Navigating the Mortgage Market: Understanding the Unique Needs of Younger and Older Homeowners

Navigating the Mortgage Market: Understanding the Unique Needs of Younger and Older Homeowners

Younger homeowners may have different financing needs and preferences compared to older homeowners.

Younger homeowners are often first-time buyers and may have less savings and a lower credit score. They may also be more inclined to take on adjustable-rate mortgages (ARMs) as they expect to move or refinance before the interest rate adjusts. They may also be more likely to choose a loan with a lower down payment, such as an FHA loan, to make it more affordable to purchase a home.

Older homeowners, on the other hand, may have more savings and a higher credit score. They may also have more equity in their current home, which can make it easier for them to qualify for a traditional mortgage or refinance. They may also be more likely to choose a fixed-rate mortgage, as they may plan to stay in their home for a longer period of time. Additionally, older homeowners may be looking for a way to tap into their home equity for retirement or other expenses, in which case a reverse mortgage could be an option.

It's important to note that these are general trends and not every young or older homeowner will fit into these categories, and that many factors such as income, credit score, location, and personal preferences will affect their choice of financing.

What are the best practices for new home buyers over 60?

New home buyers over 60 have unique needs and considerations when purchasing a home. Here are some best practices for them:

- Understand your financial situation: Before purchasing a home, it's important to have a clear understanding of your income, expenses, and retirement plans. This will help you determine how much home you can afford, and what type of mortgage is best for you.

- Get pre-approved for a mortgage: Getting pre-approved for a mortgage can help you understand how much home you can afford and can also give you an advantage when making an offer on a home.

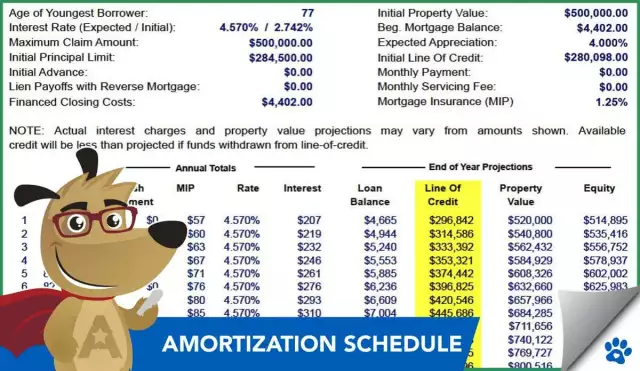

- Consider a reverse mortgage: If you're over 60, a reverse mortgage may be a good option for you. This type of loan allows you to tap into the equity in your home and use the funds for retirement or other expenses.

- Look for a home that meets your needs: Consider your current and future needs when looking for a home. For example, if you're planning to age in place, look for a home that's accessible and has features that can accommodate your needs as you get older.

- Hire a real estate agent: Hiring a real estate agent can save you time and money. They can help you find the right home and guide you through the process of buying a home.

- Get a home inspection: Before buying a home, it's important to have a professional home inspection done to ensure that the home is in good condition and to identify any potential issues.

- Consider downsizing: As you get older, you may want to consider downsizing to a smaller home that's easier to maintain and has lower expenses.

- Look for a home in a retirement community: Retirement communities offer a variety of amenities and services designed for older adults. They may also provide security and companionship.

- Understand the costs associated with homeownership: Make sure you understand all the costs associated with homeownership, including property taxes, insurance, and maintenance costs, so you can budget accordingly.

- Plan for your future: Consider how your needs may change in the future and plan accordingly. This could include things like a single-story home, a home with low maintenance, or a home in a community with accessible amenities.

Overall, the key for new home buyers over 60 is to take the time to understand their needs, budget, and financial situation, and to look for a home that meets those needs. It's also important to seek professional advice from real estate agents and financial advisors to help guide them through the process.

How does age affect financing choices for homeowners?

When it comes to purchasing a home or refinancing a mortgage, age can play a significant role in a homeowner's financing choices. Younger homeowners, who are often first-time buyers, may have different needs and preferences compared to older homeowners.

Younger homeowners may have less savings and a lower credit score, making it more challenging for them to qualify for a traditional mortgage. They may also be more inclined to take on adjustable-rate mortgages (ARMs) as they expect to move or refinance before the interest rate adjusts. They may also be more likely to choose a loan with a lower down payment, such as an FHA loan, to make it more affordable to purchase a home.

Older homeowners, on the other hand, may have more savings and a higher credit score. They may also have more equity in their current home, which can make it easier for them to qualify for a traditional mortgage or refinance. They may also be more likely to choose a fixed-rate mortgage, as they may plan to stay in their home for a longer period of time. Additionally, older homeowners may be looking for a way to tap into their home equity for retirement or other expenses, in which case a reverse mortgage could be an option.

It's important to note that these are general trends and not every young or older homeowner will fit into these categories, and that many factors such as income, credit score, location, and personal preferences will affect their choice of financing. Therefore, it's crucial for all homeowners, regardless of their age, to do their research and explore all options before making a decision on financing. A mortgage professional can help you understand all your options and help you choose the best one that suits your needs.

In conclusion, while age can play a significant role in a homeowner's financing choices, it's not the only factor that determines the best option. Homeowners should consider all their options, their personal preferences, and their financial situation before making a decision. It's always recommended to seek advice from a mortgage professional who can help you navigate the mortgage market and make the best decision for your unique situation.

Single story or two stories? What is the best for young homeowners?

When comparing a single-story house to a two-story house for young people, there are several factors to consider.

- Space: A two-story house generally provides more living space than a single-story home. A two-story home may have a larger living area, more bedrooms, and more bathrooms.

- Privacy: A two-story home may offer more privacy, with bedrooms located on the second floor away from the main living area. This can be especially beneficial for young families with children.

- Maintenance: A single-story home may be easier to maintain than a two-story home. There are less stairs to climb, and it may be easier to clean and keep the interior and exterior of the home in good condition.

- Energy efficiency: A two-story home is generally more energy efficient than a single-story home. The second floor can act as insulation, keeping the first floor cooler in the summer and warmer in the winter.

- Resale value: Two-story homes tend to have a higher resale value than single-story homes, as they are generally in higher demand.

- Lifestyle: A two-story home may be more suitable for a young family with children, as it can offer more privacy and space for different activities. A single-story home may be more suitable for a young couple or single person looking for a lower maintenance home.

Ultimately, the choice between a single-story and a two-story home will depend on the individual's personal preferences, lifestyle, and future plans. It's important to consider the pros and cons of each option and how they align with your needs and goals.

Single story or two stories? What is the best for older homeowners?

When comparing a single-story house to a two-story house for senior people, there are several factors to consider:

- Accessibility: A single-story home may be more accessible for seniors, as it eliminates the need to navigate stairs. This can be especially beneficial for seniors with mobility issues.

- Safety: A single-story home may be safer for seniors, as it eliminates the need to navigate stairs, which can be a fall hazard.

- Maintenance: A single-story home may be easier to maintain than a two-story home for seniors. There are fewer stairs to climb and it may be easier to keep the interior and exterior of the home in good condition.

- Comfort: A single-story home may be more comfortable for seniors, as it eliminates the need to navigate stairs and allows for easy access to all rooms and areas of the home.

- Cost: A single-story home may be more cost-effective for seniors, as it eliminates the need to make any modifications to accommodate for mobility issues.

- Lifestyle: A single-story home may be more suitable for seniors who are looking for a home that is easy to navigate, maintain, and offers them more safety.

- Future plans: It's important for seniors to consider their future plans, such as if they plan on aging in place or if they plan on relocating to a retirement community.

Ultimately, the choice between a single-story and a two-story home will depend on the individual's personal preferences, lifestyle, and future plans. It's important to consider the pros and cons of each option and how they align with your needs and goals.