Housing Recovery Forecast For 2024 As Homebuilder Sentiment Falls Again

Housing Recovery Forecast For 2024 As Homebuilder Sentiment Falls Again

(Photo by Justin Sullivan/Getty Images)

Getty Images(Photo by Justin Sullivan/Getty Images)

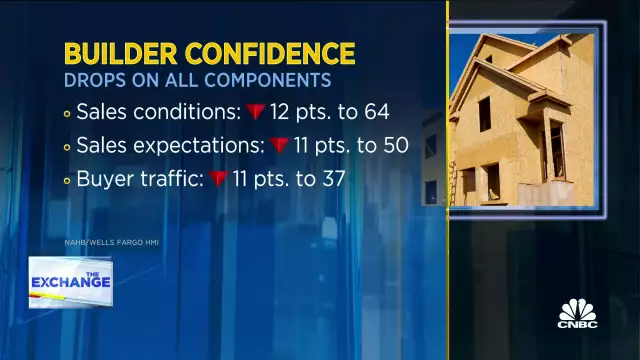

Homebuilder confidence has fallen for the 12th month in a row, with the National Association for Home Builders (NAHB) experiencing the lowest sentiment since 2012. It comes at a time as demand for real estate plummets, with interest rates rising and cost of living not yet coming back down.

Sentiment numbers below 50 are considered negative, and December saw the index drop by two points to hit 31.

In a bid to keep demand up as much as possible, a large proportion of homebuilders across the country are putting in place incentives. For buyers who are prepared to take on rates that have skyrocketed over the past 12 months, some of these incentives include mortgage rate buydowns to limit the impact of the higher rates, and reductions off the purchase prices.

In the same report, the NAHB suggested that the weak housing market is likely to persist into 2023, with a potential recovery on the horizon in 2024.

Download Q.ai today for access to AI-powered investment strategies.

Why is sentiment down among homebuilders?

The pandemic years gave the US a surprisingly hot housing market. According to the Federal Housing Price Index the average price of a home in the United States went up by almost 30% between the beginning of 2020 and the end of 2021.

The sudden explosion of remote work and the upheaval of the status quo caused many to rethink the plan for their lives.

Homebuilders were major beneficiaries. Despite difficulties in the supply chain making access to materials a challenge, demand for property remained very high. But with these same supply chain issues adding to the problems of inflation, it was inevitable that the decade of record low interest rates was going to come to an end.

At the beginning of 2022, that’s exactly what began to happen.

The Fed has implemented five interest rate hikes in a row. The first four were massive rises of 0.75 percentage points, with the latest Federal Open Market Committee (FOMC) Meeting resulting in a slightly lower increase of 0.50 percentage points.

As expected, this has meant mortgage interest rates have gone through the roof. The average rate for a 30 year fixed rate mortgage has gone up from under 3% at the end of 2021 to hit over 7% over the past few months.

For buyers, this makes a huge difference in the monthly repayment. In many cases it means the difference between buying a property and not, with potential monthly repayments increasing by hundreds or even thousands of dollars.

So, unsurprisingly this has meant a significant slow down in the housing market. Prices managed to hold pretty steady in the early part of the year, but since May they have begun to slide.

This slide has been slow so far, but transaction numbers have crashed 37.4% compared to this time last year, according to Redfin.

What is the outlook for the housing market?

The situation isn’t likely to get better in the short term. Inflation has begun to come down in the United States, but it still remains high at 7.1%. This is despite the Fed’s rate policy, which has been the fastest rate of increase experienced since the early 1980’s.

With that in mind, Fed chairman Jerome Powell stated in the most recent press conference, “There’s an expectation really that the services inflation will not move down so quickly, so we’ll have to stay at it,” he said. “We may have to raise rates higher to get where we want to go.”

This is combined with the survey of the individual members of the Fed who are surveyed after each meeting as to what they expect rates to be in the next 12 months. The so-called ‘dot plot’ shows a median projection of the base rate at 5.1% at the end of 2023. That’s up from the current rate of 4.25% - 4.5%.

That’s also on the expectation that the Fed may also have begun to bring rates back down at that point, meaning that the peak rate could be even higher.

So with rates likely to get higher, and potentially much higher, homebuilders are going to be fighting an uphill battle for some time.

Mortgages are already much more expensive than they were a year ago, and with rising prices continuing to bite, a new home with a new expensive mortgage is a cost that many households just won’t be able to stomach.

As a result, the NAHB predicts that 2023 will be a difficult year for real estate.

However they are optimistic about the slightly longer term future. Most analysts are expecting that once inflation comes down to within the Fed’s target range of 2-3%, a discussion around dropping rates will begin.

By definition, raising rates seeks to dampen the economy. After a further year of increases, potentially flat or negative economic growth and a labor market which has had to resist all of these pressures, there will likely be many calls for assistance from the Fed in the form of lower rates.

If inflation is under control, they’ll probably oblige.

If and when that happens, we could see the opposite to what we’ve seen in 2022. With inflation under control and interest rates on their way down, the economy will potentially pick up and mortgages will become more affordable.

This could see demand for properties pick up, and the upwards cycle begins. An uptick in volume and price increases interest in properties, which drives positive media coverage and improved sentiment, which further drives interest and prices.

All of this is conjecture, obviously, but it’s called the market ‘cycle’ for a reason and it’s a fair assumption of how things could play out. Of course there’s always the potential for a black swan event, something completely unforeseen to throw expectations out the window.

Hopefully not another pandemic.

What does this mean for investors?

So the housing market is in a bit of a tough spot at the moment. What does that mean for investors who are looking to get on the housing ladder? Well, it might mean that the timeline for a purchase has to be extended.

Savers who have been getting together a down payment for a mortgage they’d budgeted based on 4% interest rates have probably suffered a rude shock when looking at the figures at 6.8%.

One of the best ways to improve your mortgage position is to get together a bigger deposit.

And when it comes to maximizing a lump sum, cash in the bank just isn’t going to cut it. To clarify, if you’re looking to purchase somewhere in the short term, say less than three years, cash is probably your best bet.

It might not give you much in the way of interest, but it’s secure and you don’t have to worry about market dip reducing your down payment by 15%.

If you’ve got over three years until you’re planning to buy, you’re in the sweet spot to aim for a bigger down payment through investing.

But it’s not a myth, investing can be risky if you do it in the wrong way. This first mistake a lot of investors make is not diversifying enough. Picking a handful of stocks isn’t going to cut it. In order to get proper diversification across lots of different asset classes, you’re probably going to need some professional help.

We’ve got a range of different investment funds (which we call Kits) to choose from, that provide massive levels of diversification across a wide spectrum of assets. Not only that, but we use the power of AI to supercharge the data analysis in a way humans just can't match.

Like our Emerging Tech Kit, for example, which uses AI to predict which areas of tech are going to perform the best in the coming week, and then automatically rebalances based on those projections.

If you want even more help, we also offer Portfolio Protection on all of our Foundation Kits. This uses our AI to analyze your portfolio’s sensitivity to various forms of risk, such as market risk and interest rate risk. It then automatically implements sophisticated hedging strategies to help protect against them.

It’s seriously cutting edge stuff, and we’ve made it available to everyone.

Download Q.ai today for access to AI-powered investment strategies.