Is it a good idea if we consider buying a house with cash?

Is it a good idea if we consider buying a house with cash?

REALIFF strives to assist you in making better financial decisions in real estate. If you're looking for a home, especially in a hot market, you may hear about people making all-cash bids on properties in your neighborhood. There are numerous advantages to paying cash for a home, including making your offer more appealing to sellers. However, not everyone can afford such a huge upfront purchase without the need for financing.

Is it possible buying a house with cash?

Yes, it is possible and entirely legal to buy a house with cash. If someone is selling a house for $350,000 and you have more than that in your bank account, there's no reason you couldn't offer to write them a check right then.

It's crucial to emphasize, however, that a cash property purchase does not imply a stack of bills. It simply indicates that you are paying in full, with no borrowing. While it is possible to buy a house with cash, carrying that many paper dollars and dealing with IRS reporting requirements for such significant cash transactions makes it impractical.

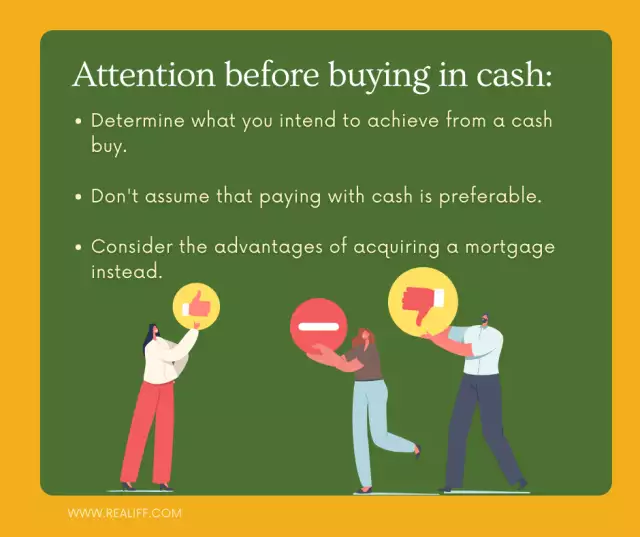

Should you think of buying a house with cash?

There are various factors that make cash house purchases enticing, but the most basic is peace of mind. You own a home outright if you pay for it in full. That implies no need for a bank or other lender funding, no debt, and no monthly mortgage bill. There is no fear of missing payments or foreclosure, and you will always have a place to live.

Offering to pay in cash makes your offer more tempting to house sellers since they get paid sooner, and there is no risk of a mortgage falling through or being denied. Furthermore, eliminating the lender expedites the closing process significantly.

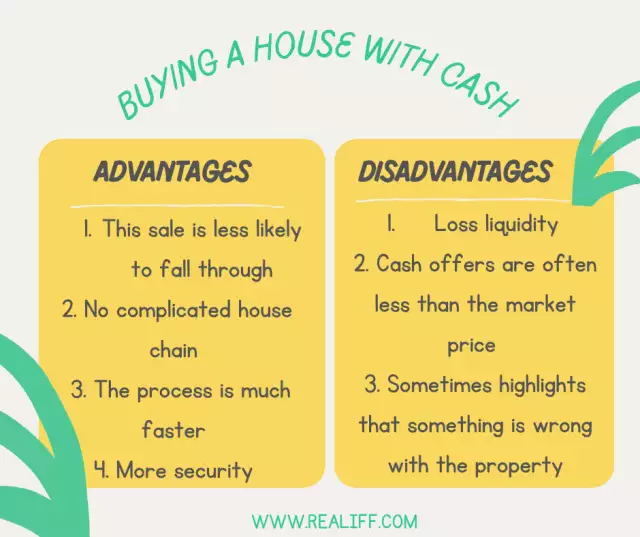

The benefits and drawbacks of buying a house with cash

When compared to acquiring a mortgage, paying cash has both advantages and disadvantages.

Reasons why buying a house with cash

- No monthly payments: If you pay in full for your property, you won't have to worry about rising interest rates or monthly mortgage payments.

- Reduced closing expenses and speedier closure: Many closing charges and delays are associated with obtaining a mortgage. Skipping the loan process expedites the closing process and reduces costs like origination fees.

- In a competitive market, this is more appealing to sellers: When an offer is contingent on financing or an appraisal price, there is always the possibility that the loan would fall through, leaving the sellers to find a new bidder. This makes financial offers more appealing, providing your bid an advantage over others.

- Lower purchase price: Because cash transactions are more tempting than financing transactions, you may be able to win a home with a lower offer.

- No underwriting: If you have bad credit or inconsistent income, you may not be able to qualify for a mortgage in the first place. You can eliminate the uncertainty of not being able to acquire a loan by accepting cash offers.

Reasons to get a mortgage instead

- Money is locked up in the house: If you consider buying a house with cash, it becomes non-liquid. That implies you'll have less money accessible if you need it for something else. If you need immediate access to your money, financing is the way to go.

- Lower investment return: Real estate might be a good investment. However, money invested in real estate might be put in higher-yielding investments to earn you more money. For example, if you invest all of your money into a house, you may miss out on larger returns in the stock market.

- No mortgage interest deduction: When submitting their tax returns, homeowners can deduct a portion of the interest they pay on their mortgage. These savings are lost when you are buying a house with cash.

Should I still get a home inspection done?

Buying a house with cash eliminates the need for a mortgage. It doesn't imply you should disregard all of the due diligence needed in purchasing a home. Yes, even if you're paying cash for a home, you should undergo a home inspection. Even if the inspection is waived, you should never, ever skip the final walk-through. Both can be set up with the assistance of your real estate agent.

Another possibility is delayed financing

Delayed financing may be an interesting option if you want the benefits of making a cash offer without tying up all of your money in your property.

In essence, you pay cash for a home and then obtain a mortgage after the transaction is completed. It's akin to doing a cash-out refinance after you buy a house. You convert some of the equity into cash that you can utilize for other purposes while making monthly payments on the remainder.

The fact that you still need to have enough cash ahead to pay to buy the home is a disadvantage. This method, on the other hand, allows you to maintain your offer desirable while avoiding tying up all of your financial resources in an illiquid item.

Bottom line

Buying a house with cash can expedite the closing process and make your offer more appealing to sellers, which is a significant advantage in a seller's market. Keep in mind, though, that you are locking up your money in an illiquid asset, so it isn't always a good decision. By the way, you don't have to worry about anything because REALIFF agents are on your side!

![Things to Consider When Buying a Condo [2022]](https://realiff.com/assets/uc/Post/PTTMqkZ6FxTN/thumbnail_default.webp?UXZUd71ASAST)