in. The table is where stories are shared, laughter is abundant, and memories are made!

The Day After

Now is the time to kick up your feet, grab a cup of tea or coffee, pull out your smart device, and hunt for some Black Friday deals! Once you’re done with that, it never hurts to find a few new recipes to repurpose all those leftovers!

less

VA Loan Success Story: Navy Veteran Turned Homeowner

- VA-loans |

- APM-Insider |

- military |

- veterans

5 Things Home Buyers Can Be Grateful For in This Market

5 Things Home Buyers Can Be Grateful For in This Market

American Pacific Mortgage / November 9, 2022 at 8:00 AM

The housing market isn’t what it was a year ago—and that’s not necessarily a bad thing. Yes, interest rates are higher year over year, but in many markets, prices are decreasing or, at the very least, not increasing at the breakneck

... more5 Things Home Buyers Can Be Grateful For in This Market

American Pacific Mortgage / November 9, 2022 at 8:00 AM

The housing market isn’t what it was a year ago—and that’s not necessarily a bad thing. Yes, interest rates are higher year over year, but in many markets, prices are decreasing or, at the very least, not increasing at the breakneck pace we’ve seen.

If you’ve tried to buy or sell a home recently, you know what we’re talking about. The market conditions have been wild, with bidding wars, all-cash buyers, and sellers demanding no contingencies. It’s all but priced out first-time home buyers.

If you’ve tried to buy or sell a home recently, you know what we’re talking about. The market conditions have been wild, with bidding wars, all-cash buyers, and sellers demanding no contingencies. It’s all but priced out first-time home buyers.

The good news is this is no more. Here are 5 things home buyers can be grateful for now that the tables have turned in the housing market, making it easier to buy a home.

1. Less Competition

Low interest rates are great, don’t get us wrong. But today’s higher mortgage rates—not to mention the recent buying spree—means there are fewer buyers in the market.

What does that mean for you? Less competition! Getting in bidding wars, paying high home prices, and waiving inspections is not fun, but many people were doing all that simply to secure a family home, any home.

Today’s market conditions take the pressure off of first-time home buyers. They can often take their time, do their due diligence, and make a counteroffer. An experienced real estate agent is still the best person to help with these items, but now the ball is in the buyer’s court!

2. Seller Concessions

Let’s talk about that counteroffer for a minute. Did you like the Jacuzzi in the backyard? Does the prospect of lower mortgage rates have you thinking about buying points? Would you like to absolve yourself of some of the other fees associated with escrow and closing costs?

Many sellers today are motivated, because they know they’ve missed out on the hottest part of the market. Most don’t want to wait any longer and risk housing prices dropping further—or, even worse, having their home sit on the market with no bites.

While sellers aren’t obligated to lower their price, throw in extras, or pay for closing costs or points, it can’t hurt to ask. Many real estate agents will tell you that a motivated seller will consider these items if it means selling their home—especially if they’ve already bought a new home and need to move.

3. More Inventory

Two things are happening in many markets right now: Homes are sitting on the market longer, and more sellers are trying to unload their homes as they don’t want to risk housing prices dropping further. This tight housing market has been so difficult on first-time home buyers, and part of that was due to low inventory.

It’s a different story today. There are generally loads of homes to choose from, giving buyers the ability to be more discerning, pick the house that has their desired features, and buy a home that’s close to what they envisioned in their dreams.

There’s no need to settle in this market; the lower rate of home sales guarantees that there’s something for everyone.

4. Supply Chain Improvement

At first glance, supply chain challenges may not seem to have much to do with buying a home, but they do.

Many sellers have waited to put their homes on the market because they couldn’t secure the materials—cement, lumber, etc.—or labor needed to carry out repairs or improvements before listing their house. Issues with transportation also delayed the delivery of these materials to the contractors who would carry out this work.

Thankfully, many materials are back in stock, and issues with transportation are waning. This means sellers can get moving on that to-do list. As they do, more homes will become available.

A bonus is that these homes will come with newly repaired items or upgrades. The supply chain untangling also means new home builders can get more supply finished and on the market.

5. That an APM Loan Officer Can Help with Everything Else

Experienced real estate agents are part of the home buying equation. A trustworthy loan officer is another. Together, they work as a dynamic team to help you navigate rate hikes, market conditions, home prices, mortgage rates, and ultimately home sales.

The one thing that’s stayed constant throughout the past few years is that the market is ever-changing. You don’t need to stay on top of it when you have an APM loan officer by your side. We eat, breathe and sleep interest rates, housing market fundamentals, and the economy. Best of all, we’re always here to answer any questions you may have.

Whether you’re ready to buy a home today or simply want to hear more about what this current market is like, we’re available anytime. Give us a call today.

less

What You Need to Know About Qualifying for VA Jumbo Loans

October: APM Elevate Newsletter

Down Payment Assistance: Differences Between Gift Funds, Grants, and Loans

How to Qualify for First Time Home Buyer Programs

How To Estimate Your Closing Costs When Buying A Home

How To Estimate Your Closing Costs When Buying A Home

American Pacific Mortgage / October 5, 2022 at 7:00 AM

A down payment and monthly mortgage payment aren’t the only costs you’re looking at when buying a new home. Some buyers forget that they will also have to pay closing costs.

How To Estimate Your Closing Costs When Buying A Home

American Pacific Mortgage / October 5, 2022 at 7:00 AM

A down payment and monthly mortgage payment aren’t the only costs you’re looking at when buying a new home. Some buyers forget that they will also have to pay closing costs.

What Are Closing Costs?

These costs are the fees associated with “closing”—also known as funding or completing—the mortgage loan on your home. These costs include things like the appraisal fee, home inspection fee, underwriting, recording fee, title search, insurance premiums, credit score report, loan origination, transfer tax, application fee, survey, attorney fees, and any discount points.

The exact closing costs and fees vary by person and even by state or city. They will also depend on the sales price of your home.

These costs may be able to be negotiated into the offer to be paid by the seller (sometimes sellers pay closing costs if it means they can stand firm on the home’s listing price). You may also be able to finance your closing costs or choose a “no closing cost” loan that covers these fees, but at a higher interest rate.

What Will My Closing Costs Be?

Homebuyers can typically expect their average closing costs to equal between 1% and 3% of the home’s purchase price. For example, if the home you’re buying costs $300,000, then you can expect to pay between $3,000 and $9,000 in closing costs. Closing costs for an FHA loan are typically between 2% and 6% of your new home’s purchase price.

Your lender will provide a loan estimate that outlines what the closing costs will be (based on the type of loan you’re applying for) within three days of receiving your loan application. They will also issue a closing disclosure that provides the final details surrounding your mortgage loan, including the closing costs, at least three days before your loan closes.

Can I Pay with a Credit Card?

Unfortunately, you can’t pay closing costs with a credit card. What you can do, however, is roll your closing costs into your home loan—if you have an FHA loan. (VA loans are not eligible for this option.) This will mean a slightly higher mortgage payment, but it can be well worth it if you’ve already stretched your budget to come up with the down payment.

Naturally, you can also pay your closing costs upfront. This is done either through cash (actually a cashier’s check) or by taking out a private loan. If you need to get creative, we have written about a few ways you can cover closing costs.

Does a Mortgage Loan Cover Closing Costs?

As mentioned, closing costs can be rolled into a mortgage loan…as long as you have the type of loan that allows for this and there is enough equity based on the appraised value of the home. This is often used in refinances, but with a purchase it’s a little trickier. Your Loan Advisor can run the numbers for you and give you some options.

There are also online tools available to help you plan in advance for your closing costs. American Pacific Mortgage offers several online loan calculators, including a “How Do Closing Costs Impact the Interest Rate” calculator.

My FICO offers an online tool that has you input the information on your new home, such as appraisal price and property taxes, and then calculates how much you can expect to pay when you close on your new home. Taking a little extra time to put in this information can leave you more prepared down the road.

Knowing what you might expect to pay can help you have a good understanding of the overall home loan process. Our APM Loan Advisors can answer any questions you have and help you estimate what your costs may be when you’re looking to buy a new home.

Are you ready to get started? We’re here for you anytime, so give us a call today.

less

21 Creative Ways to Save for a Down Payment

Closing Costs: Mortgage Points Explained

September: APM Elevate Newsletter

September: APM Elevate Newsletter

American Pacific Mortgage / September 21, 2022 at 8:00 AM

Economy Update September 2022, Elliot Eisenberg

APM Consulting Economist Elliot Einsenberg is here with this month's economic update, and the hot topic is inflation and what the Fed is doing

... moreSeptember: APM Elevate Newsletter

American Pacific Mortgage / September 21, 2022 at 8:00 AM

Economy Update September 2022, Elliot Eisenberg

APM Consulting Economist Elliot Einsenberg is here with this month's economic update, and the hot topic is inflation and what the Fed is doing to curb it. The rising costs of food and cars, coupled with continued supply chain shortages, have pushed the Fed to making moves to stop inflation as quickly as possible.

So, what's next for consumers?

REACH YOUR GOALS

Homebuyer Affordability Improves in 47 States

The playing field for homebuyers was more favorable in July as housing affordability improved for the second straight month.The average national monthly mortgage payment decreased by $49, bringing the median payment to $1,844, according to the Mortgage Bankers Association's (MBA) Purchase Applications Payment Index (PAPI), which measures how new monthly mortgage payments vary across time, relative to income.The national payment index decreased 3.8% to 157.7 in July from 163.9 in June, meaning payments on new mortgages take up a smaller share of a typical person's income.While inventory shortages, rising mortgage rates, and a decrease in homebuyer earnings all affect mortgage payments, declining home prices have lowered mortgage payments, even though rates have risen.Prospective buyers in five states may be encouraged to learn that they had the lowest payment index numbers in July: Washington, D.C. (101.4), Connecticut (105.1), Alaska (110.3), Louisiana (110.9), and West Virginia (116.6).

Source: mba.org

MORTGAGE IQ

Mortgage Payments and Escrow

If you've just purchased your first home or plan to buy soon, you may not be familiar with mortgage escrow accounts. Since most borrowers pay for home insurance and property taxes through an escrow account, here's a refresher on escrow basics.An escrow or impound account is set up and managed by your mortgage servicer. It can help homeowners manage larger property-related expenses like taxes and insurance premiums. Since these are due annually, an escrow account makes these bills easier to manage by dividing them into 12 monthly payments. Every month, homeowners pay around 1/12th of their home's annual taxes and insurance into an escrow account.Most homeowners find that their escrow account simplifies budgeting, especially as they won't have to pay an entire year's tax bill or insurance premium at one time. In addition, your mortgage servicer will pay these bills on your behalf, so you won't have to watch your mail for these bills. This eliminates the risk of being charged additional fees for late payments.After you've been in your home for a year, your mortgage servicer will conduct an annual escrow review or analysis. This review compares your escrow account's annual balance to your future annual taxes and insurance premiums. If these have become more expensive, your escrow payments may be increased to cover them. However, if your escrow analysis finds that you have surplus funds in your escrow account, you may receive a refund.

Source: consumerfinance.gov

FINANCIAL NEWS

FICO Scores Remain High, Consumers Remain Stressed

During the last few months, many consumers have coped with inflation by charging more purchases to their credit cards. However, it hasn't impacted their credit ratings, as the national average FICO score is at an all-time high of 716.This is the same average score as a year ago, which may seem to be good news...except that 2022 is the first year that FICO scores did not increase since 2009.As of April 2022, the average credit card utilization was just over 31%, up from 29.6% a year earlier. Also, a recent survey of 3,500 credit card holders found that nearly 20% of respondents feared checking their monthly credit card statements.However, if credit card holders don't allow their account balances to creep past the 30% mark, their FICO scores probably won't suffer. This is because lower levels of revolving debt won't trigger the FICO algorithm to lower their scores.

Source: cnbc.com

DID YOU KNOW?

The History of Air Conditioning

Since this year's summer was one of the hottest ever, many of us are best friends with our home's air conditioning. However, it wasn't invented for our comfort...instead, the first air conditioners were built to improve the performance of printing machinery.Willis H. Carrier invented the first air conditioning unit in 1902, while he was chief engineer at a producer of steam engines and pumps. He was approached by a publishing company and hired to provide solutions for controlling the air's humidity, which was causing paper stock to become soggy, wreaking havoc on print quality. To remedy this problem, the 25-year-old Carrier designed a system that would control temperature, humidity, air circulation and ventilation. In 1906, Carrier patented his first Apparatus for Treating Air.Fast-forward to 1914, when Carrier and other engineers formed the Carrier Engineering Corporation. While the company hit some major financial speed bumps, including the 1929 Wall Street crash and subsequent Depression, the renamed Carrier Corporation hit its stride in the 1950s. Today's Carrier Global Corporation is still profitable, reporting $20.6 billion in sales during 2021. That's a lot of cool air!

Source: howden.com

PERSONAL FINANCES

How to Choose the Best Bank

If you've moved to a new city or outgrown your current bank, you may be wondering how to choose a new one. In addition to helping you manage your finances, a bank should also provide options that meet your personal needs. For example, are you thinking of opening an investment account, or is ATM access your top priority?Before making your final choice, take these four steps:1. Identify the right accounts.

A good way to do this is to match a prospective bank's account offerings to your financial goals. For example, if you're looking to replace your checking account, you might choose a bank with high-yield checking accounts, plus Certificate of Deposit account (CD) options.2. Consider the convenience of a bank branch.While online banking is popular, 78% of consumers still visit brick-and-mortar branches. Recent data also indicates that convenient branch office locations are the primary reason consumers gave for choosing their banks. However, ATM locations and online/mobile banking options may be equally important to you.3. Consider credit unions.Credit unions are member-owned, not-for-profit organizations. Profits are typically returned to members in the form of lower fees, higher savings rates and lower borrowing rates.While credit unions don't have nearly as many ATMs as banks, the process for opening a new account has become more streamlined, although still generally slower than most banks.4. Find a bank that supports your lifestyle.Self-employed? Choose a bank that can support you as you build your business. Trying to save more? Check out banks with high-yield savings accounts or a variety of CD terms, or those that allow you to open several accounts for different goals. Many banks have budgeting tools built into their websites or apps that make it easy to see where your money is going.

Source: bankrate.com

FOOD

Dulce de Leche Brownies

Want to add a sweet new twist to chocolate brownies? Pick up a can of dulce de leche — and you're on your way to a real crowd-pleaser. These nut-free dulce de leche brownies taste even better the day after you bake them.

REAL ESTATE TRENDS

Interior Design Goes Retro

If you missed the trends of the 1970s first time around — or weren't born yet! — don't worry. Many of them are back for you to enjoy and add to your home's interiors. Best of all, there's something for every budget.Fringed accents are back big-time. Elvis Presley rocked stage outfits featuring fringe during his 1970s shows, and you can bring this trend indoors with fringed rugs or curtains. If you prefer to dress up existing items, try adding fringe to a lampshade, a pair of curtain holdbacks, or one or more sofa cushions. Be sure to choose a fringe color that matches or complements any upholstered items or existing curtains.Checkerboard patterns didn't just make a comeback in the 1970s; they were popular in previous decades and were seen everywhere, from 1920s kitchen floors to 1950s diners. This pattern creates a retro vibe while breaking up the look of an otherwise neutral room. In addition, almost any kitchen or bathroom can be transformed with black and white checkerboard floor tiles. However, it's best to limit this look to one area, so it doesn't overwhelm. Consider choosing two complementary colors if classic black and white checkerboard doesn't work in your home. And if you want to tread carefully, go for checkered bedding or area rugs.Darker wood tones are appearing for fall, as designers and decorators replace Scandinavian-style blonde wood and lighter interior paints with moodier choices. If you're not ready to replace or discard any lighter pieces of furniture, you can still set a new, dramatic mood. Re-stain light wood with a dark color, repaint a room, or add a single item such as a coffee table. Ready for a major change? Consider adding dark wooden beams to a main room's ceiling.

Source: purewow.com

less

APM Celebrates Hispanic Heritage Month 2022

APM Celebrates Hispanic Heritage Month 2022

American Pacific Mortgage / September 15, 2022 at 8:00 AM

Each member of our APM Family comes from a unique background and has a story that’s waiting to be told. From their upbringing to family values, cultural celebrations, and work in the mortgage

... moreAPM Celebrates Hispanic Heritage Month 2022

American Pacific Mortgage / September 15, 2022 at 8:00 AM

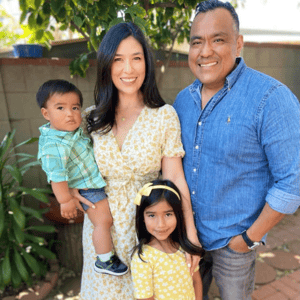

Each member of our APM Family comes from a unique background and has a story that’s waiting to be told. From their upbringing to family values, cultural celebrations, and work in the mortgage industry, we’re sharing some of their stories with you in celebration of Hispanic Heritage Month.

-2.png?width=600&name=APM%20Blog%20Size%20(2)-2.png)

David Garcia, Loan Advisor for Vault Mortgage a dba of American Pacific Mortgage, NMLS #286883

As a first-generation Mexican American, David Garcia grew up learning the value of hard work. His parents immigrated from Oaxaca, Mexico, in the late ’60s, with his working relatives taking up “labor” positions to get by, as David calls it. This, he says, has been the greatest blessing of his life.

Watching a generation of family members work as plumbers, painters, and gardeners instilled a strong work ethic in David. He carries that lesson with him today as a Loan Advisor in Los Angeles, which has a large Latino community.

Though David welcomes all races, ethnicities, and types of borrowers, he has a special place in his heart for the Hispanic community. Many of these families remind him of his own—with multiple generations living together and a sense of bonding and loyalty above all else. For these reasons, David strives to ensure that his borrowers understand their options—in either English or Spanish—which may include multiple families purchasing one property.

David also knows that he didn’t get to where he is alone. Reciprocating the opportunities that were afforded to him is a major motivator. Whether face to face or on social media, David is determined to help as many American dreams come true as possible.

He understands the value and challenges associated with creating generational wealth, particularly among the Hispanic community, and vows to do what he can to make that dream a reality for all families. David seeks out hard situations and deals that need to be explained because he knows the opportunities these doors can unlock once a loan is funded.

David thoroughly enjoys working with self-employed borrowers and small-business owners, who have already invested so much to achieve their dreams. As someone who is living the life he always dreamed of, David is honored to be the one to help these individuals and families reach the next step on their journey.

Luz Lluncor, Branch Manager for New World Mortgage Branch a dba of American Pacific Mortgage, NMLS #227914

Though there are many paths to success, Luz Lluncor believes education is the cornerstone that can help anyone achieve their dreams. That’s why she’s taken it upon herself to make sure her borrowers and the larger Latino community she serves understand the value of learning.

Now in her 22nd year in the mortgage industry, Luz learned early on that education was the key for her borrowers. She was trying to discover what would make her stand out among a crowded industry when she realized that what was lacking was the opportunity to learn more about homeownership, finance, mortgages, and generational wealth. This was especially true among her local Latino community in the Los Angeles suburb of Downey.

Luz is very proud of the workshops she hosts. They’re always on her calendar, and they’ve never stopped, even during the pandemic. These workshops are so important to her because Luz knows that if just one person listens, they can see the benefits homeownership can bring to them and their family—and family is front and center for Luz.

Luz’s mom and two siblings immigrated to the United States from Peru when Luz was 7. She didn’t speak English at the time, a language that the culture and school system highly emphasized over Spanish. Luz not only learned English, but soon found it to be her dominant language, both inside and outside the home.

Luz made a conscious effort not to lose her first language, though, and is proud to say that she remains fluent in Spanish without a trace of an American accent. The language, large family gatherings and Peruvian cooking motivate Luz to never lose sight of where she came from. She knows other Latinos feel the same and appreciates that, collectively, the culture embraces their community, family, and social events.

Luz also wants her community to keep learning, pursuing higher education whenever possible. She believes this will help close the wage gap that so often exists between Hispanic borrowers and others. As education continues, opportunities arise and advancement materializes. Luz knows homeownership can be a part of that advancement, which is why she’ll continue educating her community until she retires.

Jean Diaz, Branch Manager for APM Urbandale Branch, NMLS #523264

Jean Diaz has a passion for education that he attributes to his father. Jean moved with his parents and four siblings from Venezuela to Des Moines, Iowa, when he was 14 and instantly saw the value in education.

The United States held new potential for him, and he knew he wanted to pass the opportunities and education he received on to others within the Hispanic community. This continues to be Jean’s goal as a branch manager at APM. Jean understands that one of the biggest roadblocks to homeownership that Hispanics face is simply a lack of knowledge about where to begin. These roadblocks can turn into inaction, and that can lead to the Hispanic community being overlooked and underserved when it comes to buying a home.

That’s why Jean focuses on outreach, education, and resources for this community. Whether they’re ready to buy a home today, four months from now, or two years down the line, Jean ensures that the Hispanic community knows the options available to them. He does this in person through seminars, as well as on social media, where he maintains a steady following—particularly on Facebook, a favored platform of this community.

For Jean, succeeding in his career isn’t just about sales and loans, but making an impact on someone’s life, especially if they never thought the dream of homeownership was within reach. Success is also about personal fulfillment, which is why Jean plans to travel back to Venezuela in the next four months. Since he hasn’t been back in more than 12 years, Jean is looking forward to a time of celebrating his culture every day, particularly through food and family get-togethers.

Most of all, Jean is excited to embrace the face-to-face gatherings that his community so enjoys. He remains connected to the local Hispanic community in Des Moines and can’t wait to reconnect with his native Venezuelans.

Michelle Eubanks, APM Loan Advisor, NMLS #2096042

For Michelle Eubanks, embracing her Mexican roots while being a successful Loan Advisor is all about meeting people where they are—both figuratively and literally. Being based in Houston and having immigrated to the United States when she was 14, Michelle appreciates that the Hispanic population sometimes has its own ways of doing things. This includes face-to-face meetings and even invitations to dinner or a child’s birthday party.

For these reasons, Michelle remains open to doing business however the client feels most comfortable, which sometimes involves a festive get-together or an intimate meal shared among new friends. Meeting in person and being able to touch and feel the documents involved are important to this community, Michelle says. This is why she ensures that all her marketing materials are available in English and Spanish, and has numerous realtor partners who are bilingual. Michelle also produces social media videos in both languages.

Michelle views her mom as her hero for having raised three children on her own in a new country. To Michelle, this is a true example of the American dream: resilience paired with hard work, lots of love, and strong family values. Michelle is also very proud to note that her mom owns her own home outright, with no debt.

In her free time, Michelle loves to travel back to Mexico. She has a fondness for exploring new places within the country. This affords her the opportunity to learn even more about her roots while still feeling like she’s on vacation and seeing the world.

Travel also allows Michelle to return home to Houston refreshed and with an even greater understanding of Mexican culture. Michelle’s door is always open, and she’s more than happy to review any documents, checklists, or part of the mortgage process that might make homebuying easier for one of her clients.

Marlyn Martinez, APM Loan Advisor, NLMS #1397191

Marlyn loves the Pacific Northwest and its tight-knit Hispanic community. Her Washington roots were laid down by her parents, who immigrated to the eastern portion of the state from Mexico. They met at a party and worked at the same apple farm.

Though her mother was convinced that she would return to Mexico after making a little money, she soon found herself with a husband, a daughter, and her own version of the American dream playing out. Now a mother herself, Marlyn lives only half an hour from her parents. She and her family visit them at least once a week, especially for her dad’s famous margaritas.

Marlyn knows that hard work, sacrifice, and family are the cornerstones of the Hispanic culture, which is why she embraces all three. In her experience, Marlyn has found that many Hispanics don’t realize they can buy a home with less than 20% down, or that they don’t have to be a citizen to qualify for a mortgage.

Her outreach efforts strive to dispel these myths while arming this community with the tools, resources, and information they need to buy a home. This includes a Spanish-speaking team of realtors, title representatives, insurance agents, and home inspectors who can walk borrowers through every step of the process. Marlyn finds that explaining each step, including why certain documentation is needed, really helps Hispanic borrowers feel comfortable.

Being as community-oriented as they are, Hispanic borrowers often refer their friends and family to Marlyn and her partners. This in turn arms even more would-be borrowers with the tools they need to achieve their American dream.

When Marlyn isn’t working, she can be found visiting with her very large extended family, as both sets of grandparents had 14 children each. Some are in the Pacific Northwest, making family gatherings that much more special. Others still live in Mexico, which presents endless opportunities to visit the country and stay connected via Zoom. This connection is especially cherished on holidays like the Day of the Dead (Dia de los Muertos), when Marlyn and her immediate family could partake in festivities in Washington while watching her relatives in Mexico observe the holiday as well.

less

A Guide to Seller Concessions

Employment History & Job Changes During the Mortgage Process

Employment History & Job Changes During the Mortgage Process

American Pacific Mortgage / August 23, 2022 at 8:00 AM

Two things can be really exciting and terrifying—buying a home and changing jobs.

Combine the two, and you’ve got yourself a recipe for stress…or do you? Many people

... moreEmployment History & Job Changes During the Mortgage Process

American Pacific Mortgage / August 23, 2022 at 8:00 AM

Two things can be really exciting and terrifying—buying a home and changing jobs.

Combine the two, and you’ve got yourself a recipe for stress…or do you? Many people assume that they can’t or shouldn’t buy a home if they’re in the middle of a career change.

Will it be less paperwork if you have a long work history with the same company where you can easily produce pay stubs that explain your pay structure? Of course it will. Does that mean you should hold off on buying a house until you have more stability? Not at all!

Whether you’re switching jobs, starting a new salaried position, have a commission-based gig, or have gaps in your employment history, there are ways to move forward in the homebuying process.

So let’s clear up some of the biggest misconceptions and assumptions about whether buying a home is right for you if your job changes during the mortgage process or if your employment history is less than stellar.

Should I Accept a New Job During the Mortgage Process?

You can, but be sure to inform your lender immediately. That’s because a mortgage lender will do a final income and employment verification just before the mortgage application process is complete. The last thing you want is to have your dream home slip through your fingers at the 11th hour.

So tell your mortgage lender everything upfront, and keep them informed of any changes in income, job titles, or dates of employment.

If you have a new job, you’ll want to provide an offer letter, a letter that confirms any changes in job titles, your most recent pay stub, and a verification of employment (VOE) letter. If you’ll be relocating for the job, you’ll also need a relocation letter from your employer.

How Does a Job Change Affect My Mortgage Application?

If you had a salaried position and you’re moving to another salaried position, it’s generally no sweat as long as the salary and industry are similar. That’s because mortgage lenders like to see that you’re stable, secure, and responsible.

However, your ability to qualify for a mortgage could be affected if your income decreases substantially. That’s because a salary reduction would impact your debt-to-income (DTI) ratio, an important calculation when buying a home.

Certain job changes during the mortgage process also make lenders nervous. They don’t generally like to see a switch from a salaried position to one that’s commission based, or a change in your pay structure where you go from being a W-2 employee to a contract employee.

Commission-based or contract workers get mortgage loans approved all the time. But when your work history and pay structure suddenly change in the middle of the mortgage application process, it shakes a lender’s confidence in your ability to repay the loan.

That’s because the new position and pay structure are untested for you. No one can predict whether you’ll knock it out of the park and make even more money than you did before—or if switching jobs will result in much lower pay and an inability to make your mortgage payment.

How Do Mortgage Lenders View Gaps in Work History?

Mortgage lenders understand that not everyone has a consistent, linear employment history from the time they turn 16. But they also know that steady employment is a good indicator that a borrower will repay their mortgage.

Most mortgage lenders require only a two-year work history, so if any gaps exist before then, you should be fine. During that two-year period, a gap of a month or two may also be overlooked, but being unemployed for six months or longer could be a red flag.

The same is true of frequent job changes or swings in income. Again, it’s all about stability.

Mortgage lenders also know that you’re human. That’s why every home loan applicant is treated on an individual basis. This gives you the opportunity to explain any gaps in employment. Maternity leave, a temporary disability, caring for a loved one, a layoff, or taking time off to go back to school are generally acceptable reasons for a gap.

Whatever the reason, you may be asked to show proof related to your employment gap. In the case of going back to school, this could come in the form of a transcript. For maternity leave, it might entail a letter from your employer.

Your mortgage application can also be made stronger if you can show proof that you never missed a rent or mortgage payment during the gap in your work history.

Can I Get a Home Loan as a Contract Employee?

You certainly can, though mortgage lenders generally like to see a two-year work history as a contract employee. Becoming a contract employee during the mortgage process, on the other hand, can cause some concern.

Contract employees need to show more documentation when applying for a mortgage, which may include 1099s from clients, most recently paid invoices, additional years of tax returns, a current balance sheet, and a profit and loss (P&L) statement, among other requirements.

What if I Change Jobs After I Close on My Mortgage?

Once your loan is funded and you’ve closed on your home, you can change jobs with no consequences. Keep in mind, though, that there’s a difference between “cleared to close” and “closed.”

If your loan is cleared to close, the mortgage lender may still want to verify income and employment. This would not be a good time to make a major career move. Also, your ability to refinance a home loan in the next couple of years could be impacted by a job change after your original loan closes.

Do Lenders Verify Your Employment During and After the Mortgage Process?

During the mortgage application process? Absolutely. Some mortgage lenders will also do a second or even third VOE after the loan has closed. This typically happens if the institution is in the middle of an audit or if your mortgage is being sold to another company.

Once your mortgage is funded and the home closes, however, the house is yours.

Whatever your employment status, APM is here to help. Give us a call today to discuss your exact financial situation and goals.

less

Buying a House: Today’s Down Payment Requirements and Options

Buying a House: Today’s Down Payment Requirements and Options

American Pacific Mortgage / August 17, 2022 at 8:00 AM

Buying a house isn’t just about the sticker cost or the monthly payment. A large part of your housing budget will also be your down payment. If you’ve seen lender ads before,

... moreBuying a House: Today’s Down Payment Requirements and Options

American Pacific Mortgage / August 17, 2022 at 8:00 AM

Buying a house isn’t just about the sticker cost or the monthly payment. A large part of your housing budget will also be your down payment. If you’ve seen lender ads before, you know that this number can be all over the board.

But is a bigger down payment really better? Can you really buy a home with no money down?

We’re here to give you the lowdown on down payments!

What Is a Down Payment?

Let’s start with the basics. When you’re buying a house, you’re generally required to make a cash payment upfront. That’s called the down payment.

How much cash you put down is typically expressed as a percentage of the purchase price. For example, if you wanted to do the “standard” 20% down payment on a house that costs $450,000, you would pay $90,000 toward the cost of your home while financing the remainder.

Now, it’s important to remember that your down payment is made in addition to closing costs, such as escrow fees. Some homebuyers choose to finance those costs as well, but they’re another item to keep in mind when determining your housing budget.

Where Does the Down Payment Come From?

The money for a down payment isn’t included in your financing. Rather, it’s a way to let your lender know you’re committed to buying a house and to fulfilling its financial obligations. Think of it as a nonrefundable deposit.

Many homebuyers spend some time saving for a down payment. They create a monthly budget; scrimp where they can; and put any extra money, such as birthday card cash or work bonuses, toward the down payment amount.

Others may choose to obtain a personal loan or sell a big-ticket item like a boat or car. (Reminder: If you take out a loan for the down payment, you’ll need to include that monthly payment on your application for qualification purposes.)

Some buyers who already own a home will also consider tapping into their primary home equity if they’re buying a house as a second home, a vacation home, or an investment property.

There are also a lucky few who receive the cash for their down payment as a gift. This is perfectly acceptable—and great for them!—as long as the stipend is accompanied by a gift letter explaining that the money is, in fact, a gift and not a loan. The gift letter should also outline the relationship between the giver and the borrower.

What Is the Average Down Payment for Today’s Borrower?

The typical benchmark for down payments is 20% of the home’s purchase price. However, the National Association of Realtors (NAR) notes that most homebuyers don’t put 20% down. Instead, they put between 6% and 7% down—a trend NAR has seen since 2018.

Of course, 2018 and 2022 are worlds apart in terms of, well, the world. The pandemic upended many things in life, including home prices and interest rates.

Even still—and even in this super-competitive market—the typical down payment for a first-time homebuyer is 7%. There are loan programs that allow even lower down payments, as low as 0% to 3.5%! These include VA loans, first-time buyer programs, FHA loans, and others.

Before you start jumping for joy at the thought of putting less than 20% down, keep in mind that any down payment under 20% will typically require mortgage insurance of some sort.

Private mortgage insurance, or PMI, is the most common and generally costs between 0.5% and 2% of the mortgage annually. You can remove PMI once your loan balance reaches 78% or 80% (depending on your lender’s terms) of the home’s original price.

Considerations When Determining Your Down Payment

Aside from considering how much you’d like to put down on a home, you also have to think about what’s most strategic for you. There’s what you can afford, of course, which is an important factor when you’re parting with that much cash.

But you also have to consider whether you’re willing to pay PMI, whether your interest rate or ability to qualify for a home loan will be impacted by the size of your down payment, and whether that money might be better spent elsewhere.

Allow us to explain.

A larger down payment—typically in the neighborhood of 15% to 20%—makes lenders feel more confident that you’re committed to buying the house. That’s because you’ve got some skin in the game. If you’re putting less down, it can be considered a riskier loan for them and, therefore, can come with a higher interest rate.

Plus, a larger down payment means less money financed, which means a lower monthly payment. This can be a good thing if you’re having trouble qualifying or if you’re looking at homes at the top of your price range.

Individuals with lower credit scores or higher debt-to-income ratios may also be required to make a larger down payment.

If you and your lender are comfortable with a certain size down payment, you don’t necessarily need to put more than that down. Doing so can lower your monthly payments, absolutely.

However, you should consider whether that money could be better spent elsewhere—for example, paying down credit card or other high-interest debt, socked away into an emergency fund, or earmarked for home improvements or repairs. And don’t forget about paying for closing costs and fees, including the home inspection.

Type of Mortgage

The type of mortgage you choose can also impact how much money you put down, because some have down payment requirements. VA loans, for example, can offer zero money down. Some conventional loans can go as low as 3%, while FHA loans can get as low as 3.5%. Jumbo loans typically require a 10% down payment or more.

The size of your down payment will also be influenced by whether this house will be your primary residence or a vacation or investment property.

APM’s Mortgage Calculator can help you view the various down payment scenarios based on your parameters. Our Loan Advisors are also happy to sit down with you anytime to help you run any scenarios based on your specific financial situation and goals.

Down Payment Assistance

If a down payment still sounds intimidating, fear not. APM can direct you to a variety of down payment assistance resources, especially if you’re a first-time homebuyer.

There are many programs available at the federal, state, and local levels. Some are based on income, while others are based on the geographic region or type of home you’re looking to buy. And not all programs are exclusively for first-time homebuyers, so be sure to ask your Loan Advisor for the programs that may be right for you.

Are you ready to get started? Contact us anytime with your down payment questions, concerns or comments.

Or do you have that part of the homebuying equation already squared away? That’s great, too! We’re always ready to help you get started on pre-approval or your home loan.

less

August: APM Elevate Newsletter

August: APM Elevate Newsletter

American Pacific Mortgage / August 12, 2022 at 8:00 AM

August Economic Update with Elliot Eisenberg

The yield curve is currently inverted, which tells economists a lot about the economy and where it's headed. Elliot breaks down what it means, why it matters, and his thoughts on what it means

... moreAugust: APM Elevate Newsletter

American Pacific Mortgage / August 12, 2022 at 8:00 AM

August Economic Update with Elliot Eisenberg

The yield curve is currently inverted, which tells economists a lot about the economy and where it's headed. Elliot breaks down what it means, why it matters, and his thoughts on what it means for the near future.

REACH YOUR GOALS

Misconceptions Held by First-Time Buyers

A recent survey discovered that some first-time buyers are unaware of all the mortgage options available to them. Are any of these common home buying myths affecting your plans?"I need to put down 20%, right?" Over 40% of would-be homeowners think they need to save 20% to buy a home...but this requirement has been obsolete for 66 years. This was because private mortgage insurance (PMI) was introduced in 1956 to help provide more mortgage options."If my mortgage requires PMI, I'm stuck with it forever." Did you know that 50% of Americans plan to wait until they've saved 20% down, so they can avoid PMI? Depending on your initial mortgage program, you can either:

"My parents can't help me with a down payment - what else can I do?". There are hundreds of down payment assistance programs, low (or no) down payment loans, and ways to grow your down payment fund quickly.

MORTGAGE IQ

How To Buy A Foreclosed Home

While COVID-related relief efforts kept foreclosure figures low in 2020 and 2021, determined buyers are still locating foreclosed, or Real Estate Owned (REO) properties. While these can sometimes – but not always – be purchased at a bargain price, there are often challenges. Keep in mind that these homes are rarely "move-in ready". Instead, many reflect the prior owner's financial difficulties and may need major repairs.Here are some helpful tips for would-be buyers of foreclosed properties:

Find a real estate agent who specializes in foreclosures.

While some of the buying process is like non-foreclosures, you may need to bid for your property at an auction. Or a homeowner may be able to sell to you at a lower "short sale" price instead of going through foreclosure. This is when a specialist agent can be your best friend.

Learn how to find foreclosures.

While some will be online as Multi-Listing Service (MLS) listings, there are other places to look. Websites maintained by county judicial or sheriff's departments often post details of foreclosure auctions. More foreclosed properties may be listed at sites maintained by Fannie Mae, Freddie Mae and the Department of Housing and Urban Development (HUD).

Prepare for potential difficulties.

Foreclosed property purchases often have a few speed bumps. For example, a short sale offer may require a lender's approval. Also, if you're buying at auction, inspecting the property before the auction may not be an option. Homeowner's disclosures probably won't be available either.

Source: https://www.nerdwallet.com/

FINANCIAL NEWS

Home Inventory Grows by Double Digits

Would-be home buyers finally have some good news, as the number of properties for sale have risen 28% year-over-year. This is due to several factors, including these two:

1. More home sellers have recently entered the market, hoping to sell before a possible economic downturn.2. More buyers, frustrated by bidding wars and wary of higher interest rates, have adopted a more cautious, "wait and see" approach.There's more good news for buyers, as sellers in many areas — including cities with the most inflated home prices — are beginning to drop their initial asking prices. This includes Boise, Idaho; Tacoma/Seattle, Washington; Portland, Oregon and Tampa, Florida.

Source: https://www.cnbc.com/

DID YOU KNOW?

The 107-year History of the RV

Even though one of the first modern recreational vehicles (RVs), the Airstream Clipper, first appeared in 1936, the history of the RV can be traced back further to 1915. This is the year that Roland Conklin departed New York in a customized 8-ton vehicle.Conklin equipped it with an electrical generator and incandescent lighting, a full kitchen, sleeping berths, a concealed bookcase, a phonograph, a variety of appliances, and even a roof garden. These amenities were especially appreciated by Conklin and his 12 passengers since the vehicle's top speed was around 20 mph.Henry Ford joined the RV bandwagon in the mid-20s with the production of the Model A House car. Featuring two small beds, a kitchen and dining area, only two 1928 House Cars are still known to exist. Other competitors included the REO Speed Wagon Bungalow, a prototype of today's pickup truck. The first silver aluminum Airstream RV — the Airstream Clipper — appeared in 1936, with Winnebago joining the RV market in 1958.

Source: https://www.volocars.com/

PERSONAL FINANCES

Why It's a Great Time to See Europe

If you're undecided about this year's summer vacation and your passport's gathering dust, consider visiting one or more of the 19 countries using the Euro as currency. Here's why: For the first time in 20 years, the dollar and the euro are worth about the same. When they're equal, this is described as "on parity". This means that American travelers will be getting better prices in France, Italy, Spain, Ireland, and other countries with Euro currency.You may save more if you postpone until September (or need time to get a passport). This is the official start of the two-month "shoulder season" which falls between peak and off-peak travel seasons. Generally, both hotel and airline prices are somewhat lower during September and October.To make the most of a strong dollar, travel agents suggest using credit cards without foreign transaction fees and paying for hotels in advance. If you prefer paying with cash, waiting to withdraw Euros from foreign ATMs usually provides better conversion rates than converting currency before departure.

Source: https://www.cheapair.com/

FOOD

Slow-Cooker Chicken Tacos

Taco night just got a lot easier and cooler with the help of your trusty slow cooker! This recipe for slow-cooker chicken tacos allows the meat to absorb the flavor of the other ingredients including your own special spice blend. You can also adjust the heat level by adding jalapeño chiles.

REAL ESTATE TRENDS

Interior Wellness Design Trends

While quarantined homeowners began to create home relaxation areas two years ago, the trend is still going strong. A recent report from the American Society of Interior Designers found that "health and wellness" was a top interior design trend. Today's homeowners are creating in-house retreats where they can relax, detox and increase their wellness.Infrared saunas are popular choices with homeowners looking for the benefits of a traditional sauna with less expense and steam. Also called high-infrared or dry heat saunas, these are available with the same look as a wood sauna enclosure, or even in blanket form.Areas with soothing décor and colors are equally popular. Also known as "meditation corners", these usually provide sufficient room for yoga or other relaxing pursuits. Plants are another feature, as they improve indoor air quality by converting carbon dioxide into oxygen. Homeowners with larger budgets and more square footage have taken the concept further, adding soaking tubs and skylights that provide more Vitamin D.Considering that the past two years have delivered plenty of stress, adding a relaxation area is never a bad idea...and the ideal venue is your home.

Source: https://www.vogue.com/

less

How to Win Against Cash Offers in Today’s Housing Market

What is a Temporary Buydown?

What is a Temporary Buydown?

American Pacific Mortgage / August 5, 2022 at 8:00 AM

A temporary buydown is when a party in a mortgage transaction pays a lump sum in order to reduce the interest rate temporarily for early years of the loan. This can help a buyer ease into the full mortgage payment at the beginning

... moreWhat is a Temporary Buydown?

American Pacific Mortgage / August 5, 2022 at 8:00 AM

A temporary buydown is when a party in a mortgage transaction pays a lump sum in order to reduce the interest rate temporarily for early years of the loan. This can help a buyer ease into the full mortgage payment at the beginning of the loan term.

How Does a 2-1 Temporary Buydown Work?

In a 2-1 temporary buydown, the rate is bought down for the first two years of the mortgage loan. For instance, if the note rate is 5%, then the rate is reduced to 3% for the first year, then 4% for the second year, and then remains at the note rate for the remaining life of the loan.

The monthly payments reflect the current interest rate, so the payments are lower during the first two years than they are for the remaining years. The money put toward the buydown is put into an escrow account and is paid to the lender to make up the difference.

How Is That Different from Paying Points to Buy Down the Mortgage Rate?

When a homebuyer pays for discount points, they are buying the rate down for the life of the loan. Typically, the rate is lowered by a small amount—say 0.125% to 0.5%. While this does affect the payment slightly, a temporary buydown lowers the rate—and therefore the payments—much more significantly during the initial buydown period.

Why Would I Offer a Temporary Buydown as a Seller?

As a seller, you can offer this option as a concession, giving more buyers an incentive to purchase your property without having to lower the list price of your home. This can possibly get buyers off the fence who wouldn’t have previously considered buying now.

Which Party Pays for a 2-1 Buydown?

At American Pacific Mortgage, only the seller, builder, or lender may pay for the buydown. This involves a fee at the start of the loan.

Why Would I Want to Consider a Temporary Buydown as a Buyer?

Lower payments in the beginning years can help free up cash for home improvements, furniture purchases, or landscaping. A temporary buydown can also help a buyer ease into the mortgage payment over time, especially if their income is expected to rise in the next few years.

Now that you understand how a temporary interest rate buydown works, consider whether it makes sense for your unique situation. We are always happy to review all sides of the residential mortgage equation for you and compare different loan programs to help find the best one for you. Contact us today for more details.

less

Top Mortgage Questions for Today’s Market

20 Things to Do on a Hot Summer Day

20 Things to Do on a Hot Summer Day

American Pacific Mortgage / July 29, 2022 at 8:00 AM

It’s the dog days of summer—and we’d better take advantage of them while they’re here! Soon enough, it’ll be back to the grind. Let’s forget about

... more20 Things to Do on a Hot Summer Day

American Pacific Mortgage / July 29, 2022 at 8:00 AM

It’s the dog days of summer—and we’d better take advantage of them while they’re here! Soon enough, it’ll be back to the grind. Let’s forget about that now, though. You’ve got sunshine to enjoy and water to splash in!

Looking for some ideas on how you can soak up the most fun? We’ve got you covered!

Here are our top 20 things to do on a hot summer day:

Remember that summer is what you make it. No need to add pressure if you’re already feeling stressed—and no need to add heat if you’re already feeling hot. Make this time of year all about whatever you crave, whether that’s relaxation, adventure, sun, or shade.

Enjoy the next month and, as always, if your summer plans involve a new home, we’re here for you.

less

The Homebuying Process in 7 Easy Steps

The Homebuying Process in 7 Easy Steps

American Pacific Mortgage / July 25, 2022 at 8:00 AM

The homebuying process…where do you even start? Buying a house may be a lifetime dream of yours, but for many buyers it can feel overwhelming at first. While it may seem like a lot, our APM Loan Advisors have your back. Our

... moreThe Homebuying Process in 7 Easy Steps

American Pacific Mortgage / July 25, 2022 at 8:00 AM

The homebuying process…where do you even start? Buying a house may be a lifetime dream of yours, but for many buyers it can feel overwhelming at first. While it may seem like a lot, our APM Loan Advisors have your back. Our 100% focus is on getting hardworking people like you into the homes they deserve.

Let’s start by breaking down the homebuying process into seven easy-to-understand steps.

1. Get Pre-Approved

Despite what you might have heard, the first step in the homebuying process isn’t securing a real estate agent. Before you can go out and start looking at homes, you need to know how much home you can afford. That doesn’t just pertain to the purchase price, but the down payment, monthly payments, and even interest rates.

An experienced loan advisor will walk you through the pre-approval process. All you have to do is supply your overall financial picture, including income, credit, and assets. We’ll then give you an idea of how much mortgage you can afford.

Mortgage pre-approval not only gives you the peace of mind of knowing your purchase price range is approved, but it strengthens your position when you’re buying a home that has multiple offers. This is because the seller will have confidence that you (and your mortgage lender) can get the deal done. In many markets, submitting your pre-approval with your offer is required.