The Hidden Costs of Maxing Out Your Budget When Buying a Home

The Hidden Costs of Maxing Out Your Budget When Buying a Home

Buying a homeis a major milestone for many individuals and families, and it can be tempting to want to splurge on the biggest and most luxurious property possible. However, it's important to remember that a home is not just a status symbol, but also a long-term financial investment. As such, it's crucial to approach the home-buying process with a realistic and pragmatic mindset, rather than one based solely on emotions and desires.

One of the biggest mistakes that homebuyers can make is to max out their budget when purchasing a property. While it may be tempting to stretch your finances to the limit in order to get the home of your dreams, doing so can have serious financial consequences in the long run. In this blog post, we'll explore why it's a bad idea to max out your budget when buying a home and provide some tips for how to approach the home-buying processin a more financially responsible manner.

High monthly mortgage payments

One of the most obvious drawbacks of maxing out your budget when buying a home is that you'll likely end up with a higher monthly mortgage payment than you can comfortably afford. This can put a significant strain on your finances, and may even force you to cut back on other important expenses like food, transportation, and healthcare. If you're unable to keep up with your mortgage payments, you may eventually fall behind on them, which can lead to foreclosure and the loss of your home.

Less room for unexpected expenses

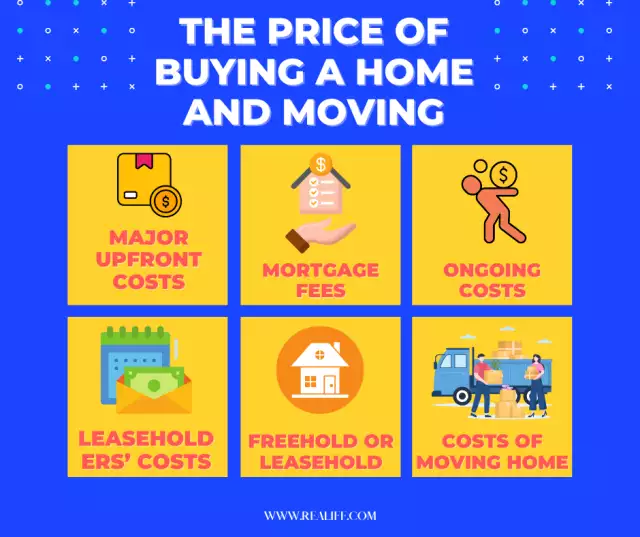

Another issue with maxing out your budget when buying a home is that it leaves you with less wiggle room for unexpected expenses. Homeownership comes with a number of hidden costs, such as property taxes, homeowner's insurance, repairs, and maintenance. If you've already stretched your finances to the limit to purchase your home, you may find yourself struggling to cover these additional costs when they arise.

Limited savings and retirement contributions

When you're maxing out your budget on your mortgage payments, it can be difficult to set aside money for savings and retirement. Saving for a rainy day, building an emergency fund, and planning for retirement are all important financial goals that can be difficult to achieve when you're already stretched thin. Failing to save for the future can leave you vulnerable to financial hardship down the road, such as unexpected medical bills or job loss.

Difficulty qualifying for other loans

Maxing out your budget on a mortgage can also make it harder to qualify for other loans in the future. Lenders will take your debt-to-income ratio(DTI) into account when considering you for a loan, and a high mortgage payment can push your DTI over the limit. This can make it harder to get approved for other loans, such as a car loan or a personal loan when you need them.

Limited room for financial growth

Finally, when you're maxing out your budget on your mortgage, you're limiting your ability to grow your wealth over time. Investing in stocks, mutual funds, or real estate can all be smart ways to build wealth over the long term, but these investments require capital. If all of your money is tied up in your mortgage payment, you may find it difficult to pursue other opportunities for financial growth.

How to avoid maxing out your budget when buying a home

Now that we've explored some of the downsides of maxing out your budget when buying a home, let's discuss some strategies for avoiding this common mistake.

Determine your budget ahead of time

Before you start looking at homes, it's important to determine your budget ahead of time. This means figuring out how much you can realistically afford to spend on a home without compromising your other financial goals, such as saving for retirement or paying off debt. You can use online calculators to get a sense of how much home you can afford based on your income, expenses, and other financial factors. It's also a good idea to get pre-approved for a mortgage before you start shopping, so you know exactly how much you can borrow.

Look for homes within your budget

Once you've determined your budget, it's important to stick to it when you're looking for homes. This means setting realistic expectations and being willing to compromise on certain features or locations if necessary. It can be helpful to work with a real estate agent who understands your budget and can help you find homes that meet your needs without breaking the bank.

Consider the long-term costs of homeownership

When you're calculating your budget for homeownership, it's important to consider not just the monthly mortgage payment, but also the long-term costs of homeownership. This includes property taxes, homeowner's insurance, maintenance and repairs, and any other expenses associated with owning a home. You should also consider how these costs may change over time, such as if property taxes or insurance rates increase.

Build an emergency fund

Building an emergency fund can help you avoid financial stress and prevent you from falling behind on your mortgage paymentsif unexpected expenses arise. Aim to save at least three to six months' worth of living expenses in an easily accessible account, such as a savings account or money market fund.

Don't forget about other financial goals

When you're budgeting for homeownership, it's important to remember that you have other financial goals beyond just buying a home. This may include saving for retirement, paying off debt, or saving for your children's education. Don't sacrifice these goals in order to buy a more expensive home.

In conclusion, maxing out your budget when buying a home may seem like a good idea in the short term, but it can have serious financial consequences in the long run. By taking a realistic and pragmatic approach to homeownership, you can avoid these pitfalls and enjoy the benefits of owning a home without sacrificing your financial stability or future goals.