Unlocking Property Value: The Power of Real Estate Appraisals

Unlocking Property Value: The Power of Real Estate Appraisals

Real estate appraisals play a crucial role in determining the value of a property. Whether you're buying, selling, or refinancing a property, understanding the appraisal process is essential. In this article, we will explore the process of property valuation, including the factors considered, appraisal methods used, and the vital role of appraisers in determining property values.

| Keywords | Summary |

| Real estate appraisals | The process of determining the value of a property |

| Property valuation | Assessing the fair market value of a property |

| Factors considered | Location, size, physical characteristics, improvements, market conditions, etc. |

| Appraisal methods | Sales comparison approach and cost approach |

| Role of appraisers | Conduct property inspections, analyze data, and prepare appraisal reports |

| Determining property values | Objective assessment by appraisers |

| Comparable properties | Recently sold properties used for comparison |

| Market conditions | Overall state of the real estate market |

The Importance of Property Valuation

Property valuation is a critical step in various real estate transactions. Let's take a closer look at the key reasons why property valuation is essential:

Home Purchases: Buyers rely on appraisals to ensure they pay a fair price for a property. By assessing the property's value, buyers can negotiate effectively and make informed decisions.

Mortgage Lending:Lenders require appraisals to assess the property's value before approving a loan. It helps them determine the loan amount and ensure that the property provides adequate collateral for the loan.

Refinancing:When homeowners refinance their mortgages, appraisals help lenders determine the loan amount based on the property's current value. Accurate valuation ensures a fair and appropriate refinancing offer.

Property Tax Assessments:Appraisals provide a basis for calculating property taxes. Municipalities use property valuations to determine the tax liability of homeowners, ensuring fairness in tax assessments.

Factors Considered in Property Valuation

Appraisers consider various factors when assessing the value of a property. These factors typically include:

Location: The property's location plays a crucial role in its value. Proximity to amenities, schools, transportation, and desirable neighborhoods can significantly impact property prices.

Size and Physical Characteristics: The size of the property, including the total square footage and the number of rooms, influences its value. Additionally, factors such as lot size, layout, condition, and age of the property are considered in the valuation process.

Comparable Properties: Appraisers look at recent sales prices of similar properties in the vicinity, often referred to as "comps." By comparing the subject property with similar properties that have recently sold, appraisers can estimate its value.

Property Improvements: Any renovations, upgrades, or additional features that enhance the property's value are taken into account. These improvements can include kitchen upgrades, bathroom renovations, added square footage, or the installation of energy-efficient systems.

Market Conditions: The overall state of the real estate market, including supply and demand factors and economic trends, influences property values. Appraisers consider current market conditions to ensure their valuation reflects the prevailing market dynamics.

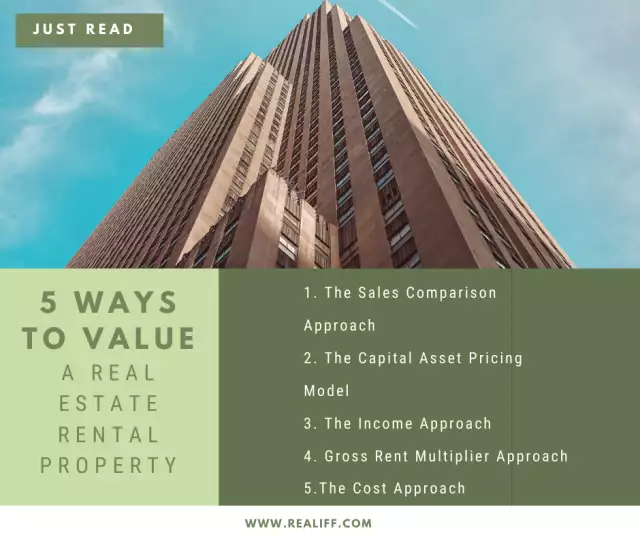

Appraisal Methods Used

Appraisers employ different methods to determine the value of a property. The two most commonly used methods are:

Sales Comparison Approach:This method involves comparing the subject property with recently sold similar properties in the area. The appraiser makes adjustments based on differences in features, condition, and size to estimate the subject property's value. This approach is widely used for residential properties.

Cost Approach:The cost approach evaluates the cost of replacing the property. It considers the value of the land and the construction costs required to replicate the property. The appraiser also accounts for depreciation and obsolescence to estimate the property's current value. This method is more commonly used for unique or specialized properties.

The Role of Appraisers

Certified appraisers are professionals trained to assess property values. Their responsibilities include:

Property Inspection: Appraisers visit the property to gather information about its size, condition, and unique characteristics. They assess both the interior and exterior of the property, taking note of any improvements or issues.

Data Analysis:App Appraisers engage in thorough research and data analysis to support their valuation. They examine a variety of data sources, including public records, Multiple Listing Service (MLS) databases, and other real estate databases. This information helps them gather comparable property sales, current market trends, and other relevant data points.

Appraisal Report:After collecting all the necessary information, appraisers compile their findings into a comprehensive appraisal report. The report includes the property's value estimate, the methodology used for the valuation, and supporting data and analysis. This report is a critical document used by buyers, sellers, lenders, and other parties involved in real estate transactions.

44 Common Questions and Answers About Maximizing Real Estate Cashback Deals in Your Area

Objective Evaluation: Appraisers provide an unbiased assessment of the property's value. They are independent professionals who don't have a personal or financial interest in the outcome of the appraisal. Their primary goal is to provide an accurate and objective valuation based on established appraisal standards and guidelines.

Regulatory Compliance:Appraisers must adhere to industry standards and guidelines set by professional appraisal organizations and governmental bodies. These standards ensure consistency, professionalism, and ethical conduct in the appraisal process. Appraisers are expected to maintain their licensure or certification and stay updated on changes in regulations and best practices.

Conclusion

Real estate appraisals are essential for various real estate transactions, providing an unbiased assessment of a property's value. By considering factors such as location, physical characteristics, comparable sales, property improvements, and market conditions, appraisers determine the fair market value of a property. Their expertise and adherence to professional standards ensure that property valuations are objective, accurate, and reliable. Understanding the appraisal process empowers buyers, sellers, and lenders to make informed decisions and promotes a fair and transparent real estate market.