What are the advantages and disadvantages of a bridging loan?

What are the advantages and disadvantages of a bridging loan?

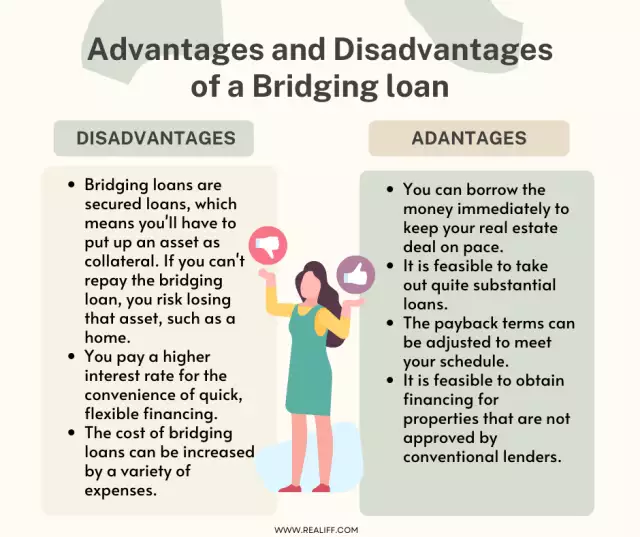

Before you apply for a bridging loan, make sure you weigh the advantages and disadvantages.

Advantages of bridging loans

- You can borrow the money immediately to keep your real estate dealon pace.

- It is feasible to take out quite substantial loans.

- The payback terms can be adjusted to meet your schedule.

- It is feasible to obtain financing for properties that are not approved by conventional lenders.

Disadvantages of bridging loans

- Bridging loans are secured loans, which means you'll have to put up an asset as collateral. If you can't repay the bridging loan, you risk losing that asset, such as a home.

- You pay a higher interest rate for the convenience of quick, flexible financing.

- The cost of bridging loans can be increased by a variety of expenses.

You can contact us to get more choices

0

You can contact us to get more choices

Related posts

Before you apply for a bridging

loan, make sure you weigh the advantages and disadvantages.

Advantages of bridging loans

You can borrow the money immediately to keep your real estate

dealon pace.

It is feasible to take out quite substantial loans.

The payback terms can be adjusted to meet your schedule.

It is feasible to obtain financing for properties that are not

approved by conventional lenders.

Disadvantages of bridging loans

Bridging loans are secured loans, which means you'll ha...

Before you apply for a bridging

loan, make sure you weigh the advantages and disadvantages.

Advantages of bridging loans

You can borrow the money immediately to keep your real estate

dealon pace.

It is feasible to take out quite substantial loans.

The payback terms can be adjusted to meet your schedule.

It is feasible to obtain financing for properties that are not

approved by conventional lenders.

Disadvantages of bridging loans

Bridging loans are secured loans, which means you'll ha...

A bridging

mortgageis a short-term loan that is intended to bridge the gap

between selling your present home and buying a new one.

Some people prefer to sell their current home first, then

utilize the proceeds to buy their new home. There are times,

though, when you wish to buy first and then sell.

Here are some cases in which a bridging loan might be

useful:

You're in a disrupted property chain, and you don't want to

lose your ideal home.

You're buying a home at auction and need to raise mon...

A bridging

mortgageis a short-term loan that is intended to bridge the gap

between selling your present home and buying a new one.

Some people prefer to sell their current home first, then

utilize the proceeds to buy their new home. There are times,

though, when you wish to buy first and then sell.

Here are some cases in which a bridging loan might be

useful:

You're in a disrupted property chain, and you don't want to

lose your ideal home.

You're buying a home at auction and need to raise mon...

The first quarter of the year generated a total of £156.78m in bridging loan transactions, representing an increase of 8.5% compared to Q1 2022, according to the latest data from contributors to Bridging Trends. The 12 specialist finance packagers reported that bridging transactions in Q1 2022 also increased from the previous quarter by 7.8% when ...

This story continues at Bridging Trends members generate £156.78m in loan transactions in Q1

Or just read more coverage at Mortgage Finance Gazet...

The first quarter of the year generated a total of £156.78m in bridging loan transactions, representing an increase of 8.5% compared to Q1 2022, according to the latest data from contributors to Bridging Trends. The 12 specialist finance packagers reported that bridging transactions in Q1 2022 also increased from the previous quarter by 7.8% when ...

This story continues at Bridging Trends members generate £156.78m in loan transactions in Q1

Or just read more coverage at Mortgage Finance Gazet...

USDA loans, also known as Rural Development loans, are a type of mortgage loan offered by the United States Department of Agriculture (USDA) and are designed to help low- to moderate-income borrowers purchase homes in rural areas. While USDA loans have several benefits, there are also some downsides to consider:Property location restrictions: One of the main downsides of USDA loans is that they are only available for properties located in rural areas or certain suburban areas. This can limit the...

USDA loans, also known as Rural Development loans, are a type of mortgage loan offered by the United States Department of Agriculture (USDA) and are designed to help low- to moderate-income borrowers purchase homes in rural areas. While USDA loans have several benefits, there are also some downsides to consider:Property location restrictions: One of the main downsides of USDA loans is that they are only available for properties located in rural areas or certain suburban areas. This can limit the...

There is a significant difference between interest and commitment. Find out more about these and learn to turn your dreams into reality.

Learn more about your ad choices. Visit megaphone.fm/adchoices

There is a significant difference between interest and commitment. Find out more about these and learn to turn your dreams into reality.

Learn more about your ad choices. Visit megaphone.fm/adchoices

Few properties meet all of a buyer’s needs when they look for suitable houses, which is why construction loans offer a unique possibility to build your own dream home or modify an existing one. If you’re interested in customizing your home, you may wonder what the requirements for a construction loan are. Construction loan requirements must be followed closely before a lender is willing to issue funds. What Is a Construction Loan? Whether you’ve already bought the home of your dreams or wi...

Few properties meet all of a buyer’s needs when they look for suitable houses, which is why construction loans offer a unique possibility to build your own dream home or modify an existing one. If you’re interested in customizing your home, you may wonder what the requirements for a construction loan are. Construction loan requirements must be followed closely before a lender is willing to issue funds. What Is a Construction Loan? Whether you’ve already bought the home of your dreams or wi...

Bridging loans have higher

interest ratesbecause you are paying for the privilege of

borrowing a large sum of money rapidly. Bridging loans are charged

daily rather than annually because they are often short-term. You

can expect to pay anything from 6%APR up to 20%APR depending on the

loan. This is far higher than the mortgage interest rates offered

by today's finest mortgage packages.

A bridging loan's interest is calculated in three ways, unlike a

regular

mortgage:

Monthly: Similar to an...

Bridging loans have higher

interest ratesbecause you are paying for the privilege of

borrowing a large sum of money rapidly. Bridging loans are charged

daily rather than annually because they are often short-term. You

can expect to pay anything from 6%APR up to 20%APR depending on the

loan. This is far higher than the mortgage interest rates offered

by today's finest mortgage packages.

A bridging loan's interest is calculated in three ways, unlike a

regular

mortgage:

Monthly: Similar to an...

VA loans are designed to help veterans and their families become homeowners with favorable terms and conditions. However, like any other type of mortgage loan, there are advantages and disadvantages associated with this type of loan. In this article, we’ll discuss the pros and cons of VA home loans so that you can decide if this type of financing is right for you. What is a VA Home Loan? VA home loans are mortgages backed by the U.S. Department of Veterans Affairs (VA). This means eligible ser...

VA loans are designed to help veterans and their families become homeowners with favorable terms and conditions. However, like any other type of mortgage loan, there are advantages and disadvantages associated with this type of loan. In this article, we’ll discuss the pros and cons of VA home loans so that you can decide if this type of financing is right for you. What is a VA Home Loan? VA home loans are mortgages backed by the U.S. Department of Veterans Affairs (VA). This means eligible ser...

A portfolio loan, also known as a "hold-in-portfolio" loan, is a type of mortgage loan that is issued and held by the lender rather than being sold on the secondary market. The main difference between a portfolio loan and other types of mortgages is that the lender keeps the loan in its portfolio rather than selling it to investors, thus, giving them more flexibility to adjust their terms and qualifications to fit a specific borrower's needs.Some benefits of a portfolio loan include:More flexibl...

A portfolio loan, also known as a "hold-in-portfolio" loan, is a type of mortgage loan that is issued and held by the lender rather than being sold on the secondary market. The main difference between a portfolio loan and other types of mortgages is that the lender keeps the loan in its portfolio rather than selling it to investors, thus, giving them more flexibility to adjust their terms and qualifications to fit a specific borrower's needs.Some benefits of a portfolio loan include:More flexibl...

By managing information for a built asset from design and construction to operation, BIM can bridge the knowledge gap between AEC and O&M.

Read the full article "Bridging The Lifecycle Gap With BIM" on Facility Executive Magazine.

By managing information for a built asset from design and construction to operation, BIM can bridge the knowledge gap between AEC and O&M.

Read the full article "Bridging The Lifecycle Gap With BIM" on Facility Executive Magazine.