Mortgage Broker vs Loan Officer | What's the difference?

Mortgage Broker vs Loan Officer | What's the difference?

You can contact us to get more choices

0

You can contact us to get more choices

Related posts

https://realiff.com/post/cI3A8WM8tpTX/what-is-the-key-difference-between-a-loan-officer-and

https://realiff.com/post/cI3A8WM8tpTX/what-is-the-key-difference-between-a-loan-officer-and

The answer is no. Unfortunately, most buyers do not know the difference between a mortgage broker and a loan officer.In fact, a loan officer works directly for a lender, while a broker is an independent party that works for no one but himself and his clients.

The answer is no. Unfortunately, most buyers do not know the difference between a mortgage broker and a loan officer.In fact, a loan officer works directly for a lender, while a broker is an independent party that works for no one but himself and his clients.

Pursuing a real estate investment can be an exciting venture, even if this isn’t your first time going through the paces. But if you intend to get a mortgage, you’ll need to decide exactly how you’ll use the home — as a personal vacation spot or to generate income from rentals. Second homes and investment properties each have their own home loan and tax requirements. So, here’s what you should know if you’re trying to decide which property type may be best for your goals. What is c...

Pursuing a real estate investment can be an exciting venture, even if this isn’t your first time going through the paces. But if you intend to get a mortgage, you’ll need to decide exactly how you’ll use the home — as a personal vacation spot or to generate income from rentals. Second homes and investment properties each have their own home loan and tax requirements. So, here’s what you should know if you’re trying to decide which property type may be best for your goals. What is c...

Real estate agents vs. Realtors vs. brokers When it comes to real estate professionals, the lines can get blurred. One reason for this is because oftentimes, people confuse the terms real estate agent, broker, and Realtor. Although similar, these terms are not interchangeable. Understanding the difference between a Realtor and a real estate agent, as well as a real estate broker, can provide clarity on the type of real estate professional that best suits your needs. In this article (Skip to...)...

Real estate agents vs. Realtors vs. brokers When it comes to real estate professionals, the lines can get blurred. One reason for this is because oftentimes, people confuse the terms real estate agent, broker, and Realtor. Although similar, these terms are not interchangeable. Understanding the difference between a Realtor and a real estate agent, as well as a real estate broker, can provide clarity on the type of real estate professional that best suits your needs. In this article (Skip to...)...

We quit searching high and low for a much-obsessed-over house buying guide. Because, unfortunately, one did not really exist—so we hit the reset button and set out to develop one. The top attribute of our coveted home buying guide was home insurance. Every buyer will need some type of home insurance to cover themselves against serious events…

The post Mortgage Insurance vs. Homeowner Insurance: What’s the Difference? appeared first on Home Lending Pal.

We quit searching high and low for a much-obsessed-over house buying guide. Because, unfortunately, one did not really exist—so we hit the reset button and set out to develop one. The top attribute of our coveted home buying guide was home insurance. Every buyer will need some type of home insurance to cover themselves against serious events…

The post Mortgage Insurance vs. Homeowner Insurance: What’s the Difference? appeared first on Home Lending Pal.

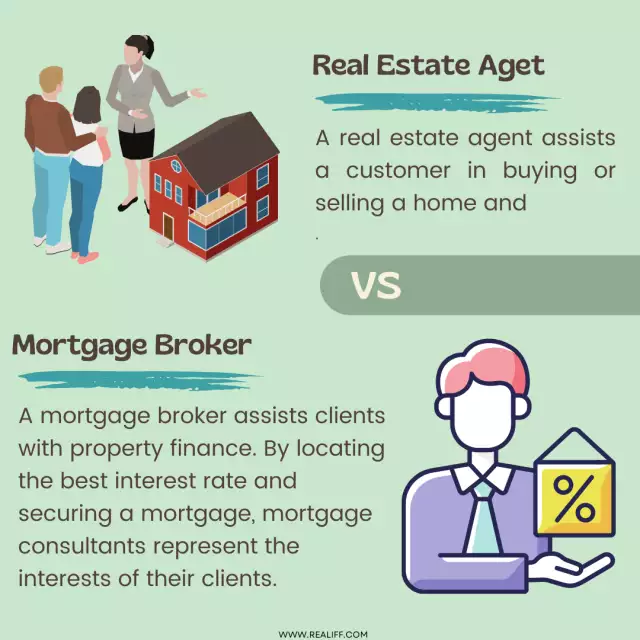

Mortgage brokers and real estate agents have a lot in common. Both assist their clients in obtaining residential or business properties as licensed real estate professionals. Their exact responsibilities, however, are somewhat different. A real estate agent assists buyers and sellers in locating and selling physical properties, whereas a mortgage broker assists purchasers in obtaining finance to acquire real estate. A real estate agentA real estate agent assists a customer in buying or selling ...

Mortgage brokers and real estate agents have a lot in common. Both assist their clients in obtaining residential or business properties as licensed real estate professionals. Their exact responsibilities, however, are somewhat different. A real estate agent assists buyers and sellers in locating and selling physical properties, whereas a mortgage broker assists purchasers in obtaining finance to acquire real estate. A real estate agentA real estate agent assists a customer in buying or selling ...

Sometimes you just don’t know how good or bad you have it. Take the mortgage business, for example. When it comes to mortgage pricing, Canada is a unique animal compared to many other countries, including the United States. Being married to a U.S. mortgage broker has made that all too clear for this author. And Tuesday, August 2, was a case in point. Frenetic rate updates While Canadian brokers watch the 5-year yield for hints on fixed-rate direction, in the U.S. the benchmark is the 10-year T...

Sometimes you just don’t know how good or bad you have it. Take the mortgage business, for example. When it comes to mortgage pricing, Canada is a unique animal compared to many other countries, including the United States. Being married to a U.S. mortgage broker has made that all too clear for this author. And Tuesday, August 2, was a case in point. Frenetic rate updates While Canadian brokers watch the 5-year yield for hints on fixed-rate direction, in the U.S. the benchmark is the 10-year T...

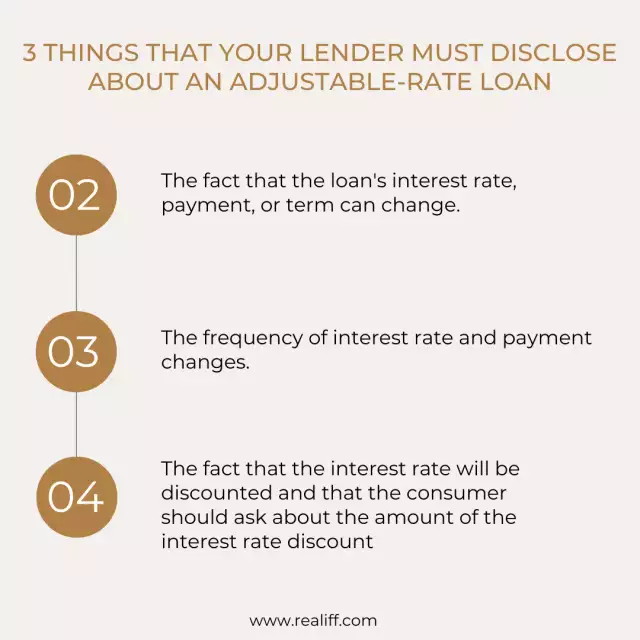

1. the fact that the loan's interest rate,

payment, or term can change.

2. the frequency of interest rate and payment changes.

3. the fact that the interest rate will be

discountedand that the consumer should ask about the amount of

the interest rate discount.

1. the fact that the loan's interest rate,

payment, or term can change.

2. the frequency of interest rate and payment changes.

3. the fact that the interest rate will be

discountedand that the consumer should ask about the amount of

the interest rate discount.

There are several challenges new investors must overcome to attain financial success. Among these difficulties is the terminology commonly associated with business and financial practices. Those who are first becoming comfortable with the inner workings of accounting and financial business may find the language used in everyday investments to be exclusive or overwhelming. The good news is, with the right education and practice, this barrier can be easily overcome. A common spot for confusion in ...

There are several challenges new investors must overcome to attain financial success. Among these difficulties is the terminology commonly associated with business and financial practices. Those who are first becoming comfortable with the inner workings of accounting and financial business may find the language used in everyday investments to be exclusive or overwhelming. The good news is, with the right education and practice, this barrier can be easily overcome. A common spot for confusion in ...

{

"@context": "https://schema.org",

"@type": "Article",

"mainEntityOfPage": {

"@type": "WebPage",

"@id": "https://www.fortunebuilders.com/primary-vs-secondary-market/"

},

"headline": "Primary Vs. Secondary Markets: What’s The Difference?",

"description": "To understand stocks, bonds, securities, and how they are traded, it is essential to know how primary and secondary markets work",

"image": [

"https://www.fortunebuilders.com/wp-content/uploads/2021/07/primary-and-s...

{

"@context": "https://schema.org",

"@type": "Article",

"mainEntityOfPage": {

"@type": "WebPage",

"@id": "https://www.fortunebuilders.com/primary-vs-secondary-market/"

},

"headline": "Primary Vs. Secondary Markets: What’s The Difference?",

"description": "To understand stocks, bonds, securities, and how they are traded, it is essential to know how primary and secondary markets work",

"image": [

"https://www.fortunebuilders.com/wp-content/uploads/2021/07/primary-and-s...