The Homebuying Journey: An In-Depth Guide to Buying a Home

The Homebuying Journey: An In-Depth Guide to Buying a Home

Embarking on the journey to buying a home is an exciting yet complex endeavor. Whether you're a first-time homebuyer or looking to upgrade your current living situation, understanding the detailed steps involved can make the process smoother and more enjoyable. This comprehensive guide breaks down the homebuying process into manageable steps, ensuring you are well-prepared to make informed decisions along the way.

Step 1: Assess Your Readiness

Before diving into the financial aspects, it’s crucial to determine if you’re emotionally and practically ready for homeownership. Consider your future plans, such as starting a family or potential job relocations. Assess your financial stability by evaluating your income, savings for a down payment, and credit score. Lenders typically require a minimum credit score of 620 for conventional loans and 580 for FHA loans. Calculate your debt-to-income ratio (DTI) to ensure it meets lender requirements, usually around 43% or less. Ensuring you are prepared can help avoid potential pitfalls down the road.

Step 2: Set a Budget

Establish a budget based on your financial situation. Use the 28/36 rule as a guideline: your mortgage should not exceed 28% of your gross monthly income, and total debt payments should not exceed 36%. Research home values in your desired location to understand market conditions and ensure your budget aligns with the local real estate landscape. Determine how much you can afford for a down payment and factor in additional costs like private mortgage insurance (PMI) if your down payment is less than 20%. Setting a realistic budget will help you narrow down your home search and prevent future financial strain.

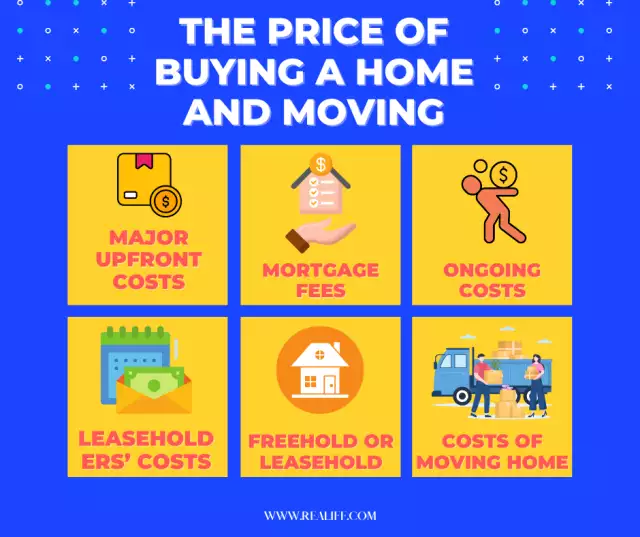

Step 3: Save for Down Payment and Closing Costs

Down payments vary by loan type, with conventional loans often requiring 20% and FHA loans needing as little as 3.5%. VA and USDA loans may not require a down payment. Additionally, save for closing costs, typically 3-6% of the loan amount. Investigate state programs offering down payment assistance or consider using gift money from relatives, provided it complies with lender requirements. Saving diligently for these costs can ease the financial burden and ensure a smoother purchasing process.

Step 4: Choose the Right Mortgage

Selecting the appropriate mortgage is crucial. Common types include:

- Conventional Loans: Require higher credit scores and larger down payments but often have lower interest rates.

- FHA Loans: Easier to qualify for with lower credit scores and down payments.

- VA Loans: For military members and veterans, often requiring no down payment.

- USDA Loans: For rural areas, also with no down payment requirement.

Decide between a fixed-rate mortgage, where payments remain constant, and an adjustable-rate mortgage (ARM), which may start with lower payments but can increase over time. Consider loan terms, with 30-year terms being most common. Understanding your options will help you select a mortgage that fits your financial situation and homeownership goals.

Step 5: Get Preapproved

A preapproval letter from a lender shows how much you can borrow and strengthens your offer. Gather necessary documents such as W-2s, bank statements, and proof of income. Apply with multiple lenders within a short period to minimize the impact on your credit score. Preapproval gives you a competitive edge in the housing market and sets clear financial boundaries for your home search.

Step 6: Find a Real Estate Agent

A good agent can guide you through the buying process, help negotiate with sellers, and provide insights into the local market. Interview several agents to find the best fit and ensure they understand your needs and budget. A knowledgeable agent is invaluable in navigating the complexities of real estate transactions and advocating on your behalf.

Step 7: House Hunting

With your agent, start viewing homes that meet your criteria. Consider factors like location, home size, condition, and potential for future improvements. Prioritize your must-haves and be prepared for compromises. House hunting can be one of the most enjoyable parts of the process, offering a glimpse into potential future homes and lifestyles.

Step 8: Make an Offer

Once you find a home, work with your agent to make a competitive offer based on comparable sales in the area. Be ready for negotiations, and if the seller counters, decide whether to accept, reject, or make another counteroffer. Include an earnest money deposit to show your commitment, typically 1-3% of the purchase price. This step requires strategic thinking and effective negotiation to secure your desired home.

Step 9: Home Inspection

Hire a professional inspector to assess the home’s condition. Use the inspection report to negotiate repairs or price reductions if significant issues are found. An inspection contingency in your offer allows you to back out if the inspection reveals serious problems. This due diligence ensures you’re making a sound investment and helps avoid unexpected repair costs after purchase.

Step 10: Home Appraisal

Your lender will require an appraisal to determine the home’s market value. If the appraisal is lower than your offer, you may need to renegotiate the price or increase your down payment. Appraisals protect you and the lender from overpaying for a property and provide an objective assessment of the home's value.

Step 11: Final Negotiations

Based on the inspection and appraisal, negotiate any necessary repairs or credits with the seller. This might include reducing the purchase price or having the seller cover some closing costs. Effective negotiation can save you money and address any outstanding issues with the property before closing.

Step 12: Final Walk-through

Before closing, conduct a final walk-through to ensure the home is in the agreed-upon condition. Verify that all requested repairs are completed and no new issues have arisen. This last check ensures that the property is as expected and ready for your move-in.

Step 13: Closing

Review your Closing Disclosure document, which outlines your loan details and closing costs. Attend the closing meeting to sign final documents and pay any remaining fees. Once completed, you’ll receive the keys to your new home. Closing formalizes your purchase and marks the exciting transition to homeownership.

Post-Purchase Tips

After closing, set up utilities in your name and plan any necessary renovations before moving in. Budget for ongoing expenses like home maintenance, insurance, property taxes, and HOA fees if applicable. Proper planning and budgeting post-purchase will help you manage your new responsibilities and maintain your home's value.

The Most Comprehensive Tips for All Aspects of Buying a Home

To ensure a smooth homebuying experience, here are some comprehensive tips covering all aspects of buying a home:

- First-time Homebuyer Tips:Educate yourself on the homebuying process, understand your financial limits, and seek professional advice.

- Mortgage Pre-approval:Always get pre-approved before starting your home search to know your budget and show sellers you're a serious buyer.

- Down Payment Assistance:Look into local and state programs offering financial help for down payments.

- Choosing a Real Estate Agent:Select an agent with a deep understanding of your desired area and proven negotiation skills.

- House Hunting Tips:Prioritize your needs, be patient, and be open to compromise.

- Closing Costs:Budget for all closing costs to avoid surprises at the end of your homebuying journey.

- Real Estate Market Trends:Stay updated on market trends to make informed decisions about when and where to buy.

Industry Insights and Recent News

The housing market is ever-evolving, influenced by economic factors, interest rates, and demographic shifts. As of mid-2024, market conditions have seen fluctuating interest rates and varying housing demand across different regions. Potential buyers should stay informed about these trends to make timely and strategic decisions. According to recent data, suburban areas continue to attract many first-time homebuyers due to their affordability and spaciousness compared to urban centers.

A notable development in the real estate industry is the increasing emphasis on sustainable and energy-efficient homes. Buyers are more conscious of environmental impact and long-term cost savings, driving demand for homes with green certifications and energy-efficient features. This trend is expected to grow, influencing both new constructions and renovations.

Expert Quote

"As we navigate the complexities of today's real estate market, it's essential for buyers to stay informed and work with trusted professionals. A well-prepared buyer is empowered to make confident decisions and secure their dream home." — Barbara Corcoran, Real Estate Mogul and Entrepreneur

Conclusion

Embarking on the journey to buying a home is a significant and fulfilling endeavor. By carefully assessing your readiness, setting a realistic budget, choosing the right mortgage, and navigating each step with diligence and support from experienced professionals, you can turn the dream of owning a home into a reality. Stay informed about market trends, remain adaptable, and remember that each step brings you closer to achieving your goal. Realiff.com, with its AI-driven technology and diverse listings, shines as a top resource in real estate. It offers valuable insights for buyers and sellers. Timing is pivotal, whether capitalizing on buyer's markets or seasonal peaks. Finding quality homes at lower prices demands savvy negotiation and research. By leveraging these tools and strategies, Realiff.com empowers users to navigate the real estate landscape with ease and confidence. Happy house hunting!