Installed Onshore Wind, Solar and Storage Hits US Record in Q1

Installed Onshore Wind, Solar and Storage Hits US Record in Q1

May 26, 2022 Debra K. Rubin KEYWORDS Americann Clean Power Association / Offshore Wind / Renewables Order Reprints No Comments

The U.S. installed a record 6.62GW of utility-scale onshore wind, solar, and storage capacity in the first quarter of 2022, which is an 11.5% increase from a year ago, said the American Clean Power Association in a new report, but signs of a slowdown are growing.

Battery storage was the biggest growth catalyst, with 758MW of new capacity—up 173% from the same quarter in 2021, with 24 projects completed, according to the report.

There are nearly 1,100 projects in the pipeline totaling 125.476 GW of operating capacity, including 40.522 GW of projects under construction and 84.953 GW in advanced development.

But renewable energy project progress is slowing, growing by 4% in the first quarter compared to 12% quarterly in 2021, said the association.

The 3GW of solar installations were also a record for the period and an 11% increase from last year's first quarter, although 8.6GW of projects scheduled to come online are delayed into the latter part of 2022 or to 2023 and later. Solar projects made up 58% of all projects delayed, said the group's report.

There was 40.52GW of solar, battery and onshore wind capacity under construction in 43 states as of March 31, with Texas, California, Wyoming and Nevada leading the country

Onshore wind installations fell 3% to 2.86GW compared to the same 2021 quarter, but these still represented good performance historically for the period, according to the report.

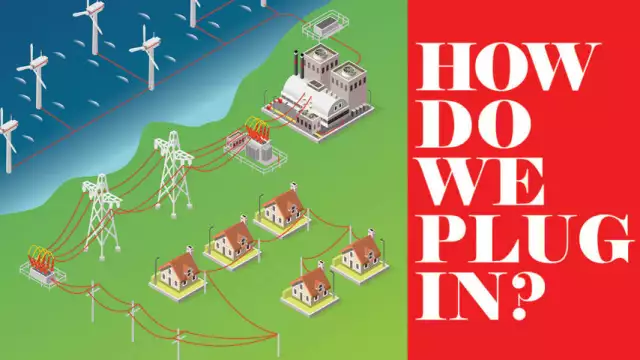

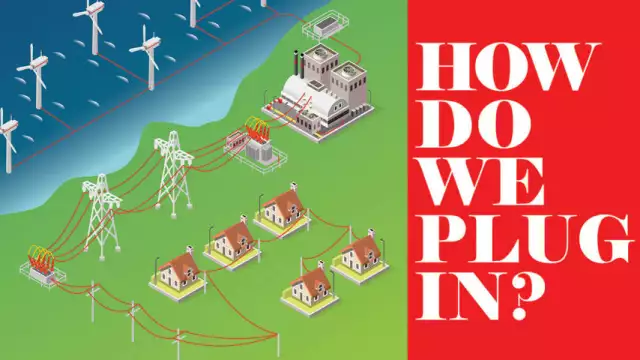

The survey also reported 18 offshore wind projects in development that have off-take contracts totaling nearly 17.5GW, but none are yet at the in-ocean construction stage. But nine states have set offshore wind targets totaling nearly 45GW, with New York breaking ground on the second utility scale project in the country, South Fork, and the US Interior Dept. holding a lease auction in the NY Bight south of Manhattan that netted a record $4.37 billion.

In Massachusetts, utilities National Grid, Unitil Corp. and Eversource Energy on May 25 filed long-term plans with the state to buy power from two planned offshore wind projects, Commonwealth Wind and Mayflower Wind, which would add 1,600 MW to New England’s power grid when on line later in the decade.

Avangrid Renewables is developing Commonwealth Wind, and Shell PLC, EDP Renewables and Engie are developers of Mayflower Wind.

But industry observers are watching the progress of a House bill, passed in March, that would require crews on foreign-flagged vessels operating in the US Outer Continental Shelf related to offshore wind projects to have US citizenship.

“The record-breaking quarter for clean power is encouraging, but the industry still faces many hurdles that are stalling growth,” said association CEO Heather Zichal, citing the impacts of inflation, supply chain delays, the “unsettled fate” of clean energy tax credits and ongoing uncertainty related to a U.S. Commerce Dept. solar tariff probe—related to retroactive tariffs for projects using crystalline silicon photovoltaic cells assembled in Southeast Asia with alleged Chinese-made components—that may not be resolved until August, at the earliest.

She said the controversy has led to leading utility solar developers indicating that at least 65% of the forecasted 17GW of crystalline silicon capacity additions to the grid this year could be delayed or cancelled, mostly due to slowdowns in component imports. These issues are “making investment and planning decisions a difficult challenge,” Zichal added.

Analysts also speculate that Europe’s renewables acceleration may add new competitive and supply chain pressures to the U.S. market.