What's Up With Today's Big Nasty Sell-Off?

What's Up With Today's Big Nasty Sell-Off?

What's Up With Today's Big Nasty Sell-Off?

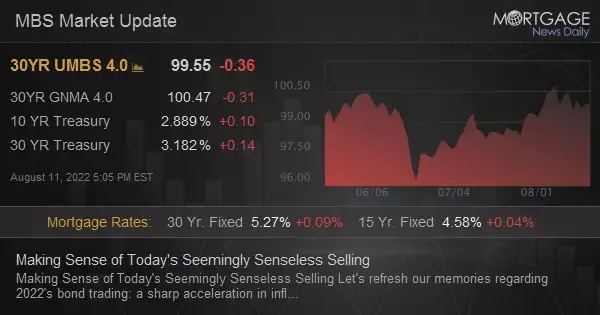

After a stretch of 3 days where bonds could seemingly do no wrong, and 3 weeks spent generally rallying from the top to the bottom of the prevailing yield range, bonds were met with the sharpest sell-off since mid-June. Granted, this one is a bit less traumatic since it began with the lowest yields in months, but sharp selling is sharp selling. Scapegoats include Fed comments, rampant corporate debt issuance, and a fertile environment for an overbought technical bounce. This perfect little storm is discussed in greater detail in today's video.

Stronger at the start of the overnight session as equities lost ground in Asia. 10yr fell 5-7bps and has chopped around near those levels ever since--currently down 5.7bps at 2.53. MBS up more than an eighth.

Quick, moderately big selling between 9 and 930am ET. 10yr back up to unchanged. MBS down an eighth, roughly (a bit more where illiquidity is involved).

Tanking hard into the PM hours with 10s up almost 15bps at 2.732 and MBS down roughly 1 point.

Treasuries still pushing weakest levels with 10yr up 17+ bps at 2.761. MBS are holding more sideways over the past few hours, but also heavily damaged. 4.0 coupons are down a full point at 99-26 (99.81).