Episode 86 - This Buyer is a ‘Hands On & Bottom Line’ type of guy

Episode 86 - This Buyer is a ‘Hands On & Bottom Line’ type of guy

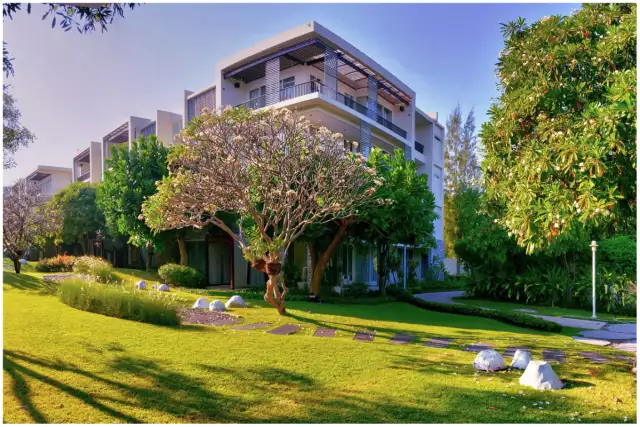

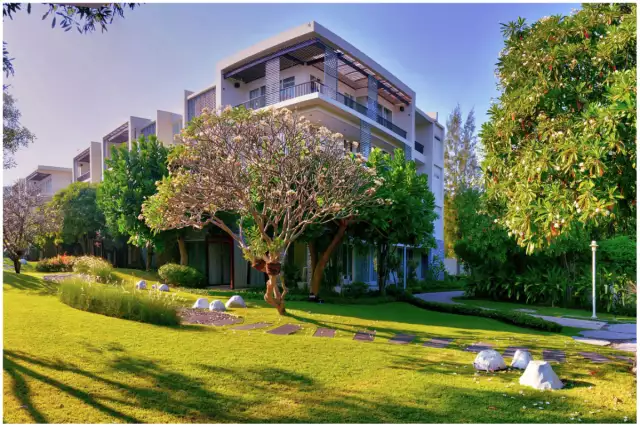

Mike Spotts just closed on a stabilized 94 unit apartment building. Mike grew up in Plano and attended Texas State University. He was in the high technology business and wanted to transition into real estate. Mike started buying duplexes and single family homes. Mike was equity rich with a 13 homes, but was liquidity poor. He decided to sell his homes and raise liquidity to buy apartments. Mike is a big fan of multifamily education and mentoring. That was his first investment. He invested in himself with apartment education. Mike had passively invested in 3 separate apartment partnerships before he felt ready to ‘lead’ his own transaction. His first transaction is a property called Agave Villas Apartments in Irving, Texas. Mike liked the submarket and condition of the asset. The property is near a high school. During due diligence, Mike and his team found a huge water leak. Hundreds of gallons were flowing down the drain every day. When fixed, that one line expense item saved them thousands. Additionally, Mike explains the bottom line on getting higher rents after doing some moderate rehab on his asset. Amazing. Mike decided that he wanted to know more about repairs and maintenance to his property so went back to school to learn air conditioning and heating repair. He does not work on his own systems, BUT having 94 individual HVAC systems, he wanted to make sure he knew what the real costs were. It probably was a good investment. Ricardo explains how he was able to provide Fannie Mae financing for a first time apartment buyer. Here is Mike’s contact info: MSpotts@greystoneprop.com To receive our FREE 15 page WHITE PAPER REPORT on the 2017 FUNDAMENTALS OF MULTIFAMILY FINANCING 101 and to learn more about upcoming events at Old Capital Speaker Series please visit us at OldCapitalPodcast.com Are you interested in learning more about how Multifamily Syndications work? Please visit www.spiadvisory.com to learn about Michael's Real Estate Syndication business with SPI Advisory LLC.