Hotel Conversions: Striking the Right Balance Between the Public Sector & Private Developers

Hotel Conversions: Striking the Right Balance Between the Public Sector & Private Developers

We Lend LLC Managing Partner Ruben Izgelov examines the surge in hotel conversions brought on by the pandemic, exploring the impact of both public and private developers, as well as the potential of the formerly niche segment.

The significant uptick in hotel-to-multifamily conversion projects across the United States throughout the last 18 months has been arguably one of the best unintended consequences of the pandemic for the real estate industry.

In fact, it’s a rare win-win for all parties involved: Owners of sub-performing or vacant hotels are able to offload assets that are generating little to no revenue; developers have a greater supply of distressed real estate to choose from; new affordable units are entering local markets that suffer from a chronic supply shortage; and blue-collar workers are getting access to much-needed workforce housing.

What’s more, according to RENTCafé, there are 52,700 units due to be created as a result of conversions in the coming year, with vacant hotels representing a large share of this figure. In fact, there have beennearly 4,000 hotel conversions since 2020.

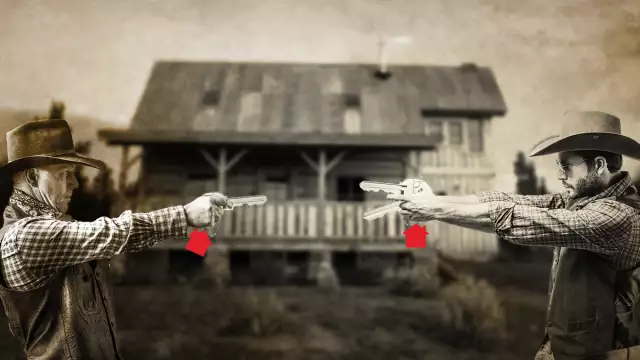

Yet, amidst this clear demand for hotel-to-multifamily conversions, it’s essential that municipalities and developers strike the right balance. In particular, policies prioritizing government agencies as the purchasers and developers of conversion projects risk underperforming on the potential to deliver affordable housing via hotel conversions.

Putting it in Context

Many developer-led conversion projects are happening nationwide currently. In Detroit, New York-based Rhodium Capital Advisors recently purchasedthe former Dearborn Hyatt Regency, and plans are underway to convert the property from an 800-room hotel to a 400-unit apartment complex.

Meanwhile, many private developers throughout the Florida market are stepping up to provide a solution to the prohibitively high housing costs facing lower-wage hospitality workers by converting vacant hotels into affordable apartment units. As an example, Miami-based ICM Development Group is convertingthe 435-room Champions World Resort into a 352-unit micro-apartment complex that will serve as workforce housing. The completed project — known as Champions Village — is expected to be priced below other types of housing in the area and should fill a void for workers at local resorts, such as Disney, who need affordable housing in the area.

These projects are just some of the many hotel-to-multifamily conversion projects that are now trending in the private sector across the country. Conversely, the success of government-as-developer conversion projects is much more of a mixed bag.

For example, New York’s Housing Our Neighbors with Dignity Act (HONDA) has attempted to turn empty hotels into affordable apartments — but the organization’s ability to actually deliver on that objective has been called into question, since it has yet to create any permanent housing thus far. In fact, media outlets have pointed outthat “the biggest obstacles facing nonprofit developers trying to convert hotels into affordable housing are zoning restrictions and building code requirements that make construction too costly.” It’s also been that “regulations have led some of the properties to be converted into transient shelters, instead of permanent housing.”

On the opposite coast, California’s initiative to purchase and convert hotels into housing — called Project Homekey — has been successful, creating 6,000 affordable housing units to date. However, this policy has not been without challenges of its own as some of these properties have only been converted into interim, rather than permanent, housing. Plus, in the rush to meet a government funding deadline, there is speculation that the state might have overpaid for many of these assets.

How Developers Can Continue to Deliver

Meanwhile, thanks to the comparatively faster and cheaper cost per door of hotel conversions versus ground-up construction projects, developers are able to deliver solid workforce housing. For example, units in extended-stay hotels already contain kitchens and bathrooms, which allow developers to keep their renovation costs down, a strategy employed by a number of investors.

More precisely, according to RealtyMogul Co. CEO Jilliene Helman, a hotel purchased for $40,000 per door with renovation costs of another $40,000 per door will yield a sale price of around $120,000. As such, this enables a very healthy profit margin for developers working on large projects, while bringing to market housing for renters that is far below average prices. Moreover, many of these projects are bringing affordable housing units to market without the need for government subsidies — thereby enabling local authorities to save on tax dollars.

What’s more, the potential for private developers to deliver is limited only by the number of convertible hotels — which, as of yet, show no signs of slowing down. On the other hand, government budgets will always be finite: HONDA, for example, has an initial budget of just $100 million. So, with such limited budgets, it only makes sense for the private sector to step in and utilize its large pool of capital to spearhead these conversions.

Cutting the Red Tape

Alternatively, where local governments can be most effective is by creating favorable conditions to help private developers deliver even more hotel-to-residential conversions. This includes relaxing or grandfathering in zoning rules and building codes to better suit the context of hotel conversions. Specifically, this may help avoid some of the roadblocks faced in New York — such as elevators that are just a few inches too narrow and rooms that are slightly smaller than the minimum square footage regulations.

However, some positive developments in this regard include a hotel-to-apartment conversion in Minnesotathat launched after the city council worked with developers on conditional use permits. Similarly, in Buffalo, New York, tax breaks paved the way for New York City-based DMG Investments to convert a hotel into student housing.

Yet, in other locations, developers are expressing concern as local governments seek expanded oversight as the concept of hotel conversions takes hold. For example, in Osceola County, Fla., commissioners are instituting enhanced regulationson hotel conversion standards, which could push up unit prices for renters and purchasers. Granted, while high standards should be ensured with all conversions, policies also shouldn’t be so restrictive as to discourage developers from taking on these projects.

Clearly, there’s massive potential with hotel conversions throughout the next few years. According to a research paper from JLL, the total market value of hotels sold for conversion during the next five years could be anywhere between $25 and $30 billion — and the benefits for both the public and private sectors could be massive. Therefore, it’s up to the private sector to lead the way in pursuit of hitting that mark.

About

Ruben Izgelov is the co-founder and managing partner of We Lend LLC , a New York-based private lender with a national reach focused on serving real estate investors by providing quick and low-cost capital.