10 Ways to Obtain an Affordable Home Price

1. Take a look at recently sold homes.

A comparable property is one that is similar to the one you're buying in terms of size, condition, neighborhood, and amenities

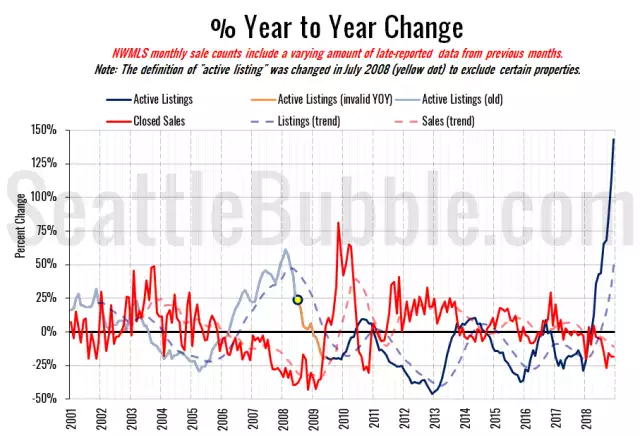

2. Look for similar properties on the market.

In this situation, you may really go to different houses and feel how their size, quality, and facilities compare to the one you're looking at.

3. Take a look at comparables that haven't sold yet.

If the house you're looking at is priced similarly to homes that have been pulled off the market because they haven't sold, it may be overvalued. Prices should also be reduced if there are numerous similar homes on the market, especially if those properties are empty.

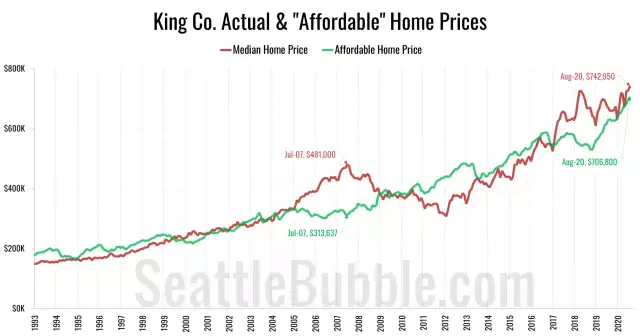

4. Gain Knowledge of Market

Conditions Have prices recently risen or fallen? Homes in a seller's market are likely to be overpriced, whereas properties in a buyer's market are likely to be underpriced. It all depends on where the real estate boom-and-bust curve is at the moment.

5. Be Wary of Properties for Sale by Owner

A for-sale-by-owner ( FSBO) property should be discounted to reflect the lack of a seller's agent's commission of 2.5 percent to 3 percent (on average), which many sellers overlook when determining how to price a home.Another issue with FSBOs is that the seller may not have had the benefit of an agent's advice in the first place, or they may have been so dissatisfied with an agent's advice that they decided to go it alone. The property may be expensive in any of these scenarios.

6. Look into the Appreciation Expected

The future possibilities for your chosen community may influence the pricing. If positive development is planned, such as the construction of a major mall, the extension of light rail to the neighborhood, or the relocation of a large new firm, the prospects for future home appreciation appear promising.If, on the other hand, grocery stores and petrol stations close, property prices should drop to reflect this, and you should probably avoid moving to the neighborhood.

7. Consult with your real estate agent

Your real estate agent is likely to have a solid gut feeling (based on experience) about whether the property is priced adequately or not, and what a fair offering price would be, without even evaluating the data.

8. Consider this: Does the price seem reasonable?

Even if you receive a good deal, if you don't like the property, the price will never seem fair. You won't mind paying a little more than market value for a property you adore in the end.

9. Put it to the Test

Even in a seller's market, you can always make a lower offer to see how the seller responds. Because they don't want to bargain, some sellers market properties for the lowest price they're willing to accept. Others list their properties for more than they expect to earn in the hopes of negotiating a lower price or seeing if an offer will be made at the higher price. If a seller accepts your price or counteroffer, you'll know that the property isn't worth as much as it was listed for, and you'll have a decent chance of getting a good deal.

10. Obtain an appraisal as well as an inspection.

To safeguard its financial interests, the lender will have an assessment of the property done (usually at your expense) once you're under contract. The lender wants to make sure that if you stop making payments on your mortgage, it will be able to recoup a respectable amount of money when it forecloses on your house. You may not be receiving a fair deal if the assessment comes in much lower than your offer price. In fact, the lender may refuse to let you buy the house unless the seller agrees to reduce the price.