US Bonds Fighting Against European Weakness

US Bonds Fighting Against European Weakness

The message from today's overnight trading session is clear: European yields have broken well above their most recent ceiling after hotter inflation data in Spain and France. That ceiling had seen similar activity to the US version at 3.98% in 10yr yields. Today begins with US bonds fighting to stay inside the sort of range that EU yields just abandoned.

In other news, home price indices were updated for both FHFA and Case Shiller this morning. No major surprises. Annual totals remain in positive territory. Monthly changes are slightly negative.

You can contact us to get more choices

0

You can contact us to get more choices

Related posts

Global equities indices fell sharply at various opening bells (and the closing bell too, as far as Asia was concerned). This was less of a concern for the likes of the Nikkei, but a defining theme for Chinese equities markets as covid/lockdown/slowdown issues persist. One might assume that Chinese lockdowns would have enough of an impact on inflation expectations to put upward pressure on bond yields, but that risk seems to be more than offset at the moment by a drop in fuel prices.

In...

Global equities indices fell sharply at various opening bells (and the closing bell too, as far as Asia was concerned). This was less of a concern for the likes of the Nikkei, but a defining theme for Chinese equities markets as covid/lockdown/slowdown issues persist. One might assume that Chinese lockdowns would have enough of an impact on inflation expectations to put upward pressure on bond yields, but that risk seems to be more than offset at the moment by a drop in fuel prices.

In...

Big Intraday Weakness Against Backdrop of Bigger Picture Strength MBS lost more than 3/8ths of a point between 1030am and 330pm today and 10yr yields rose roughly 8bps during the same time. But even after those losses, the day-over-day gains were roughly the same size (i.e. MBS 3/8ths stronger and 10yr yields more than 7bps lower). Credit the PMI data overnight in Europe for a strong start this morning and domestic PMI data at 9:45am for another injection of bond buying momentum. The bigge...

Big Intraday Weakness Against Backdrop of Bigger Picture Strength MBS lost more than 3/8ths of a point between 1030am and 330pm today and 10yr yields rose roughly 8bps during the same time. But even after those losses, the day-over-day gains were roughly the same size (i.e. MBS 3/8ths stronger and 10yr yields more than 7bps lower). Credit the PMI data overnight in Europe for a strong start this morning and domestic PMI data at 9:45am for another injection of bond buying momentum. The bigge...

People like to tell me all the ways that New York is too loud. They send emails to my Ask Real Estate column complaining about the noises that torment them during the day and keep them up at night. There are the usual suspects — barking dogs, crying babies, outdoor diners, jackhammers and sirens. But even seemingly pleasant sounds — wind chimes, children playing, opera singing — can induce rage, given the right circumstances. So when I stepped into the PinDrop, a space billed as “one of ...

People like to tell me all the ways that New York is too loud. They send emails to my Ask Real Estate column complaining about the noises that torment them during the day and keep them up at night. There are the usual suspects — barking dogs, crying babies, outdoor diners, jackhammers and sirens. But even seemingly pleasant sounds — wind chimes, children playing, opera singing — can induce rage, given the right circumstances. So when I stepped into the PinDrop, a space billed as “one of ...

Nice Push Back Against Tuesday's Weakness. ECB On Deck Tuesday was brutal and the only real explanation for the extent of the weakness was the covered in more detail in today's opener). Today's trading session managed to undo a fair amount of that weakness, essentially getting yields in line with last week's worst levels. MBS were more than 3/8ths of a point higher by 4pm and 10yr yields had dropped 8bps. The reversal of the weakness is "nice" for now, but it doesn't guarantee a reversal....

Nice Push Back Against Tuesday's Weakness. ECB On Deck Tuesday was brutal and the only real explanation for the extent of the weakness was the covered in more detail in today's opener). Today's trading session managed to undo a fair amount of that weakness, essentially getting yields in line with last week's worst levels. MBS were more than 3/8ths of a point higher by 4pm and 10yr yields had dropped 8bps. The reversal of the weakness is "nice" for now, but it doesn't guarantee a reversal....

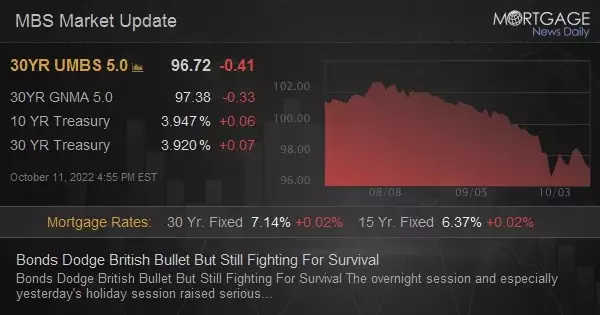

Bonds Dodge British Bullet But Still Fighting For Survival The overnight session and especially yesterday's holiday session raised serious concerns about how the week might start for the US bond market. it was touch and go as late as 10:30am ET, but after that, bonds made it safely back under the technical level at 3.92% and traded near unchanged levels into the PM hours. Huge volatility overseas during holiday session. Only moderately weaker in the US by comparison. 10yr up 4.3bps at 3....

Bonds Dodge British Bullet But Still Fighting For Survival The overnight session and especially yesterday's holiday session raised serious concerns about how the week might start for the US bond market. it was touch and go as late as 10:30am ET, but after that, bonds made it safely back under the technical level at 3.92% and traded near unchanged levels into the PM hours. Huge volatility overseas during holiday session. Only moderately weaker in the US by comparison. 10yr up 4.3bps at 3....

Despite inflation and rising interest rates, some economic indicators are playing out favorably for commercial real estate.

The post Economist’s View: Do Not Bet Against the US Economy appeared first on Commercial Property Executive.

Despite inflation and rising interest rates, some economic indicators are playing out favorably for commercial real estate.

The post Economist’s View: Do Not Bet Against the US Economy appeared first on Commercial Property Executive.

Surprisingly Resilient as Range-Finding Expedition Continues Bonds began the day in weaker territory but quickly began making their way back to 'unchanged.' Treasuries ultimately made it back into positive territory, and MBS were close enough. This was a surprisingly strong showing given the bumpy 7yr Treasury auction and the ongoing uptick in oil prices (and the inflationary implications). One of the only ways to make a case for the recovery is via the sharp selling seen in equities (S&P ...

Surprisingly Resilient as Range-Finding Expedition Continues Bonds began the day in weaker territory but quickly began making their way back to 'unchanged.' Treasuries ultimately made it back into positive territory, and MBS were close enough. This was a surprisingly strong showing given the bumpy 7yr Treasury auction and the ongoing uptick in oil prices (and the inflationary implications). One of the only ways to make a case for the recovery is via the sharp selling seen in equities (S&P ...

June 1, 2022

Mary B. Powers

KEYWORDS border wall / Fisher Sanbd & Gravel / private border wall

Order Reprints

No Comments

South Dakota-based contractor Fisher Sand and Gravel, which received nearly $2 billion in federal US-Mexico border wall construction contracts, has settled a lawsuit brought by the US government over flood risks posed ...

June 1, 2022

Mary B. Powers

KEYWORDS border wall / Fisher Sanbd & Gravel / private border wall

Order Reprints

No Comments

South Dakota-based contractor Fisher Sand and Gravel, which received nearly $2 billion in federal US-Mexico border wall construction contracts, has settled a lawsuit brought by the US government over flood risks posed ...

June 1, 2022

Mary B. Powers

KEYWORDS border wall / Fisher Sand & Gravel

Order Reprints

No Comments

North Dakota-based contractor Fisher Sand & Gravel, which received nearly $2 billion in federal US-Mexico border wall construction contracts, has settled a lawsuit brought by the US government over flood risks posed by a separate 3.5-mile priv...

June 1, 2022

Mary B. Powers

KEYWORDS border wall / Fisher Sand & Gravel

Order Reprints

No Comments

North Dakota-based contractor Fisher Sand & Gravel, which received nearly $2 billion in federal US-Mexico border wall construction contracts, has settled a lawsuit brought by the US government over flood risks posed by a separate 3.5-mile priv...

June 1, 2022

Mary B. Powers

KEYWORDS border wall / Fisher Sanbd & Gravel / private border wall

Order Reprints

No Comments

North Dakota-based contractor Fisher Sand and Gravel, which received nearly $2 billion in federal US-Mexico border wall construction contracts, has settled a lawsuit brought by the US government over flood risks posed ...

June 1, 2022

Mary B. Powers

KEYWORDS border wall / Fisher Sanbd & Gravel / private border wall

Order Reprints

No Comments

North Dakota-based contractor Fisher Sand and Gravel, which received nearly $2 billion in federal US-Mexico border wall construction contracts, has settled a lawsuit brought by the US government over flood risks posed ...