What are the differences between a HELOC loan and a reverse mortgage?

HELOC (Home Equity Line of Credit) and a reverse mortgage are both types of loans that allow homeowners to access the equity in their homes, but they have some key differences.

HELOC:

- A HELOC is a type of loan that allows a homeowner to borrow against the equity in their home by using the home as collateral.

- The loan is set up as a line of credit, much like a credit card, so the homeowner can borrow and repay the loan as needed.

- The homeowner is responsible for making payments on the loan, including interest, and the loan has a set repayment period.

- A HELOC can be used for various purposes such as home improvements, debt consolidation, and education expenses.

- The borrower has to make payments on the interest and principal.

- Borrowers must have good credit and income to qualify.

Reverse mortgage:

- A reverse mortgage is a type of loan that allows a homeowner who is 62 or older to borrow against the equity in their home without having to make payments until they no longer live in the home.

- The loan is repaid when the homeowner dies, sells the home, or permanently moves out of the home.

- The homeowner does not have to make payments on the loan, but they are responsible for paying taxes, insurance, and maintaining the home.

- Reverse mortgages can only be used for specific purposes such as home improvements, long-term care expenses, and paying off existing mortgages.

- The interest on the loan is added to the loan balance and the borrower or the borrower's heirs will have to pay it when the house is sold.

- The borrower does not have to make payments on the loan, but they are responsible for paying taxes, insurance, and maintaining the home.

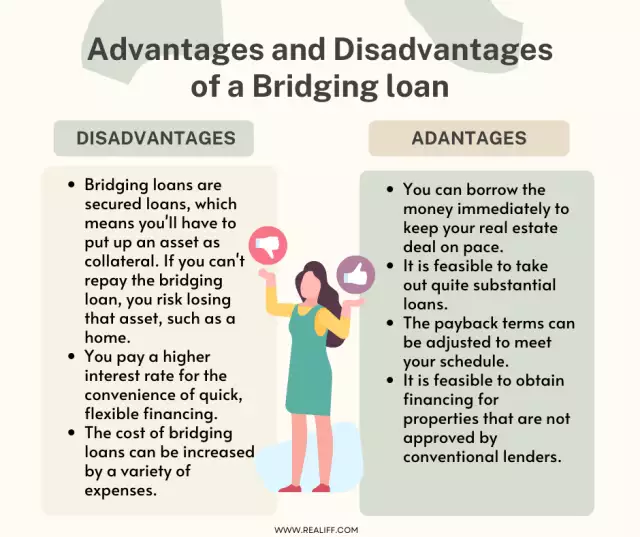

It's important to note that both options have their own set of pros and cons and you should consider your financial situation, your needs and your goals before making a decision. It's also recommended to consult with a financial advisor or a mortgage expert to help you make the decision that's right for you.

You can contact us to get more choices