Interest rates on bridging loans

Interest rates on bridging loans

Bridging loans have higher interest ratesbecause you are paying for the privilege of borrowing a large sum of money rapidly. Bridging loans are charged daily rather than annually because they are often short-term. You can expect to pay anything from 6%APR up to 20%APR depending on the loan. This is far higher than the mortgage interest rates offered by today's finest mortgage packages.

A bridging loan's interest is calculated in three ways, unlike a regular mortgage:

- Monthly: Similar to an interest-only mortgage, where the interest payments are made each month and not added to the loan balance.

- Rolled up: Interest payments are rolled up into the loan and paid when the bridging loan is paid off.

- Retained: You borrow the interest upfront for a set length of time, and then any unused interest is returned to you when the loan is repaid.

You can contact us to get more choices

0

You can contact us to get more choices

Related posts

Bridging loans have higher

interest ratesbecause you are paying for the privilege of

borrowing a large sum of money rapidly. Bridging loans are charged

daily rather than annually because they are often short-term. You

can expect to pay anything from 6%APR up to 20%APR depending on the

loan. This is far higher than the mortgage interest rates offered

by today's finest mortgage packages.

A bridging loan's interest is calculated in three ways, unlike a

regular

mortgage:

Monthly: Similar to an...

Bridging loans have higher

interest ratesbecause you are paying for the privilege of

borrowing a large sum of money rapidly. Bridging loans are charged

daily rather than annually because they are often short-term. You

can expect to pay anything from 6%APR up to 20%APR depending on the

loan. This is far higher than the mortgage interest rates offered

by today's finest mortgage packages.

A bridging loan's interest is calculated in three ways, unlike a

regular

mortgage:

Monthly: Similar to an...

A bridging

mortgageis a short-term loan that is intended to bridge the gap

between selling your present home and buying a new one.

Some people prefer to sell their current home first, then

utilize the proceeds to buy their new home. There are times,

though, when you wish to buy first and then sell.

Here are some cases in which a bridging loan might be

useful:

You're in a disrupted property chain, and you don't want to

lose your ideal home.

You're buying a home at auction and need to raise mon...

A bridging

mortgageis a short-term loan that is intended to bridge the gap

between selling your present home and buying a new one.

Some people prefer to sell their current home first, then

utilize the proceeds to buy their new home. There are times,

though, when you wish to buy first and then sell.

Here are some cases in which a bridging loan might be

useful:

You're in a disrupted property chain, and you don't want to

lose your ideal home.

You're buying a home at auction and need to raise mon...

Specialist challenger bank and buy-to-let lender Monument has recruited Fatlum Lushi as bridging relationship manager. Lushi joins from PCF Bank where he assisted with the creation of the lender’s bridging proposition. He has previously held roles at Santander and is CeMAP qualified. At Monument, Lushi will lead the team in providing solutions for any Bridging related ...

This story continues at Monument hires Lushi as bridging relationship manager

Or just read more coverage at Mortgage Fin...

Specialist challenger bank and buy-to-let lender Monument has recruited Fatlum Lushi as bridging relationship manager. Lushi joins from PCF Bank where he assisted with the creation of the lender’s bridging proposition. He has previously held roles at Santander and is CeMAP qualified. At Monument, Lushi will lead the team in providing solutions for any Bridging related ...

This story continues at Monument hires Lushi as bridging relationship manager

Or just read more coverage at Mortgage Fin...

By managing information for a built asset from design and construction to operation, BIM can bridge the knowledge gap between AEC and O&M.

Read the full article "Bridging The Lifecycle Gap With BIM" on Facility Executive Magazine.

By managing information for a built asset from design and construction to operation, BIM can bridge the knowledge gap between AEC and O&M.

Read the full article "Bridging The Lifecycle Gap With BIM" on Facility Executive Magazine.

There is a significant difference between interest and commitment. Find out more about these and learn to turn your dreams into reality.

Learn more about your ad choices. Visit megaphone.fm/adchoices

There is a significant difference between interest and commitment. Find out more about these and learn to turn your dreams into reality.

Learn more about your ad choices. Visit megaphone.fm/adchoices

The first quarter of the year generated a total of £156.78m in bridging loan transactions, representing an increase of 8.5% compared to Q1 2022, according to the latest data from contributors to Bridging Trends. The 12 specialist finance packagers reported that bridging transactions in Q1 2022 also increased from the previous quarter by 7.8% when ...

This story continues at Bridging Trends members generate £156.78m in loan transactions in Q1

Or just read more coverage at Mortgage Finance Gazet...

The first quarter of the year generated a total of £156.78m in bridging loan transactions, representing an increase of 8.5% compared to Q1 2022, according to the latest data from contributors to Bridging Trends. The 12 specialist finance packagers reported that bridging transactions in Q1 2022 also increased from the previous quarter by 7.8% when ...

This story continues at Bridging Trends members generate £156.78m in loan transactions in Q1

Or just read more coverage at Mortgage Finance Gazet...

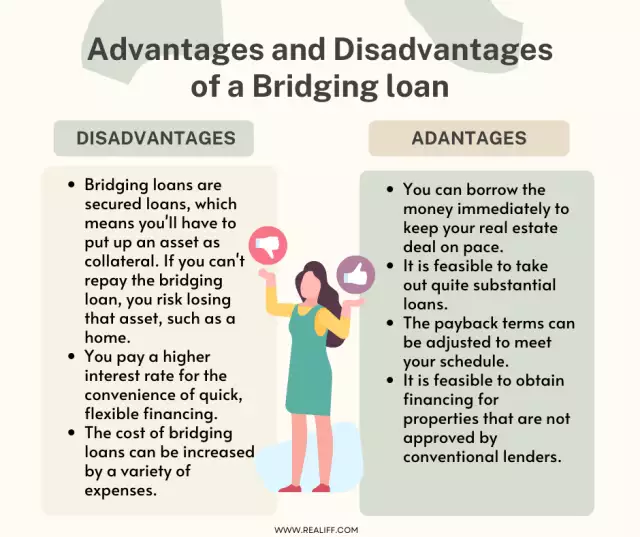

Before you apply for a bridging

loan, make sure you weigh the advantages and disadvantages.

Advantages of bridging loans

You can borrow the money immediately to keep your real estate

dealon pace.

It is feasible to take out quite substantial loans.

The payback terms can be adjusted to meet your schedule.

It is feasible to obtain financing for properties that are not

approved by conventional lenders.

Disadvantages of bridging loans

Bridging loans are secured loans, which means you'll ha...

Before you apply for a bridging

loan, make sure you weigh the advantages and disadvantages.

Advantages of bridging loans

You can borrow the money immediately to keep your real estate

dealon pace.

It is feasible to take out quite substantial loans.

The payback terms can be adjusted to meet your schedule.

It is feasible to obtain financing for properties that are not

approved by conventional lenders.

Disadvantages of bridging loans

Bridging loans are secured loans, which means you'll ha...

Thermal Bridging: Everything you need to know about

Thermal bridging happens when a tiny portion of a wall, floor, or roof loses much more heat than the rest of the structure.

The post Thermal Bridging: Everything you need to know about appeared first on ConstructionPlacements.

Thermal Bridging: Everything you need to know about

Thermal bridging happens when a tiny portion of a wall, floor, or roof loses much more heat than the rest of the structure.

The post Thermal Bridging: Everything you need to know about appeared first on ConstructionPlacements.

The Hertfordshire-based lender hit the new milestone, despite six loans redeeming in May totalling over £7m with the largest being almost £4m.

TAB chief executive and founder Duncan Kreeger says: “Over the course of the last six months we’ve been working hand in hand with brokers and June has been no exception.”

“We have done some massive multi-million pound deals as well as some really fast ones where our tech has been tested as we speed up applic...

The Hertfordshire-based lender hit the new milestone, despite six loans redeeming in May totalling over £7m with the largest being almost £4m.

TAB chief executive and founder Duncan Kreeger says: “Over the course of the last six months we’ve been working hand in hand with brokers and June has been no exception.”

“We have done some massive multi-million pound deals as well as some really fast ones where our tech has been tested as we speed up applic...

You don’t have to be a silver-tongued orator to create trust — you do have to listen.

You don’t have to be a silver-tongued orator to create trust — you do have to listen.