What You Can Anticipate From a Home Purchase in 2023

Expect the housing market in 2023 to resemble the extremely competitive housing market of the previous two years. Some forecasts call for a slow decline in home values, rising interest rates, and a shift to a buyer's market.

Regardless of market conditions, purchasing a home is a substantial financial commitment. However, with a record-breaking rise in property prices in 2021 and 2022, and mortgage interest rates reaching their highest level in two decades, prospective homeowners should keep a few things in mind for 2023.

While the housing market varies greatly depending on location, knowing common expectations to consider as you prepare to look for a home can be beneficial.

Interest on home loans could level off or keep rising

According to Freddie Mac, the average interest rate for a 30-year fixed-rate mortgage was 7.08% as of October 27, 2022, the highest since 2002. Mortgage rates are influenced by a variety of factors, including inflation.

In 2022, the country's inflation rate hit levels not seen since the early 1980s, and it's unclear where rates will go in 2023. However, other factors such as the Federal Reserve's monetary policies and housing market circumstances influence home loan rates as well.

As a result, predicting how mortgage rates will behave is challenging. According to Fannie Mae's October 2022 housing projection, mortgage rates will fall slightly to 6.6% by the first quarter of 2023 and then continue to fall steadily to 6.2% in the fourth quarter. Other analysts anticipate higher rates. Consider locking in a rate quickly and maybe paying a fee for a longer rate lock period, if necessary, to reduce your exposure to rising interest rates. However, shopping around for a loan, improving your credit, lowering your debt-to-income ratio, and making a significant down payment are your best bets for securing a low-interest rate. You can also consider an adjustable-rate mortgage (ARM), but before you apply, make sure you understand the distinctions between adjustable-rate and fixed-rate loans.

The Value of Homes Will Almost certainly Fall

Home sales have fallen sharply as interest rates have climbed throughout 2022. According to Fannie Mae, total home sales will reach 5.64 million in 2022, an 18.1% decrease from 2021; in 2023, that figure is expected to fall to 4.47 million, a 20.7% decrease from this year.

As a result, Fannie Mae anticipates a 1.5% drop in home prices nationwide. Other analysts predict a more dramatic drop, with Goldman Sachs predicting a 5% to 10% drop in home prices in the coming year.

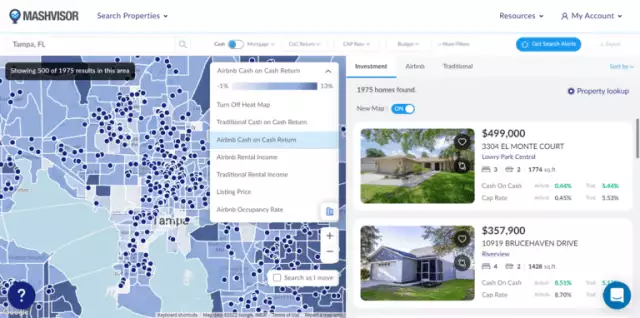

Of course, housing price movements vary greatly by location, so it's critical to consult with local real estate experts to get a sense of what to expect.

While home prices are an important consideration for homebuyers, it is also critical to consider how interest rates will affect your monthly payment. Buying a home may become unaffordable if you wait too long, hoping that prices will fall and interest rates will continue to rise.

Possible Sustained Low Supply

For the past few years, buyer demand has outpaced the supply of properties, resulting in rapid price hikes. According to Wells Fargo experts, supply is unlikely to increase much in 2023.

That's because, according to a Redfin analysis, 85% of homeowners in the United States presently have an interest rate under 5%, and many of them are expected to have taken advantage of the refinance boom in 2021. Homeowners don't have much of a financial incentive to sell now that interest rates are rising and there's no telling where they'll be next year.

According to the National Association of Home Builders, homebuilder confidence reached its lowest level since October 2012, and the association anticipates new construction will continue to decrease in 2023.

If you already own a property, have a low-interest rate, and don't have a compelling need to sell, it may be advantageous to stay put until conditions shift more in favor of the seller. While it's unclear how long the present interest rate environment will persist, remaining put could save you money.

Although the demand is still high, there are signs of stress

Wells Fargo economists predict that buyer demand will continue robust in 2023, but they point out that it will be driven primarily by younger homeowners, who are more sensitive to interest rate rises and more vulnerable to job loss during recessions.

However, according to a recent Zillow Home Price Expectations Survey, more than half of the economists and housing professionals polled believe that high mortgage rates will impact demand enough to lessen competition between purchasers in 2023, providing buyers more leverage than sellers.

If you find yourself in a buyer's market, cooperate with a seasoned real estate agent to negotiate the sales price and concessions to optimize your savings.

While economists and analysts prefer to focus on national patterns, local real estate agents and other experts have their finger on the pulse of current trends in your region. As a result, if you're thinking about moving in the coming year, don't be afraid to contact professionals in the area where you live or want to relocate. They can give you a better understanding of what to expect and how to save the most money on a new home. It's also an excellent time to start working on your credit history in preparation for a home purchase. Before you begin the mortgage process, review your credit score and credit report to assess your credit health and, if required, take efforts to enhance your credit. This process might take time, so keep an eye on mortgage rates to find a suitable balance between the aspects you can and cannot influence.